XRP’s week has been an anomaly, but here’s why it may or may not remain so

- XRP bulls dominate after losing correlation with the rest of the market

- Bears may soon regain control as volatility and network growth have slowed down

XRP has turned out to be one of the best hedges against this week’s bearish market trend. Ergo, the question – How much longer can XRP sustain its current trajectory on the charts?

How much are 1,10,100 XRPs worth today?

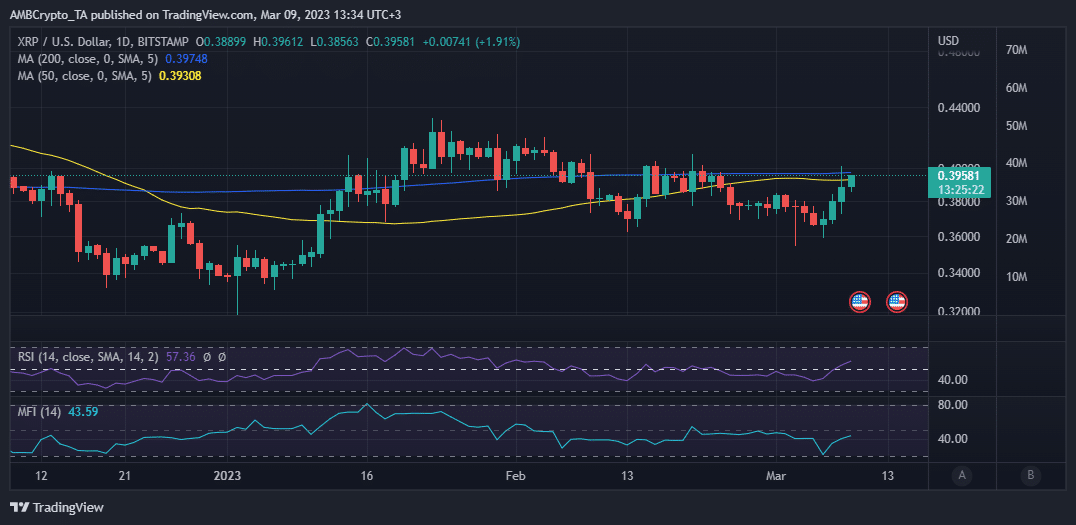

XRP’s press time price of $0.39 represented a 10% upside after four consecutive days of being in the green. For context, Bitcoin recorded a 4% pullback while ETH was down by roughly 3.25% during the same 4-day period.

These observations confirm that XRP managed to overcome the general correlation and trend across the rest of the market.

Source: TradingView

Will XRP maintain this momentum? Well, the altcoin’s RSI indicator, at press time, was back above the mid-point, thus confirming that Relative Strength is now in favor of the bulls.

Nevertheless, the crypto’s latest rally has now pushed above the 50-day MA and is about cross above the 200-day MA. These indicators often act as pivot zones. Hence, there is a chance that XRP might pull back towards the weekend.

XRP’s bullish momentum might be short-lived

There are already some signs that indicate a slowdown in momentum might be imminent.

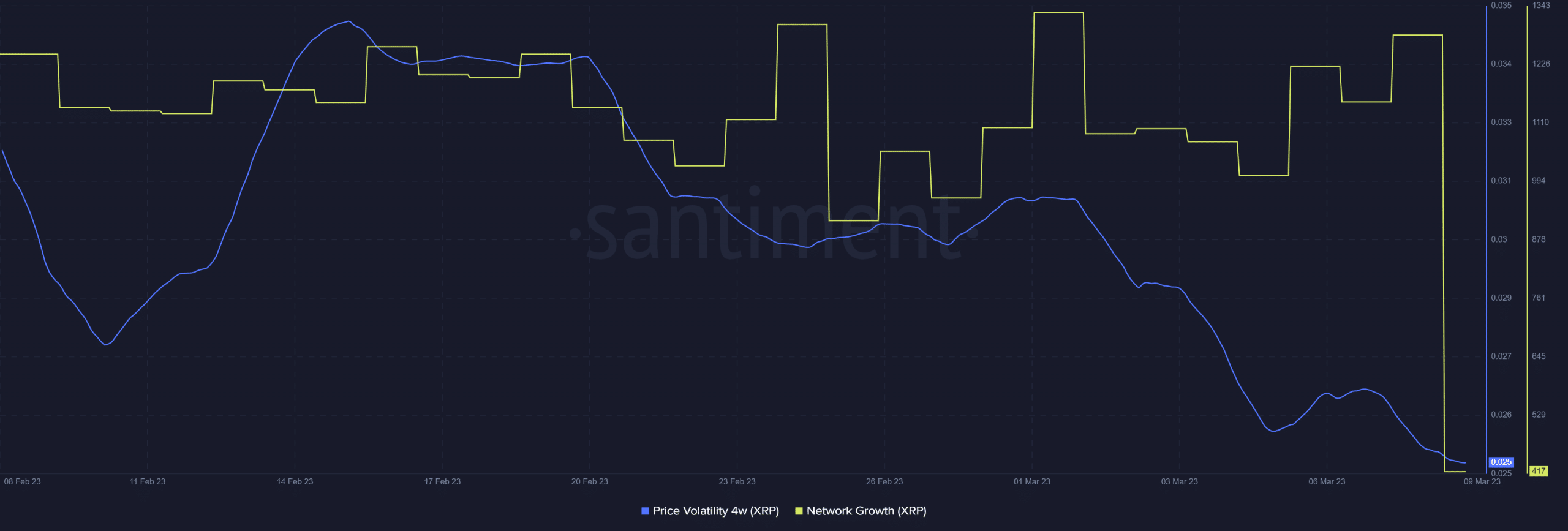

For instance – XRP’s price volatility is now at a 4-week low despite its latest rally. This is a confirmation that the price may not register significant price movements, unless there is a volatility resurgence.

Source: Santiment

Additionally, the network growth metric registered some upside too this week. However, it then crashed hard to a 4-week low over the last 24 hours. Could this be a sign of what to expect from XRP’s price action? That might be the case if sell pressure starts to mount on the aforementioned potential pivot zones.

Is your portfolio green? Check out the XRP Profit Calculator

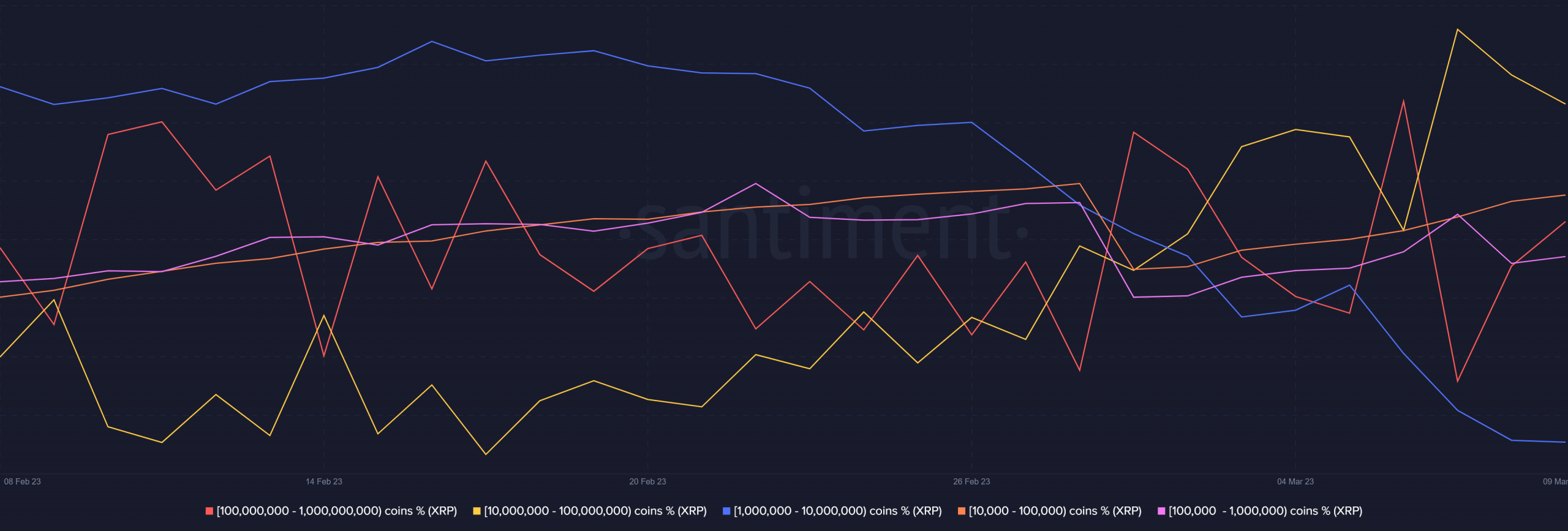

Whale activity is a major component of price action. As such, it makes sense to observe whale activity, especially now that bearish signs are piling up.

An overview of the supply distribution metric seemed to reveal mixed results, meaning there is a lot of buying and selling activity. Nevertheless, addresses holding over 100 million XRP have been buying in the last 24 hours.

Source: Santiment

Here, it’s worth noting that there are still some whale categories that have been contributing to sell pressure over the last 24 hours. As far as expectations are concerned, it is unclear how long XRP will retain its ability to move against the market.

In fact, we may see an extended rally if the rest of the market does favor the bulls.