XRP could enter a price correction in the next few days, here’s why

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- XRP exhibited divergence on key price chart technical indicators.

- The token saw an increased building on the network, but investors’ confidence declined.

Ripple [XRP] could face a correction because of increasing divergence between key price chart indicators. Despite the January rally, XRP hasn’t reclaimed its pre-FTX level of $0.5.

At press time, the asset’s value was $0.4090 and could drop to a critical support level in February.

Is your portfolio green? Check out the XRP Profit Calculator

XRP exhibited a volume and RSI divergence

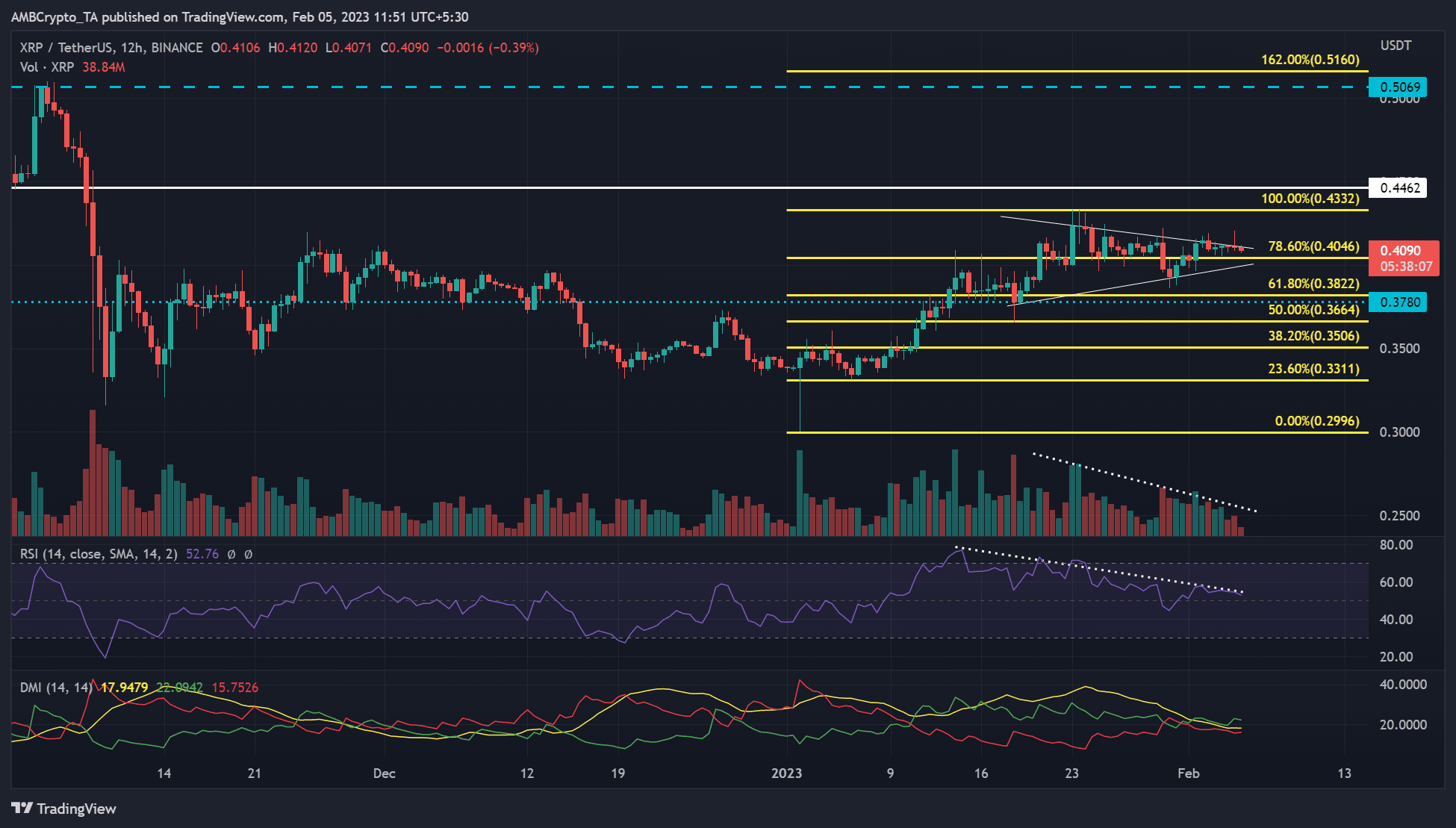

Source: XRP/USDT on TradingView

XRP’s price action in the past few days chalked a symmetrical triangle pattern. In addition, there was an increasing Relative Strength Index (RSI) and volume divergence to XRP’s price action in the same period.

Read XRP Price Prediction 2023-24

As a result, XRP could enter a price correction in the next few days/weeks. Based on the triangle’s height, the drop could inflict a bearish breakout with the target at $0.3780 – a 5% potential plunge.

However, a bullish patterned breakout would invalidate the above bearish forecast. The upswing would target the 100% Fib level of $0.4332. The upward movement could aim at the pre-FTX level of $0.5069 if BTC surges above the $23.5K level.

The RSI dropped significantly from mid-January and rested slightly above the equilibrium of 50, showing a decline in buying pressure. If the drop in buying pressure continues, bears could gain more leverage.

However, the Directional Movement Index (DMI) indicated that buyers (green line) still had market leverage at 22 while sellers were behind at 15. Therefore, investors should also monitor BTC price action to gauge the possible direction of the patterned breakout.

Development activity improved, but sentiment remained negative

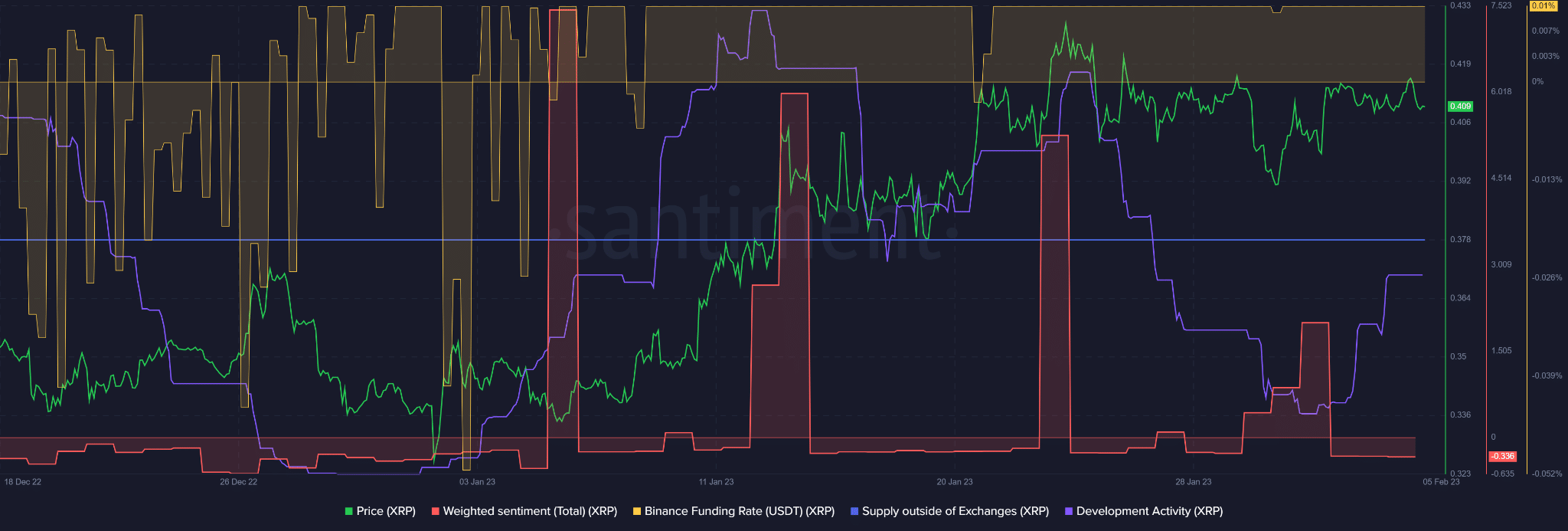

Source: Santiment

XRP recorded an improvement in its development activity as per Santiment data. Developers in the network slowed down at the end of January but have been active in the past few days.

The increase in development activity could assure investors and boost their confidence in the native token. As such, the XRP value could be boosted if the trend continues.

Besides, the Funding Rate for XRP/USDT pair has remained fairly positive since mid-January, showing it enjoyed massive demand in the derivatives market.

However, the negative weighted sentiment could complicate the demand and overall uptrend momentum.