Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Higher and lower timeframe charts were bearish.

- Network growth and velocity declined.

At press time, Ripple [XRP] depreciated about 7% since Wednesday (8 March) and was on the verge of breaching another key Fib retracement level.

At the same time, Bitcoin [BTC] dropped below the $20K psychological level ahead of the U.S. Jobs Report on 10 March.

Read Ripple [XRP] Price Prediction 2023-24

A strong jobs report could tip the Fed to adopt higher rates and increase selling pressure, while a weak report could lead to a potential dovish approach in March’s FOMC meeting.

Can the 23.6% Fib level hold?

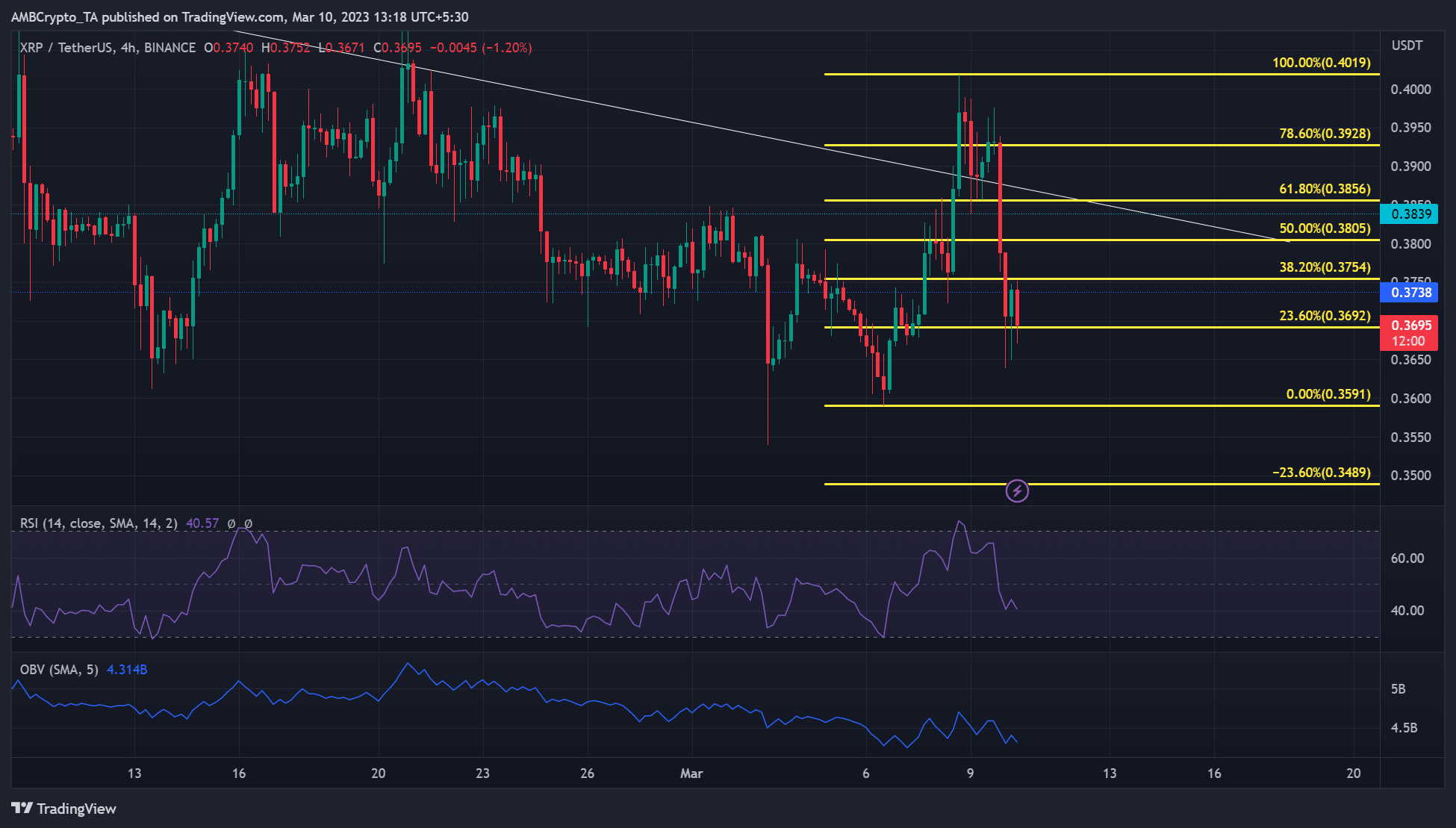

Source: XRP/USDT on TradingView

XRP has been toiling below the descending line (white) in the past few weeks. A false breakout above it happened on 8 March before facing price rejection at $0.4019.

Although a pullback retest on the descending line offered a recovery, it was stopped by the 78.6% Fib level ($0.3928) and set XRP for an extended correction. At the time of writing, the price oscillated between 23.6% and 38.2% Fib levels but was on the verge of breaching the lower boundary.

XRP could retest $0.3591 if short-term bears clear the hurdle at $0.3650. Therefore, these levels could be shorting opportunities if the price close below the 23.6% Fib level ($0.3692).

Also, the price could bounce to 38.2% Fib level ($0.3754) and face rejection, offering another shorting opportunity with targets at $0.3692.

However, a move above 38.2% Fib level ($0.3754) will invalidate the thesis. The upswing could set near-term bulls to target the 50% Fib level ($0.3805) and other upper resistances for gains.

The RSI and OBV registered downticks, indicating the limited buying pressure which could offer bears more leverage in the short-term.

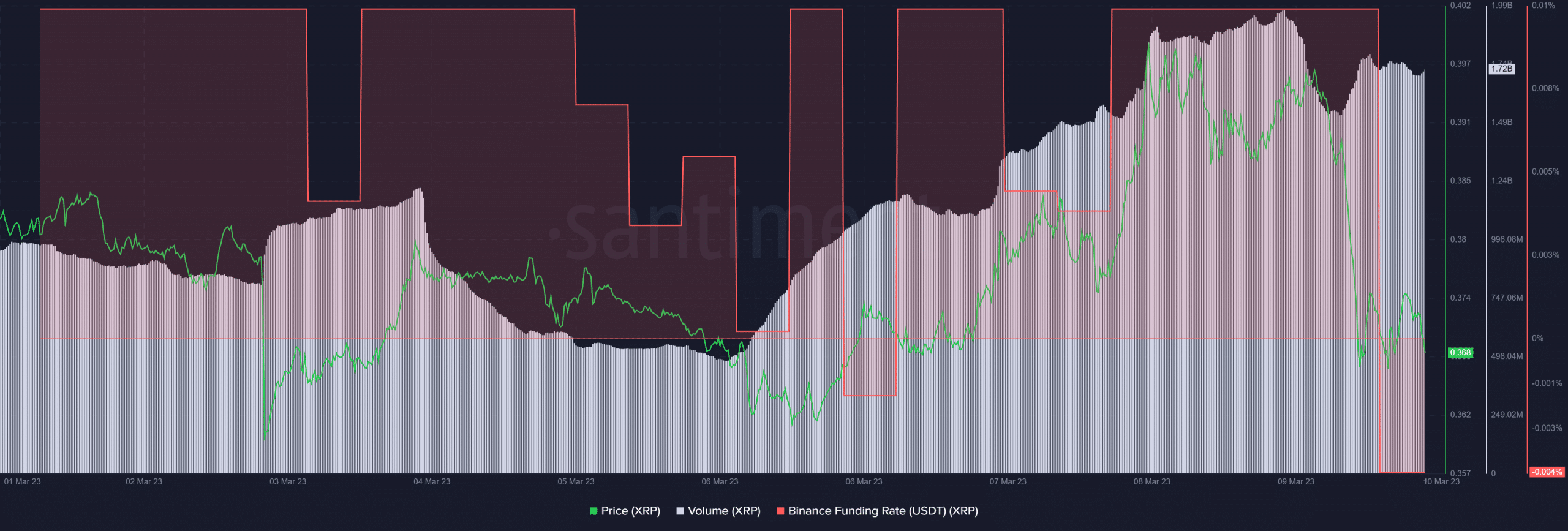

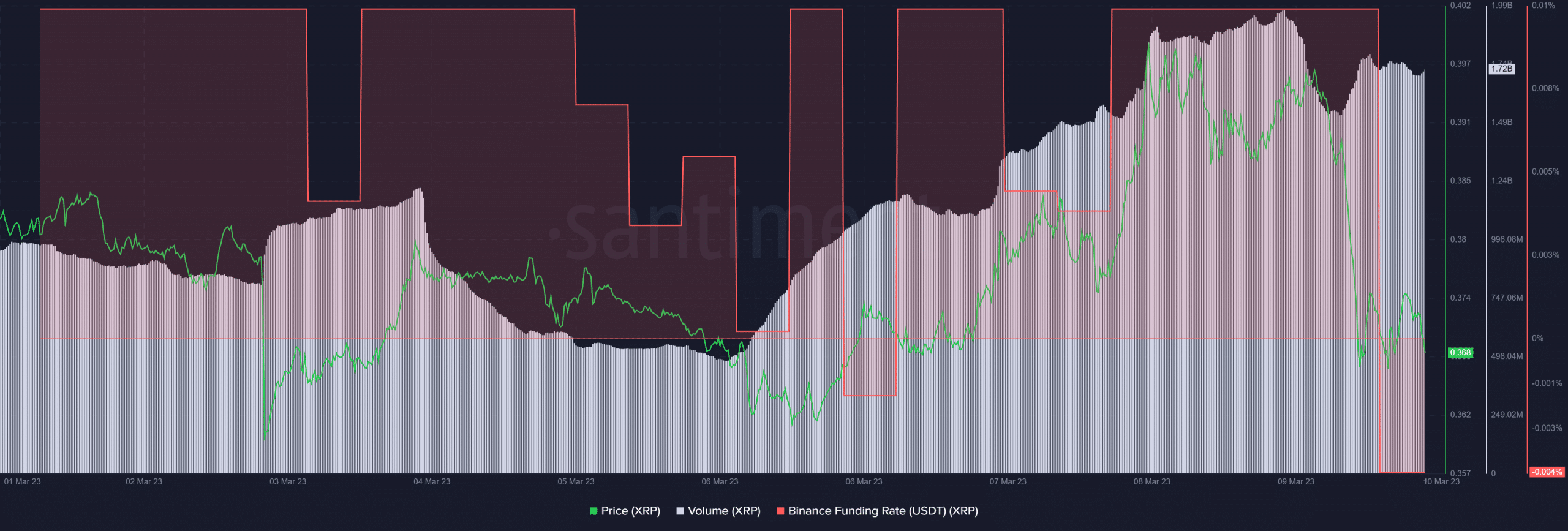

Source: Santiment

According to Santiment, Funding Rate flipped to negative at the time of writing, showing bearish sentiment in the derivatives market. Similarly, trading volumes dropped slightly and could offer bears more influence in the market.

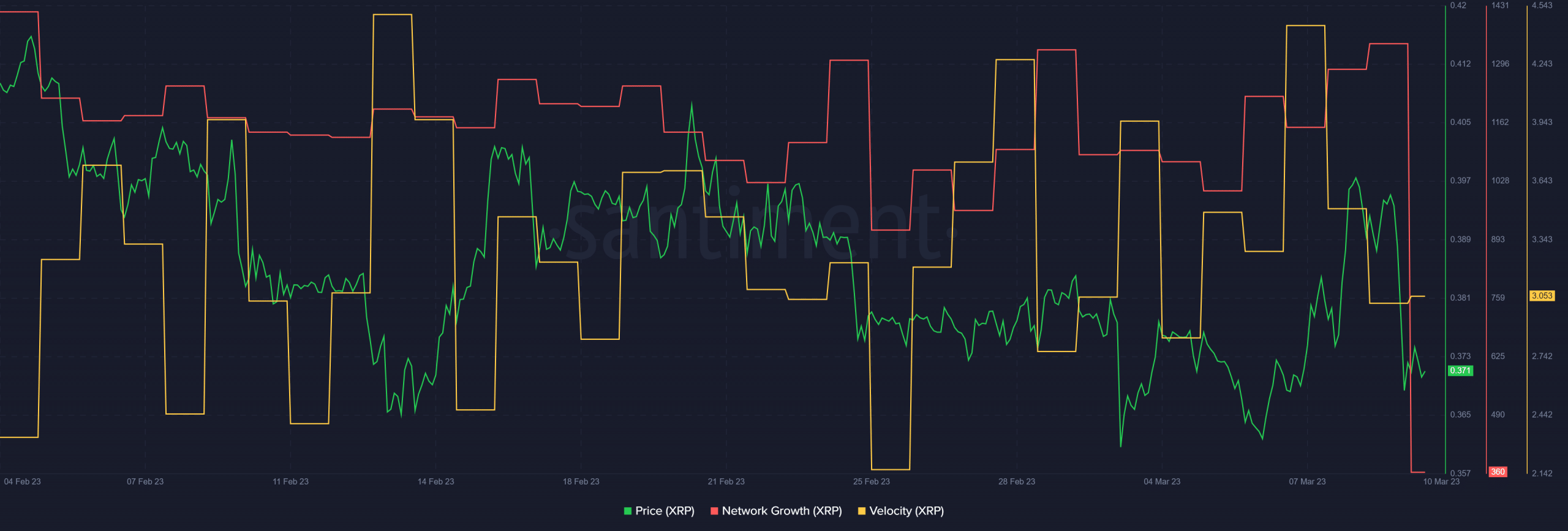

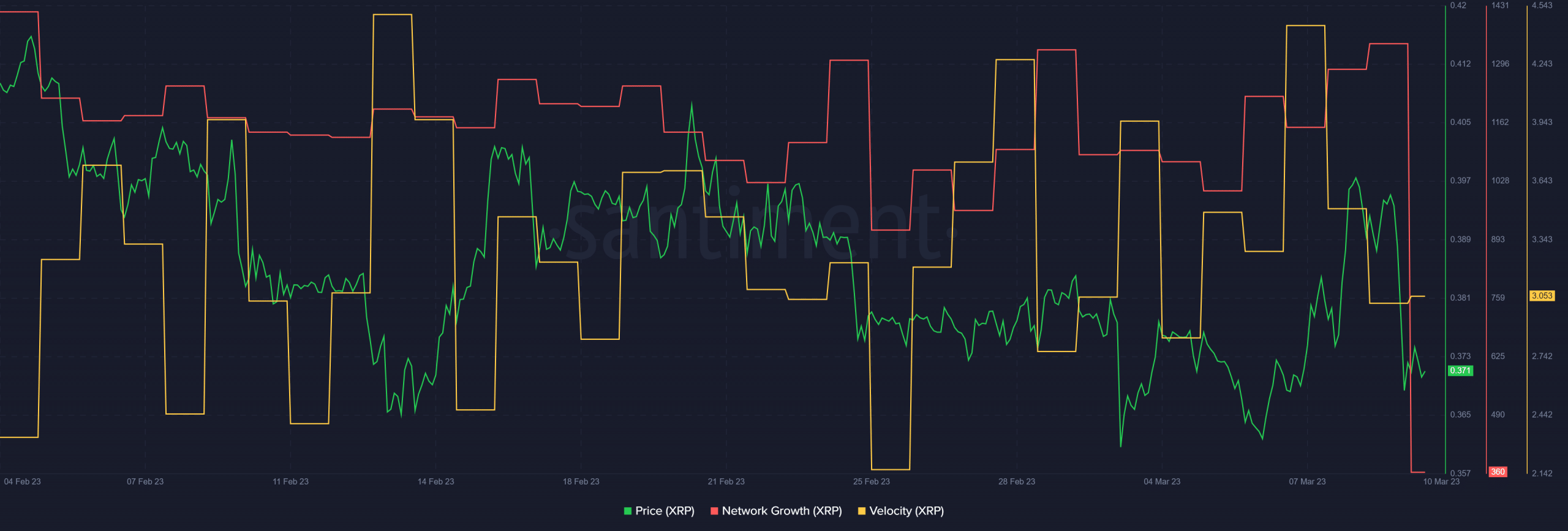

On the other hand, XRP’s velocity dipped, indicating that fewer tokens were exchanged in the past few days/hours. In addition, the network growth also declined sharply at the time of writing, evidence of a decline in the traction of the project.

Source: Santiment