What these Bitcoin [BTC] metrics reveal about its current position

- Bitcoin’s performance in February reveals that investors are optimistic about long-term prospects.

- Bitcoin is off to a bullish start, but exchange inflows suggest that some more sell pressure may curtail the short-term rally.

Bitcoin [BTC] just wound up the shortest month of the year above its end of January, close despite more uncertainty in February. Now the big question for most trading is whether it will sustain the bullish bias or keep give in to the bears.

Is your portfolio green? Check out the Bitcoin Profit Calculator

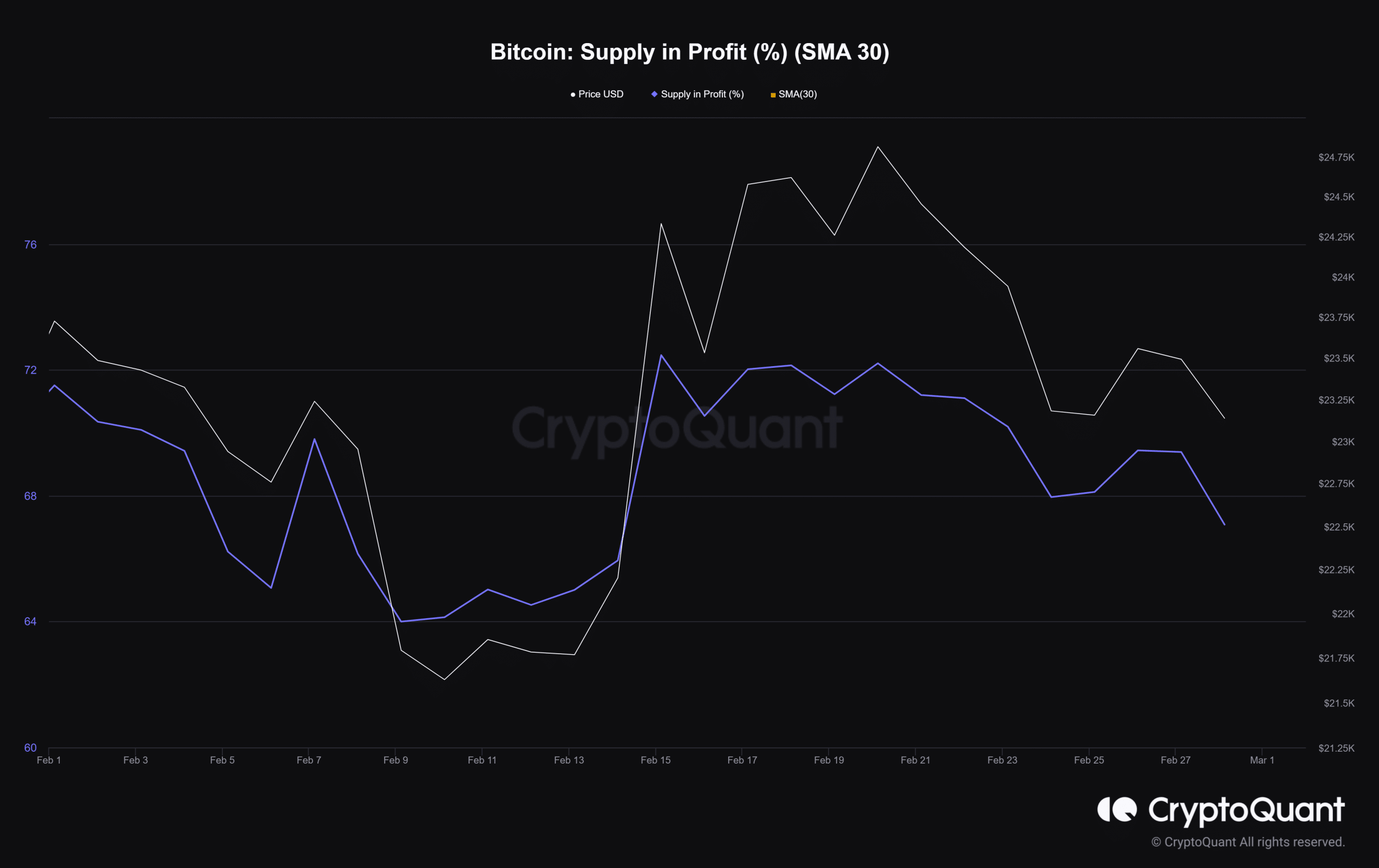

Bitcoin’s performance in February may offer some insights into the cryptocurrency market’s current condition and March expectations. BTC’s supply in profit was down to 67% by the end of February, after peaking at 72.2% during the same month.

This decline confirms that there was ample accumulation near recent highs with the expectation that prices will remain. It also confirms that most of the current holders bought in January.

Source: CryptoQuant

In contrast, the current level of Bitcoin supply in profit is still above the lowest level in the last four weeks. The supply in profit bottomed out at 63.99% during the month. This means there is still some room for more downside before it reaches the perceived bottom range below 45%. The glass half full view suggests that there is a lot of room for more upside before it the peak of the bull cycle.

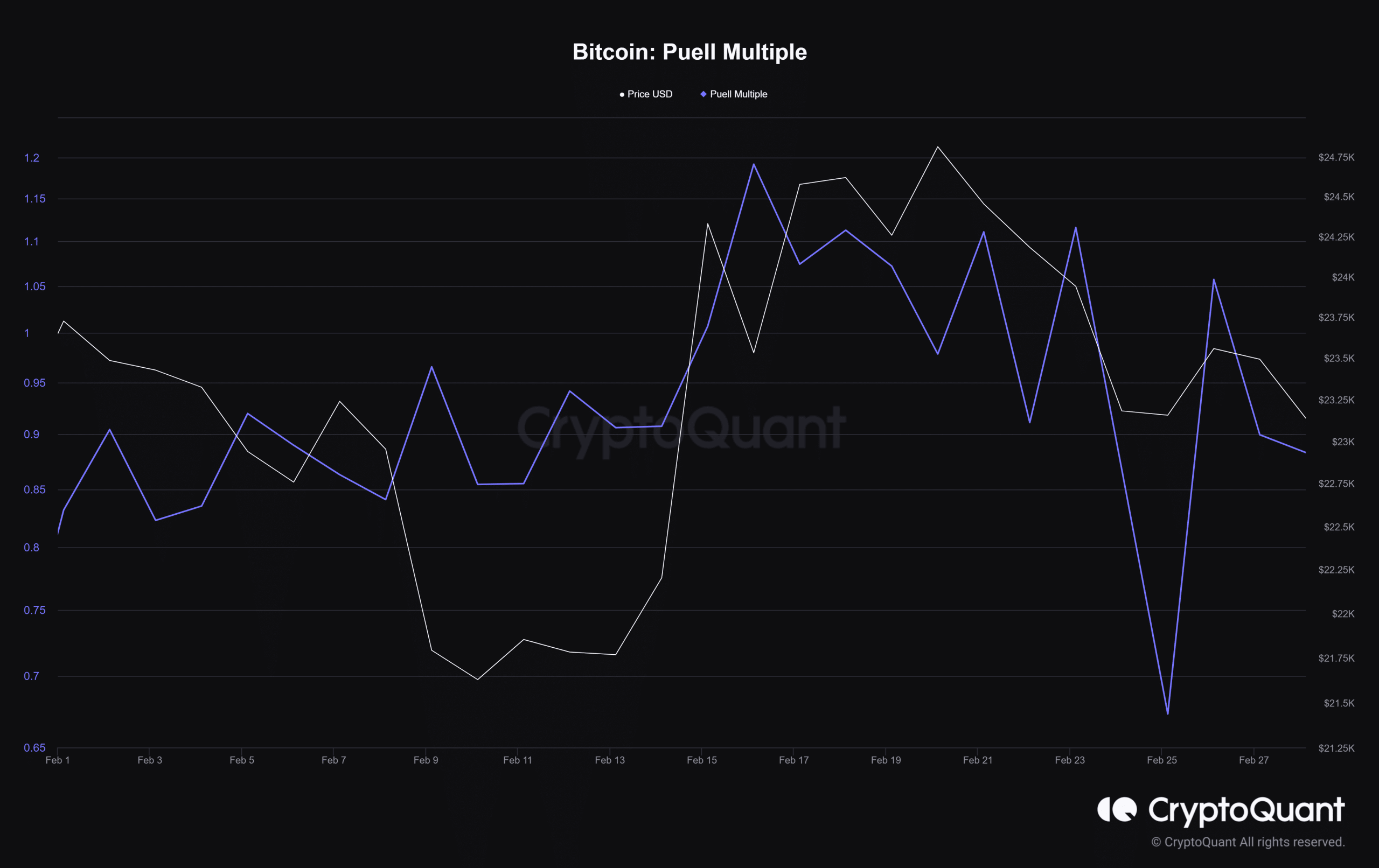

As far as the value of the Bitcoin issued on a daily basis is concerned, the Puell multiple dropped to its lowest monthly level on 25 February. Its value at the lowest point was 0.67, hence indicating relative strength among the BTC holders.

Source: CryptoQuant

Bitcoin’s peak Puell multiple figure was 1.19 in mid-February. This means it was well below the level considered as euphoria, but the lower range was also not in the capitulation range. These findings further add to the evidence suggesting that investors maintained an optimistic sentiment in February.

Can Bitcoin sustain the optimism?

So far, the market has maintained some degree of optimism, as was the case with most investors holding for long-term gains. However, the FOMC’s next meeting, which will take place later this month, might determine the next major outcome. Press time sentiments expect FED to raise rates slightly. Such a move may trigger some market FUD and send Bitcoin potentially below $20,000 once again.

The economic dice is yet to roll; hence, the expected FED interest rate hike is not guaranteed to take place. Bitcoin kicked off March with a bit of a rally as it attempts to bounce off the RSI mid-range.

Source: TradingView

How much are 1,10,100 BTCs worth today?

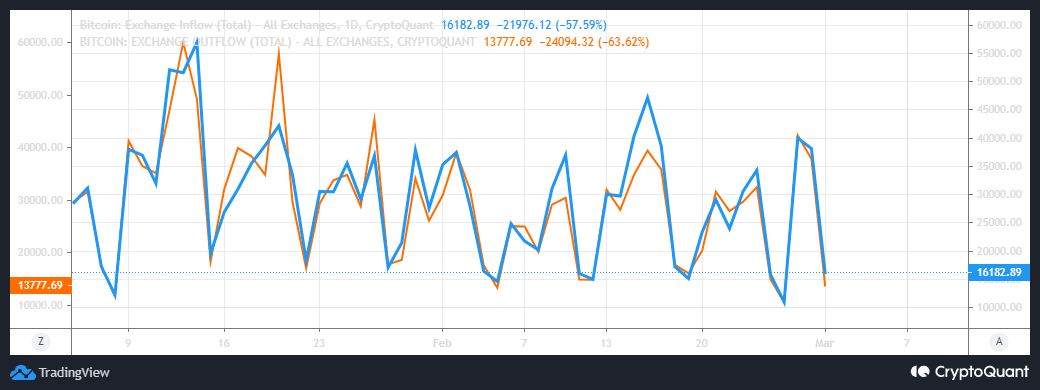

Bitcoin achieved a 2.63% rally in the last 24 hours, but the MFI indicates that it is experiencing outflows. A look at the Bitcoin exchange flows confirmed that exchange inflows were higher than exchange outflows at the time of writing.

Source: CryptoQuant

These higher exchange outflows may give way for the bears in the short-run unless a demand shift occurs.