TRON [TRX] overtakes ETH in this metric, but troubles manifest

- Stablecoin adoption in retail payment has been increasing in the TRON network.

- Monthly active users increased, but TVL registered a decline.

On 26 February, TRON [TRX] overtook Ethereum [ETH] in terms of USDT supply on the network. As per a TRON community tweet, USDT supply on TRON rose to over 40 billion while declining on Ethereum at the same time.

#USDT supply on the #TRON network has risen to over 40 billion while at the same time declining on #Ethereum 💪 pic.twitter.com/Iuh7jcmDvg

— TRON Community (@TronixTrx) February 26, 2023

How much are 1,10,100 TRXs worth today?

Additionally, Cuy Sheffield, head of crypto at Visa, highlighted TRON’s growth and increased adoption. He asserted that Stablecoin adoption in retail payment has been increasing, which resulted in a spike in the TRON network. As a result, TRON stepped up its game in global adoption.

2/ By assigning a <$200 value heuristic to the on-chain transaction data, a base level proxy for payments can be created. Applying this to the top chains used for stablecoins provides an interesting picture. pic.twitter.com/ORMQSq5ihH

— Cuy Sheffield (@cuysheffield) February 25, 2023

TRX grows in leaps

Unsurprisingly, TRX’s growth in terms of monthly active users seemed in better stead than its competitors. TRONSCAN’s data revealed that TRX’s total accounts increased from 80 million to over 144 million in just one year. The official account of TRON took to Twitter on 27 February to celebrate these achievements.

Hey #TRONICS! We’re blazing ahead with fast transactions, massive scalability, and TVM/DPoS design.

✅140M+ accounts

✅40B+ #TRC20–#USDT in circulation#TRON is the go-to chain for #DeFi, #NFTs, #Oracle and #GameFi. Join us and build the decentralized future together! 🚀 pic.twitter.com/5dcE0a3ckI— TRON DAO (@trondao) February 27, 2023

However, while TRON’s adoption and accounts continued to rise, a slight decline was noted in the network’s Total Value Locked (TVL) in the last few days. The decline can be attributed to TRX’s latest price plummet, thanks to the bearish market.

According to CoinMarketCap, TRX’s price decreased by 4% in the last week, and at the time of writing, it was trading at $0.06867 with a market capitalization of over $6.28 billion. Considering the above-mentioned updates, an increase in TRX’s price could help the network regain its upward momentum in terms of TVL.

A TVL increase might be delayed

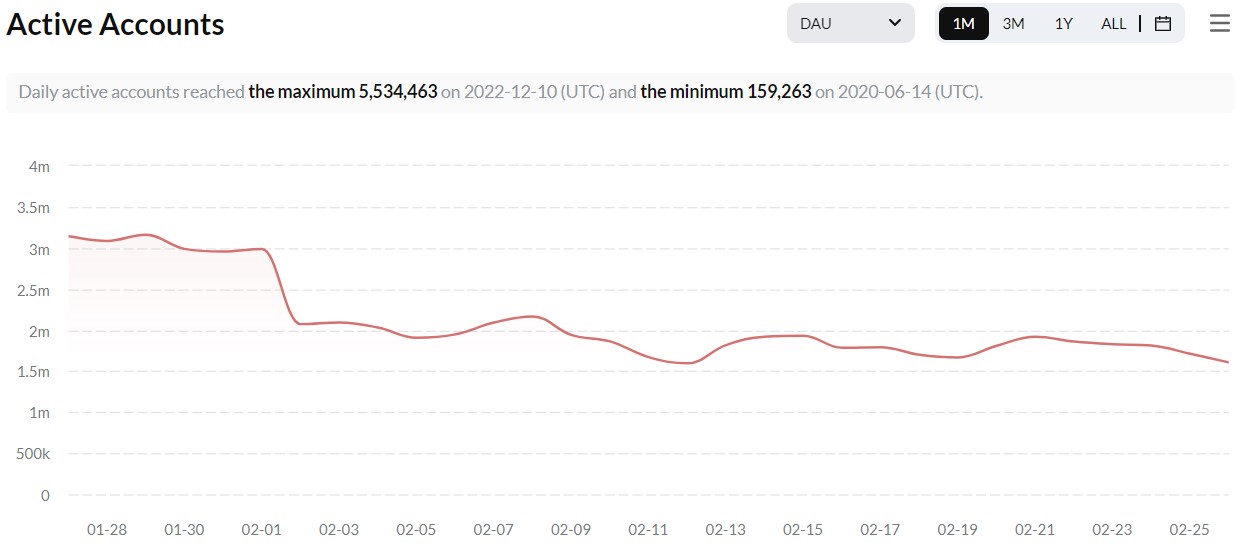

Surprisingly, while total accounts increased considerably, TRON’s daily active accounts registered a decline in the last 30 days, which was a negative signal.

Realistic or not, here’s TRX market cap in BTC’s terms

Source: TRONSCAN

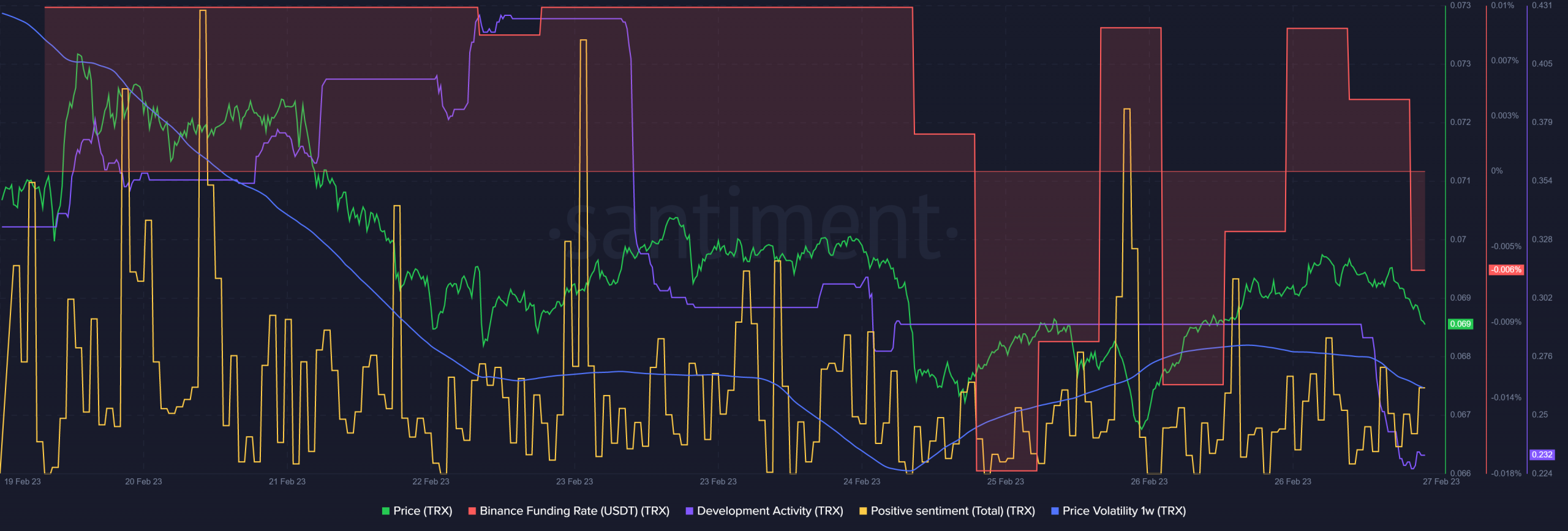

A look at Santiment’s chart also revealed that the TRON ecosystem was not in the best of health, as some of the on-chain indicators were against the possibility of a price increase in the coming days. For instance, TRX’s demand in the derivatives market fell on 27 February as its Binance funding rate declined.

TRX’s development activity also went southward last week, which is a negative signal. Positive sentiments around TRX seemed to have declined last week, suggesting less faith among investors in the token. Additionally, TRX’s one-week price volatility was also down, minimizing the chances of a sudden price uptick.

Source: Santiment