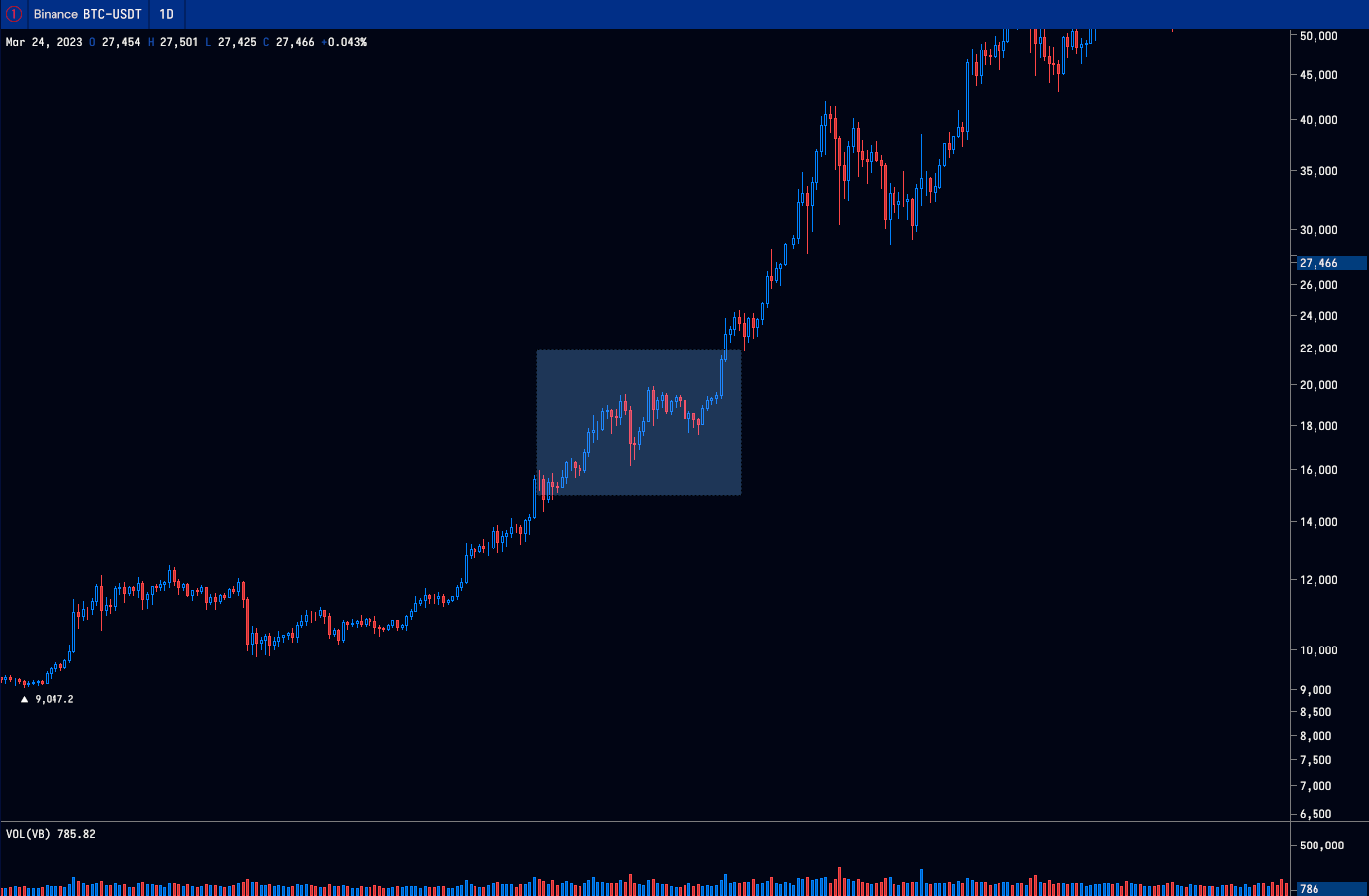

Top Trader Says Bitcoin (BTC) Flashing 2020-Style Accumulation Prior to Breaking Out to New All-Time Highs

A closely followed trader believes that Bitcoin’s (BTC) current market structure looks similar to its price action in the second half of 2020 before the king crypto convincingly took out the $20,000 level.

Pseudonymous trader Cantering Clark tells his 163,300 Twitter followers that Bitcoin looks bullish after managing to absorb the sell-off last Friday.

According to the analyst, BTC bulls have the upper hand as long as Bitcoin trades above support at $27,000.

“So we failed to break out of the inside day setup, and instead it looks like we accumulated a bit of panic selling below. Coin margined OI (open interest) is up, probably due to hedging, and some long stablecoin margined OI is down, part of the flush. I grabbed a long as long as yesterday’s lows hold.”

At time of writing, Bitcoin is trading for $27,644, well above the trader’s support area.

The trader also highlights that Bitcoin’s four-hour chart appears to mimic a pattern witnessed in November 2020 when BTC took a breather before taking out the key psychological area of $20,000.

“I don’t like to lean on fractals, but this one from 2020 looks almost identical to what we have now on the 4-hour chart. This occurred as price consolidated under the 2017 high.”

Although Cantering Clark is bullish on BTC, he says that traders should be patient and wait for more signals. According to the analyst, BTC still continues to trade within a narrow range between $27,000 and $28,868. A break of either the low or the high of the range could determine BTC’s next move, says Cantering Clark.

“I think it is worth being patient with Bitcoin here, given the high timeframe break, but I do see the other side’s valid points about possible distributive price action. That being said, there is a pretty clean inside day break that is set up. Acceptance above or below yesterday’s range should offer a brief continuation play. If through the lows, down to $26,5000, and a break above possibly much longer of a throw to $30,000.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Sensvector/EB Adventure Photography