the new layer-2 solution for Bitcoin

Marathon Digital, a leader in the Bitcoin mining sector, on February 28 unveiled to the public the design of the Anduro blockchain, a layer-2 solution aimed at solving the scalability issues of the world’s most well-known cryptographic network.

Conceptually similar to the Lightning Network but at the same time very different on a technical level, Anduro is set to become the ideal place for Bitcoin developers who want to build new successful applications and implementations.

Meanwhile Marathon reports financial results above expectations in the last quarter, consolidating its position on the Nasdaq with MARA stock prices up 300% compared to a year ago.

Let’s see all the details below.

Marathon Digital announces the launch of Anduro, a layer-2 blockchain built to improve Bitcoin scalability

Marathon Digital, a company dedicated to cryptocurrency mining, announced on Wednesday, February 28th that it has started work on Anduro, a layer-2 blockchain capable of improving the performance of the main Bitcoin network.

In the company’s blog post, we can read that it is a multichain solution, designed to accelerate the development and adoption of Bitcoin, offering developers an ideal place to build the future of the chain.

Today, we’re announcing Anduro: a multi-chain, layer-two network on #Bitcoin. pic.twitter.com/kgEAlbJdto

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) February 28, 2024

Although at first glance, Anduro may seem similar to the Lightning Network, a secondary network of Bitcoin capable of supporting economic and instant transactions, it actually has very different characteristics.

The creation of the giant Marathon Digital was in fact designed essentially to support the creation of multiple sidechains, capable of differentiating and fragmenting the significant weight of transactions on the primary layer.

By the way, the miner is already working in particular on 2 sidechains, Coordinate and Alys, conceived respectively to offer a fertile ground for the proliferation of Ordinals and to allow compatibility with Ethereum and with the tokenization operations of institutional assets.

In fact, this layer-2 was mainly designed to facilitate the work of developers and explore new connections with web3, before improving the final user experience.

As written in the blog, Anduro is programmed for:

“systematically integrate decentralized governance, with the goal of becoming the most reliable and developer-oriented layer-2 of Bitcoin”

It is worth noting how Anduro features an innovative system called “merge-mining“, which allows Marathon to earn simultaneously from both Bitcoin mining and transaction fees of the new blockchain, all with protection against MEV attacks.

At the center of the project is the “Anduro Collective“, a sort of heterogeneous consortium composed of entities particularly devoted to Bitcoin, which will manage the governance of the chain

in the early stages of life and will gradually be abandoned with other decision-making alternatives not based on trust.

Source: Litepaper Anduro

As highlighted by Fred Thiel, president and CEO of Marathon, the Bitcoin ecosystem needs a shake-up from an architectural point of view of the blockchain, capable of supporting a new wave of innovation:

“We believe in experimentation, iteration, and letting the market decide which ideas are successful. Anduro is one of those ideas that provides value to Bitcoin holders and application developers, while also strengthening the long-term sustainability of Bitcoin’s Proof-of-Work.”

The layer-2 is not live yet; at this stage Marathon is focusing on finding “influential and aligned” commercial partners capable of investing in the mainstream adoption of Bitcoin.

Marathon’s financial performance and analysis of the MARA stock

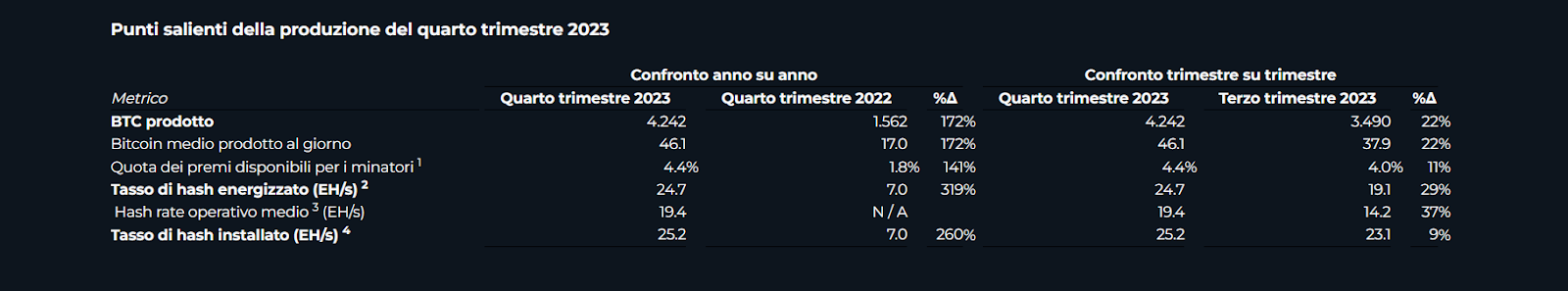

On the same day as the announcement of the Bitcoin Anduro layer-2, the Marathon Digital miner celebrated the release of fourth quarter financial results recording data in strong growth compared to the previous year.

In particular, the cryptocurrency miner reported a net profit of 261.2 million dollars (1.06 dollars per diluted share) which stands out from the net loss of 994 million dollars (6.12 dollars per diluted share) recorded in the last quarter of 2022.

The revenues increased by 229% to $387.5 million in 2023 starting from a base of $117.8 million in 2022.

Obviously, the excellent performance is due to the healthiness of the Bitcoin blockchain, where the company bases its core business: block production in 2023 for Marathon was more than 210% higher than last year, thus managing to mine more coins that at the same time boast an increased value on average of 101%.

The revenues of Marathon just listed actually mainly come from the sale of the Bitcoins mined from the network, having liquidated about 74% of what was produced in the calendar year.

The miner’s solid financial position is confirmed by the data on the liquidity of the company, which as of December 31, 2023 held $357.3 million in unrestricted and equivalent funds in its balance sheet in addition to a balance of 15,126 bitcoins.

Overall, cash and bitcoin amount to 997.0 million dollars, ready to be invested or used to enhance your business structure.

Below is a snapshot of Marathon’s mining production, with a year-over-year and quarter-over-quarter comparison.

For more information you can consult the press release from the company where all financial data are detailed.

In a context like this, made largely positive by Marathon’s strong presence in Bitcoin mining, the MARA stock can celebrate a revived price action after a disastrous 2022.

Following a 95% drawdown from the highs of November 2021 to the lows of January 2023, the stock listed on the Nasdaq reports an overall price growth of 650% up to the present day.

Compared to March 1, 2023, the increase in the value of MARA shares was instead 300%, driven by the recovery of the crypto market.

The price action so bullish of Bitcoin, has positively influenced the performance of the mining stock, whose fate depends on that of the digital gold that the company extracts daily.

MARA even presents an increased volatility compared to its underlying Bitcoin, with very evident mood swings in the midst of bull and bear market phases.

Currently prices are holding above the 50-week EMA and are struggling with the $30 threshold that separates the stock from another bullish leg up.

Although we might expect a small correction for the stock at this point, especially if Bitcoin does not perform positively, the path from here to the next few months for MARA is marked upwards.

Indicatively, we expect it to reach at least 50 dollars, especially if Marathon manages to succeed among the Bitcoin community with the launch of the layer-2 Anduro.

Weekly chart of MARA stock price