Solana (SOL) and Altcoins Still Have Massive Room To Rally, According to Macro Guru Raoul Pal

Macro guru Raoul Pal says that Ethereum (ETH) competitor Solana (SOL) is not done rallying even after soaring in recent weeks.

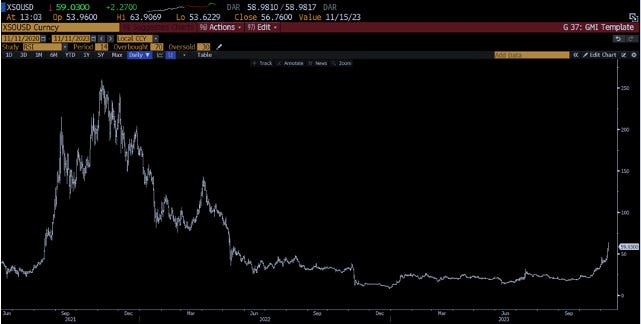

In a new edition of Pal’s Global Macro Investor (GMI) newsletter, the former Goldman Sachs executive says that Solana entered an uptrend after breaking out of a classic bullish pattern.

“SOL broke out from its inverse head-and-shoulders last month and is now up over 475% year-to-date. This has been one of our core trades at GMI (Global Macro Investor) this year and has worked out really well.”

However, he warns that SOL will likely retrace after the sudden surge based on the relative strength index (RSI), a widely used momentum indicator that aims to determine if an asset is overbought or oversold.

“Short-term, SOL is overbought with an RSI of 89 (highest since September 2021), so we should expect to see some selling pressure soon. This should not surprise anyone – we’re up 240% in two months!”

Zooming out, Pal expects Solana to continue rallying based on SOL’s broader historical price pattern.

“But then you look at this [chart] and realize it’s ALL still to play for.”

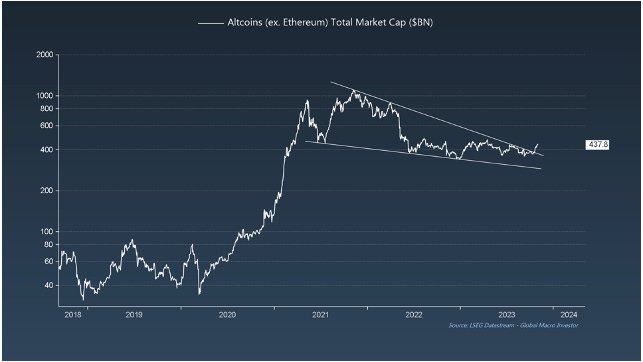

He also suggests that the total market capitalization of Solana and other altcoins is in an uptrend after breaking out of a bullish falling wedge pattern.

“And this chart too. Blimey.”

Solana is trading for $52.53 at time of writing, down 6.3% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Shacil/WhiteBarbie