Ripple (XRP) Price Prediction 2025-2030: Will impending verdict keep investors divided

Disclaimer: The datasets shared in the following article have been compiled from a set of online resources and do not reflect AMBCrypto’s own research on the subject.

Ripple’s native token XRP is currently the sixth largest cryptocurrency in the world. It was created in 2012 to enhance global financial transfers and the exchange of various currencies. XRP operates on the decentralized, open-source XRP ledger [XRPL], and transactions are facilitated by the Ripple transaction protocol. With a pre-mined token supply of 100 billion, XRP is unique compared to other cryptocurrencies.

Read Price Prediction for XRP for 2023-24

After the company was established, XRPL architects gifted 80 billion XRP tokens to Ripple for the company to build on the network. The XRP Ledger uses a consensus system that involves several bank-owned servers to verify transactions. The validators verify that the proposed transactions are valid by comparing them to the most recent version of the XRP Ledger. A transaction must be accepted by most validators to be verified.

In 2017 and early 2018, XRP reached an all-time high of $3.40, marking a 51,709% increase from its original price at the beginning of that year. Although it has since declined, XRP remains a significant player in the cryptocurrency market and is consistently ranked among the top ten coins in terms of market capitalization. The team behind XRP and Ripple continue to work on the development of the XRP ledger and its potential use cases in the global financial system. Overall, XRP remains a significant and influential cryptocurrency in the world of finance and technology.

According to data from CoinMarketCap, XRP was worth $0.4086 at press time. The token’s market capitalization of $20.75 billion made it the sixth largest cryptocurrency in the world. Moreover, XRP had a 24-hour trading volume of $813.17 million.

Despite its price fluctuations, XRP has proven to be a popular choice for many investors and traders, and its adoption and use by financial institutions has continued to grow.

A report by CoinShares indicated that investors are confident of Ripple’s victory in the landmark case against the SEC. This is based on the fact that XRP investment products have seen consistent inflows for three consecutive weeks.

On the business front, Ripple revealed key developments pertaining to its European expansion. The company shared its progress with Paris- based Lemonway and Xbaht in Sweden. Businesses in France and Sweden will now be able to leverage Ripple’s On-Demand Liquidity (ODL).

On 15 November, Ripple announced that it partnered with MFS Africa, a leading fintech firm with the largest mobile money footprint in the continent. This joint venture seeks to streamline mobile payments for users in 35 countries.

In other news, Ripple CTO David Schwartz took to Twitter to offer former employees of the troubled crypto exchange FTX, a place at Ripple. However, this offer only stands for employees who were not involved with compliance, finance, or business ethics.

About the platform

Ripple’s tie-up with Tokyo Mitsubishi Bank in 2017 was a major milestone. Following the same, it became the second-largest crypto by market capitalization for a brief period. A year later, Ripple was in the news again for its partnership with international banking conglomerate Santander Group for an app focusing on cross-border transactions.

In terms of rivals, Ripple has close to none at the moment. They are the leading crypto firm catering to financial institutions around the world. As the number of partnerships grows, XRP will reap the benefits. After all, it is the medium of exchange for all cross-border transactions enabled by RippleNet.

Ripple has been capitalizing on the need for quick transactions and another untapped potential in emerging economies, given that nations in Latin America and Asia-Pacific regions are more likely to realize the value of blockchain and its tokens compared to their first-world counterparts. With the rise of central bank digital currencies (CBDC), it is likely that developing countries looking to explore this option will go for Ripple since it already offers a well-established cross-border framework. Increased adoption of CBDCs will also lead to banking institutions considering integrating crypto into their services. This will work out very well for Ripple since RippleNet is already associated with a number of banks.

Blockchain solutions being offered to Ripple’s Central Bank partners wanting to venture into CBDCs include the option to leverage the XRP ledger using a private sidechain.

Ripple is predicted to develop rapidly over the forecast period, as it can be used for a variety of functions like accounting, investment, smart contract implementation, and decentralized programming.

XRP has an edge over its rivals due to its low cost of entry. The fact that a few dollars will buy tens of XRP seems appealing to new investors, especially those who prefer little investment.

According to a Valuates report, the cryptocurrency market’s size is expected to hit $4.94 billion by 2030, growing at a CAGR of 12.8%. A number of crypto-firms will benefit from this, Ripple among them.

The growth in the cryptocurrency market is spurred by an increase in the demand for operational efficiency and transparency in financial payment systems, as well as an increase in demand for remittances in developing nations.

The general idea is that RippleNet’s adoption by financial institutions will increase, leading to more recognition of the platform as well as its native token. This has also been factored in while calculating predictions for 2025 and beyond.

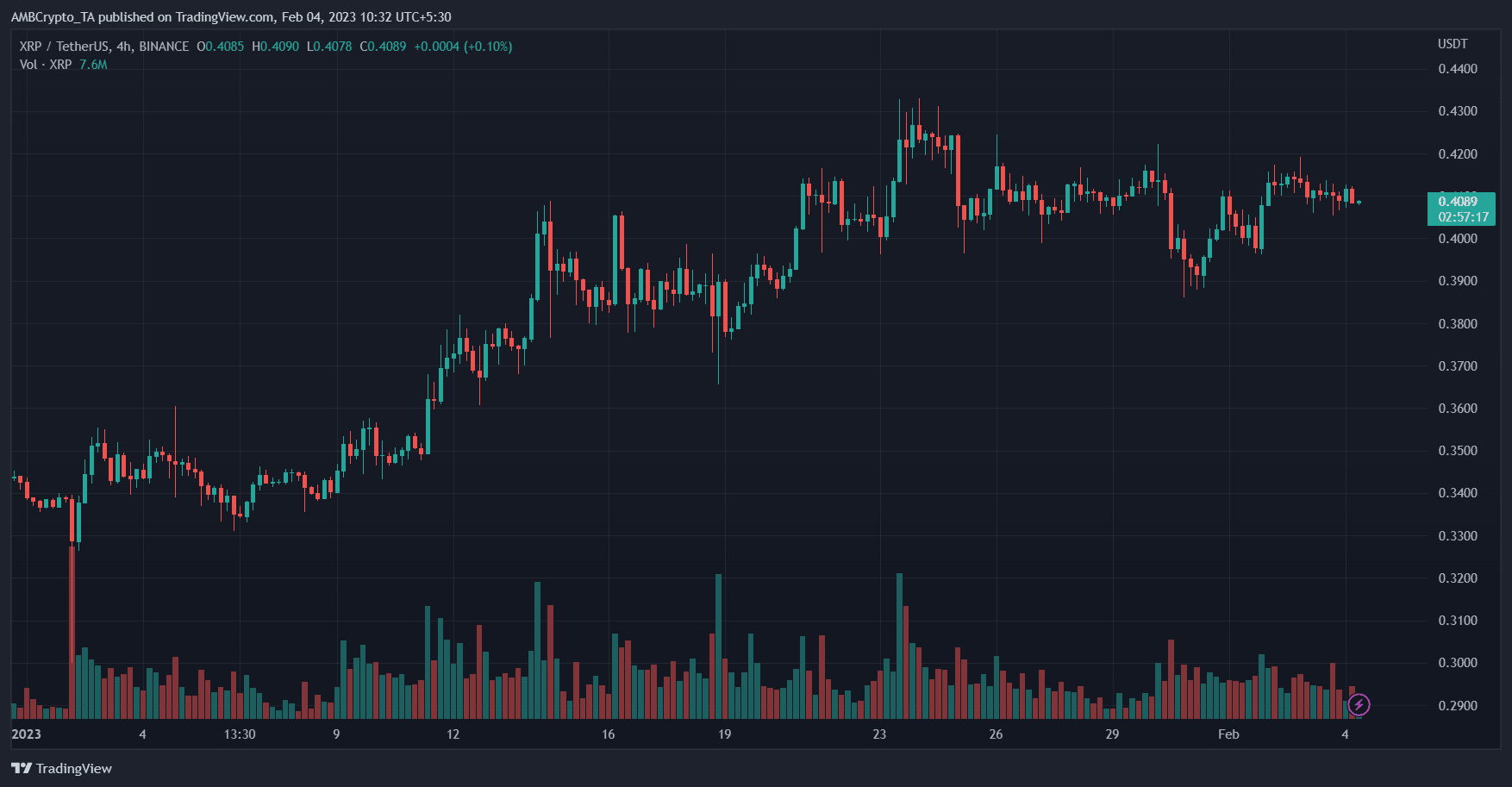

At press time, XRP was trading at $0.4089.

Source: TradingView

XRP’s press time price was a far cry from its all-time high of $3.84 in January 2018. As a matter of fact, its price was closer to its launch price than its all-time high.

Although XRP gained somewhat over the last 30 days, its year-to-date returns have investors worried.

SEC lawsuit and its impact

On 22 December 2020, the U.S Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs. The lawsuit alleged that Ripple had raised $1.3 billion through the sale of ‘unregistered securities’ (XRP). In addition to this, the SEC also brought charges against Ripple’s top executives, Christian Larsen (Co-founder) and Brad Garlinghouse (CEO), citing that they had made personal gains totaling $600 million in the process.

The SEC argued that XRP should be considered security rather than a cryptocurrency and as such, should be under their purview.

A verdict in favor of the SEC will set a rather unpleasant legal precedent for the broader crypto market. This is why this case is being closely observed by stakeholders in the industry.

It is evident that developments in the lawsuit have a direct impact on XRP’s price. Following the news of the lawsuit in 2020, XRP tanked by almost 25%. In April 2021, the judge handed Ripple a small victory by granting them access to SEC’s internal documents, which caused XRP to rise over the $1-mark – A threshold that the crypto hadn’t crossed in 3 years.

According to a tweet by Defense Attorney James Filan on 15 August 2022, the U.S District Court for the Southern District of New York dealt yet another blow to the SEC when Judge Sarah Netburn granted Ripple’s motion to serve subpoenas to obtain a set of video recordings for the purpose of authentication, dismissing the regulators claim that Ripple was trying to reopen discovery. This was in response to Ripple’s motion filed on 3 August 2022.

In the Opinion & Order published earlier in July, Judge Sarah Netburn condemned the SEC for its “hypocrisy” and actions which suggested that the regulator was “adopting its litigation positions to further its desired goal, and not out of a faithful allegiance to the law.”

The lawsuit’s verdict, whatever it is, will have a lasting impact on XRP’s value. It is important to note that a verdict in favor of the SEC would make XRP security only in the U.S because the regulator does not have jurisdiction across the country’s borders. This should offset some of the damage to Ripple, given that it has a substantial amount of business globally

Carol Alexander, Professor of Finance at the University of Sussex, believes that XRP is unlike any other crypto. She believes that if Ripple manages to beat the SEC lawsuit, it could start taking on the SWIFT banking system. SWIFT is a messaging network that financial institutions use to securely transmit information and instructions

In an interview with CNBC, Ripple CEO Brad Garlinghouse talked about the possibility of an IPO after the case with the SEC is resolved. Ripple going public will have a significant impact on XRP’s price action in the following years.

In an interview with Axios at Collision 2022, Garlinghouse further stated that the current price of XRP has already factored in Ripple losing the case. “If Ripple loses the case, does anything change? It’s basically just status quo,” he added.

As for his personal opinion on the verdict, Garlinghouse is betting that it will be in favor of Ripple. “I’m betting that because I think the facts are on our side. I’m betting that because the law is on our side,” he remarked.

Curiously, support for Ripple and XRP hasn’t been universal really, with Ethereum’s Vitalik Buterin recently commenting,

“XRP already lost their right to protection when they tried to throw us under the bus as “China-controlled” imo”

In court and in papers

Ripple and the SEC’s lawsuit is not just restricted to the courtroom. The matter is often covered by the media with both parties having been featured in multiple op-eds, often criticizing each other. Just this month, the market watchdog and the crypto firm were the subject of a heated exchange through pieces published by the Wall Street Journal.

On August 10, SEC Chairman Gary Gensler reiterated his stance on the definition of crypto assets and their oversight in his op-ed piece featured in The Wall Street Journal. “Make no mistake: If a lending platform is offering securities, it . . . falls into SEC jurisdiction.”

Chairman Gensler went on to cite the $100 million settlement that the regulator had reached with BlockFi, stating that the crypto markets must comply with “time-tested” securities laws. As per the terms of the settlement, BlockFi has to rearrange its business to comply with the U.S Investment Company Act of 1940 in addition to registering under the Securities Act of 1933 to sell its products.

In response to Chairman Gensler’s op-ed, Stu Alderoty published his own piece in The Wall Street Journal and did not mince his words while taking a shot at the regulator. Alderoty accused Gensler of side-lining fellow regulators (CFTC, FDIC etc.) and overreaching its jurisdiction, as opposed to the executive order by U.S President Joe Biden, which directed agencies to coordinate on regulations for crypto.

“What we need is regulatory clarity for crypto, not the SEC swinging its billy club to protect its turf at the expense of the more than 40 million Americans in the crypto economy,” Alderoty added.

A controversial article authored by Roslyn Layton in Forbes on 28 August pointed out that since 2017, the SEC’s Crypto Assets Unit has been involved in 200-odd lawsuits. According to Layton, this figure suggests that instead of coming up with clear regulations to ensure compliance, the regulator would rather engage crypto firms with lawsuits in an attempt to regulate by enforcement.

Ripple CTO David Schwartz found himself in a stand-off with Ethereum Co-Founder Vitalik Buterin earlier this month, after Buterin took a dig at XRP on twitter. Schwartz hit back and responded to Buterin’s tweet, comparing miners in the PoW ecosystems like Ethereum to stockholders of companies like eBay.

“I do think it’s perfectly fair to analogise miners in PoW systems to stockholders in companies. Just as eBay’s stockholders earn from the residual friction between buyers and sellers that eBay does not remove, so do miners in ETH and BTC,” Schwartz added.

Now, putting an accurate figure on the future price of XRP is not an easy job. However, as long as there are cryptocurrencies, there will be crypto pundits offering their two cents on market movements.

Ripple [XRP] Price Prediction 2025

Changelly has gathered an average prediction of $0.47 for XRP by the end of 2022. As for 2025, Changelly has provided a range between $1.47 to $1.76 at max for XRP.

Finder’s conclusion from a panel of thirty-six industry experts, is that XRP should be at $3.61 by 2025. It should be noted that not all of those experts agree on that forecast. Some of them believe that the crypto won’t even cross the $1 threshold by 2025. Keegan Francis, the global cryptocurrency editor for Finder, does not agree with the panel of experts. He predicts that XRP will be worth $0.50 by the end of 2025 and, surprisingly, a mere $0.10 in 2030.

According to data published on Nasdaq, the average projection for 2025 is around $3.66.

Are your XRP holdings flashing green? Check the profit calculator

Ripple [XRP] Price Prediction 2030

Finder’s experts had a rather conservative figure for XRP in 2030. They believe that the crypto could hit $4.98 by 2030. In a statement to Finder, Matthew Harry, the Head of Funds at DigitalX Asset Management, revealed that he doesn’t see any utility in XRP other than the speculation element.

According to data published on Nasdaq’s website, the average projection for 2030 is around $18.39.

Conclusion

Year-to-date (YTD) figures from Ripple’s Quarter 2 earnings report have made it clear that despite the drop in XRP’s price, demand for their On-Demand Liquidity service not only remained undeterred but actually grew by nine times year-over-year (YoY) with ODL sales totalling $2.1 billion in Q2. The report further stated that Ripple has pledged $100 million for carbon removal activities, in line with their carbon neutral objective and sustainability goals.

Ripple’s Crypto Trends report claims that NFTs and CBDCs are still in their nascent stages and as their potential is gradually realized, its impact on Ripple’s network and on the broader blockchain space will be visible.

It should be noted that while various experts have predicted XRP’s price to increase in the following years, there are some who believe that XRP will lose all value by the end of the decade.

The major factors that will influence XRP’s price in the coming years are:

- Verdict of the SEC lawsuit

- IPO after lawsuit is resolved

- Partnerships with Financial Institutions

- Mass Adoption

- CBDC ventures by Central Banks

Predictions are not immune to changing circumstances, and they will always be updated on new developments.

With the Fear and Greed index leaning towards ‘neutral’ at press time, it implies that more investors were experiencing confidence with regards to Ripple.

Source: CFGI.io