NFT Investing Explained for Today’s Market

NFT

NFT investors and artists have had a rough April. Both trading volume and unique users hit lows not seen since July 2021, and the royalty wars have artists in an endless marketplace blacklisting cycle.

The phrase, “we are still early” is now old. Early and new adopters need it like a cigarette addict sucks dopamine from a nicotine patch.

In traditional markets, chasing novelty is a losing strategy, leading to cynicism in times of opportunity and over-optimism in times of prudence.

The NFT market, though, is a unique beast because it is a direct monetization of novelty. Like the traditional art market, it follows the intangible whims of originality and mimetic desire – but at lighting speed.

Despite the apparent randomness of these whims, they do follow cyclical patterns of change. These historic lows amid the marketplace battle for users is a sign that the NFT industry is entering a new era of investing. But before we explain why and how, we need to review NFT investing fundamentals.

What makes an NFT valuable?

At some point, you have probably read that the value of NFTs comes from their demand. This circular and lazy reasoning misses the question by a mile. NFT collections derive value from the ability to inspire new and original non-fungible works. It is ultimately measured by their ability to shape and pull from the collective subconscious.

For example, the number of spin offs of the Bored Ape Club collection demonstrated that the project tapped into a deeper societal meme – something that could be replicated with little difficulty. It introduced the concept of monkey NFTs and is now considered a blue-chip asset in the space.

Once the concept behind a collection stops inspiring new works, the novelty and trading volume of the collection tends to drop as the meme fades to black. But like the death of a god, new memes are always ready and eager to fill a vacancy. They can even pull forgotten works of art back into the spotlight.

The best approach to NFT investing is to study markets the same way you would a Greek pantheon. You want to map the hierarchy of ruling memes, how they differ, the length of their dynasty, and their potential usurpers. NFT investors often refer to this narrative mapping as the meta – a series of factors that keep an NFT collection alive and relevant. Here is a brief list.

Scarcity

NFT investors tend to view the scarcity of a collection as a key indicator of its value. They evaluate it multiple ways. First they measure the limitation of supply. For example if a project sets a permanent cap to a collection’s supply, its collectors may perceive the NFTs as more valuable and exclusive.

Secondly, they look at the rarity within the collection. If there is a distribution of traits that produce common, rare, and ultra rare NFTs, it can generate a sense of urgency and competition within collectors. Greater complexity and depth of meaning tends to attract more serious and committed collectors.

The famous success of CryptoPunks is a perfect example. The creators permanently capped the collection at 10,000. And within the set, there are various levels of rarity based on the traits of each character. Some CryptoPunks have common features, while others have rare or ultra-rare attributes, such as unique hairstyles, accessories or facial expressions.

Community

A strong NFT community provides social validation and credibility. This can attract more collectors, investors and enthusiasts, leading to increased demand and higher prices. It can also create a network effect, where the value of the NFT collection increases as more people join the community and participate in the ecosystem. This pattern adds to the scarcity by increasing competition.

These neworks foster collaboration and partnerships between new and existing creators. The synergy ultimately helps propagate the broader meme in new and interesting ways.

Functionality

Collectors and investors may be more inclined to purchase NFTs with specific use cases or purposes, which can drive up demand and prices. For example, NFTs can represent in-game items, characters or assets that have utility within a specific game or virtual world. The more useful or powerful these assets are, the higher their value can be. They can also grant holders exclusive access to events, content or experiences.

Additionally, NFTs that have a connection to real-world assets can increase their value. Examples include NFTs that represent physical art, real estate or tickets to live events.

Form

Form, and aesthetic and artistic qualities of an NFT collection, can play a significant role in determining its value. There is no limitation to form. It can be a JPEG, music file, text, video, domain address, virtual land, and even geo coordinates.

However, the most popular NFTs tend to gravitate toward one form. For example, the top 5 NFT collections are all JPEGs.

The visual appeal, design, and uniqueness has more variation between the leading NFTs. Collectors like to evaluate pop culture appeal, compare storytelling depth and overall artistic quality. Form is one the top factors in most investors’ meta and investing strategy.

Many devote their time to predicting what style or animal will become popular in the future. This phenomenon tends to be a self fulfilling prophecy where if a group of investors predict that people will buy penguins in the future, they will be the ones to fulfill their prophecy. These trends though are sometimes socially engineered in a way to prey on secondary investors.

Creator royalties

The importance of creator royalties is a hot topic of debate. Some investors argue that royalties add value because they provide greater sustainability to artists and create a healthier ecosystem. They also incentivize greater investment from the artist to promote the collection and form new collaborations and partnerships.

Other investors avoid collections or marketplaces that enforce royalties because of the added cost. If their purchase is a short-term investment, then fees take a greater cut in profit margins.

Read more: How NFT Royalties Work and Sometimes Don’t

Marketing

A strong social media presence can help an NFT collection reach a wider audience, create a community and engage with potential buyers. Platforms such as Twitter, Instagram, Discord and Reddit are often used for promotion and community-building.

Additionally, collaborating with influencers, artists, or celebrities can boost the visibility and credibility of an NFT collection. These partnerships can attract new audiences, generate hype, and create a sense of exclusivity around the collection.

But influencer marketing has also been used deceptively. For example, a class action lawsuit alleged that Paris Hilton and Jimmy Fallon neglected to disclose that they were paid to promote Bored Ape Yacht Club NFTs. Many other influencers have also been unknowingly pulled into promoting projects that would later get rug pulled.

Psychology of NFT Investing

NFT investing may be a unique beast that plays by a different set of rules, but it’s not pure chaos. To understand the psychology of investing, we need to review the history of meme theory.

Meme theory

Meme theory is the psychological and philosophical study of how ideas, symbols and stories spread through culture and history. The first to study this, Rene Girard, believed that a central component of the phenomenon is mimetic desire – the belief that humans are wired to imitate the desire of others.

Richard Dawkins was the first to coin the term “meme” and defined it as units of cultural transmission. Dawkins believed that through the force of natural selection, memes seek their own survival as if they are a living organism.

History shows that some memes are more contagious and useful than others. And whether by natural selection or some mysterious force, they form super structures that often compete for attention and adoption. This dynamic and contentious tapestry is why the Greek pantheon and usurper myth is a fitting analogy. Each niche, like NFT investing, is a microcosm of what’s happening on a global scale. So for the purpose of clarity, let’s define some of these terms as they relate to NFTs:

Meme: An idea of what an NFT can be (not the NFT itself)

Example: The monkey NFT and penguin NFT memes

Every meme has a story arc, which can be mapped to better understand the current stage and potential future of a particular NFT trend. NFT investing involves identifying where a meme is in its arc and predicting its trajectory.

This requires some creativity and storytelling fundamentals. For example, to gauge the status of the meme of Penguin NFTs, an investor would use market data and social sentiment to plot a story arc of it in relation to its competitors. This insight allows investors to capitalize on opportunities and navigate risks associated with the ever-evolving NFT landscape.

Meta narrative: A hierarchical list of characteristics that make an NFT more valuable than others

Example: The prioritization over form than function

All memes within a given niche and era follow a meta narrative. These archetypal patterns represent the shared characteristics and values driving the popularity of certain NFTs. These narratives get more abstract than the memes themselves. But investors should be aware of the competing narratives within the NFT space and recognize that these narratives all have expiration dates (some later than others) and will eventually evolve or get left behind.

Meta cycle: The emergent narrative driving the value behind all or most NFTs

Example: This is harder to pin down because it is the invisible venn diagram of all shared meta narrative characteristics

Meta cycles encompass the overlapping components of these narratives and serve as a reflection of the collective behavior of the NFT market. At any given time, there can only be one NFT meta cycle, which dictates the overall direction of the market. Understanding the current meta cycle helps investors identify patterns and trends, providing valuable context for their investment decisions.

Analyzing NFT meta narratives

One of the major narratives surrounding NFTs is the idea of supporting artists and creators through a sustainable income stream. This ruling narrative was challenged when NFT marketplaces stopped enforcing royalties. This sparked a major divide between communities and the marketplaces themselves.

While backlashes ensued, a rival trader’s first narrative emerged. This meta prioritizes the potential of NFTs as speculative assets over other characteristics and argues that royalties limit the market as a whole from potential upside.

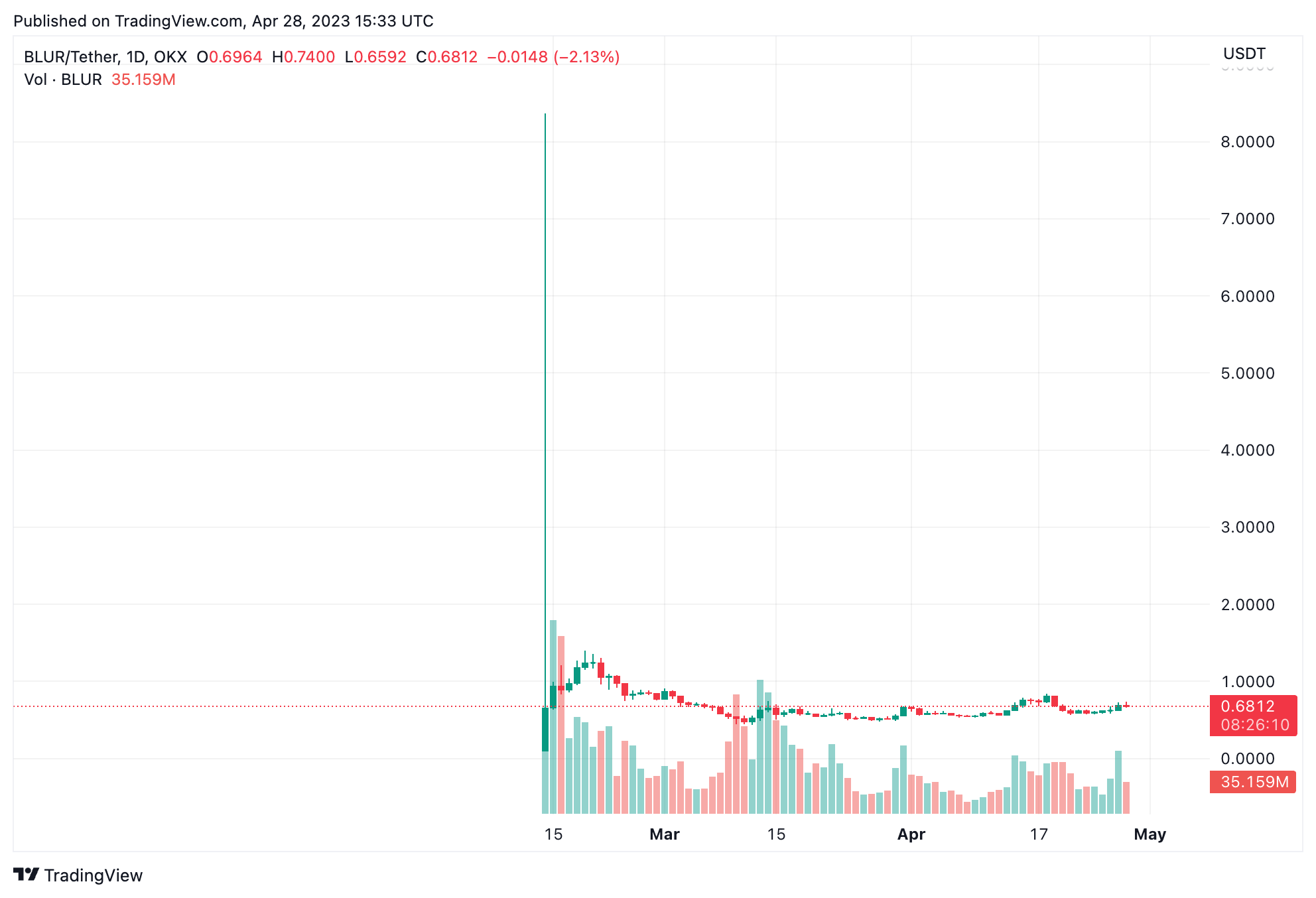

This tension ultimately came to a head between NFT marketplaces OpenSea and Blur.io. Blur initially followed the trend of most marketplaces and dropped royalties and all trading fees to embrace a trader-first narrative. They even created trading incentives through airdropping a loyalty token.

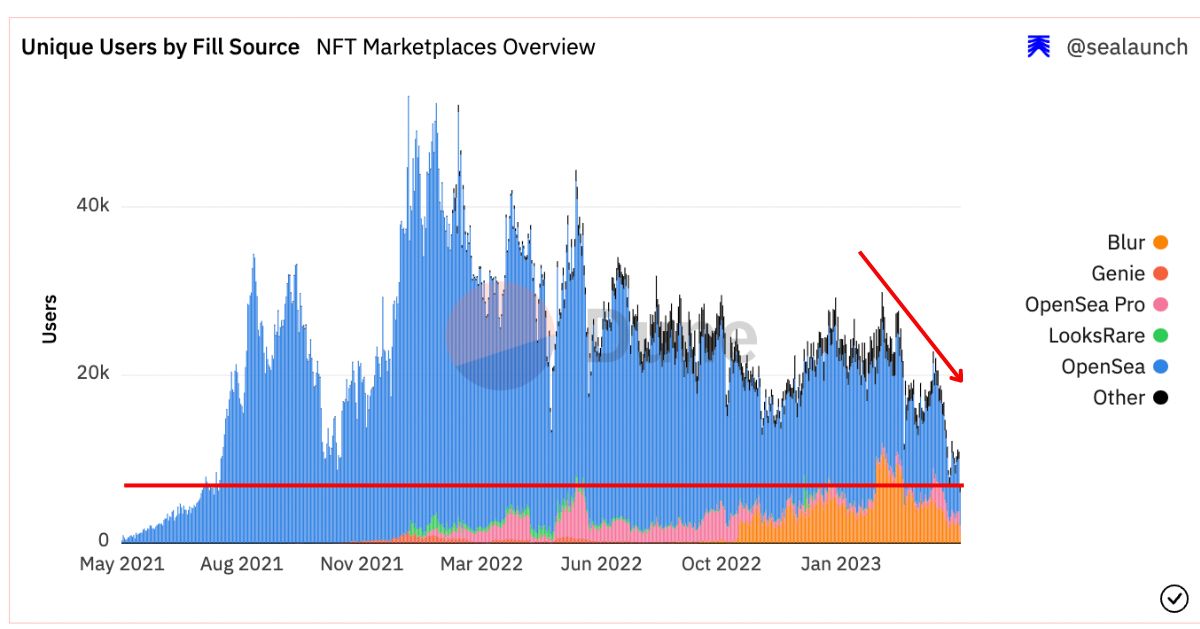

This shift in narrative initially created a surge in trading volume in mid February 2023 and even helped Blur.io flip OpenSea as the marketplace with the most trading volume.

Source: @sealaunch

Prior to this surge, in November 2022, OpenSea implemented a policy that required collections to block non enforcing marketplaces like Blur if they wanted royalties on OpenSea.

This inflamed the contention between the rivals. Blur initially tried and failed to make a way for creators to get around the blacklist. And then on Feb. 15, 2023, one day after the token airdrop, Blur reinstated royalties with a clause requiring collections to block OpenSea.

With the surge in volume from the Blur airdrop, this motivated many collections to follow suit in blocking OpenSea. But the price of the BLUR token has dropped from $5 on Feb. 14, 2023 to the $0.60 range at the time of writing – making it harder to incentivize trading.

Source: TradingView

NFT trading itself has followed a similar decline in interest. Unique users dropped to lows not seen since Aug. 2021.

Source: @sealaunch

The next era of NFT investing

Some like Erick Calderon, the artist and founder behind prominent NFT studio ArtBlocks see this marketplace war as a “race to the bottom.” Some creators view the trader-first narrative as a way for hype and speculation to ultimately suck out all the value of existing works. They believe that low fees and airdrop gimmicks are a meme fated to die soon. And maybe the current market is an indication that we are on the cusp of a new meta cycle.

It is hard to say exactly what will replace it, but rising popularity in Bitcoin NFTs such as Taproot Wizards, the coming Amazon NFT marketplace, developments in gaming NFTs and major media pivots from NFT projects like Doodles could offer clues.

Frequently asked questions about NFT investing

How do you buy and sell an NFT?

You can buy and sell NFTs on popular platforms like OpenSea, Blur.io and Rarible. Anyone who wants to purchase an NFT on one of these platforms will need to set up a digital wallet capable of holding non-fungible tokens, and then fund it with a cryptocurrency, such as ether (ETH). Then you will want to connect it to the marketplace through a browser extension. If you want to use a hardware wallet, extensions like Metamask can connect it on your behalf. Then you can use the wallet to sign the transaction necessary to purchase the NFT.

Selling an NFT is similarly straightforward. Begin by listing your NFT on a marketplace that supports the specific token standard of your asset (e.g., ERC-721 or ERC-1155). Upload your NFT, and provide necessary details, such as the name, description, and any royalties you’d like to receive for secondary sales. Set a price for your NFT or opt for an auction format to allow potential buyers to bid on your asset.

Read more: The Investor’s Guide to NFT Marketplaces

How can you make money with NFTs?

Flipping/trading

Buying and selling NFTs frequently, like day trading cryptocurrencies, can yield profits. Acquiring NFTs during minting events and selling them after project milestones or news developments can result in substantial gains. Traders must determine the right currency and price level to maximize profits.

Royalties

Creators can receive royalties on each secondary sale of their NFTs, generating passive income. Royalties typically range between 1% to 10% and are defined during the token mint event. Loyal communities can bring significant royalties over time, thanks to smart contracts.

Staking

NFT staking allows investors to earn rewards on their assets. Depositing NFTs on artist portals or DeFi lending protocols can yield additional income. NFT staking rewards are still emerging, with platforms like NFTfi and Solend offering limited functionalities.

Gaming

Investing in Web3 gaming projects, or play-to-earn games, involves acquiring in-game character NFTs and earning income through gameplay. Projects like Axie Infinity, MOBOX and Zookeeper support NFT staking and provide in-game marketplaces for easy sales.

Renting

Renting NFTs can generate passive income, particularly for expensive or utility-rich collections. Platforms like reNFT and Vera offer NFT renting options, and demand for such services will likely grow as the NFT market expands.

Nothing in this article is intended to provide investment, legal or tax advice and nothing in this article should be construed as a recommendation to buy, sell, or hold any investment or to engage in any investment strategy or transaction.