Lido retains its spot as the leading DeFi protocol, the reason isn’t surprising

- Lido remains the number one DeFi project with the highest TVL.

- Staking APR on the platform has, however, fallen consistently.

With a 16.77% market share of the $47.2 billion worth of crypto assets locked on several decentralized finance (DeFi) protocols, Lido Finance (Lido) retains its spot as the leading project with the highest total value locked (TVL).

Read Lido Finance’s [LDO] Price Prediction 2023-2024

After displacing MakerDAO for the first time in January, Lido has held on to its position. According to data from DefiLlama, Lido’s TVL at press time was $7.92 billion and was closely followed by MakerDAO, which had a TVL of $7.09 billion.

The confirmation of a March date for the Shanghai Upgrade for the Ethereum network might have contributed to a jump in the value of assets locked on Lido.

According to a report published in December by blockchain analytics platform Nansen, staking solutions have been highly sought after since Ethereum’s transition to a proof-of-stake (PoS) consensus mechanism in September 2022.

The report emphasized the influence of the Merge in bringing staked ETH as a yield-generating instrument that is purely native to cryptocurrency and has surpassed other yield-generating services that are collateralized.

Additionally, the sustained increase in the demand and usage of stETH, a tokenized version of staked Ether native to Lido, further solidified the protocol’s position as the DeFi project with the largest TVL.

As of now, Lido’s TVL has exceeded its value prior to the FTX collapse.

Source: DefiLlama

State of ETH staking on Lido

According to Dune Analytics, Lido’s share of the ETH staking market was 29.36% at press time. So far this year, this has oscillated between 29.25% and 29.37%.

Realistic or not, here’s LDO’s market cap in BTC’s terms

While Lido remains the most preferred platform for ETH staking, its market share has declined consistently since May 2022. As of 16 May 2022, Lido controlled over 32% of the total ETH staked.

Source: Dune Analytics

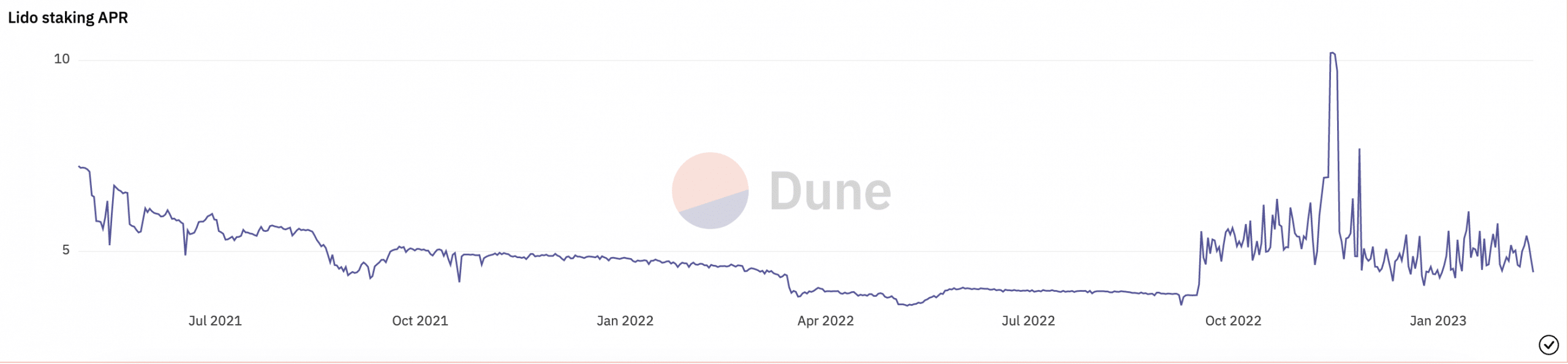

The gradual reduction in the annual percentage rate (APR) offered by Lido for ETH stakers might be the reason behind the decline in its market share.

After rallying to an all-time high of 10.21% on 14 November 2022, Lido staking APR has since declined. As of this writing, this was 4.79%, data from Dune Analytics showed.

Source: Dune Analytics

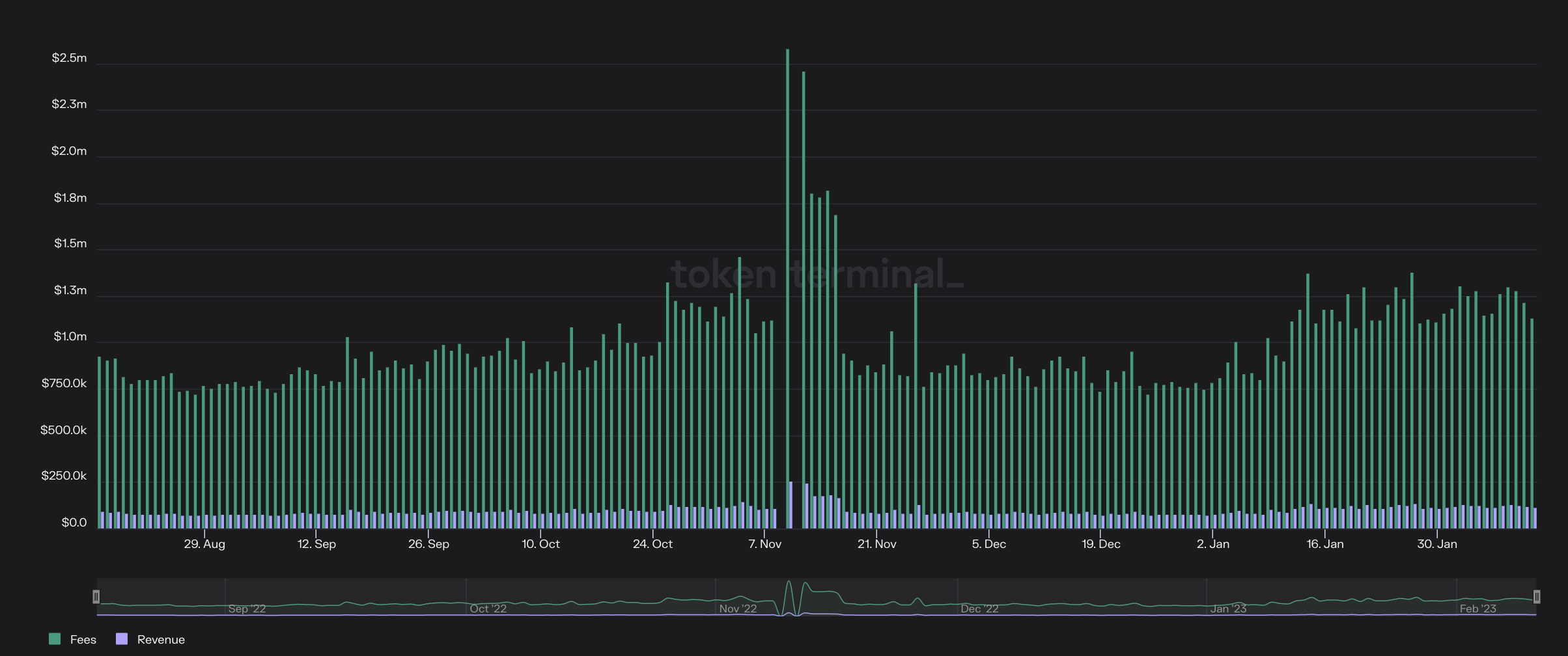

Finally, revenue on the network continued to grow, per data from Token Terminal. Lido’s revenue is closely tied to Ethereum PoS earnings as Lido transfers the received Ether to the staking protocol.

After the FTX collapse, Ethereum’s activity increased due to a surge in decentralized exchange (DEX) activity. On 8 November, Ethereum fees and revenue hit a 30-day high, with $9.1 million in fees and $7.3 million in revenue recorded.

Source: Token Terminal