Is Bitcoin [BTC] offering a short-term opportunity to LTH?

- Bitcoin transactions in million-dollar figures rose over the weekend and could offer a buying opportunity.

- Analyst says a $200 trillion market cap is possible but the positive sentiment was non-existent.

A 13 February market insight from Santiment opined that Bitcoin [BTC] could present investors to buy at a discount. According to the on-chain platform, a short-term opportunity could be lurking especially as BTC decreased to $21,600 over the weekend.

Is your portfolio green? Check out the Bitcoin Profit Calculator

These whales may have opened up the holes

However, whales responded to the decline as the number of $1 million transactions reached the highest since November 2022. As of 11 February, there were 479 transactions within the range but had decreased to 183 at press time.

🐳 #Bitcoin dipped down to $21.6k on Sunday, and whale addresses responded by transacting at their highest rate in 3 months. Read our latest community insight, focusing on why $BTC may be offering a short-term #buythedip opportunity. 🤑 https://t.co/YKwlMxS7br pic.twitter.com/RXL34z8QIB

— Santiment (@santimentfeed) February 13, 2023

Although the move might be considered significant, the BTC price reaction signaled a possible increase in large sell-offs. This inference was a result of the Market Value and Realized Value (MVRV) ratio.

The metric acts as a measure of evaluating an asset’s value and a projection of investors’ route toward profitability. From the chart above, it can be seen that the two-year MVRV ratio was 33.83%.

Compared to the BTC trend over the first 44 days of the year, this could be an opportunity to accumulate for short-term gains.

Prior to the weekend price decline, traders who stayed true to their BTC positive enthusiasm plunged into losses.

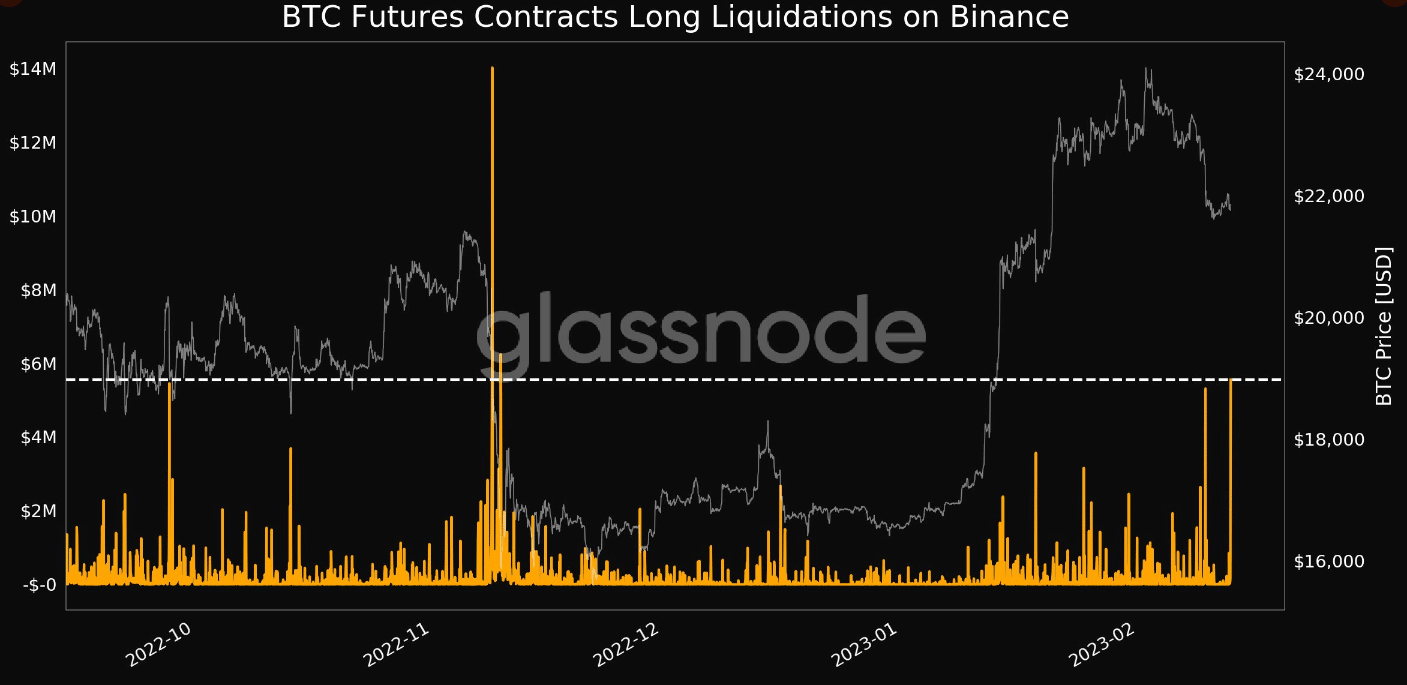

According to Glassnode, long liquidations in the derivatives market reached a three-month high of $5.30 million on 9 February.

Since another value drop followed the liquidations, it signified Bitcoin’s resolve to remain in the red zone or consolidation.

Source: Glassnode

Glory comes in the long term

In the long term, several analysts seemed not to be interested in shifting their bullish projection. Adam Back mentioned that the next two halvings could propel BTC to a $200 trillion market cap.

While that might look like an overstretch, the famous cryptographer and hashcash inventor considered the 10-year trend to arrive at his projection.

early this year i was curious of the claim “bitcoin 2x’s per year on average”. it checks: the decade jan 2013 – dec 2022 #bitcoin went up 2.036x/year (1200x in a decade). if that continues we’ll cross $10mil/BTC and $200 tril market cap by end of next 2 halvenings, about 9 years. pic.twitter.com/mqmO2SRdAv

— Adam Back (@adam3us) February 12, 2023

Other than the last decade’s trend, Back also evaluated the possible hyperinflation and increased adoption as reasons for his opinion. He tweeted,

“Given volatility, I think Bitcoin can overshoot wildly and tap one of these $100-300 trillion market caps, correct and then regain a steadier adoption over time.”

How many are 1,10,100 BTCs worth today?

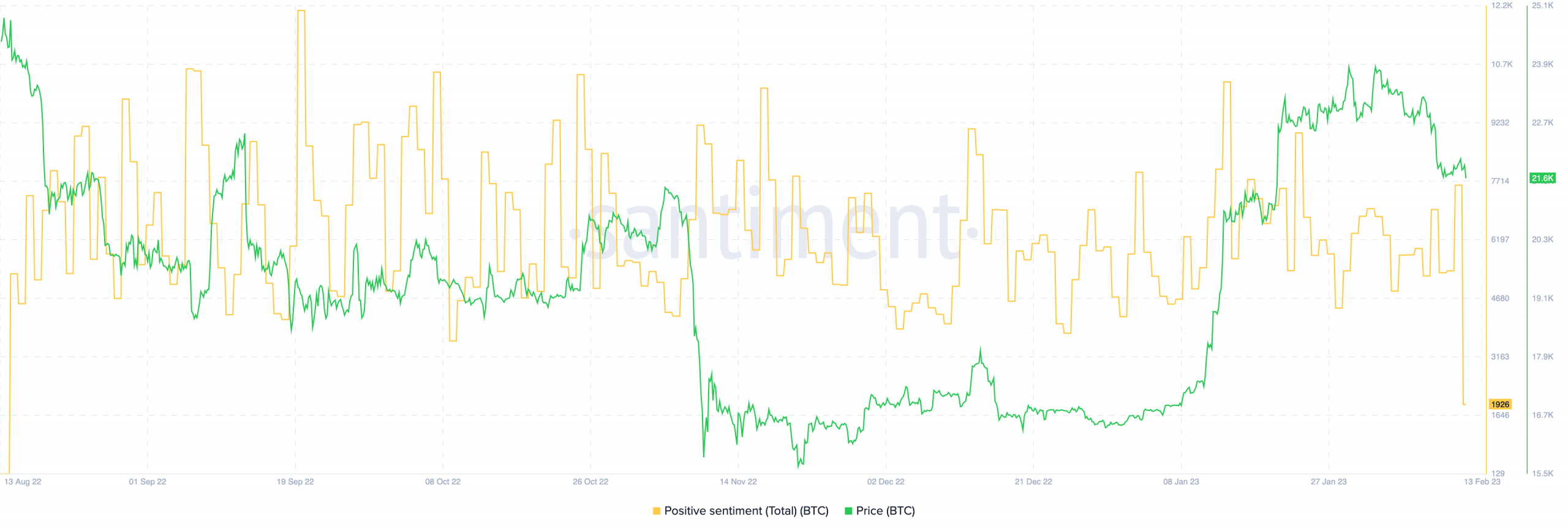

Notwithstanding, the aura around Bitcoin remained at an extremely low level. According to Santiment, the positive sentiment was at 1926— a point it failed to hit since August 2022.

Source: Santiment

This explains that investors were not necessarily optimistic about the coin price in spite of the opportunity presented. At the time of writing, BTC’s price still traded around $21,600.