How to Short Sell Bitcoin

advanced

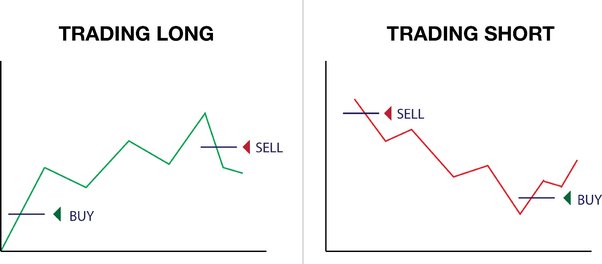

Cryptocurrency exchange rates can change several times a day. Just like fiat exchanges, there are two main behaviors among cryptocurrency players: some of them buy coins at a low price (as most traders do) or purchase coins at their peak during the all-time high period. It is easier to buy a currency at a low price and wait for its growth. None of the coins has ever shown an increase without a fall, so a cryptocurrency trader needs to be able to short.

How to Short Bitcoin?

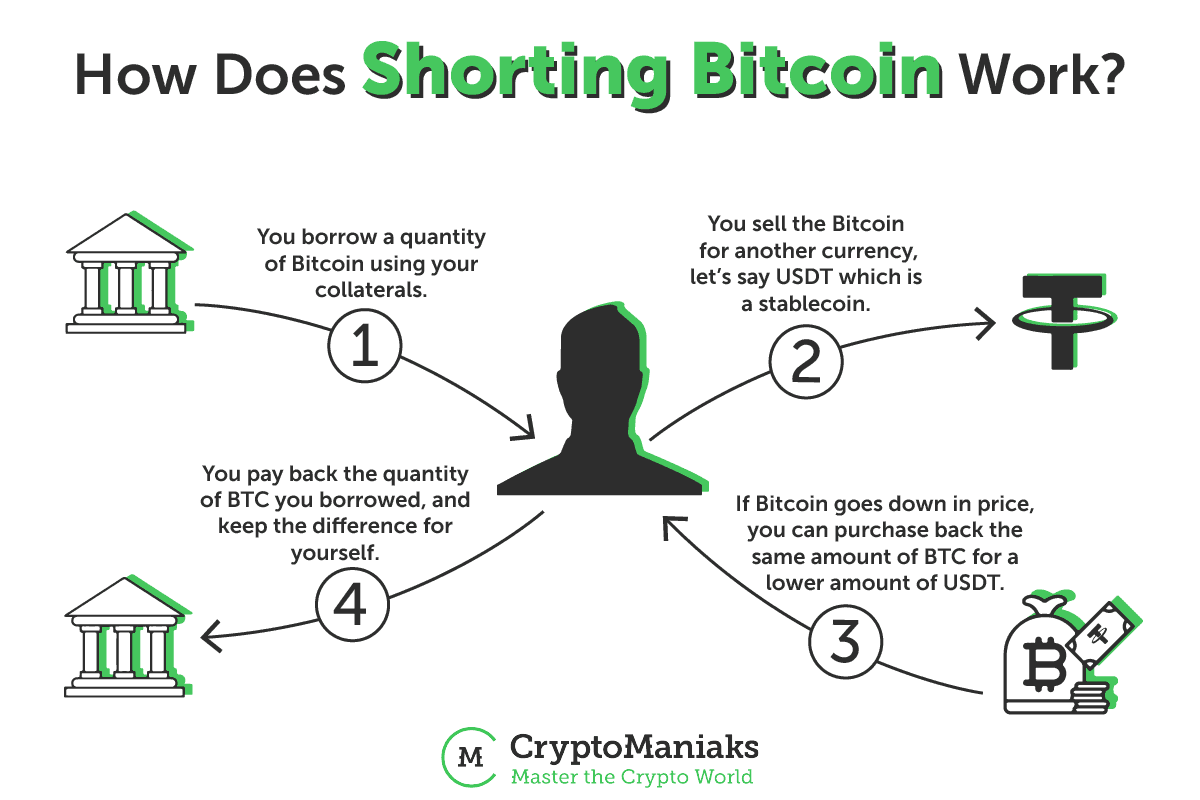

Short-selling is a trading practice that lets you benefit from a drop in an asset’s price. To put it simply, it involves selling an asset you don’t own and then buying it back later. It goes like this:

- You borrow an asset

- You sell it

- You repurchase it when the price drops

Obviously, that’s not all there is to it. Since you’re borrowing the asset you’re selling, its original owner can request you to return it — not personally (since all this is done via a third-party service like a broker or an exchange), but automatically — and then you will be forced to buy the asset back at the current market price. Go to the Risks of Shorting Bitcoin section to learn more about this.

What Does Shorting Mean in Crypto?

Shorting in the context of cryptocurrency refers to betting against the value of a particular cryptocurrency. This is done by borrowing the cryptocurrency from someone else, selling it at the current market price, and hoping to buy it back at a lower price later to repay the loan and pocket the difference as profit.

Imagine a scenario in which you think that Bitcoin price is going to drop soon, either because you’ve done your own research or have read somebody else’s (remember to never blindly follow other people’s financial advice!). To profit from this knowledge, you borrow 1 BTC from an exchange and sell it for $60,000. A week later, just as you predicted, Bitcoin drops to $40,000 — and you promptly buy back that 1 BTC you borrowed, thus getting $20,000 of profit.

The Risks of Shorting Bitcoin

If everything goes according to plan, then you will be able to buy back the assets you borrowed at a lower price and make a hefty profit. Unfortunately, things rarely go according to plan — and especially so in a market as volatile as crypto.

The biggest downside of shorting is that there is technically no limit on how much money you can lose. When you short Bitcoin, you open a position. Usually, you choose when to close that position (buy back the asset you borrowed) by yourself, but that’s not always the case. If a margin call is issued, then your broker or exchange will automatically buy back the assets you borrowed using the funds in your account.

However, sometimes that is not possible — the market may not be open, or the demand may far outweigh the supply — and in such cases, the buyback price can even exceed your account balance, making you indebted to the exchange. However, that happens very rarely. Still, always stay cautious and monitor the market and the price of the asset you want to buy.

Where to Short Crypto?

Well, now you’re probably wondering: How do you short Bitcoin? Don’t worry, it’s really easy! As crypto became more popular, a wide variety of trading platforms fit for every kind of user emerged. Here are the best platforms for shorting Bitcoin:

- Changelly PRO: great for beginners

- Binance: great for experts

How to Short BTC: 5 Ways to Short Bitcoin

How you short Bitcoin will depend on several factors, including but not limited to your risk aversion, available funds, level of expertise, and so on. Here are the 5 main ways in which you can short cryptocurrency.

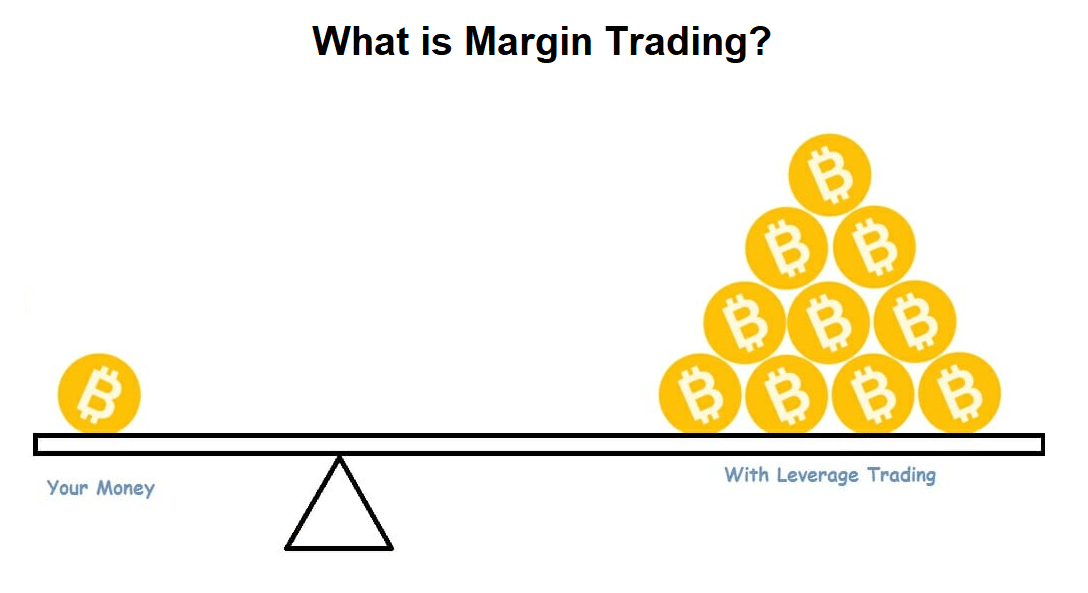

Margin Trading

This is one of the easiest ways to short Bitcoin.

Getting a margin account on Changelly PRO is as easy as ABC! All you need to do is enable 2-factor authentication and pass KYC. That’s it!

Margin trading also allows you to use leverage, meaning you can borrow more money from the exchange than you have deposited in your account. While this opens up doors for higher profits, it is naturally riskier, too — your position may close sooner than you expected if you’re engaging in leveraged shorting.

Learn more about margin trading in our ultimate guide: Margin Trading on Changelly PRO.

Futures Market

Just like other assets, Bitcoin has a futures market. In a futures trade, you basically agree to buy an asset — in our case, BTC — on the condition that it will be sold later at a predetermined price. This agreement is called a futures contract.

However, it is also possible to sell futures contracts. In that case, unlike when buying them, you will be able to benefit from the asset’s price dropping.

Read more about the Bitcoin futures market here.

Binary Options Trading

Binary options trading allows you to bet on “yes or no” scenarios. This financial product provides buyers with the option but not the obligation to complete the deal. You basically bet on whether an asset’s price will go up or down. To short sell crypto using this method, purchase put options.

Binary options trading offers great flexibility and higher-than-usual leverage. We would advise against engaging in it unless you’re an expert trader.

Prediction Markets

Prediction markets are somewhat similar to sports betting agencies. Such platforms haven’t been around in the crypto industry for a long time, yet they present a good way to short Bitcoin. They allow you to make a wager on a specific outcome, such as “Bitcoin is going to fall by 10% next week.” If somebody takes you up on the bet, you can make quite a hefty profit.

Short Selling Bitcoin Assets

If you have enough of your own funds, you can also short sell Bitcoin directly. All you need to do is sell BTC when the price is high and then buy back when it’s low. This method of short selling Bitcoin is relatively beginner-friendly, as you don’t need to learn how to use trading platforms to utilize it. It is also a lot less risky since you can’t lose more than you own. On the other hand, it is less profitable. As always, the higher the risk, the higher the reward.

Things to Watch out for While Shorting Crypto

Just like other trading practices, short selling requires you to be careful and informed. Thoroughly research all assets you’re planning to short and only ever spend money you can afford to lose.

Risk

Shorting is a high-risk, high-reward activity. In fact, it is one of the riskiest ways to make money since your profit is limited while your losses are not.

Besides what we’ve already mentioned, another risk you should look out for is potential regulations. There have been bans issued on short selling in the past, forcing traders to cover their positions at big losses.

Short selling is also not fit for traders who don’t know how to stop themselves. If you know you have a hard time admitting your losses, we would advise you against trying shorting.

Volatility

It’s no secret that the crypto market is highly volatile, which presents obvious challenges when short selling: the price of Bitcoin can change quite drastically at any point. Some people use complex analysis to predict price movements, but even the most well-researched predictions aren’t correct 100% of the time.

With prices being so unpredictable, short selling becomes somewhat of a gamble. However, there’s a way to safeguard yourself against extreme market volatility: stop-loss orders.

A stop-loss order is an order placed via a broker or an exchange that will sell/buy the asset once its price reaches a certain point.

Conclusion

Short selling Bitcoin is a good way to make a profit if you are confident in your ability to research the market. Besides the ones we’ve mentioned here, there are other ways to short sell Bitcoin, like spread betting or CFDs trading. If you’re interested in shorting cryptocurrency, we encourage you to start with something relatively easy and not rush straight into complex strategies.

Remember to always do your own research and make sure to only invest what you can afford to lose. And if you need a reliable launchpad to kickstart your trading journey or want to try out some of the things we’ve mentioned here, check out Changelly PRO, our full-featured yet easy-to-use trading platform.

Bitcoin Short Selling: FAQ

Do you lose money if Bitcoin goes down?

No, because of the nature of shorting, you will actually make a profit if Bitcoin’s price drops.

Is short selling unethical?

To a non-trader, short selling may seem unethical and even downright evil — after all, you’re basically betting on a business or an underlying asset doing badly. Since so many people are passionate about Bitcoin as a technology, they may see betting against the cryptocurrency’s success as something negative.

However, this couldn’t be further from the truth. Short sellers, to a certain extent, are very beneficial to any market. In addition to providing liquidity, they also prevent asset prices from inflating too much. Of course, some unethical short sellers use strategies like “short and distort,” but it’s not that different from people who use “pump-and-dump” schemes in traditional trading. At the end of the day, it’s not the activity itself that’s unethical — it’s the (few and far between) people who indulge in unethical practices.

In addition to what we’ve already said, short sellers can also help expose financial fraud since one has to do a lot of research to short sell successfully. So, short sellers usually notice mistakes, inflated numbers, etc. in financial reports.

What happens if a short seller defaults?

In most cases, that will never happen — your position will be closed once the price of an asset goes up and a margin call is issued. However, if the price rises significantly while the markets are closed, and the loss you incur can’t be covered by your account balance, the exchange/broker will have to chip in and assist you with closing your position. They can sue you afterward to get that money back.

Is there a way to short Dogecoin?

Yes, you can short any cryptocurrency, including Dogecoin, Ethereum, and many others. It all depends on what trading pairs are available on your exchange of choice.

Is short selling bad?

The act of short selling crypto is a risky maneuver. Whether or not it is bad depends on the individual’s approach. If a person fully understands the implications of short selling crypto and takes precautions to protect themselves from losses, then they can benefit greatly from the quick potential appreciation in crypto prices. However, if a person does not grasp associated risks or fails to safeguard their investments, then short selling could lead to disastrous outcomes.

How do you know if a stock is being shorted?

To learn whether the stock is being shorted, examine its long/short ratio. This is also a great way to look out for short squeezes — a situation where the number of short positions for an asset significantly prevails. It is usually a harbinger of price spikes.

Can you hold a short position forever?

Well, yes. However, in reality, no short position is held forever.

Your position can be closed for two reasons: either you close it yourself when the market price of the asset you borrowed drops enough for you to make the profit you wanted, or it gets closed automatically because the price has risen too far. Of course, technically, the price may remain the same, but it’s more than highly unlikely. Alternatively, you can lose access to your trading account or forget that you opened a trade.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.