GMX enjoys post-FTX whale interest, but challenges arise

- GMX witnessed interest from whales.

- However, the protocol faced challenges in terms of daily activity.

According to new data provided by Santiment, GMX tokens have been on the receiving end of massive whale interest after the FTX collapse. This whale interest has resulted in a surge in GMX’s prices over the past few months.

‘@CryptoHayes isn’t the only one buying $GMX! 🧐

On-chain data from @santimentfeed shows that wallets with 100K to 1M #GMX have bought 10 million tokens since #FTX collapse, worth around ~$20 million. And their purchasing power doesn’t appear to be slowing down. https://t.co/KxwjBqNfvf pic.twitter.com/cbD7Jtw7WR

— Ali (@ali_charts) February 27, 2023

Read GMX’s Price Prediction 2023-2024

The data from Santiment suggested that wallets holding 100,000 – 1 million GMX bought about 10 million tokens. Even though a large amount of GMX being bought could impact the token positively in the short term, it would make holders more vulnerable to the whale actions in the long run.

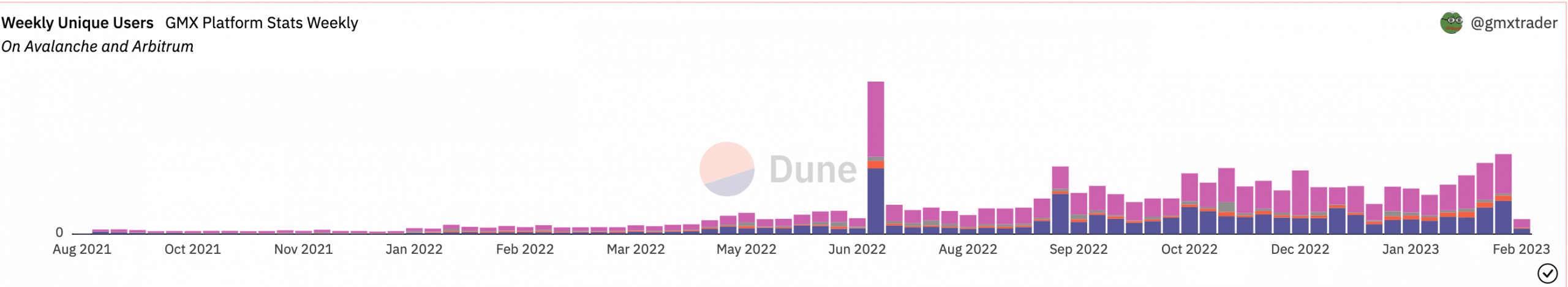

Apart from the token, there was interest generated in the GMX protocol as well. According to data provided by Dune Analytics, the number of unique weekly users signing up to the GMX protocol increased. The overall number of unique users being added to the platform was the result of users’ margin trading, swaps or liquidating.

Source: Santiment

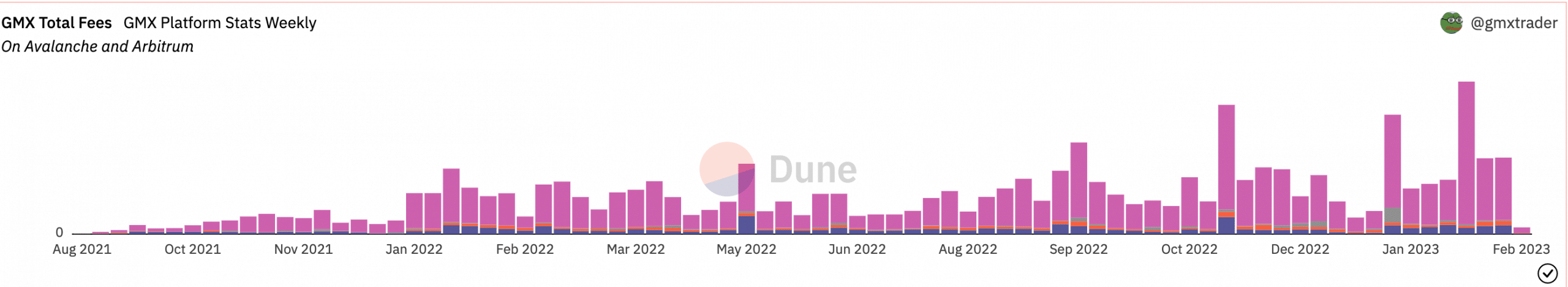

However, despite the growing number of users on the GMX protocol, the overall fees collected by GMX continued to decline. Even though the fees generated from liquidations and swaps remained the same, the fee collected from margin trading on the platform declined.

The fee generated from margin trading fell from $7.65 million to $3.34 million at press time.

Source: Dune Analytics

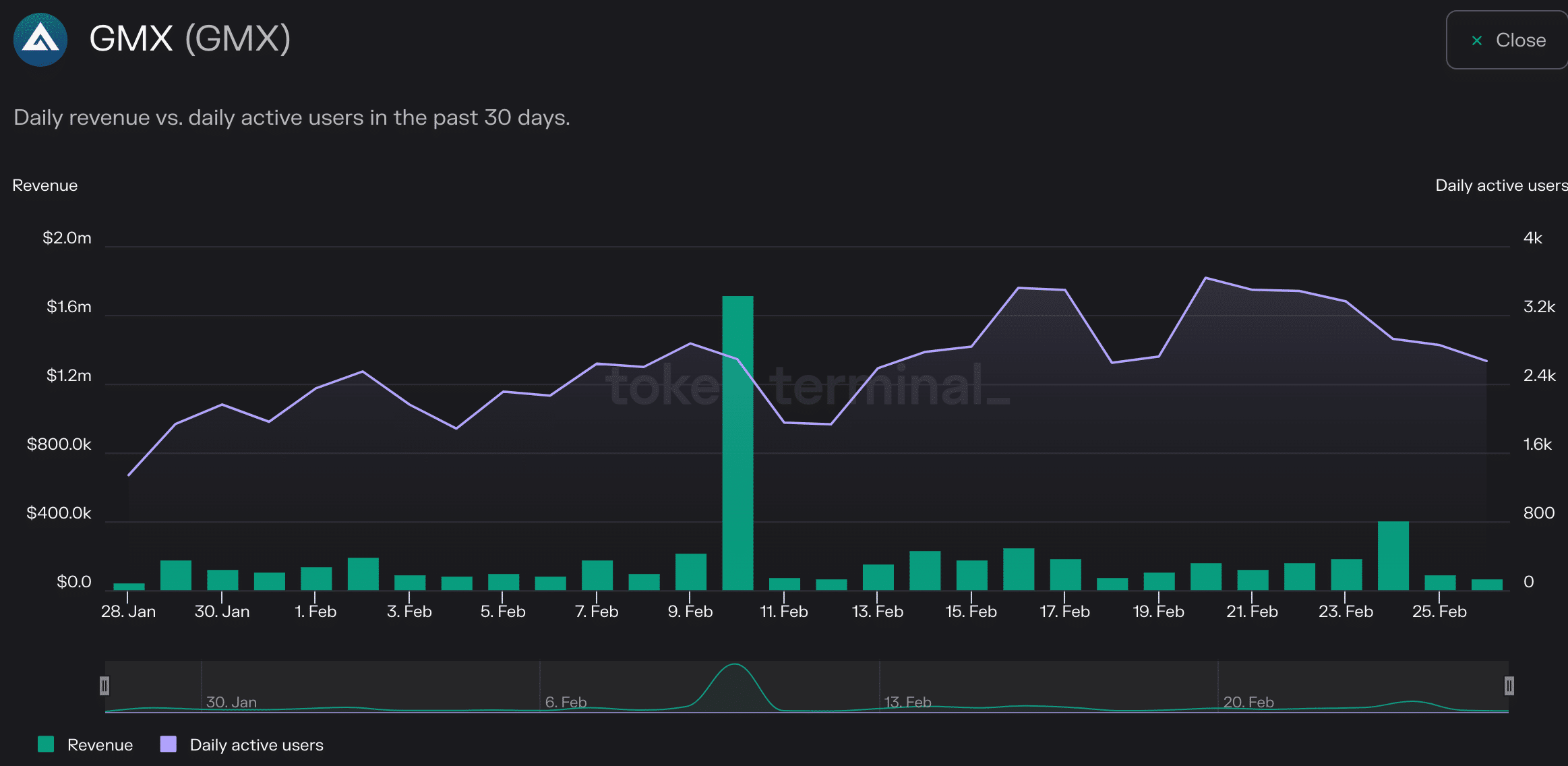

The decline in fees generated impacted the revenue collected by the protocol as well, which decreased by 24.5% in the last 24 hours. Additionally, the number of active users on the network fell by 6.5%, according to Token Terminal. A fall in activity on the protocol could impact the token severely.

Source: Token Terminal

Chances of attracting more users

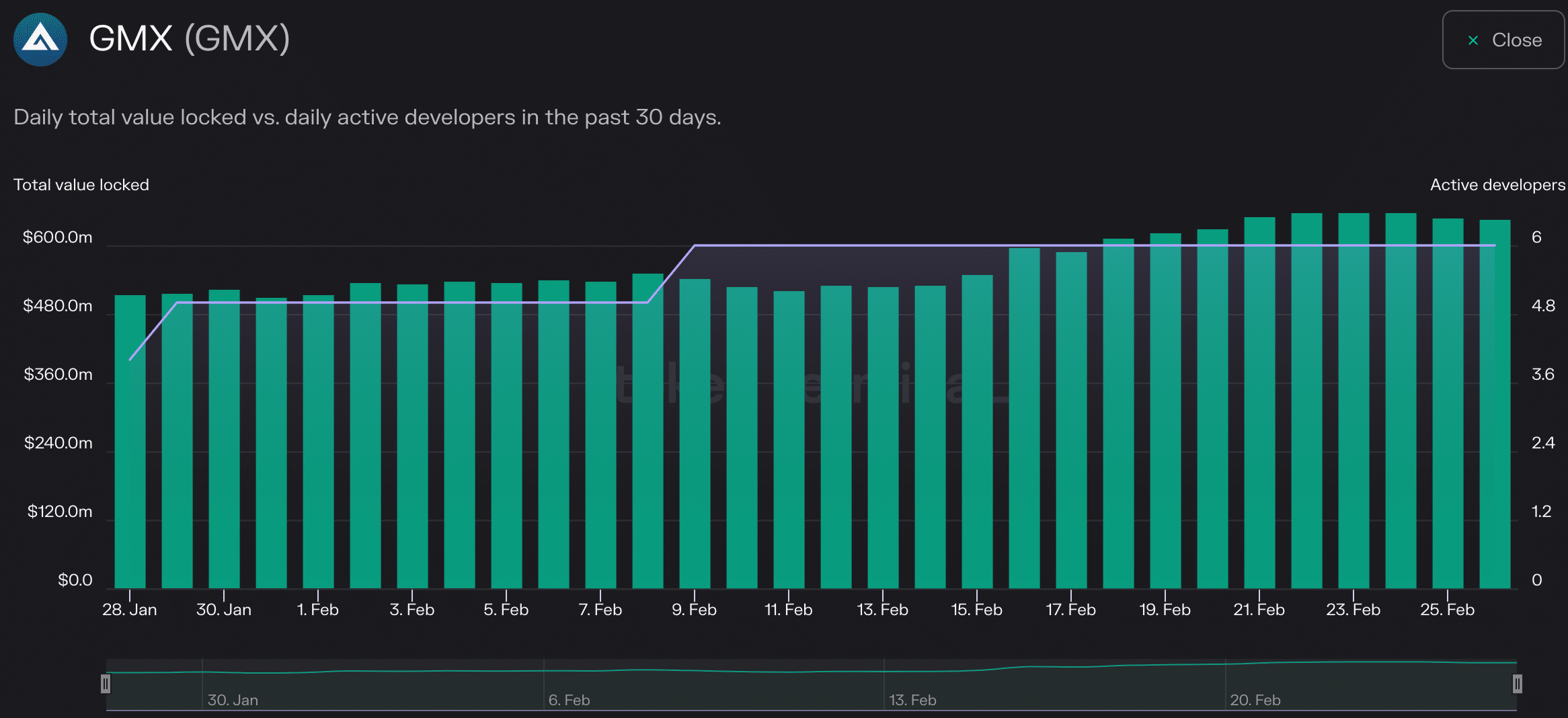

However, this could change in the future. According to Token Terminal, the number of active developers on the network increased by 22% over the past month. As the number of active developers on the network rose, the possibility of new upgrades and updates on the protocol increased with it.

These new updates could attract new users to the protocol and encourage them to stay active.

Is your portfolio green? Check out the GMX Profit Calculator

Even though the number of active users of the protocol declined, the overall TVL of the protocol continued to rise. This indicated that the few users that were active on the network were contributing significantly to the network.

Source: Token Terminal

With so many factors working for and against the protocol, only time will tell how things turn out for GMX in the future.