Flood of Ethereum Futures Exchange-Traded Funds Could Launch on Monday, According to Bloomberg ETF Analyst

A Bloomberg exchange-traded fund (ETF) analyst says that the market could be inundated by Ethereum (ETH) futures ETFs starting on October 2nd.

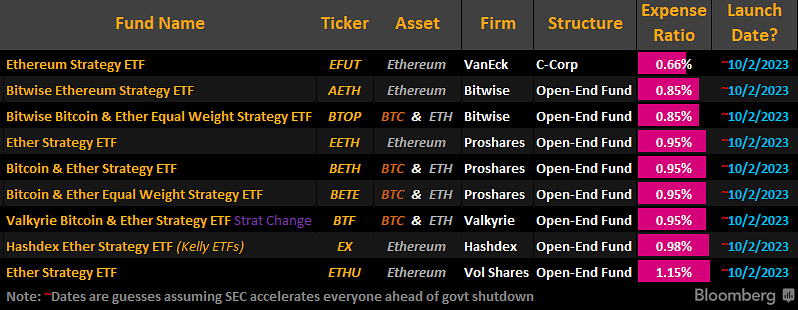

In a new thread on the social media platform X, Bloomberg ETF analyst James Seyffart notes that nine different ETH-based futures ETFs are set to potentially launch on Monday, adding that it will be a “crazy day.”

The financial firms on Seyffart’s list that are gearing up to issue Ethereum futures ETFs include VanEck, Bitwise, Proshares, Vol Shares, Hashdex and Valkyrie.

The analyst goes on to say that other firms interested in issuing Ethereum ETFs, such as Grayscale, have yet to submit updated filings and are likely not going to.

“The only potential issuers that have not yet submitted updated filings are Direxion, Roundhill, and Grayscale. It’s likely that some or all of them are just not going to bother.”

According to Seyffart, the reason the ETFs are likely launching early is due to the fear of a looming government shutdown.

Last month, global investment manager VanEck announced that it’s preparing to roll out its ETH futures ETF, which the company stated would not be investing in Ethereum itself but rather in standardized, cash-settled ETH futures contracts traded on registered commodity exchanges.

At the time, VanEck said that the fund – which will be listed on the Chicago Board Options Exchange (CBOE) – intends only to invest in ETH futures traded on the Chicago Mercantile Exchange.

Also in September, VanEck released a statement saying that they expect “effectiveness to occur upon the earlier of October 3, 2023, or the time at which the U.S. Securities and Exchange Commission (SEC) accelerates [the] effectiveness of the registration statement.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney