FIL sees increased interest as Filecoin launches virtual machine, details inside

- Filecoin has launched its Filecoin Virtual Machine.

- The FVM has led to increased FIL trading in the last 24 hours.

To provide an execution environment for running the Ethereum [ETH] Virtual Machine (EVM)-compatible smart contracts on its network, leading decentralized storage network Filecoin [FIL] finally launched its Filecoin Virtual Machine [FVM] on the mainnet on 14 March.

Read Filecoin’s [FIL] Price Prediction 2023-24

The launch of the FVM formed the final step of Filecoin’s Masterplan to bring large-scale computation and the ability to power web-scale apps to the decentralized storage network.

According to the press release, the Filecoin Virtual Machine will provide similar abilities to Ethereum, allowing for the development and deployment of decentralized applications and the ability to connect with other blockchains.

Following the launch of the FVM, leading cryptocurrency exchange OKX announced the integration of its web3 wallet with the upgrade.

Day traders rally toward FIL

In the last 24 hours, FIL’s price rallied by 7%. With a surge in FIL trading following the launch of the FVM, trading volume has climbed by 30% during the same period, per data from CoinMarketCap. As of this writing, the altcoin exchanged hands for $6.81 per FIL token.

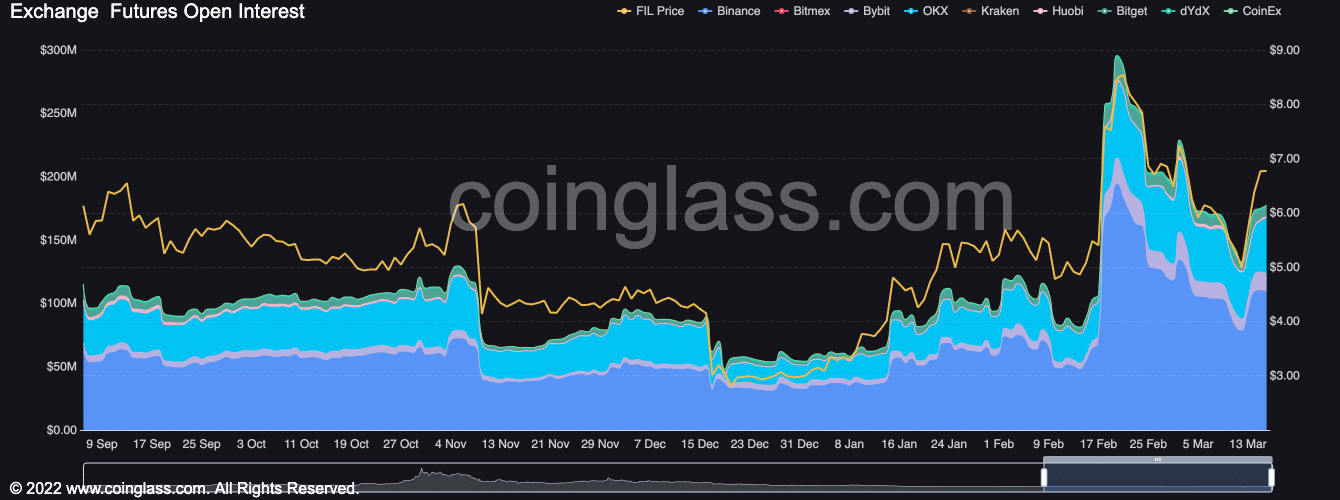

Taking advantage of the FVM launch, data obtained from Coinglass indicates that there has been an increase in the number of FIL trading positions opened within the past 24 hours. At $177.5 million at press time, FIL’s Open Interest has climbed by 2%.

Source: Coinglass

A jump in an asset’s Open Interest indicated that more traders were interested in taking positions in the asset. This often reflected a growing bullish sentiment toward that asset’s price.

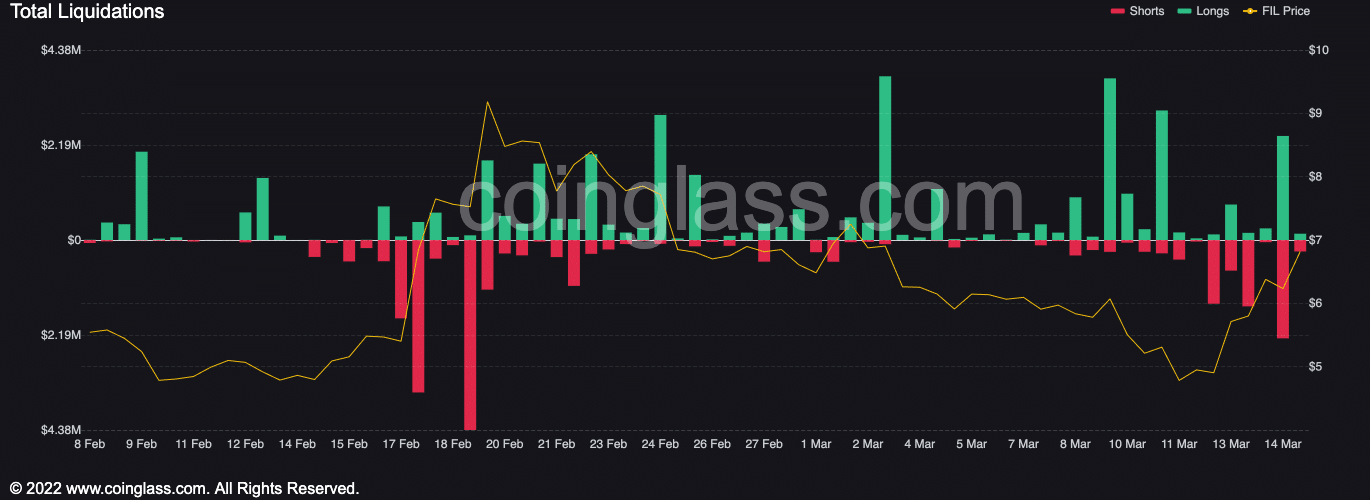

Moreso, there were a higher number of short liquidations than long liquidations in the last 24 hours. As the positive sentiment toward FIL continued to rise, data from Coinglass revealed.

Source: Coinglass

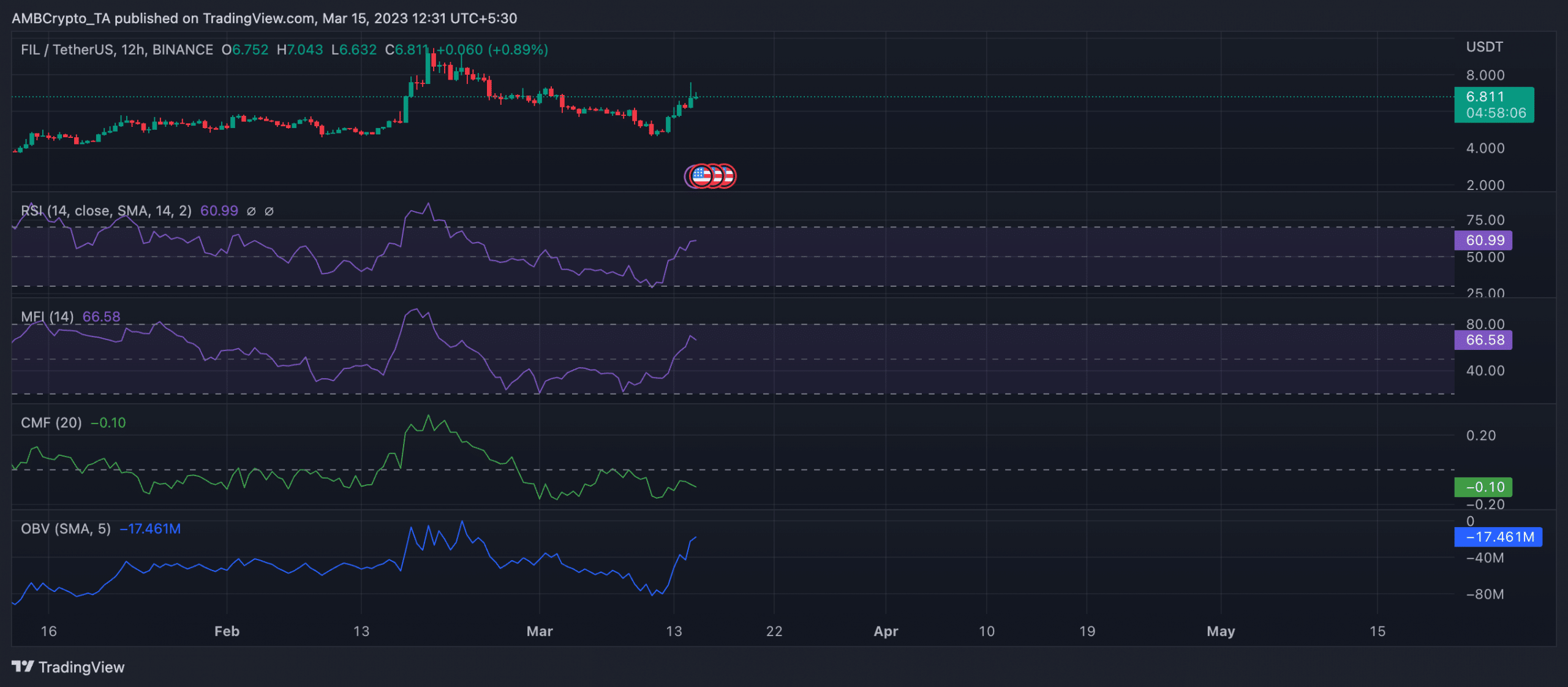

Further, on a 12-hour chart, FIL accumulation rallied significantly. FIL’s Relative Strength Index (RSI) and Money Flow Index (MFI) approached the overbought region at press time. The RSI was 60.99, while the MFI was 66.58. With weighted sentiment still in the positive territory per data from Santiment, this accumulation momentum is expected to be sustained. Therefore, more price growth should be on the horizon for FIL.

Realistic or not, here’s FIL market cap in BTC’s terms

Also, FIL’s On-balance volume (OBV) maintained an uptrend at press time, suggesting rallying token accumulation. When an asset’s OBV is trending upwards, it means that the volume of trades is heavier on the buy side, indicating that investors are more interested in buying the asset than selling it.

Source: FIL/USDT on TradingView