Federal Reserve To Pause Interest Rate Hikes This Month, Forecasts Banking Giant Goldman Sachs: Report

US financial titan Goldman Sachs reportedly believes that the Federal Reserve will not raise interest rates this month following the high-profile collapses in the banking sector.

Goldman Sachs’ chief economist Jan Hatzius predicted on Sunday that the Fed will pause rate hikes this month instead of bumping them up by another 25 basis points, as was previously expected, according to a report from CNBC.

“In light of the stress in the banking system, we no longer expect the FOMC [Federal Open Market Committee] to deliver a rate hike at its next meeting on March 22nd.”

Fellow banking giant JP Morgan, however, believes the opposite, according to Wall Street Journal economics correspondent Nick Timiraos.

“If they indeed have used the right tool to address financial contagion risks (time will tell), then they can also use the right tool to continue to address inflation risks – higher interest rates. So, we continue to look for a 25bp hike at next week’s meeting.”

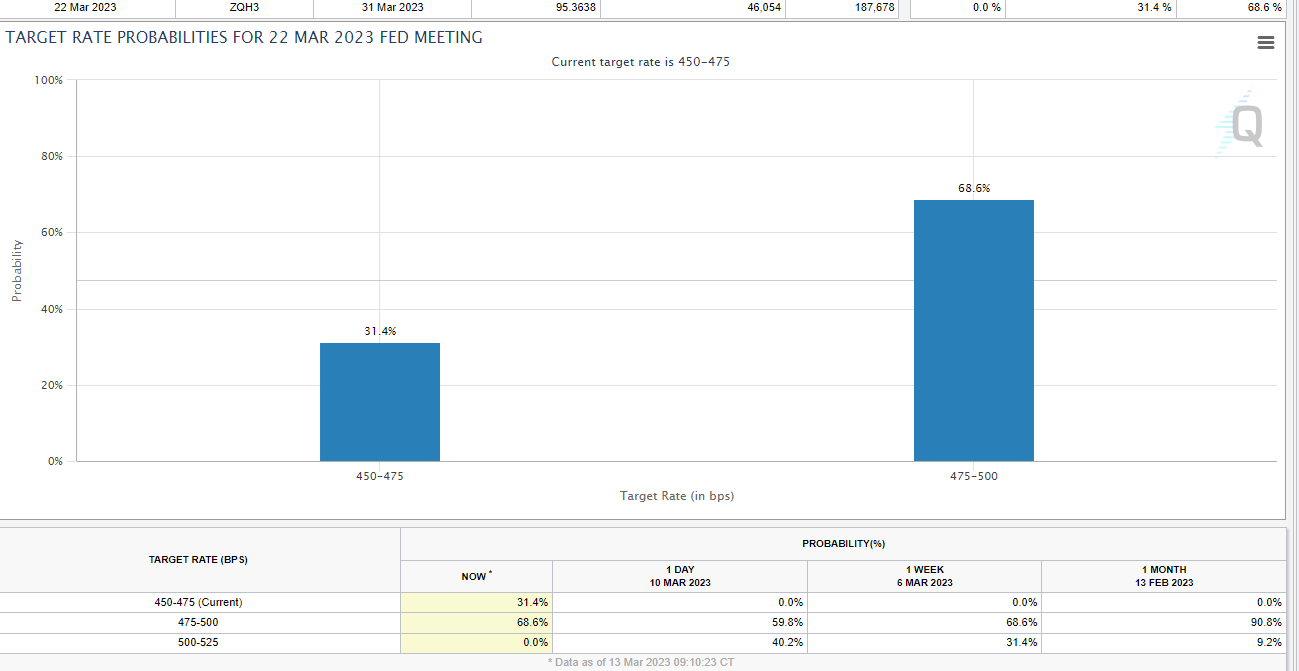

At time of writing, investors believe that there’s a nearly 69% chance that the Fed will increase rates by 25 basis points next week with a 31% chance that the agency will pause.

Silicon Valley Bank (SVB) suffered a run and collapsed last week after it revealed $1.8 billion in losses, largely due to selling US bonds that lost much of their value because of the Fed’s aggressive rate hikes.

The contagion spread from SVB to New York-based institution Signature Bank, which shut its doors on Sunday after facing down a $10 billion run on deposits on Friday. Signature’s collapse was the third-biggest bank failure in the country’s history, according to CNBC.

Over the weekend, the Federal Reserve and Treasury Department announced they would make up to $25 billion available as loans for banks to ensure they can stay liquid and meet any withdrawals.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney