Exploring XRP’s price action as Ripple files Fair Notice defense

- Ripple’s fair defense takes center stage in determining judicial outcome.

- XRP struggles to attract investment as the lawsuit discourages investors.

Ripple [XRP] is back in the spotlight courtesy of its recent filing regarding its lawsuit filed by the SEC. The new filing focuses heavily on Fair Notice defense, which has been part of Ripple’s argument since the beginning. But what is new this time?

Read Ripple’s [XRP] Price Prediction 2023-24

Ripple’s new filing is particularly noteworthy because it is from the United States Supreme Court. More importantly, a favorable ruling based on fair notice defense may affect the average person in case they are sued. This is because the filing states that people need some guidance regarding the law before they are sued.

Ripple just filed a strong case supporting its Fair Notice Defense.

Strong because it comes from the U.S. Supreme Court and states that regular-ish people like you and me need to have guidance and know what the law/rules are ( before we are sued). https://t.co/iNBhadl6Xz

— Jeremy Hogan (@attorneyjeremy1) March 3, 2023

The filing might allow Ripple some legal leverage against a potential scenario where the judiciary might go against the fair notice defense. The same defense might weigh heavily on the outcome of the final ruling. The timing of the ruling is still not clear, although Ripple CEO Brad Garlinghouse stated that it should be in 2023.

The impact of the lawsuit on XRP price

The lawsuit has undoubtedly hindered Ripple’s progress, as well as deterred investors. The impact is evident in XRP’s performance. It is one of the cryptocurrencies that has seen low demand and low trading activity. To put it into perspective, XRP has been hovering near the $0.37 price range since 25 February.

Source: TradingView

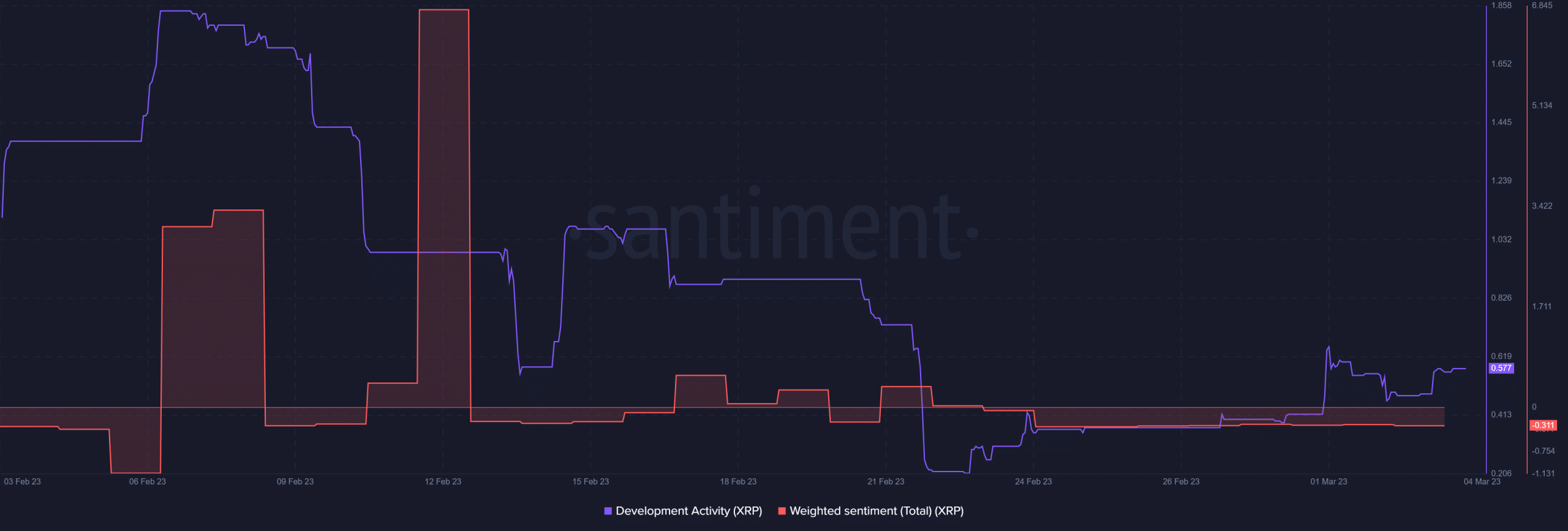

Low investor confidence in XRP is reflected in the weighted sentiment. The latter remained in bearish territory since the last week of February. In addition, Ripple network’s development activity remained low despite a bit of improvement since the end of February.

Source: Santiment

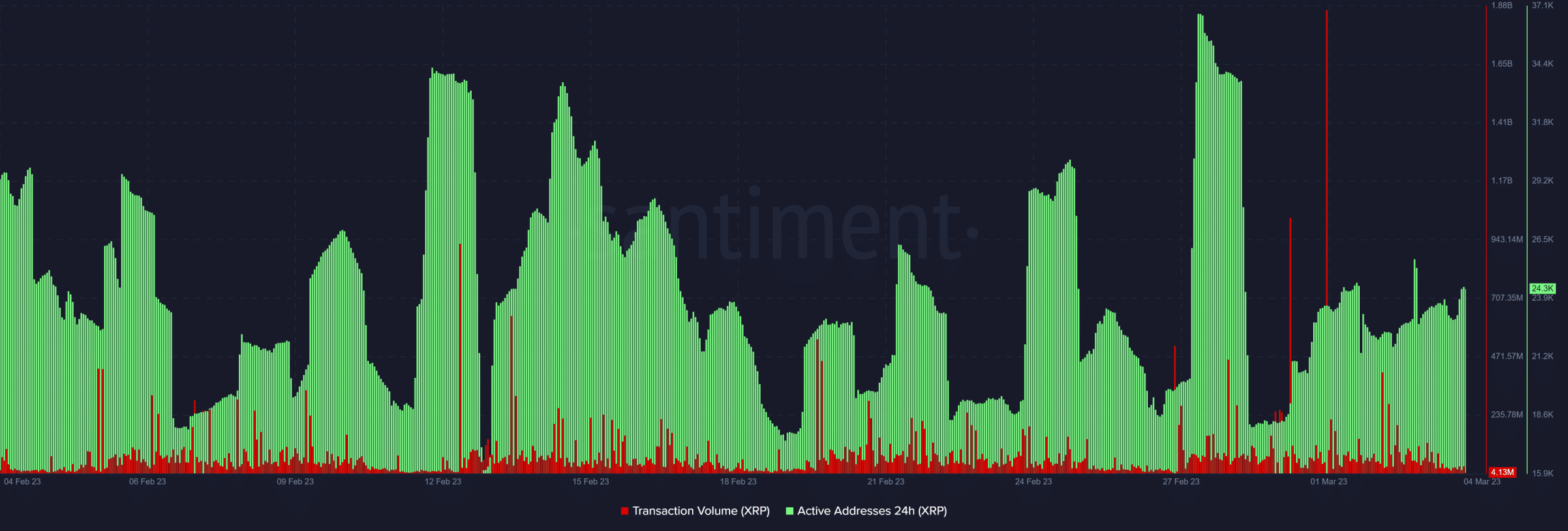

The impact is particularly visible in the number of active addresses. The highest number of active addresses since the start of March is just over $25,000, and just over 36,000 in the last four weeks. A relatively low figure for a layer-1 network. Despite this, Ripple has maintained significant on-chain volume, largely because of the institutional utility associated with XRP.

Source: Santiment

Realistic or not, here’s XRP’s market cap in BTC’s terms

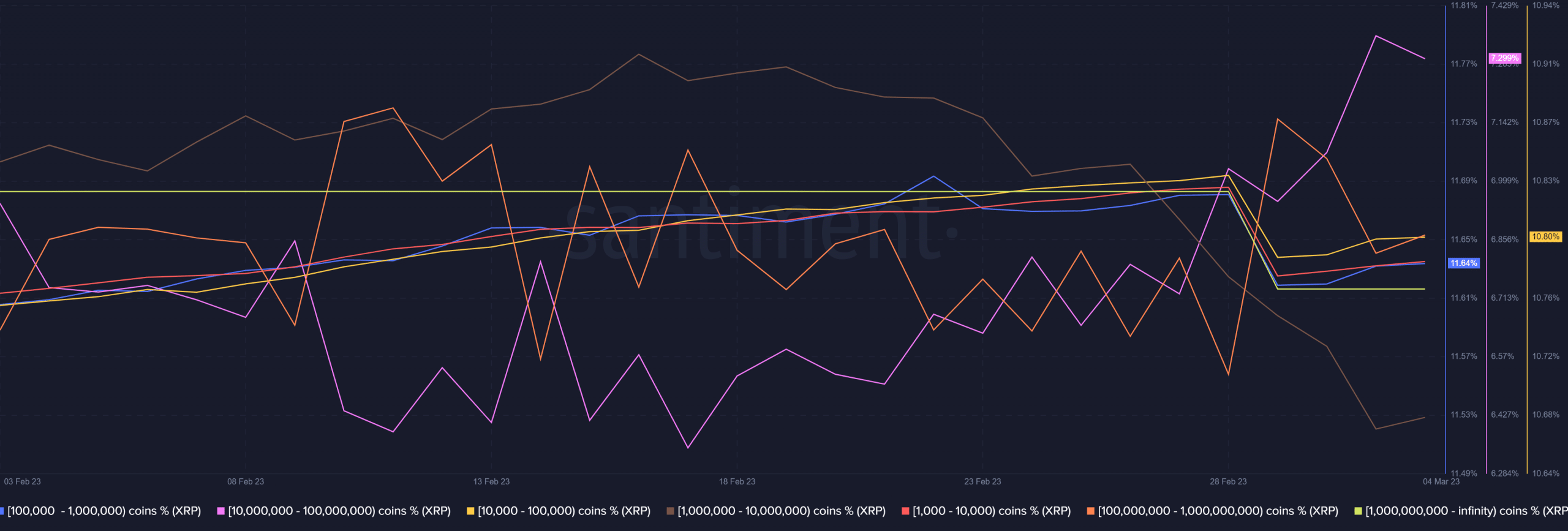

As far as demand and sell pressure are concerned, XRP maintained healthy whale activity in the last 30 days. However, it has been a mixed bag with some buying while other whales have been contributing to sell pressure.

Source: Santiment

For example, addresses holding between 10 million – 100 million coins have been buying. Meanwhile, those with balances greater than that have been contributing to sell pressure for the most part in the last few days. As a result, the buying and selling forces have been cancelling each other out, causing low price changes.