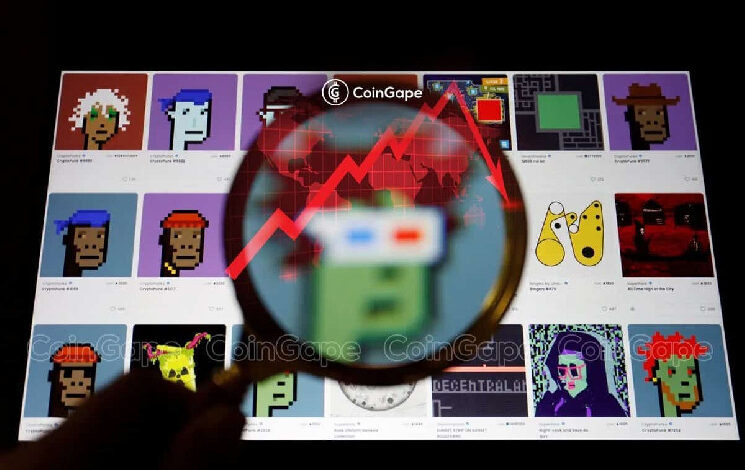

Ex-SEC Chief Calls Jack Dorsey’s First Tweet NFT “Worthless” & NFT Marketplace A “Scam”

John Reed Stark, former Chief of the US Securities and Exchange Commission Enforcement Office, on Wednesday said the NFT of Jack Dorsey’s first Tweet now has no value or is essentially worthless. He argues that the NFT marketplace is totally manipulated or controlled by deceptive ways and the smart contracts are incapable of total security and ownership.

John Reed Stark Criticizes NFT Marketplace

John Reed Stark has been vocal against crypto exchanges, executives, and the NFT space. In a new tweet on July 20, he urged people to stay away from non-fungible tokens as they are an investment scam. He believes that buying an “NFT for fun or as a photo for your Instagram or Twitter, whatever, have at it,” but it as an investment is completely useless.

He calls the NFT of Jack Dorsey’s first Tweet “worthless.” Moreover, he added that a Bored Ape with funny glasses and a colorful hat and the NFT of a Tweet are not sound investments that grantees a financial dream. The NFT market is totally manipulated without any control.

“While NFTs are supposed to be completely decentralized, in most cases there’s no cryptographic relationship between the image that an NFT points to and its token. The image could be easily altered or replaced if people with the access to servers changed the file names.”

The NFT market has duped investors of billions of dollars after the NFT bubble burst during the crypto winter. Celebrities have long been tied up in the world of cryptocurrencies, NFTs, and other digital assets. Stark slammed celebrities such as Paris Hilton, Jimmy Fallo, and Kim Kardashian blatantly exploited their own fans, shamelessly shilling crypto and these nonsensical fractionalized JPEG links.

Stark On Binance and Coinbase Lawsuit

John Reed Stark sides with the US SEC to allege that Binance and Coinbase have violated multiple federal and state securities laws. He believes the SEC will win the lawsuits against Binance and Coinbase and stop them from harming investors.

However, the Torres Doctrine established in the US SEC v Ripple Labs lawsuit weakened the SEC’s claim that most digital assets are securities and violate securities laws.

Also Read: Terra And Do Kwon To Dismiss US SEC Lawsuit Citing XRP Ruling As Precedent