Ethereum Selling Pressure To Be Lower Than Feared After Shanghai Upgrade, Says CryptoQuant – Here’s Why

On-chain analytics platform CryptoQuant is optimistic that Ethereum (ETH) will not come under severe selling pressure as feared following the Shanghai upgrade scheduled for next week.

CryptoQuant says that the Shanghai upgrade, which is expected to allow the unstaking of Ethereum on April 12th, is unlikely to trigger above-normal selling pressure.

According to CryptoQuant, the selling pressure is likely to be lower than feared due to the fact that most of the staked Ethereum is below the price it was bought at.

“There is an ongoing fear that the activation of withdrawals on April 12th with the Shanghai upgrade would bring more than usual selling pressure.

However, our profit and loss analysis shows otherwise.

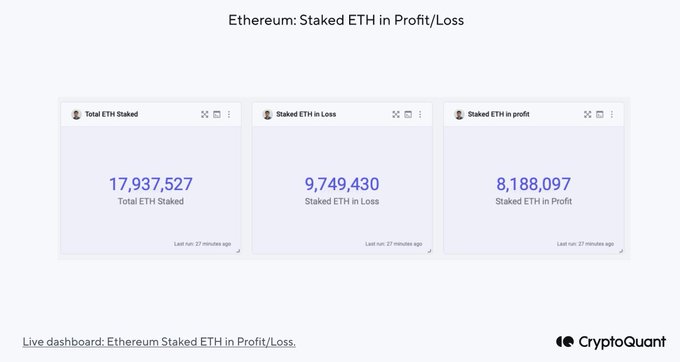

With the current ETH prices, more than half of the staked ETH (9.7 million out of 17.9 million) is currently at a loss.

For the sole reason that the significant staked ETH is currently at a loss, we believe that the selling pressure will be lower than expected.”

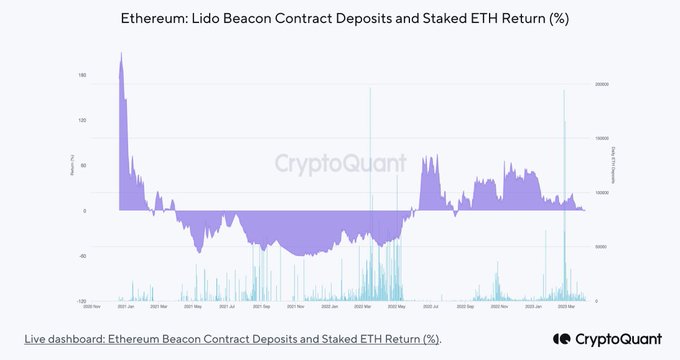

CryptoQuant further says that a significant number of the Ethereum staked by the liquid staking solution Lido is also in the red.

“Also, it is worth noting that a significant portion of the deposits made by the Lido pool is currently underwater.”

According to Binance Research, there are over 16.5 million staked Ethereum, which is approximately 14% of the total supply.

Ethereum is trading at $1,867 at time of writing.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney