Decoding the mixed reactions towards BTC as CPI rose by 0.5%

- CPI increased by 0.5% as the annual rate of inflation hit 6.4%.

- BTC witnessed a brief downtrend after the CPI report but recovered briefly after.

The US Bureau of Labor Statistics issued its Consumer Price Index (CPI) report on 14 February, ending days of anticipation and rumors. So, what was Bitcoin’s [BTC] trajectory after the report was published?

Read Bitcoin’s [BTC] Price Prediction 2023-24

CPI within range as inflation rate surprises

According to the estimates of economic experts, the CPI increased by 0.5% in January, up from 0.1% in December. The annual inflation rate, however, was much higher than expected, coming in at 6.4% (up from 6.5% in December) despite forecasts of only 6.2%.

In addition, the core CPI, which excludes food and energy costs, rose 5.6% from a year ago. This was quicker than the 5.5% predicted and down from 5.7% in the previous month. According to the numbers, the Federal Reserve will probably maintain its hawkish stance. Further interest rate hikes could also be on the table at future Federal Open Market Committee (FOMC) meetings.

Trader’s sentiments pre-CPI

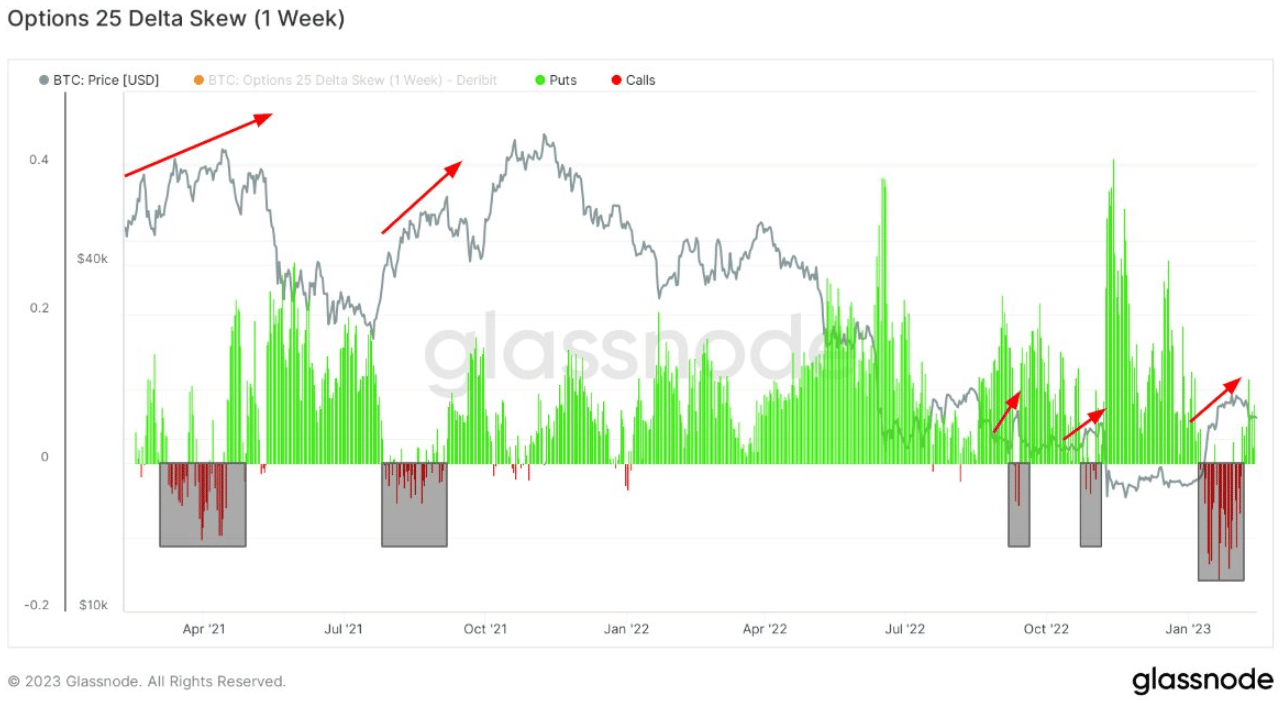

As measured by the Options 25 Delta Skew, options traders appeared to have bearish feelings toward Bitcoin before the release of the CPI report. The observed statistic indicated that, before the CPI announcement, puts were more popular than calls. Furthermore, puts were deemed more expensive than calls, signaling a bearish sentiment before the CPI announcement.

Source: Glassnode

A measure of the disparity between the implied volatility of options contracts that are 25 delta out of the money (OTM) and at-the-money (ATM) is known as the “options 25 delta skew.” When the skew is positive, investors are more worried about potential losses, while when it’s negative, they’re more concerned about potential gains.

BTC’s volatility drops as price recovers

Bitcoin’s volatility has been decreasing, as indicated by Coinglass’ Volatility Index. At the time of this writing, observed volatility was just over 2%, and it appears to be declining as nerves calm in the wake of the CPI news.

Source: Coinglass

How much are 1,10,100 BTCs worth today?

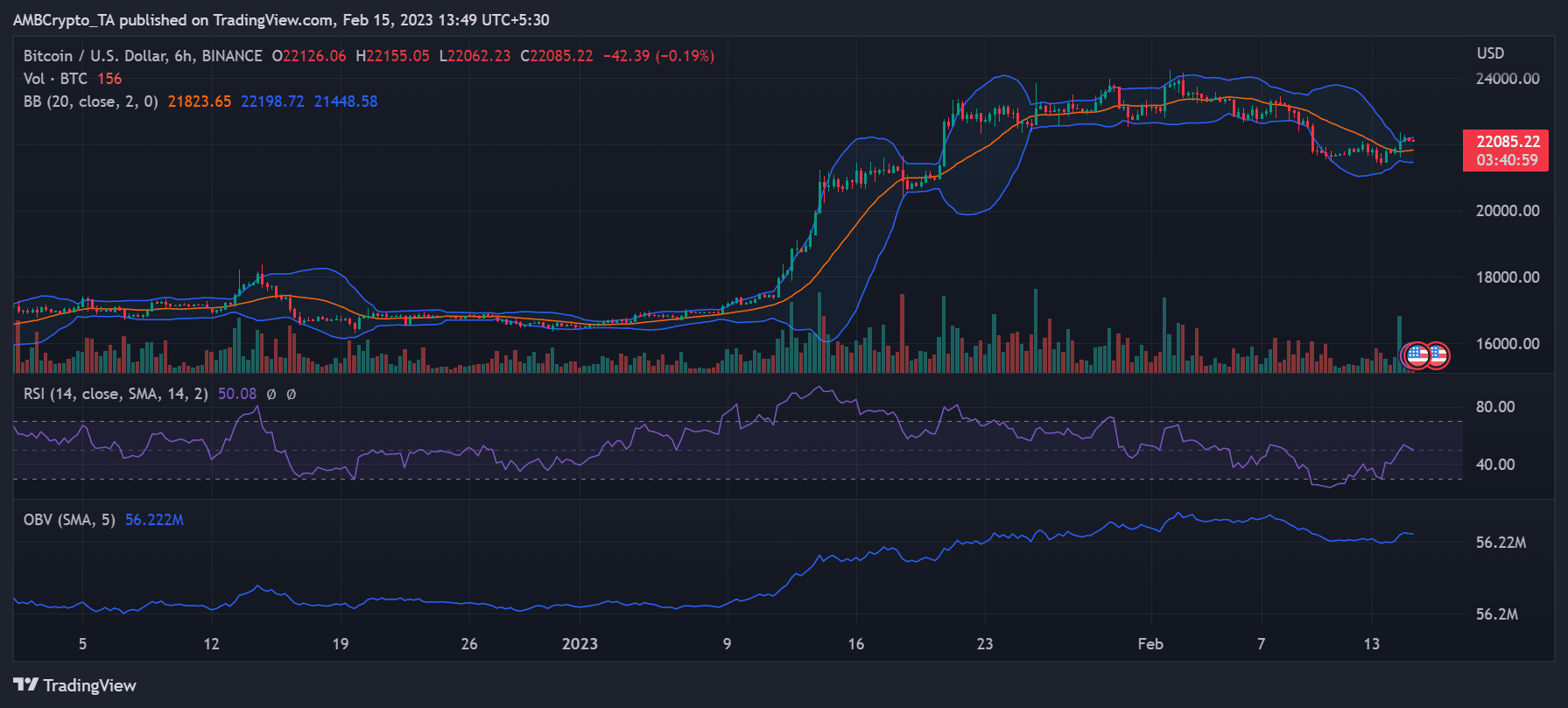

The market’s reaction to the CPI report was quite volatile after its release. The news first sent Bitcoin prices tumbling on the six-hour timescale chart. Nonetheless, on 14 February, it jumped by $700 to a trading high of $22,300 before retracing to a close of approximately $22,400. It dropped to about $22,100 in trading as of this writing, a loss of about 0.47%.

Source: Trading View

Also, the asset’s Relative Strength Index indicated that the price rise had initiated a bull trend. Because of this price increase, the RSI line was above the 50 level at press time. It did, however, appear to be in danger of slipping below the line again if the observed price decrease persisted.