Crypto liquidations top $300M as Bitcoin drops below $20k

Bitcoin (BTC) tumbled below $20,000 for the first time since the beginning of the year and liquidated $123.25 million long positions held on the assets in the last 24 hours, according to Coinglass data.

Across the broader crypto market, the total liquidations were $323.86 million over the last 24 hours, according to Coinglass data. The sell-off wiped off all traders who took long positions on the market.

Meanwhile, $114.14 million was liquidated on Binance alone. Other exchanges with top liquidations included OKX and Huobi, with $78.1 million and $43 million, respectively. During this period, 98,955 traders were liquidated — the most significant liquidation being a $9.49 million long position on BTC.

Bitcoin falls below $20k

In the last 24 hours, the flagship digital asset fell to $19,968 at the time of writing, according to CryptoSlate’s data.

Bitcoin had a negative net flow of $13.7 million during the period. Glassnode data showed that while $782.9 million BTC was sent to crypto exchanges over the reporting period, investors withdrew $796.6 million as the bears took over the market,

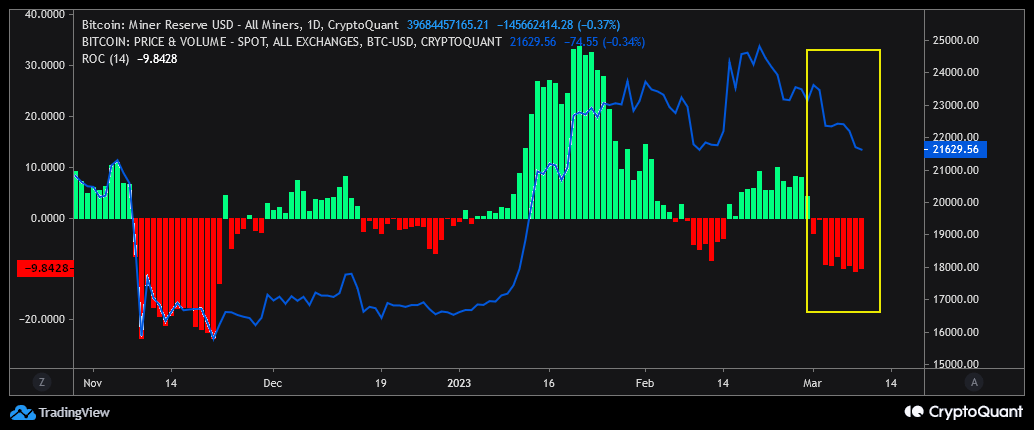

Meanwhile, BTC analyst Barovirtual, citing CryptoQuant data, said BTC miners were putting pressure on the asset. It noted that the miners had increased the pressure from March 1, which could decrease the asset’s value to either $19,500 or $16,600.

Besides that, BTC short-term holders cashed out their profits as the profit ratio rose above 5%, according to CryptoQuant data.

The Silvergate, KuCoin factor

The recent market bloodbath has also coincided with the current issues battling crypto-friendly bank Silvergate and the lawsuit filed against the KuCoin crypto exchange by the New York authorities.

On March 8, Silvergate said it would “voluntarily liquidate” its assets and shut down operations. A CryptoSlate report identified how the bank’s struggles had impacted crypto’s U.S. Dollar market depth over the past month following.

In its lawsuit against KuCoin, New York alleged that Ethereum was a security, further fueling fears surrounding the digital asset.

Meanwhile, U.S. President Joe Biden proposed a 30% crypto-mining tax on all energy costs involved in cryptocurrency mining.