Chainlink [LINK] is still heavily undervalued, according to this report

- LINK’s discounted price has a lot of room for growth before it retests the breakeven point for most investors.

- LINK’s current price point and mixed signals from whales.

Chainlink’s native token LINK has achieved some relief from the downside since the start of 2023. But just how much potential upside should LINK holders expect as far as a sizable recovery is concerned?

How many are 1,10,100 LINKs worth today?

According to a recent analysis by blockchain research firm IntoTheBlock, roughly 70% of LINK’s current holders are currently at a loss.

While this applies to most cryptocurrencies, the estimated breakeven point for most of the holders suggests that the LINK is still heavily oversold.

The report further stated that the breakeven point for most traders was above the $30 price level.

1/4 Let’s talk about @chainlink . Despite its stable price movement over the past 6 months, on-chain analytics indicate that 70% of $LINK holders are at a loss. This isn’t uncommon for many altcoins, but it’s still something to keep in mind. #LinkMarines pic.twitter.com/Sg9dqPwisD

— IntoTheBlock (@intotheblock) March 8, 2023

Chasing the discount?

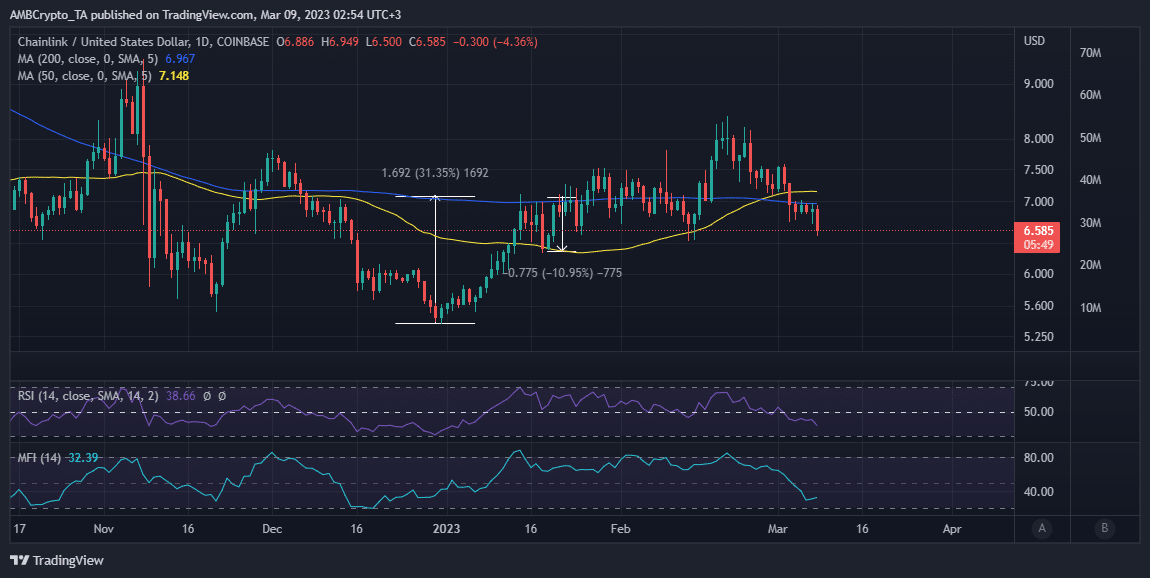

The $30 price target is currently a long way off from its $6.58 press time price level. LINK will have to pull off a $357% rally to reclaim the breakeven price level. In other words, the token is still oversold and trading at a healthy discount.

Source: TradingView

The IntoTheBlock analysis also highlighted the $6.34 price range as one of the closer support levels to watch for. So far the price has tanked by 21% from the current 2023 high.

Nevertheless, the current range is still within a healthy discount range. But is a strong pivot in the works, or will the price continue crashing?

Is your portfolio green? Check out the Chainlink Profit Calculator

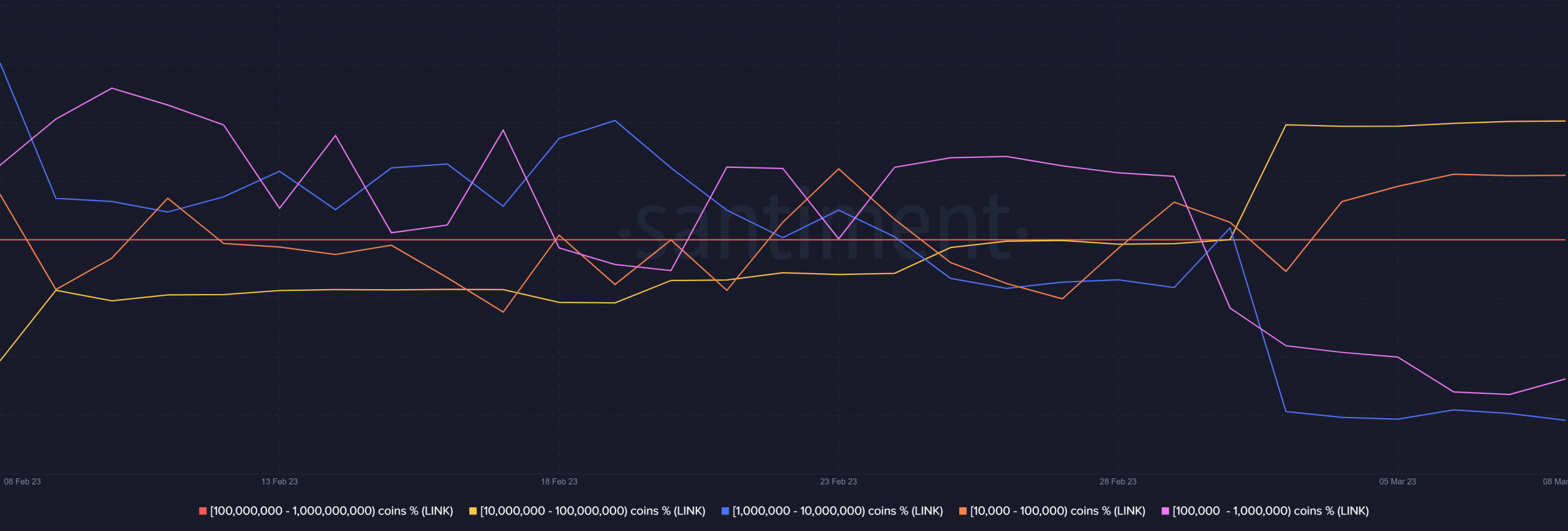

An analysis of LINK’s supply distribution reveals that whale activity has slowed down this week. Despite this, we did see a bit of accumulation by addresses in the 100,000 to 1 million LINK category.

The latter controlled 10.76% of LINK’s circulating supply. Furthermore, addresses holding between 1 million and 10 million have experienced some outflows in the last three days.

The same category controls roughly 15% of the circulating supply, hence the higher impact on price.

Source: Santiment

So far most of the other top whale categories have been relatively inactive which aligns with the market uncertainty.

On the other hand, the supply held by top addresses achieved positive growth in the last four weeks. The latest addition observed in this metric was within the first three days of March.

Source: Santiment

Should LINK investors anticipate a robust pivot?

Market outlook is an important aspect of LINK’s performance. The IntoTheBlock report confirms that LINK is heavily correlated with Bitcoin, Ethereum, and MATIC.

This means we might see some bullish relief if Bitcoin manages to bounce off its support zone. If that fails then LINK may also extend its downside.