Bloomberg Analyst Mike McGlone Issues Bitcoin Alert, Warns One Thing Could Create Headwinds for BTC

Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin (BTC) may run into strong headwinds this year.

McGlone tells his 58,800 Twitter followers that a US economic recession is likely coming soon and it could drag down risk assets like Bitcoin and other cryptos.

“Notably Negative Liquidity vs. Bouncing Bitcoin – Recessions typically portend struggling risk assets and lower interest rates as central banks add liquidity. Cryptos are tops in risk, with Bitcoin the smallest worry. It’s unlikely the US will avoid economic contraction by year-end, according to Bloomberg Economics, but futures show the Fed more inclined to keep hiking.

Respecting the rules of liquidity, which was notably negative at the end of 1H (first half of the year), our bias is the long-anticipated recession will add typical headwinds, particularly to cryptos and stocks that bounced.”

McGlone also says Bitcoin may perform similarly to how gold performed during the Great Recession of 2008 when it declined 30% before taking off on a rally.

“The graphic shows Bitcoin’s upward trajectory facing a first – the NY Fed’s probability of recession from the yield curve at its greatest since 1982. That gold dropped about 30% from its peak in 2008 before rallying may have implications for its digital descendent in 2H (second half of the year).”

However, McGlone says that if Bitcoin could decorrelate from the Nasdaq 100 (NDX) it could lead to broader adoption that would help the king crypto perform stronger during a recession.

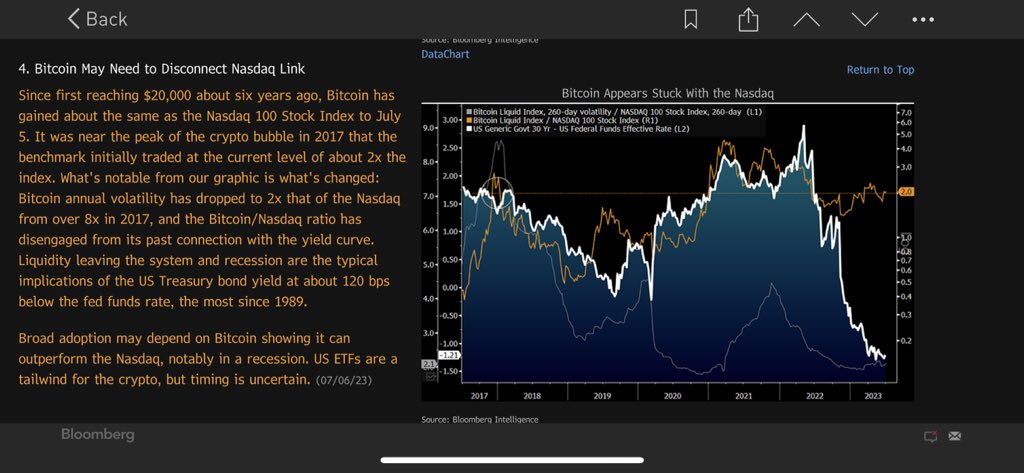

“Bitcoin May Need to Disconnect Nasdaq Link – Since first reaching $20,000 about six years ago, Bitcoin has gained about the same as the Nasdaq 100 Stock Index to July 10. It was near the peak of the crypto bubble in 2017 that the benchmark initially traded at the current level of about 2x the index. What’s notable from our graphic is what’s changed:

Bitcoin annual volatility has dropped to 2x that of the Nasdaq from over 8x in 2017, and the Bitcoin/Nasdaq ratio has disengaged from its past connection with the yield curve. Liquidity is leaving the system and recession are typical implications of the US Treasury bond yield at about 120 bps below the Fed funds rate, the most since 1989. Broad adoption may depend on Bitcoin showing it can outperform the Nasdaq, notably in a recession.”

McGlone also highlights how approval of Bitcoin spot exchange-traded funds (ETF) could provide BTC with a significant tailwind during a recession, but it is unclear when the U.S. Securities and Exchange Commission (SEC) will make a decision on the pending applications.

“US ETFs are a tailwind for the crypto, but timing is uncertain.”

Bitcoin is trading for $30,369 at time of writing, down 0.7% during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Featured Image: Shutterstock/Alexander56891/Sensvector