Bitcoin’s hashrate increase isn’t helping miners in any way, here’s why

- Bitcoin miners were found facing some challenges with the rise in the BTC’s hashrate.

- The number of rigs required to mine Bitcoin increased, however, it caused a decline in miners’ profits.

Over the last few months, Bitcoin miners have reaped the benefits of BTC’s short-term rally. Interestingly, besides BTC’s price, the hashrate of the network has also increased.

Read Bitcoin’s Price Prediction 2023-2024

“Hash”ing it out

Due to the growing hashrate, the demand for ASIC rigs required to mine Bitcoin has also increased.

As #Bitcoin hashrate pushes to new ATHs, we can estimate the number of operational ASIC rigs required to generate that hashpower.

Using three latest generation Antminer rigs, we estimate a fleet of

– 🟢5.5M S17s

– 🟡2.8M S19 Pros

– 🔴1.2M S19 XP Hydhttps://t.co/O2EU4gZTCe pic.twitter.com/EQabTeA7mS— glassnode (@glassnode) March 5, 2023

This has caused the overall investment behind Bitcoin mining to rise by a sharp number which, in turn, has affected the profitability of miners.

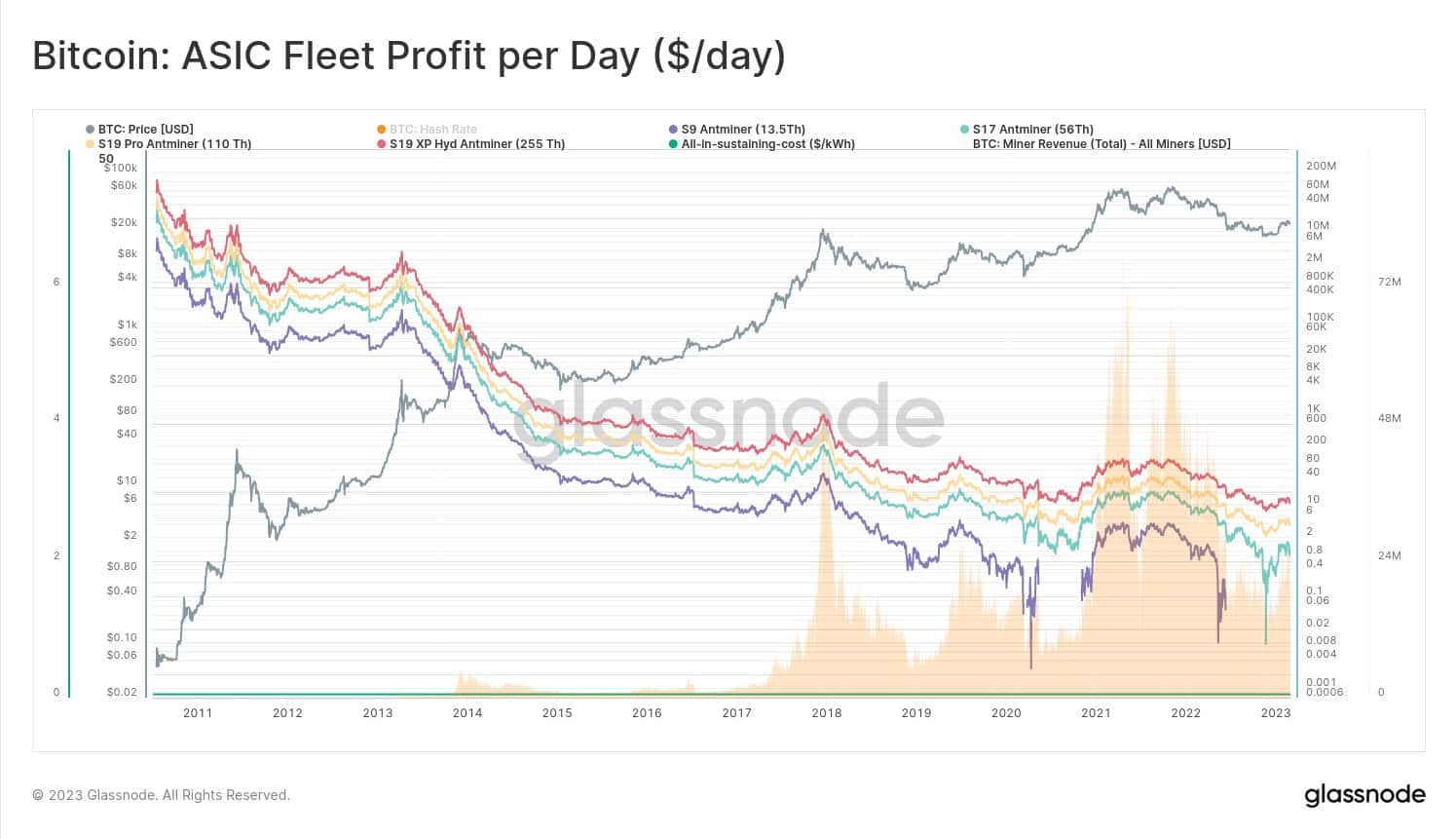

According to glassnode’s data, the ASIC profit per day has fallen significantly. Due to the decline in ROI (Return On Investment) for miners, the revenue generated by them has gone down by a significant margin.

Source: glassnode

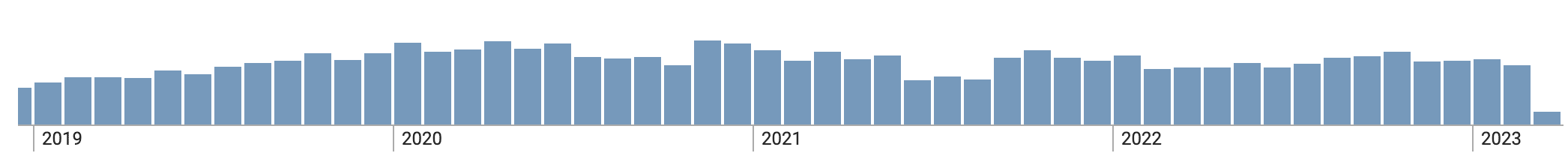

Over the last week, the amount of revenue generated by miners has fallen from 1065.06 BTC to 986.026 BTC. However, despite the falling revenues, most of the large mining pools remained unaffected.

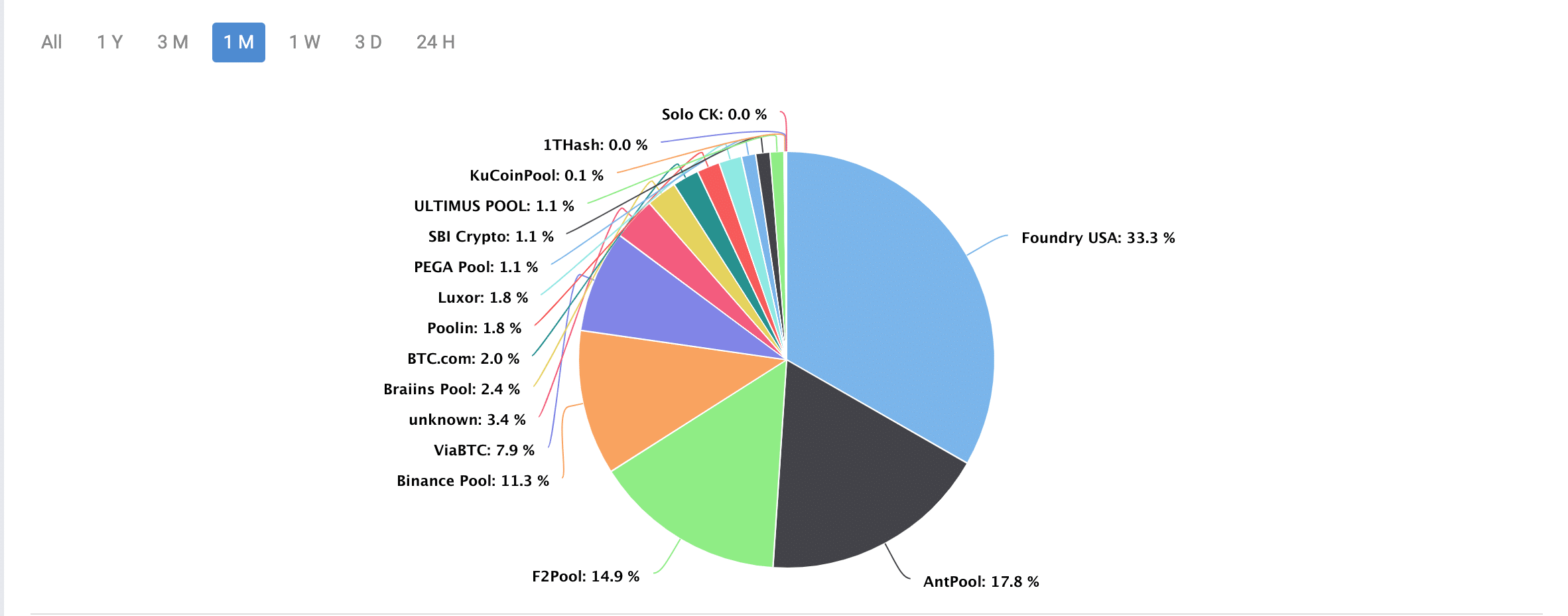

At the time of writing, three major mining pools dominated the sector, namely, Foundry USA which took 33.3% of the entire mining share. It was followed by Antpool and F2Pool, which captured 17.8% and 14.9% of the mining shares, respectively.

Source: BTC.com

Foundry USA managed to mine 7577 blocks in the past six months. At press time, it managed to supply 2.29% of the transaction fees as a block reward.

On the other hand, Antpool mined 5,123 blocks during the same period. However, F2Pool couldn’t manage to do very well and was only able to mine 4,084 blocks in the last six months.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The monthly blocks mined by F2Pool declined from 761 in October to 615 in March. If this trend continues, F2Pool could lose its position as the third most successful mining pool.

Source: BTC.com

That being said, it remains to be seen how these mining pools manage to perform, given the high number of ASIC fleets required.

Evidently, if Bitcoin price rises and rallies further, it would provide some relief to miners.

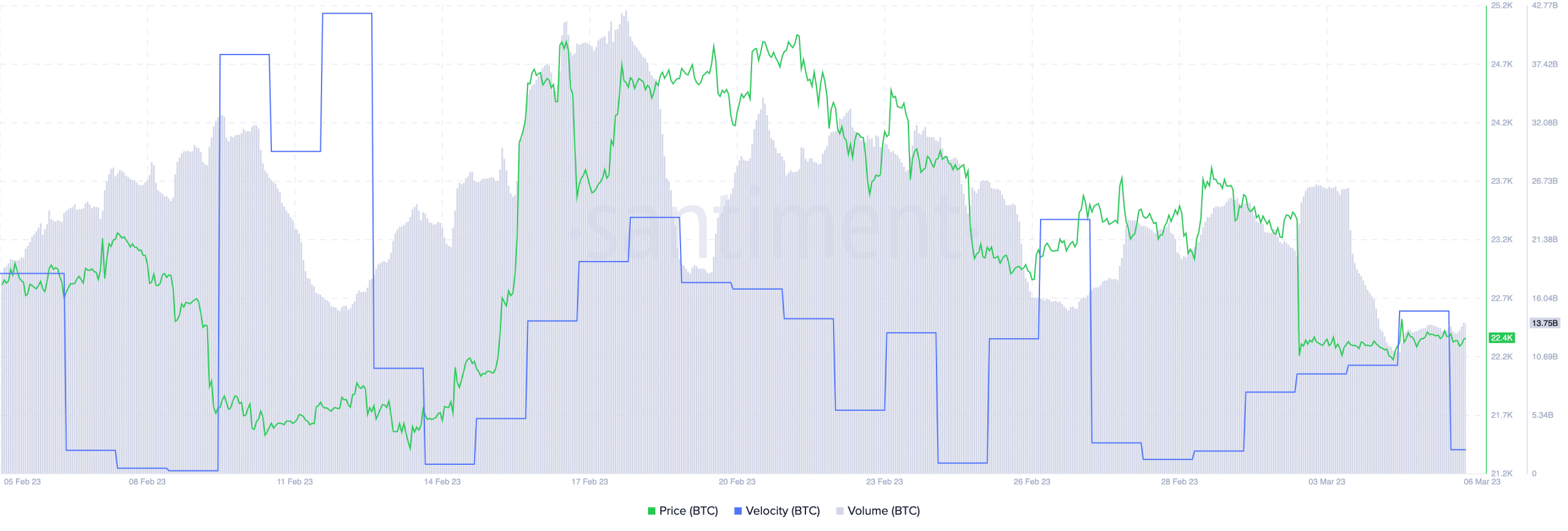

However, at press time, BTC was trading at $22,400 and its price had fallen by 3.85% over the past week.

Its volume followed suit and fell from 22.78 billion to 13.75 billion in the same period.

Source: Santiment