Bitcoin’s fall to $67K fueled $200M liquidations – What next for holders?

- BTC stumbles below $70,000.

- Liquidation crosses $100 million.

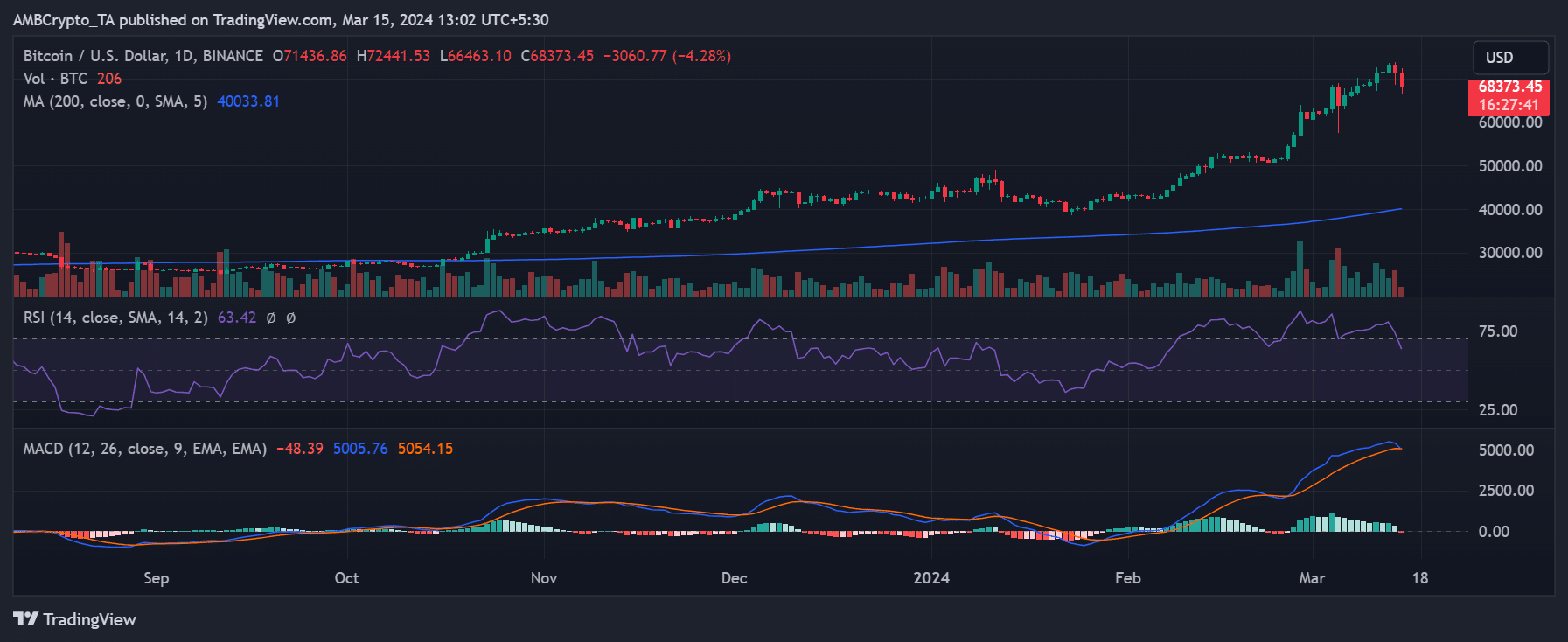

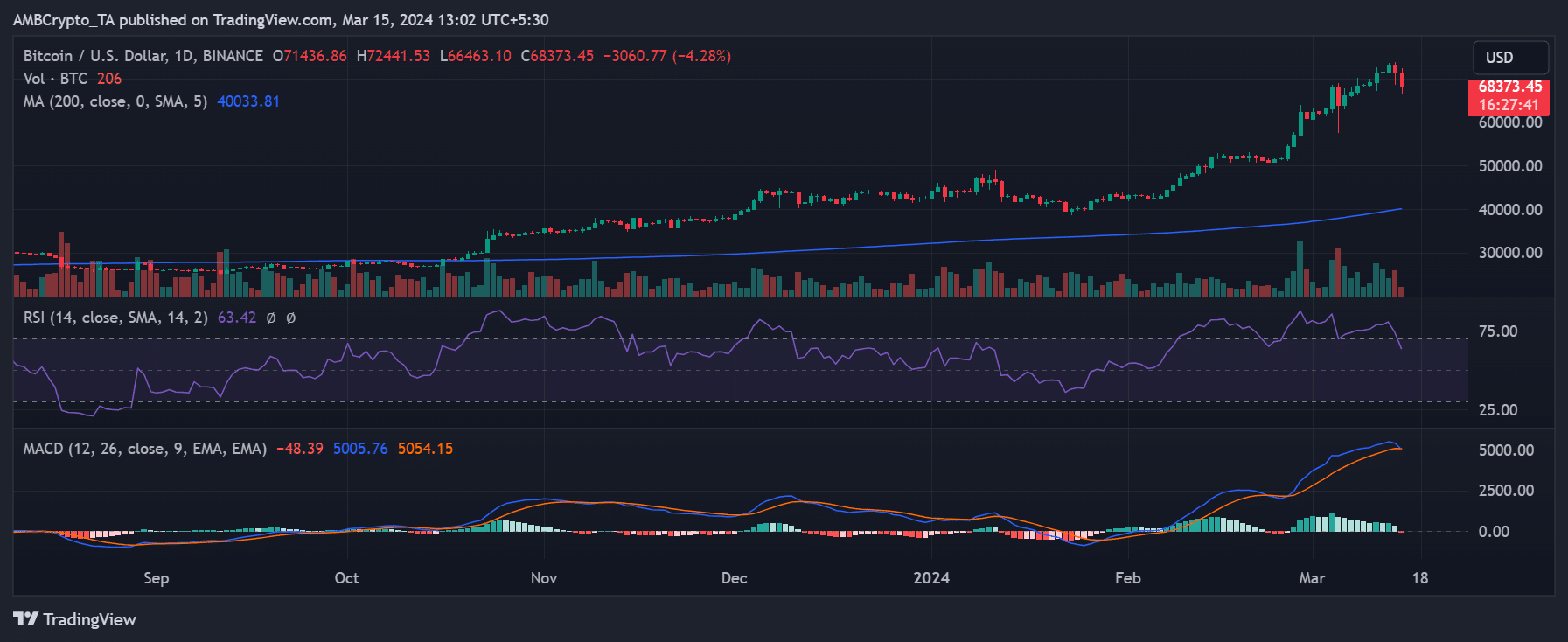

Bitcoin [BTC] surged past the $73,000 price level, fueling anticipation of a potential new all-time high (ATH). However, the price dropped below the $70,000 mark, triggering a significant volume of liquidations.

Bitcoin falls below $70,000

On 14th March, Bitcoin experienced a significant downturn, lowering its price by over 2% to approximately $71,400. This decline followed its surge above $73,000, marking a new all-time high for BTC.

At the time of this writing, the price had fallen to around $66,880, reflecting a decline of over 8%. This marked the first consecutive decline for BTC since late February.

Source: Trading View

Furthermore, it also signaled the first exit from the overbought zone for the Bitcoin Relative Strength Index (RSI) since then, with the RSI trending below 70. Despite these declines, Bitcoin remained in a strong bullish trend.

However, the downturn led to a significant increase in liquidation volume.

Bitcoin sees over $140 million liquidation

Analysis of the Bitcoin liquidation chart on Coinglass revealed that by 14th March, the liquidation volume had surged to over $143.6 million.

Long positions bore the brunt of the liquidation, accounting for over $111 million, while short positions also saw significant liquidations totaling over $32.6 million. At the time of this writing, liquidations continued, with long positions remaining the primary target.

Long position liquidation exceeded $90.6 million, compared to short position liquidation, which amounted to over $21.2 million. These figures indicate that traders who were bullish on Bitcoin’s price experienced significant losses in the past 24 hours.

Additionally, examining the funding rate suggested that buyers continued to exhibit aggression. At the time of this writing, the funding rate stood at around 0.04%.

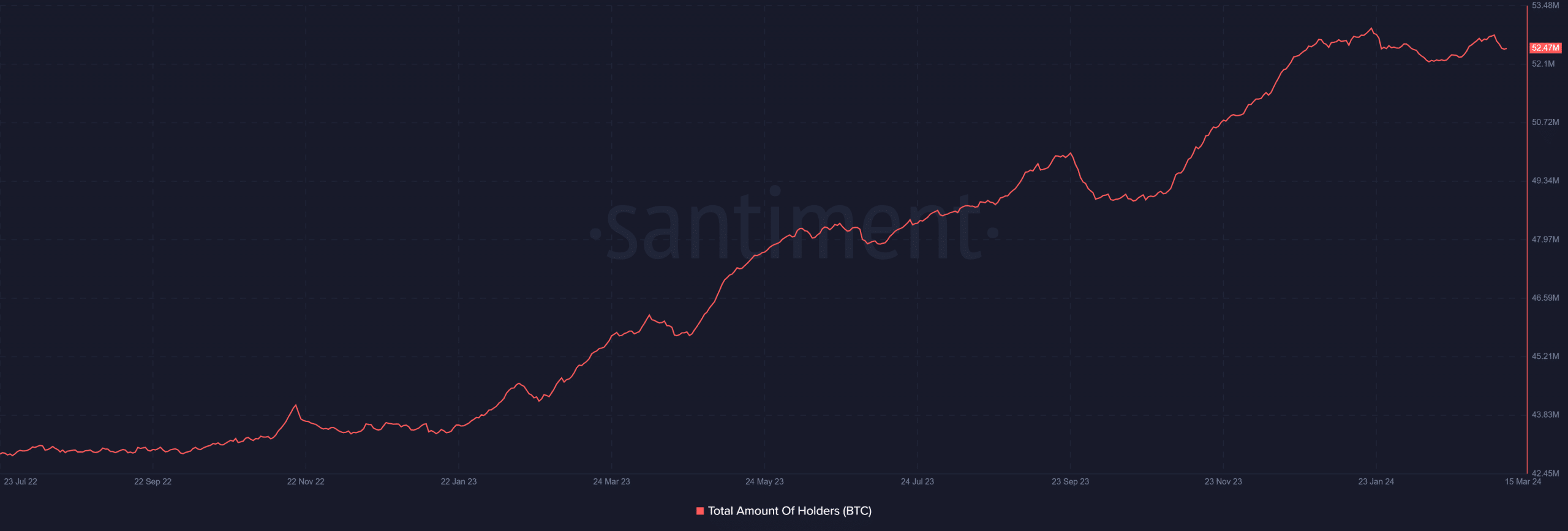

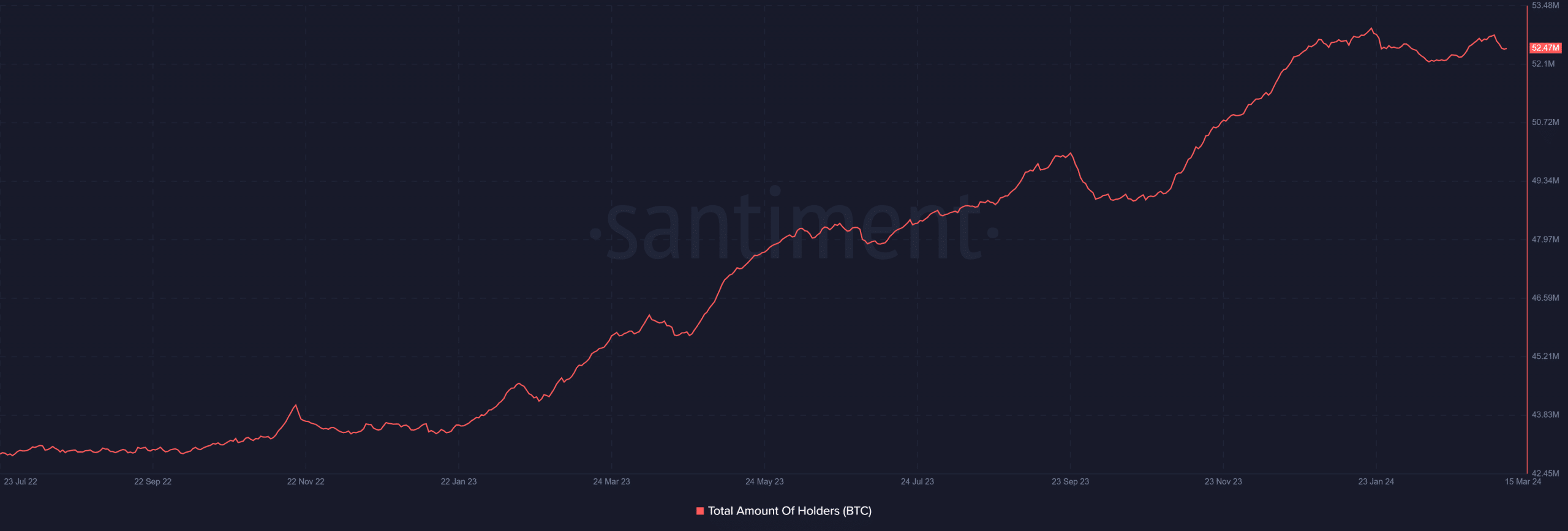

BTC holders drop

According to an analysis of the metric on Santiment, there has been a slight reduction in the number of Bitcoin holders. The chart revealed that around 10th March, the total number of holders approached 52.8 million.

However, during the week, this number started to experience slight declines.

Source: Santiment

How much are 1,10,100 BTCs worth today

At the time of this writing, the total number of holders was around 52.4 million. This suggests that some holders have opted to take profit with the recent increase in BTC’s value.

Furthermore, an analysis of Bitcoin’s volume showed a notable surge to over $75 billion at the time of writing. This marked a significant increase from the approximately $50 billion observed in previous days.