Bitcoin: With Puell Multiple above capitulation, will miners halt selling?

- Miners might revert to a revenue increase as the Puell Multiple left the capitulation area.

- Market statistics showed that the current condition was not overheated.

Bitcoin [BTC] holders were not the only recipients of welcome developments recently. Like the holders, miners who have struggled with inhospitable conditions may also have cause to celebrate in the near term. This is after they had spent months in losses.

How many are 1,10,100 BTCs worth today?

Solace in the face of hope

The reason for this projection is due to the Puell Multiple’s exit from the red zone. The Puell Multiple is an important metric that gauges mining profitability. The metric underpins the correlation between the daily coin issuance and the 365-day Moving Average (MA) of the same issuance.

According to Philip Swift, founder of LookIntoBitcoin, the Puell Multiple was out of the capitulation region after 191 days of languishing in the zone.

The Puell Multiple shows recent relief for #bitcoin miners.

After 191 days in capitulation zone, the Puell Multiple has rallied. Showing relief for miners via increased revenue and likely reduced sell pressure.

Free live chart: https://t.co/G9HDcNLL9T pic.twitter.com/MBRef5fZIE

— Philip Swift (@PositiveCrypto) February 2, 2023

Furthermore, Glassnode data showed that the metric was close to overthrowing the erstwhile defeat. At press time, the Puell Multiple was 0.996. This was considered an impressive rally considering that a lower value indicates a revenue shred.

On the other hand, the current state of approximately one suggests an increase in miner revenue. Hence, this could be vital to reducing the selling pressure from miners, which they had used to cover up for the hawkish market condition.

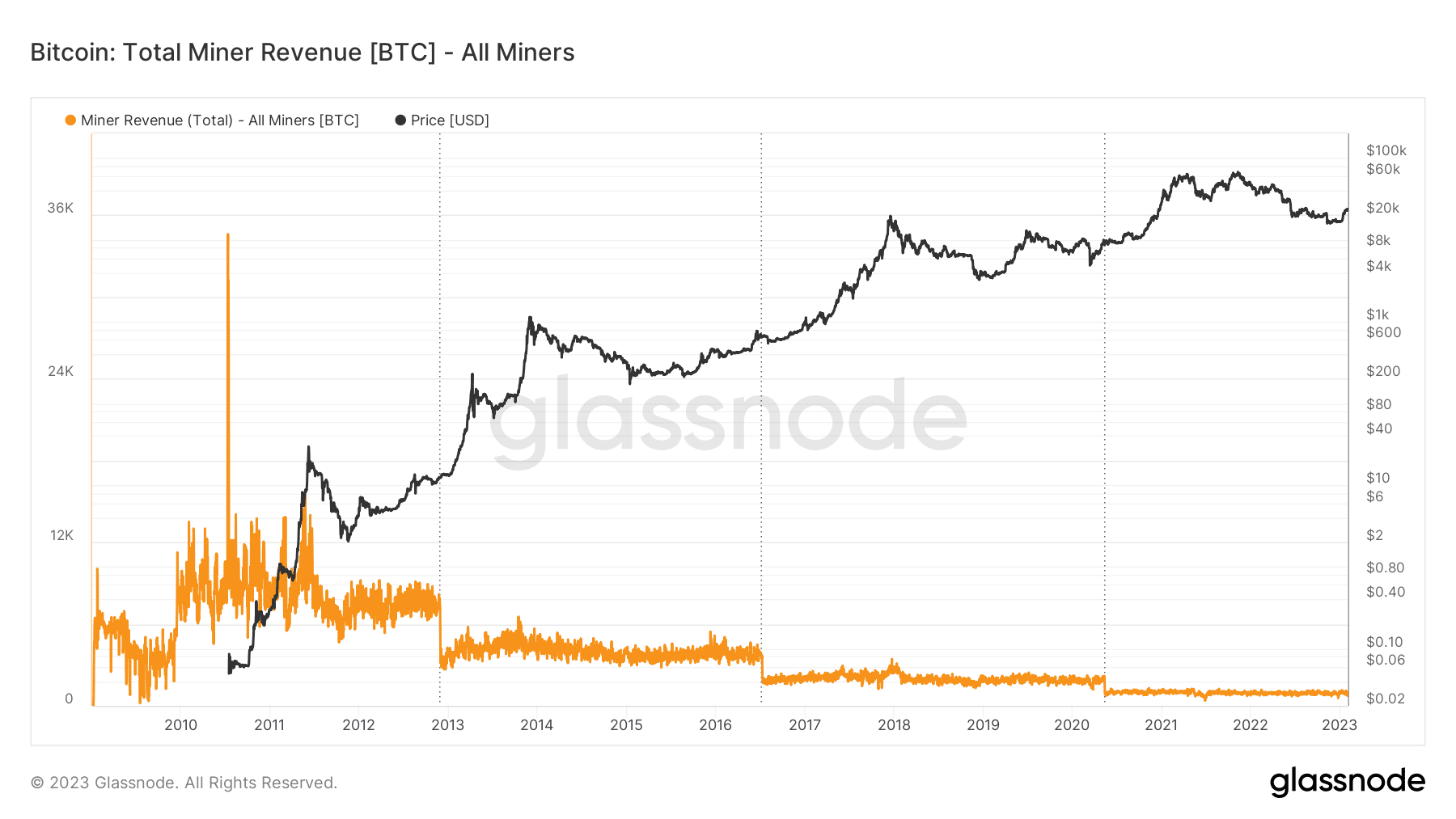

At the time of assessing the information from Glassnode, the miner revenue was edging toward the uptrend. This metric shows how much validators of the network have made. And this includes newly minted coins. At the time of writing, the revenue was 976.80 BTC.

Source: Glassnode

Indeed, the positive market reaction to the FOMC announcement also expanded to the mining operational sector.

Ease on the heat

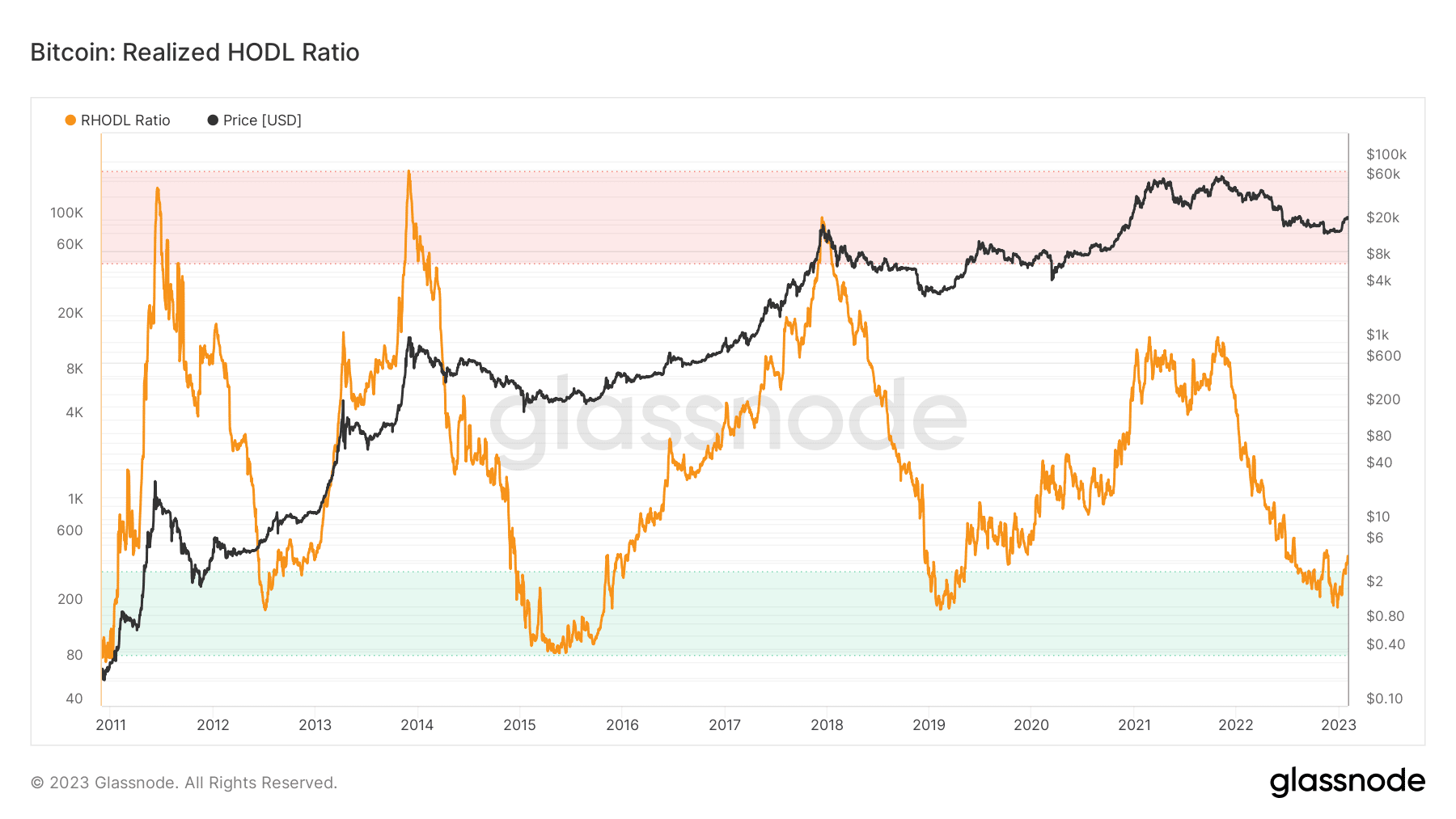

In addition, Glassnode data revealed that the entire Bitcoin market was stabilizing. According to the on-chain information provider, the Realized HODL (RHODL) ratio had risen to 387.22 on 28 January.

The RHODL ratio weighs the relationship between the one-week and one to two years Realized Cap HODL waves. But since the ratio was not extremely high, it indicated that the market was not overheated and that this cycle top would still be a far reach. This could offer a buying opportunity for the long term.

Source: Glassnode

Is your portfolio green? Check out the Bitcoin Profit Calculator

Meanwhile, the BTC price action was able to get the better of the projected downside following the FOMC pronouncement. However, the price found it challenging to re-hit $24,000, according to CoinMarketCap. Some analysts maintained the status quo that the coin was only getting stronger.

In a recent tweet, stock-to-flow creator PlanB stuck to his previous opinion of a $25,000 200-week MA while noting that the halving would play a crucial role.

#bitcoin is getting stronger .. halving is coming🔥 pic.twitter.com/h4TD3JPuWC

— PlanB (@100trillionUSD) February 2, 2023