Bitcoin [BTC] long liquidations soar as price crashes below $23k, more inside

- Bitcoin’s latest pullback triggers heavy liquidation of leveraged long positions.

- According to the delta cap metric, Bitcoin’s macro bottom was looming.

Bitcoin [BTC] has finally given in to capitulation after struggling to bounce off from support in the $23,000 range. A closer look at the dynamics of its latest bearish outcome revealed that long liquidations may have something to do with the downward momentum.

Is your portfolio green? Check out the Bitcoin Profit Calculator

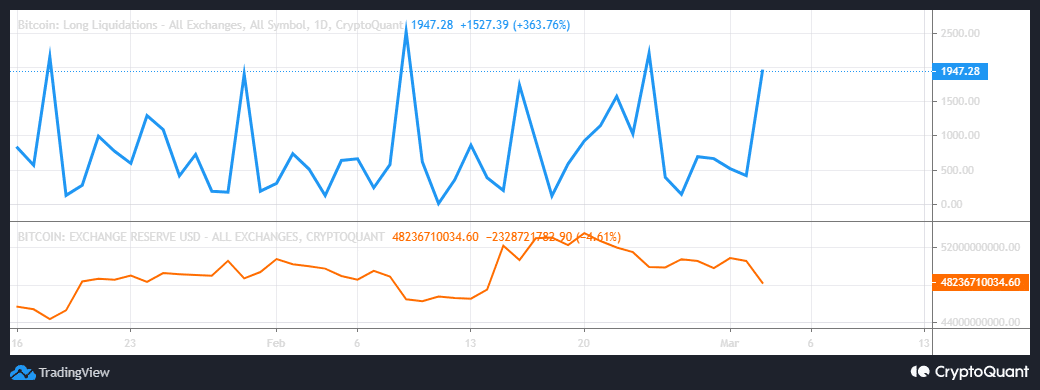

Bitcoin’s long liquidations metric soared in the last 24 hours, proving that there were a large number of leveraged positions. Liquidations surged by over 360% within a matter of hours and this might have contributed to more sell pressure. Bitcoin exchange reserves drew down slightly despite the price drop and liquidations.

Source: CryptoQuant

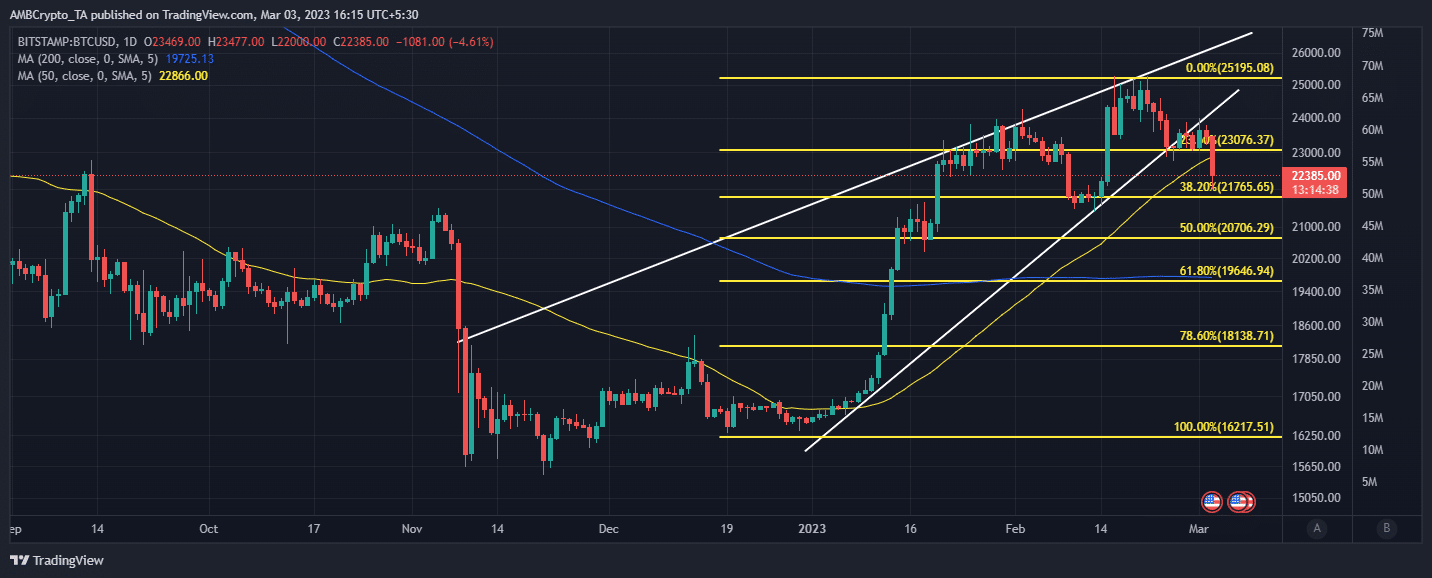

Bitcoin’s performance this week extended on the bearish momentum that prevailed since last week. Moreover, BTC’s extended downside reflected its inability to sum up enough demand to trigger a rally.

Source: TradingView

Traders should expect the next support range between the $21,500 – $22,000 price range If Bitcoin maintained its press time trajectory, which was also within the 0.382 Fibonacci zone. The next major support range after that was the $20,500 – $21,100 range.

Is this the start of March’s Bitcoin FUD?

Bitcoin’s latest price crash is not surprising because the Federal Reserve may end up announcing an interest rate hike. Such an outcome would have a negative impact in the market, as has been the case in the past. Now investors have to contemplate the extent of sell pressure to anticipate if the FED hikes rates later this month.

Another major crash might send BTC crashing potentially below $20,000 once again. As such, investors will look to determine the next bottom in case of another large bearish move. A recent CryptoQuant analysis suggested that the delta cap metric might be one of the best tools for predicting the market bottoms.

How many are 1,10,100 BTCs worth today?

According to the analysis, Bitcoin’s price bottom is often formed when the market cap crosses with the delta cap. Such instances occurred in 2011, 2015 and 2018, and an extended pullback occurred after each crossing followed by the market’s recovery.

Source: CryptoQuant

If this analysis holds true, then Bitcoin might be headed for an extended pullback in the next few weeks. However, this is an oversimplification considering the myriad of factors that influence Bitcoin’s demand or sell pressure. Nevertheless, the delta cap metric has been accurate in pointing out macro bottoms, and may indicate that the current bearish cycle is not yet over.