Are Bitcoin Cards Worth It?

If you’ve lived a day in the modern world, there’s a really high chance that you’ve interacted with a credit or debit card before. But what about crypto cards? Just like their traditional cousins, they can be used to make online and in-store purchases, earn rewards, and make transactions. Unlike the cards issued by banks, however, they store crypto assets. Today, I will talk about some of the best crypto debit cards available on the market — and also look at whether these cards are worth using at all.

The 5 Best Bitcoin Debit Cards in 2024

While there are not as many crypto debit (or credit) cards as traditional debit cards, there are still enough to choose from. The Bitcoin debit cards below are some of the best on the market, and cover a wide range of preferences.

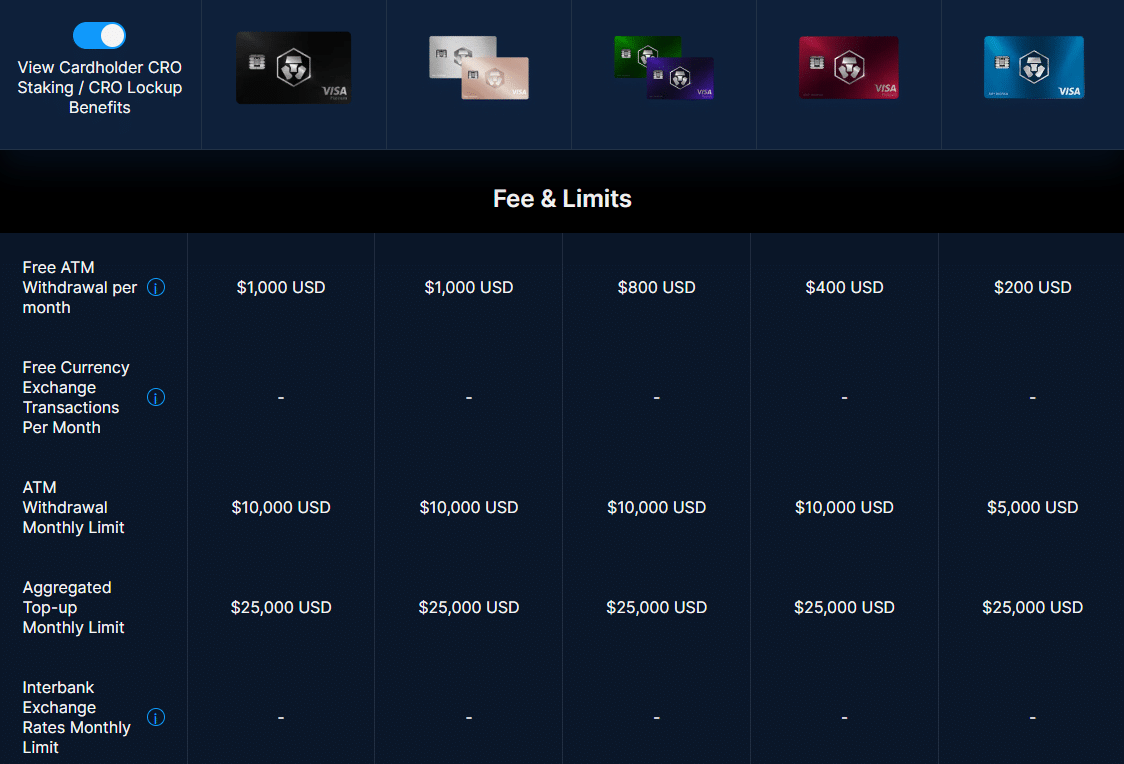

Crypto.com Visa Card

One of the most popular options in the cryptocurrency card market, the Crypto.com Visa Card makes it possible for users to convert and spend their crypto holdings on everyday purchases while earning generous rewards. Linked directly to Crypto.com’s platform, it enables seamless conversion of crypto assets to fiat currency, which can be spent at any location that accepts Visa. The card offers a tiered rewards system based on the amount of CRO tokens (Crypto.com’s native token) staked, with higher tiers offering more benefits such as higher cashback percentages, complimentary airport lounge access, and no foreign transaction fees.

- No. of Crypto Supported: Wide range of cryptocurrencies

- Fees: No annual fee; specific fees depend on card tier

- Rewards: Up to 5%, varying by card tier

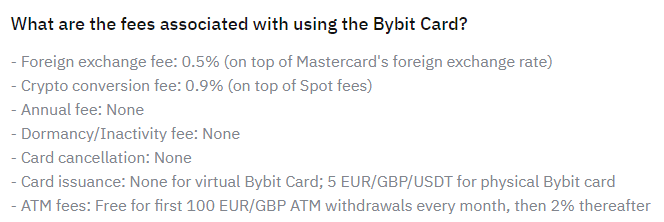

Bybit Crypto Card

The Bybit Crypto Card, powered by Mastercard International Incorporated, is designed to allow Bybit exchange users to spend their crypto holdings globally. This card converts digital currency into fiat currency automatically, enabling straightforward purchases and ATM withdrawals. It offers a virtual card option, which can be used immediately upon approval, and a physical card that arrives later. The Bybit card stands out for its integration with Bybit’s trading platform, making it easy for users to manage their digital and fiat currencies in one place.

Please note that the Bybit card is currently only available in AUS and EEA.

- No. of Crypto Supported: Various cryptocurrencies supported on Bybit

- Fees: No annual or hidden fees; competitive ATM withdrawal fees

- Rewards: Rewards vary, promotional cashback offers

Coinbase Crypto Card

Coinbase, one of the largest crypto exchanges globally, offers the Coinbase Crypto Card, a Visa debit card that converts cryptocurrency into fiat currency for purchases and ATM withdrawals. The card integrates directly with Coinbase accounts, allowing users to spend any of the cryptocurrencies they hold. It offers security features such as two-factor authentication and instant card freeze through the mobile app. The Coinbase card facilitates management of crypto and fiat expenses directly from the Coinbase app, providing detailed receipts and summaries after each transaction.

- No. of Crypto Supported: Supports all cryptocurrencies available on Coinbase

- Fees: No spending or annual fees; other fees may apply

- Rewards: Up to 4% back in crypto rewards

BitPay Crypto Debit Card

The BitPay Debit Card is a prepaid card. With it, crypto holders can convert their digital assets into US dollars: the latter can be spent anywhere Mastercard is accepted. This card is notable for its ease of use, allowing for fast conversion from crypto to fiat without the need for a bank. It’s an excellent choice for those who want to use their cryptocurrency for daily expenses without the hassle of multiple transfers or exchanges. BitPay’s card also supports withdrawals from ATMs, providing a liquidity option for users.

- No. of Crypto Supported: Supports Bitcoin, Ethereum, and other major cryptocurrencies

- Fees: Has no issuance fee and standard transaction fees

- Rewards: Cashback varies by offer

At the time of writing, BitPay has temporarily paused the issuance of new BitPay cards. U.S. residents can join the waitlist on their website.

Wirex Visa Card

The Wirex Visa Card empowers users to spend their cryptocurrency assets by instantly converting them to fiat currency. This card is available in several regions, including Europe and Asia, and offers significant rewards through its Cryptoback™ program, where users earn back a percentage of their spending in cryptocurrency. Wirex card users enjoy the benefit of free international ATM withdrawals and zero exchange fees up to a specific limit, making it a competitive option for international travelers.

- No. of Crypto Supported: Supports multiple cryptocurrencies

- Fees: No issuance fee; free international ATM withdrawals up to a certain limit

- Rewards: Up to 8% back with Cryptoback™

Binance Visa Card – No Longer Available

The Binance Visa Card used to grant Binance users the freedom to spend their cryptocurrency holdings at over 60 million merchants worldwide, directly converting their crypto assets into fiat currency at the point of sale. This card integrated seamlessly with Binance’s crypto wallets, facilitating real-time conversion of digital assets to fiat currency, ensuring users can manage their funds efficiently. The Binance Card also offered cashback in BNB on every purchase, which increased depending on the amount of BNB the user holds.

However, Binance card is no longer available – it ceased operations in December 2023 due to regulatory issues.

How to Choose the Best Crypto Debit Card

When choosing the best crypto debit card, several key factors should be considered to ensure the card meets your financial habits and lifestyle needs. Here’s a comprehensive guide, equipped with essential keywords, to help you navigate the selection process:

Understanding the Basics

Crypto debit cards function similarly to traditional debit cards; yet, you spend your cryptocurrency holdings for everyday transactions. Unlike crypto credit cards, these do not require credit checks, thus simplifying the application process. It’s essential to understand that when you use a crypto card, the digital currency is usually converted into fiat currency, potentially triggering a taxable event each time you transact.

Card Issuance and Provider

Selecting a reputable card provider is crucial. The provider should offer robust customer support, straightforward card issuance processes, and have a good track record in the cryptocurrency market. Check whether the card is issued by a well-known payment network like Visa or Mastercard, as this will affect where the card can be accepted.

Supported Cryptocurrencies

Consider which cryptocurrencies you can spend with the card. While some cards may only support major coins like Bitcoin and Ethereum, others might offer a wider range of digital currencies. Ensure your card is compatible with your cryptocurrency wallet and supports the specific crypto assets you hold.

Fees and Limits

Understand all associated costs, including card issuance fees, monthly or annual fees, and transaction fees such as ATM withdrawals or foreign transaction charges. Also, consider the ATM withdrawal limits, as these can vary significantly between cards and might impact your access to cash.

Cashback Rewards and Benefits

Many crypto debit cards offer cashback rewards on purchases in cryptocurrency. These rewards can vary from 1% to as high as 8%, depending on the card tier and how much you spend or hold in your associated crypto wallet. Additionally, some cards offer perks such as airport lounge access, higher withdrawal limits, and lower foreign transaction fees, depending on the level of crypto assets you maintain with the issuer.

Security Features

Opt for cards that provide advanced security measures. These can include two-factor authentication, the ability to freeze and unfreeze your card through a mobile app, instant transaction notifications, and secure chip technology. Such features protect against fraud and unauthorized access to your funds.

Integration and Convenience

Assess how well the card integrates with existing financial tools and services you use. Some cards offer better integration with specific cryptocurrency exchanges or wallets, allowing for real-time crypto balance updates and seamless conversion from crypto to fiat currencies.

User Experience

Read user reviews and check the card provider’s app and online tools. A good user interface and user experience in managing your card and crypto assets can greatly enhance your overall satisfaction.

Regulatory Standing

Finally, ensure that the card provider complies with the regulatory requirements of your jurisdiction. This compliance not only affects the legality of using the card but also ensures that the provider follows stringent data protection and privacy laws.

Crypto Debit Cards: Are They Worth Using?

How do the best crypto debit cards match up against a regular debit card? Well, since there are fundamental differences between the cards issued by traditional financial institutions and crypto projects, there are naturally differences in what they are good — and bad — at. Here are some of the upsides and downsides of using crypto debit cards that you should consider before getting one yourself.

Crypto Debit Card: Upsides

- Ease of Use: Much like a regular debit or credit card, crypto debit cards can be used for online purchases, in-store transactions, and even to withdraw cash from ATMs. They are particularly handy for those who want to spend their crypto holdings without the need for multiple transactions to convert them into fiat currency first.

- Rewards and Incentives: Many crypto debit cards offer enticing rewards such as crypto cashback on purchases, which can be a significant incentive for users to spend crypto rather than traditional fiat via bank accounts. These rewards often vary by card tiers, potentially increasing with more extensive usage or higher balances maintained.

- Immediate Access to Funds: Users can spend their cryptocurrency holdings directly, without the need to transfer funds to a bank account. Some cards also support features like Google Pay, allowing users to check out instantly with their smartphones.

- No Credit Check: Since crypto debit cards typically do not extend a credit line, they rarely require a credit check. This can make them more accessible than traditional credit cards, especially for users with poor credit history.

Crypto Debit Card: Downsides

- Volatility: Spending crypto can be tricky because of the price volatility associated with cryptocurrencies. The value of the crypto cashback earned could also significantly fluctuate, potentially eroding the real value of the rewards.

- Fees: Crypto debit cards can be weighed down with various fees, including monthly fees, transaction fees for foreign transactions, and ATM withdrawal fees. These can add up and might negate some of the benefits of using the card, especially if the fees are higher compared to those associated with regular debit cards.

- Regulatory Concerns: Crypto debit cards operate in a rapidly changing regulatory environment. This can lead to complications or discontinuation of certain card features without much notice, impacting how you track transactions or manage your account.

- Limited Acceptance: While many crypto cards are backed by major payment networks like Visa or Mastercard, the acceptance of crypto for everyday transactions is not universal. This could limit where and how you can use the card, especially in areas with less developed digital payment infrastructures.

FAQ

Is there a crypto debit card with no KYC?

Most crypto debit cards require some level of KYC (Know Your Customer) verification to comply with regulatory standards and prevent fraud. The KYC verification process typically involves providing identification documents and, in some cases, proof of address. The requirement for KYC verification helps ensure that financial institutions, including crypto card issuers, adhere to anti-money laundering laws. It is highly unlikely to find a reputable crypto debit card that offers full functionality without any KYC processes.

What is the best anonymous Bitcoin debit card?

True anonymity is rare with Bitcoin debit cards due to the regulatory requirements for KYC verification mentioned above. While some cards may offer limited functionality without full identity verification, these often come with strict limits on transactions and ATM withdrawals. Users looking for higher levels of privacy should focus on cards that prioritize secure data practices and minimal personal data retention rather than complete anonymity.

Is there a crypto card with free ATM withdrawals?

Some crypto debit cards offer free ATM withdrawals, but these are typically capped at a certain number of withdrawals or a maximum monthly withdrawal amount. Beyond these limits, fees are usually applied. Cards that offer free ATM withdrawals tend to use this feature as a selling point, so it’s highlighted in their marketing materials. However, users should read the fine print to understand the conditions under which free withdrawals are permitted.

What are the crypto debit card fees?

Fees associated with crypto debit cards can vary widely depending on the card issuer, the payment network, and the specific card tier. Common fees include monthly maintenance fees, ATM withdrawal fees, foreign transaction fees, and crypto-to-fiat conversion fees. Some cards may also charge for issuance and replacement. Higher-tier cards, which often require holding or staking the issuer’s native digital asset, may offer lower fees as part of their benefits to encourage more extensive usage and loyalty.

How do I get a Bitcoin debit card?

Let’s use the Coinbase card as an example. To obtain a Coinbase Bitcoin debit card, you’ll first need to have a verified Coinbase account. If you don’t already have one, you can sign up on the Coinbase website or through their app and follow the on-screen instructions to complete the KYC (Know Your Customer) verification process. Once your Coinbase account is set up and verified, you can apply for the Coinbase Card through the same platform. Link your Coinbase wallet to the card to start using it for everyday transactions like traditional debit cards, but be mindful of the tax implications associated with every single transaction.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.