Arbitrum DeFi protocol shows promise, but is it bankable in the long run

- MUX protocol saw promising growth in trading volume and fees.

- The protocol’s native token MCB shot up by 6% at press time.

MUX Protocol, a decentralized perpetuals exchange, made players in the DeFi arena sit up and take notice. Built on layer-2 scaling solution Arbitrum, MUX has seen considerable growth in key performance indicators (KPIs) over the past few weeks, as highlighted by a crypto analyst on 31 January.

Both the daily volume as the cumulative volume is rapidly increasing, showing of the potential of the protocol:

15/N $MUC $MCB pic.twitter.com/elQqQhe07E

— Uncle (APE certified) 🧢 (@UVtho) January 30, 2023

How many are 1,10,100 MCBs worth today?

As per the Twitter thread, the daily trading volume and cumulative trading volume on the protocol rose sharply since its launch in August 2022, drawing attention to its potential.

MUX sees MAX growth

Small to mid-cap decentralized exchanges (DEXes) have registered steady growth in the DeFi ecosystem of late. Previously, Gains Network [GNS], which is built over Polygon [MATIC] and Arbitrum, displayed promising activity.

MUX protocol works on a similar mechanism as the Gains Network and has replicated some of its success as well. According to data from Token Terminal, the total number of active users on the protocol increased significantly since the start of 2023.

Source: Token Terminal

The rise in fees paid by traders has been exponential over the past month, reaching over $30k from a little over $200 on 31 December. For DEXes, growth in trading fees is as an important metric in estimating the protocol’s worth, as this could attract liquidity providers and investors to its fold.

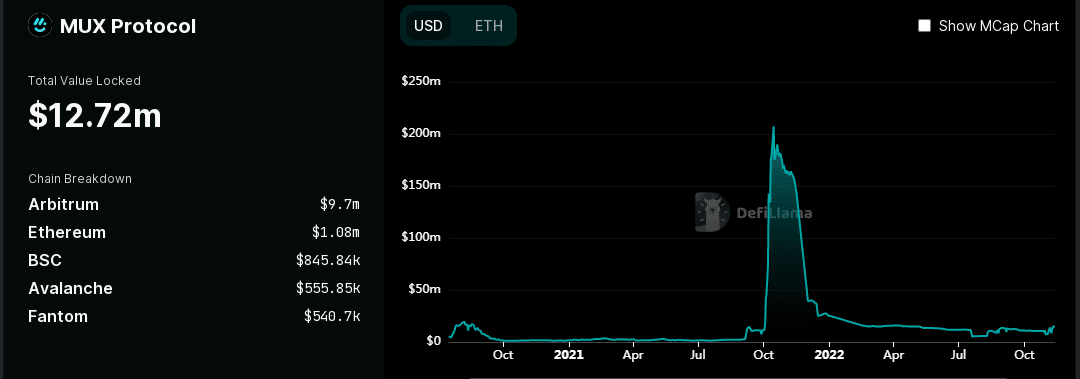

TVL gives negative signals

On the other hand, the total funds locked into the protocol’s smart contracts have stayed flat mostly without showing noticeable growth, as highlighted by DeFiLlama. This implied that the network is yet to grow popular among a large section of investors.

Source: DeFiLlama

Is your portfolio green? Check out the MCB Profit Calculator

In fact, according to CoinMarketCap, the Market Cap/TVL ratio was 6.47 for MUX protocol, meaning that the network was overvalued and could stem its growth in the long run.

Despite this, the protocol’s native token MCB shot up by 6% at press time to $5.32. The token’s trading volume rose by more than 36%.