ApeCoin [APE]: This latest development can trigger selling pressure

- APE worth more than $2.3 million was recently transferred to Binance.

- Market indicators and metrics suggested increased selling pressure for the alt.

ApeCoin [APE] recently rejected a proposal that presented the idea of the Forever Apes team producing 1000 ApeCoin capsules, including four stickers, one patch, and one poster.

This proposal was aimed at increasing token accumulation and reducing unauthorized sales via unofficial channels. However, the majority of the ApeCoin community voted against the AIP, hence the rejection.

Interestingly, while this proposal was aimed at increasing APE accumulation, the opposite was happening in the market.

Read ApeCoin’s [APE] Price Prediction 2023-24

Is selling pressure inevitable?

Lookonchain recently posted a tweet, which mentioned that an address “0x4BE5” transferred 463,137 APE worth over $2.3 billion to Binance.

Address “0x4BE5” transferred 463,137 $APE($2.36M) to #Binance 20 mins ago.

The address received 512,062 $APE on Dec 6, 2022, Jan 10 and Jan 20, 2023, the average receiving price is $4.74.

And still has 131,222 $APE staked.https://t.co/YnLJCVzotd pic.twitter.com/bGDKxA7Ram

— Lookonchain (@lookonchain) February 25, 2023

The addresses that transferred APE had received the token in the recent past. This latest APE transfer underlines the possibility of incoming selling pressure, which can push APE’s price down in the coming days.

At press time, APE had declined by nearly 1% in the last 24 hours. It was trading at $5.07 with a market capitalization of over $1.86 billion.

Well, the anticipation of sell pressure was also revealed by a few of the market indicators, which pointed out that the sellers were in charge of the market, at press time.

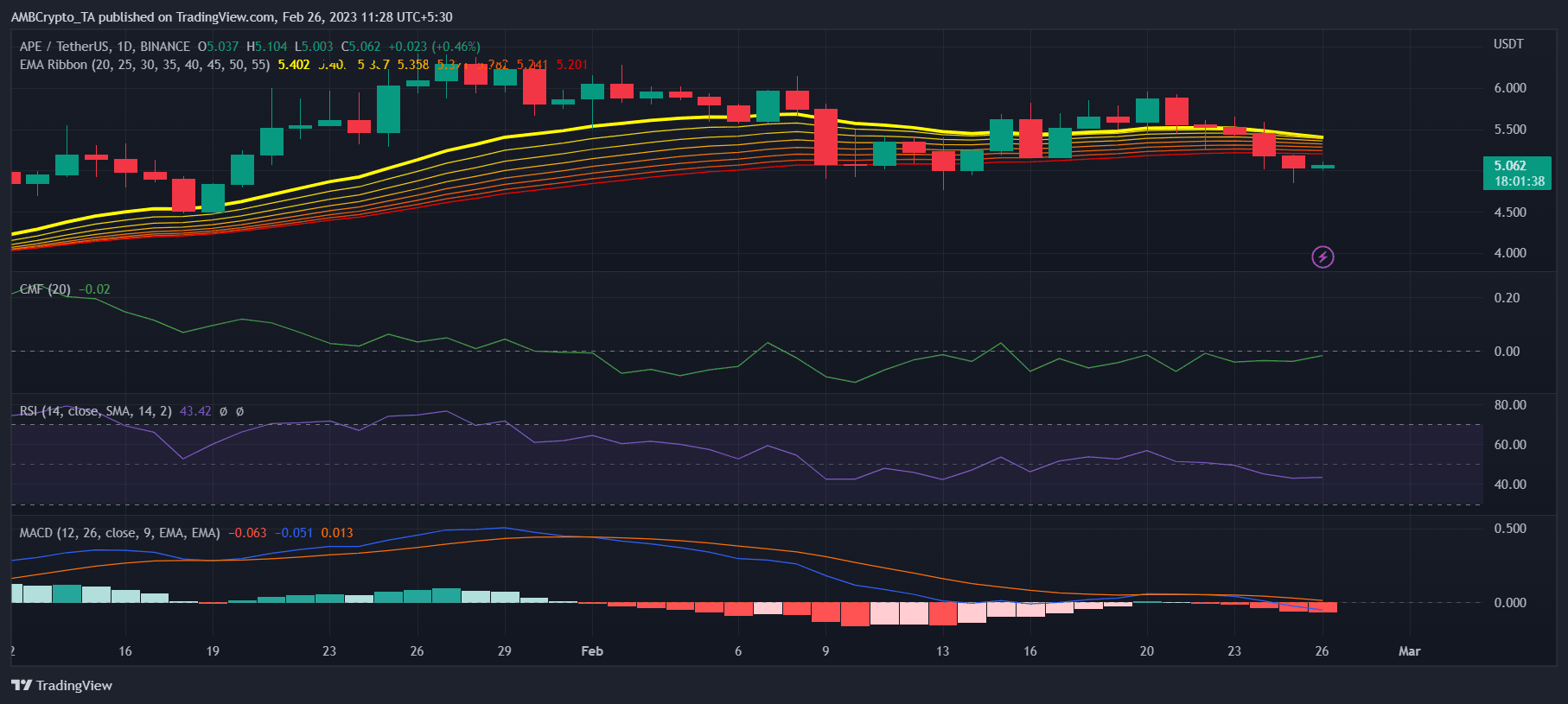

APE’s Relative Strength Index (RSI) went below the neutral mark, which was bearish. On the other hand, the Exponential Moving Average (EMA) Ribbon indicated that the bears were about to take control of the market, as the distance between the 20-day EMA and the 55-day EMA shrank.

APE’s MACD further established sellers’ advantage as it displayed a bearish crossover. However, though the Chaikin Money Flow (CMF) was below the neutral mark, it registered a slight uptick, which was a positive signal for APE.

Source: TradingView

Realistic or not, here’s APE market cap in BTC’s terms

The trouble is real

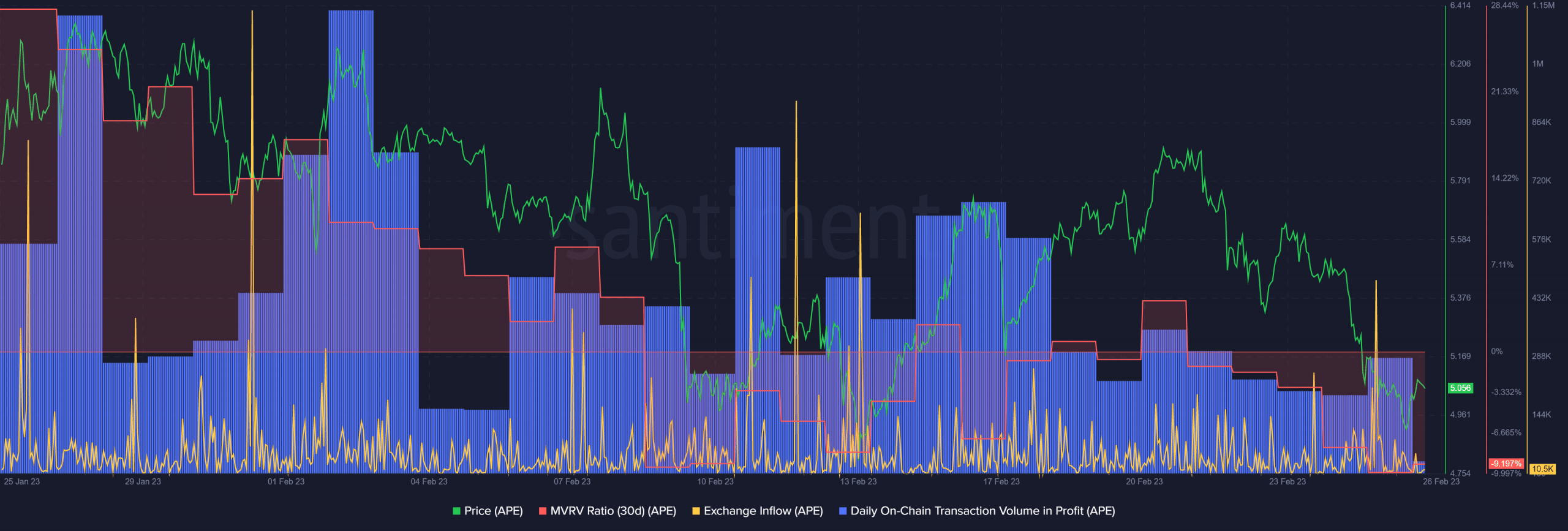

Meanwhile, APE’s exchange inflow spiked quite a few times over the last few days, which also signified increased selling pressure.

As APE’s price went down over the last week, its MVRV Ratio also fell. Thus, indicating a smaller degree of unrealized profit was in the system.

The alt’s on-chain transaction volume in profit also fell because of the price decline. Therefore, considering all the datasets, APE might have to endure increased selling pressure in the days to come.

Source: Santiment