ApeCoin [APE] retraces to perch atop $5 – will bulls maintain the uptrend?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure was flipped to bearish.

- Momentum is also in favor of sellers.

Bitcoin [BTC] has traded in the $21.6k region over the past few days. The determined defense of this support level by the buyers meant an upward move could soon follow. Beneath the $21.2k-$21.6k area, BTC does not have significant support until $20k and $19.6k.

How much is 1, 10, 100 APE worth today?

If Bitcoin sees a rally in the coming days, ApeCoin [APE] will also likely follow in its footsteps. As things stand, APE has a bearish outlook, but it was in a deep retracement. The uptrend from mid-January will not be broken until the price falls beneath $4-$4.5.

ApeCoin closes in on another bullish daily order block

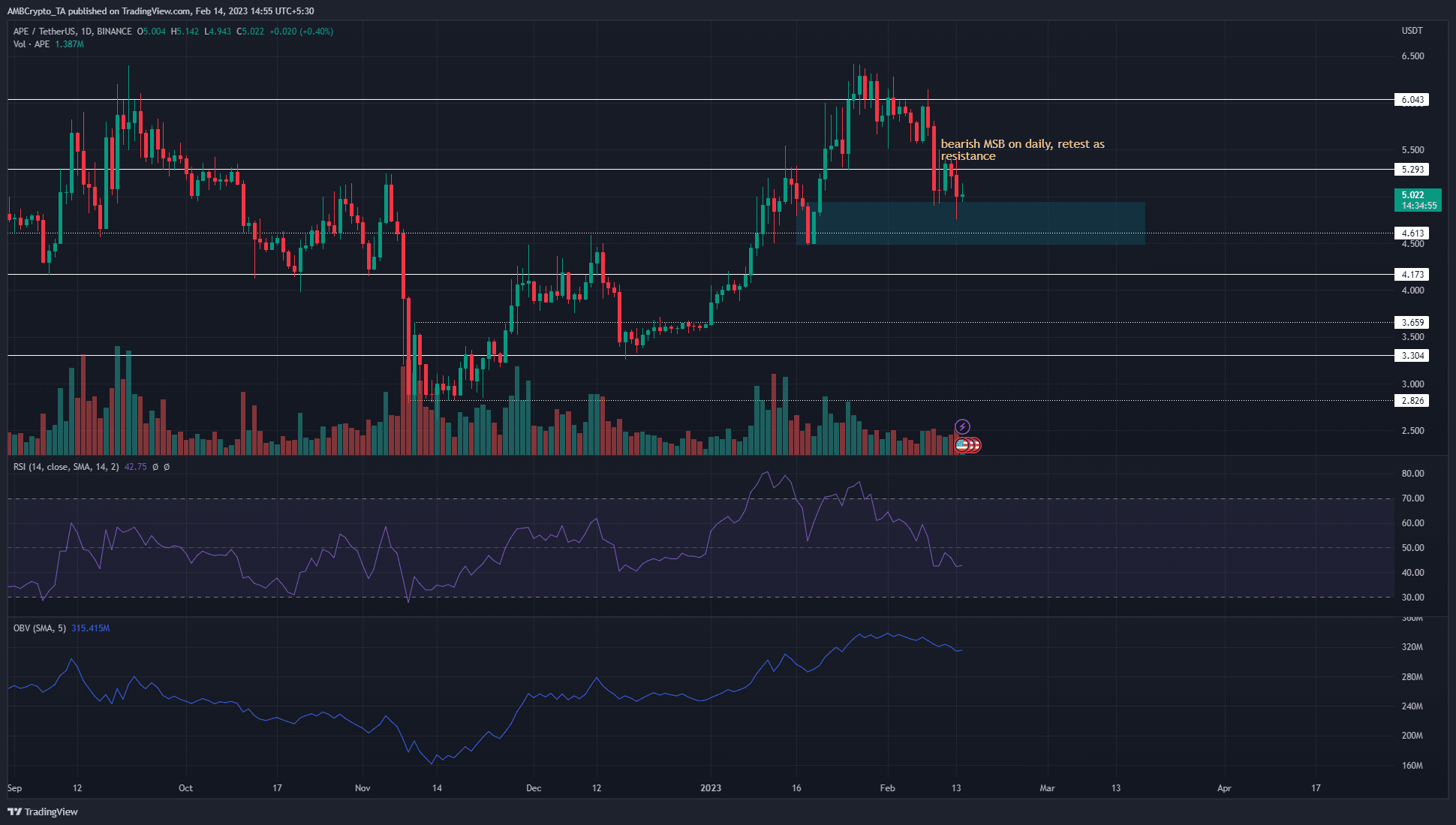

Source: APE/USDT on TradingView

The market structure was broken when APE descended beneath $5.29. However, there remained another zone of support, highlighted in cyan. This bullish order block extended from $4.5 to $4.95, and there is also a horizontal level of significance at $4.6.

The $4.6 level is likely to be retested once more. The RSI stood at 42 to show weak bearish pressure, but this could heighten if Bitcoin sees another slump toward $21.4k or lower. On the other hand, the OBV saw minimal retracement. This suggested that the pullback from $6.3 did not witness large-scale selling.

An uptick in the OBV could be a sign that a bullish reversal was around the corner. Buyers can wait for lower timeframe market structures to see a sharp bullish break before looking to buy.

Realistic or not, here’s APE’s market cap in BTC’s terms

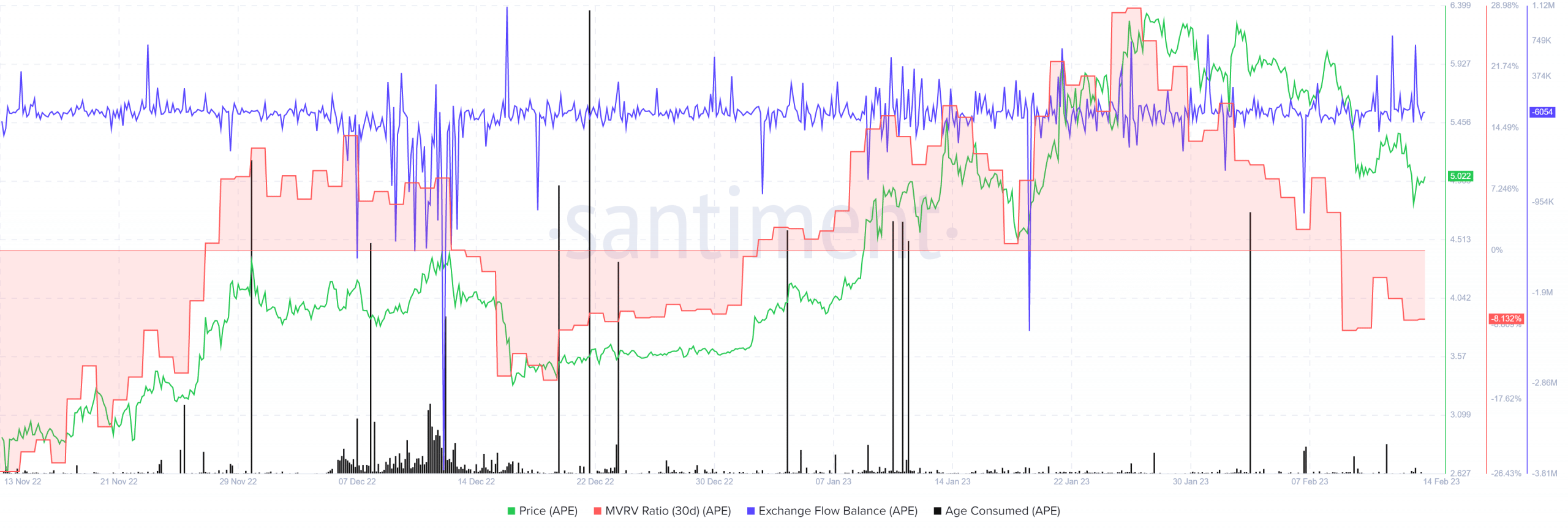

The exchange flow balance shows selling pressure spikes in recent days

Source: Santiment

While the OBV did not witness a large drop, 12 – 13 February saw large spikes in the amount of APE transferred into exchanges. They amounted to a positive balance of 800k and 700k on successive days. This suggested that the APE sent the exchanges were likely sold. Indeed, ApeCoin has fallen from $5.4 to $5 in the past three days.

The age consumed metric showed that the assets transferred might not have been from long-term holders. There were no noticeable spikes on this metric in the past two weeks. Meanwhile, in response to the fall in prices, the 30-day MVRV ratio fell into negative territory. The profit-taking that occurred after 20 January was over.