Crypto market can witness another crash if Bitcoin [BTC] drops below..

- If BTC’s price goes below the $22,300 range, it can drop further down.

- Negative sentiments prevailed in the market but a few metrics had a bullish bias.

Bitcoin [BTC] has been disappointing investors for quite a few days with its sideways price action. CoinMarketCap’s data revealed that BTC failed to register gains last week as its price dropped by 4%. At the time of writing, BTC was trading at $22,405.25 with a market capitalization of more than $432 billion.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The market might be in danger

As per the latest report by Santiment, a few analysts believe that BTC’s price can drop further in the coming days and even touch the $19,500 mark, which is concerning.

The possibility of BTC going down would emerge if it fell below the $22,300 range, the band in which the price has been fluctuating of late.

📉 #Bitcoin‘s price drop a couple days ago, likely attributed to the #Silvergate share collapse, has had a tough time rebounding back. Our latest community insight discusses a potential $BTC support level to watch, and what could be in store for #altcoins. https://t.co/HMgIIuc5AD pic.twitter.com/i22qLhCLbV

— Santiment (@santimentfeed) March 6, 2023

The situation was critical, as a catastrophic decrease between 15% to 25% in the value of altcoins might occur if Bitcoin were to reach the $19,500 threshold. Thus, causing yet another collapse of the crypto market.

An overview of the current crypto market

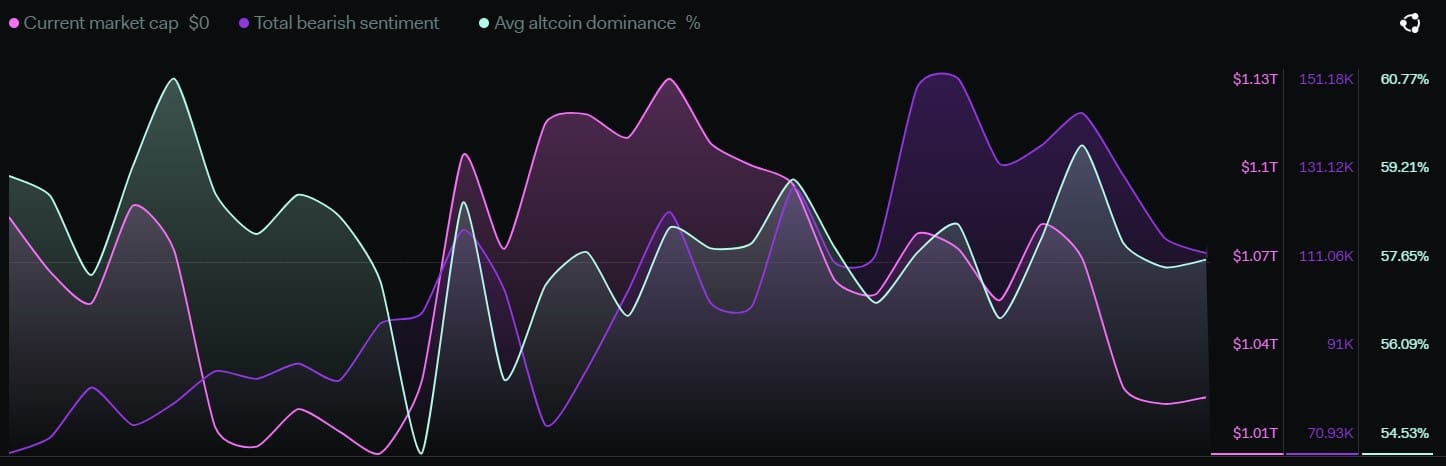

LunarCrush’s chart helped provide a better understanding of the current scenario. The data showed that there was a decline in the global crypto market capitalization over the last week.

At press time, it was just over $1.02 trillion. Though the market cap went down, altcoin’s market dominance increased, which can be attributed to Bitcoin’s price decline. The total bearish sentiment metric went up significantly during the past week.

Source: LunarCrush

Another analysis from Santiment pointed out a similar negative trend in the crypto space. The report mentioned that there was a spike in negative sentiment around crypto on various social media platforms. Interestingly, the majority of the negative words on social media were coming from Twitter.

😨 Some bizarrely high levels of negative #crypto sentiment has appeared this weekend, particularly here on #Twitter. It’s hard to gauge what may be contributing to one of the highest levels of #FUD @santimentfeed has ever recorded. Read our thoughts! 👇https://t.co/b9Z3LGtDVr pic.twitter.com/17lZ6bF95X

— Santiment (@santimentfeed) March 5, 2023

Is your portfolio green? Check the Bitcoin Profit Calculator

Caution is advised

While the possibility of a downtrend can’t be ruled out, a few of the on-chain metrics looked optimistic.

For instance, BTC supply outside of exchanges registered an uptick while supply on exchanges declined. This in general is a bullish signal, decreasing the chances of a price plummet.

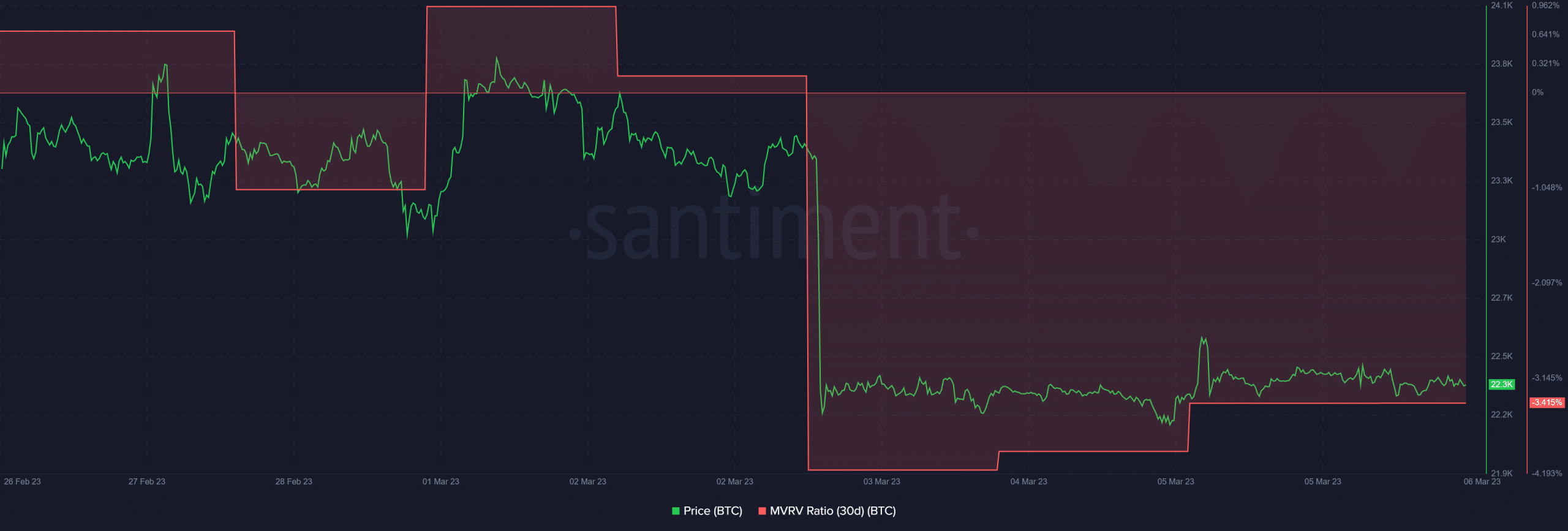

The king coin’s MVRV Ratio also showed signs of recovery by increasing slightly in the last few days.

Source: Santiment