Solana’s NFT landscape is expanding significantly- what’s more to come

- Solana’s weekly NFT sales volume hit more than $17.5 million in value, a jump of about 32%.

- SOL saw an increase in the number of long positions taken over the past few days.

The Solana [SOL] ecosystem got a reason to celebrate as the daily NFTs minted on the network jumped to a three-month high recently.

As per a tweet by Solscan, the number of NFTs minted on 3 March hit 129, 872, which was nearly three times the average daily figure across the last three months.

Almost tripled the avg. daily figure within a 3 month span💪 pic.twitter.com/4Hartk1wsZ

— Solscan🔍 (@solscanofficial) March 6, 2023

Further data from Solscan revealed that Solana was home to 274.36k collections and more than 33 million NFTs, at the time of writing.

How much are 1,10,100 SOLs worth today?

NFTs are powering Solana!

Solana’s NFT landscape suffered a major challenge after it hit a three-month low in the last week of February. This was after Solana’s big network outage which triggered significant FUD among the community.

Source: Crypto Slam

Since then, the NFT activity has rebounded impressively. Data from Crypto Slam showed that the weekly sales volume hit more than $17.5 million in value, a jump of about 32%.

The total number of NFT transactions also grew by more than 9% over the previous week.

The expansion of Solana’s NFT ecosystem holds importance as the chain was hit by high-profile desertions not too long ago. DeGods, one of the most valuable NFT collections on Solana, announced in December last year that it was migrating to Ethereum [ETH] while another collection y00ts shifted towards Polygon [MATIC].

As per CryptoSlam data, Solana was the second-largest destination for NFTs behind market leader Ethereum at the time of writing.

Investors going long on SOL

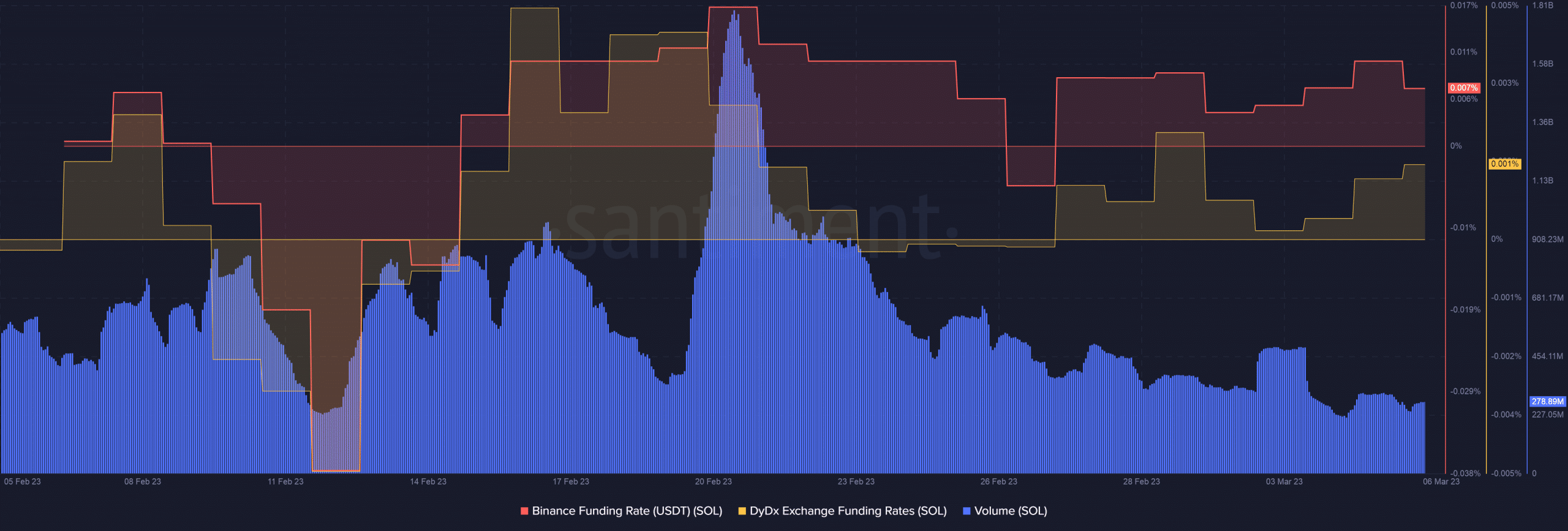

SOL’s on-chain data gave some reasons to worry. From a monthly peak of 1.79 billion on 20 February, the trading volume went downhill and declined by 84% until press time, as per Santiment.

On the other hand, the funding rates on Binance and dYdX increased, implying that there was a demand for SOL in the derivatives market. This is generally taken as a bullish signal.

Source: Santiment

Read Solana’s [SOL] Price Prediction 2023-2024

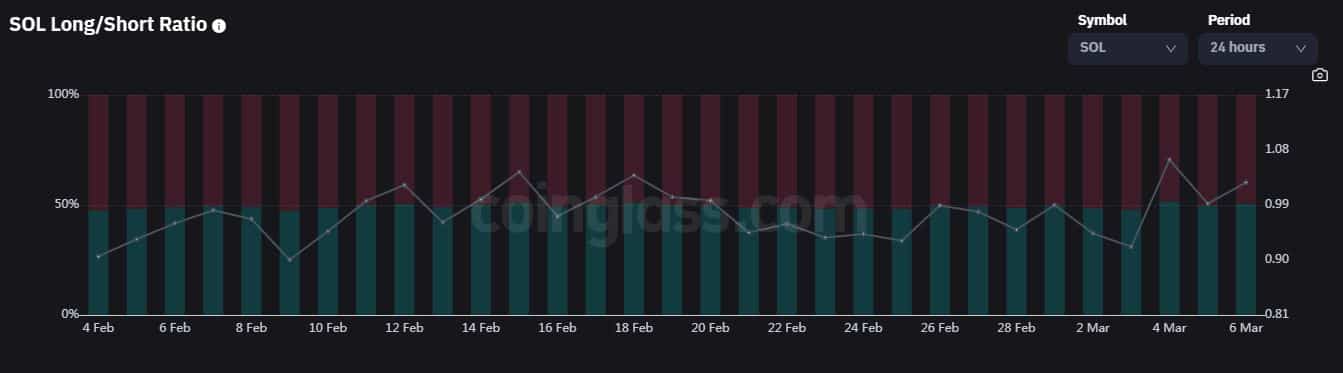

The bullish sentiment was reflected in the increasing Longs/Shorts Ratio, according to data from Coinglass. There was a substantial increase in the number of long positions taken over the past few days.

However, at press time, SOL was down 2.48% in the 24-hour period, according to CoinMarketCap.

Source: Coinglass