Curve Finance: The $250M bribes talk you shouldn’t miss out on

- Bribes paid out to vlCVX holders have started to go down.

- Moreover, the Curve protocol is reportedly struggling as the number of users on the protocol has been declining.

According to data provided by Delphi Digital, a large sum of bribes, totaling $250 million was paid out to vlCVX holders.

A total of $250M of bribes have been paid out to $vlCVX holders. pic.twitter.com/QYNOw9tIvW

— Delphi Digital (@Delphi_Digital) March 5, 2023

Read CRV’s Price Prediction 2023-2024

Bribes serve as an incentive for voting on gauge weights and can lead to the injection of more liquidity into pools as a secondary effect.

This can occur both at the base layer of the Curve or through Votium on the Convex, which is a layer above.

The individuals offering the bribes are taking a gamble that the extra liquidity that their offering generates, due to the additional CRV rewards, will be more valuable to them than the bribe itself.

The individuals can earn bribes by holding onto the vlCVX token, which is an instrument of Convex Finance.

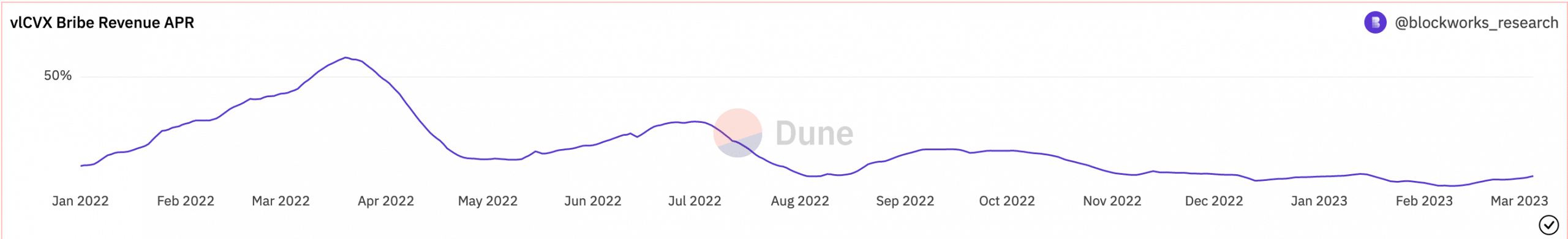

A majority of the bribes were accumulated in Q4 of 2022. As Q1 of 2023 approaches an end, the overall bribes sent declined massively. One of the reasons for the same would be the decreasing APR generated through vlCVX’s bribe revenue.

Based on Dune Analytics’ data, it was observed that over the last few months, the APR provided by the vlCVX token fell from 30.72% to 23.17%.

Source: Dune Analytics

This decline in vlCVX’s APR and the subsequent fees paid out could signal the fact the Curve protocol may be struggling.

Curves and forks in the road

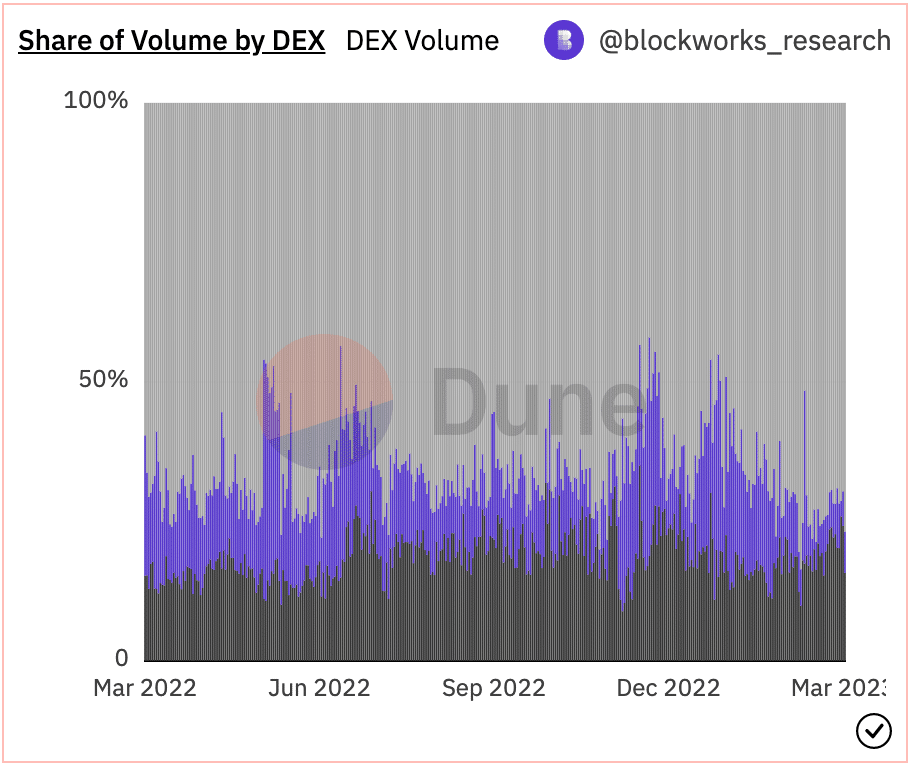

Another indicator of the Curve protocol facing challenges would be the fall of its share in the DEX space. Since the beginning of the year, Curve Finance’s dominance in the DEX markets in terms of volume fell from 15.2% to 6.2%.

Uniswap and other successful DEXs managed to take up a large part of the market share during this period.

Source: Dune Analytics

Curve’s struggles in the DEX market may be attributed, in part, to a decrease in its user base. Based on Messari’s data, it was found that there was a 0.21% decrease in the number of unique users on the Curve Finance platform in the last month.

This decline also had an impact on the trading volume of the protocol, which decreased by 0.39% during the same period

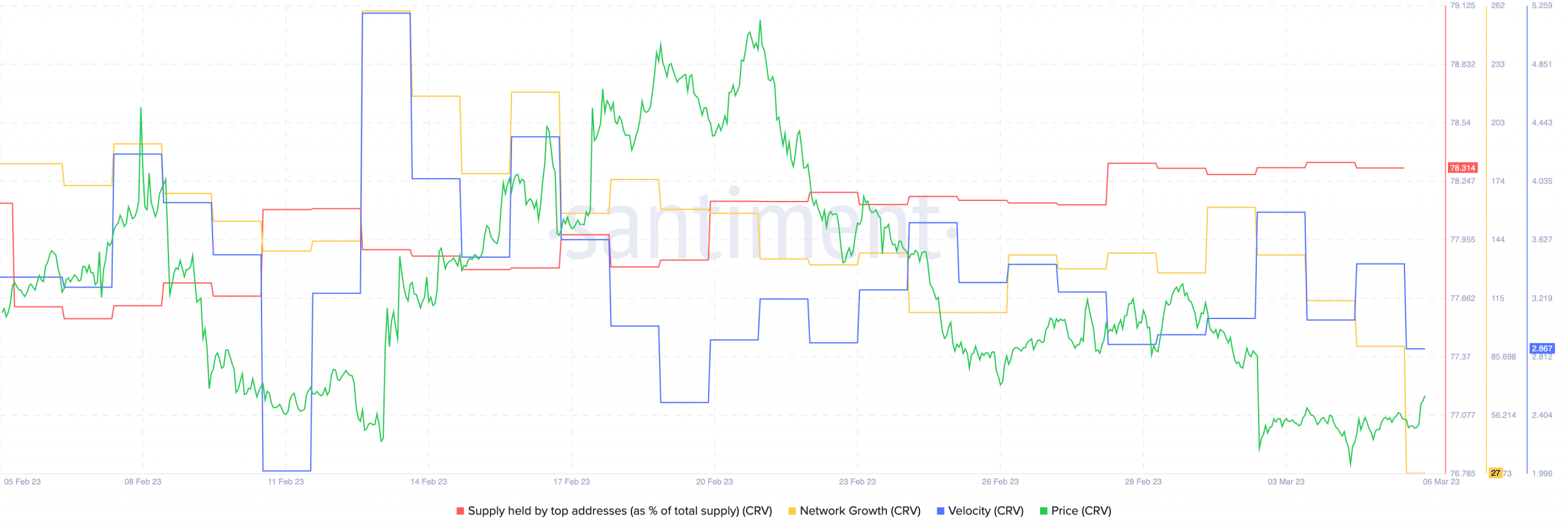

The problems weren’t limited to the protocol alone, as the token associated with it also encountered difficulties.

Is your portfolio green? Check out the Curve Profit Calculator

Santiment’s data indicated that there was a decrease in both network growth and velocity for CRV. Thus, suggesting a drop in overall activity and interest from new addresses.

Source: Santiment