Bitcoin’s [BTC] price struggles continue as analysts warn of further drop

- BTC long liquidations rose to their highest position since August 2022.

- Analysts believe that a decline in BTC’s price is imminent.

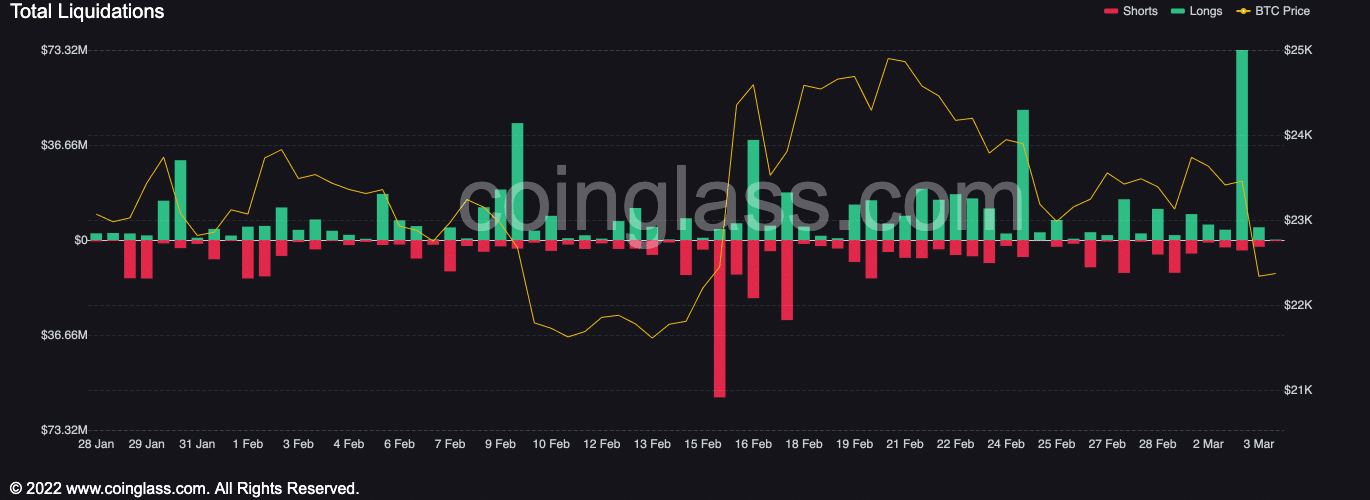

Following the sharp decline in Bitcoin’s [BTC] price in the early trading hours of 3 March, long liquidations soared to a seven-month high, data from Coinglass showed.

The drop in value was triggered by apprehension and uncertainty regarding Silvergate Capital, a financial institution recognized for its supportive attitude toward digital currencies.

Source: Coinglass

According to CryptoQuant analyst caueconomy, these long liquidations were the third such event since the Terra/LUNA crash in May 2022 and the second following the fallout of cryptocurrency FTX in November 2022.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The pseudonymous analyst found further that the sharp decline in the market was caused by a massive spot sale on most exchanges, particularly on Binance, where many buyers had positioned contracts.

Source: CryptoQuant

More pain for BTC holders?

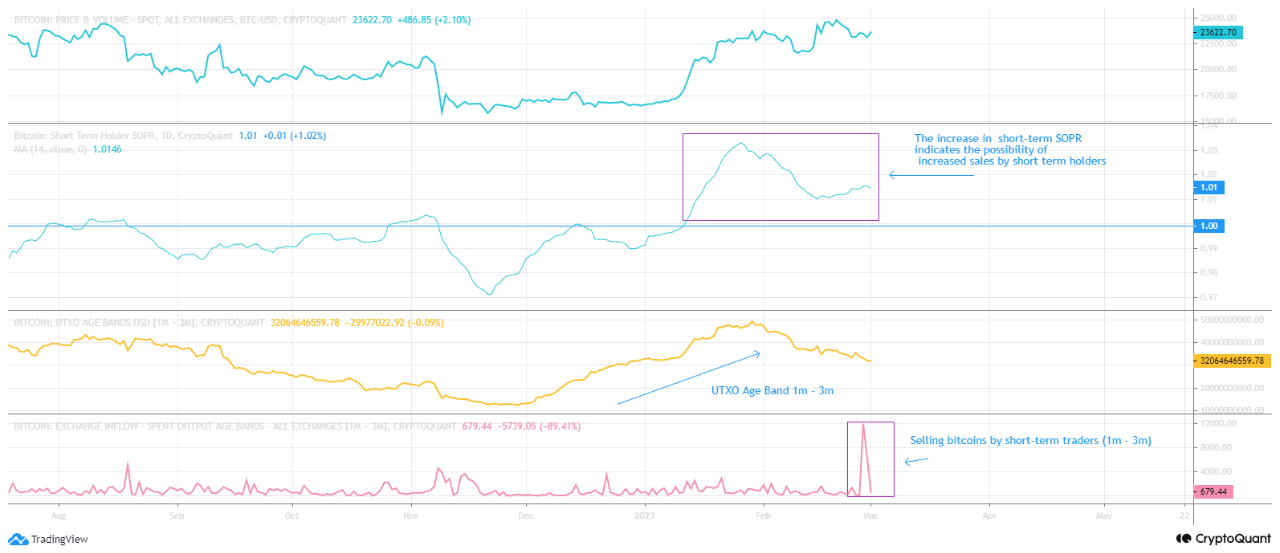

With BTC struggling to reclaim the $25,000 price mark, another CryptoQuant analyst with the pseudonym CryptoOnchain has opined that the king coin’s price might drop further.

According to CryptoOnchain, while short-term holders have been buying BTC, long-term holders have not supported the recent price rise.

To benefit from the price growth so far this year, an on-chain assessment of BTC’s price revealed a surge in coin distribution by these short-term holders as well.

BTC’s exchange inflow by 1-3 months holders was spotted at its highest value since June 2022, CryptoOnchain noted.

Source: CryptoQuant

Moreover, the crypto market has seen an increase in the outflow of stablecoins from exchanges, which cannot sustain the current price increase and could potentially lead to a further decrease in prices, the analyst added.

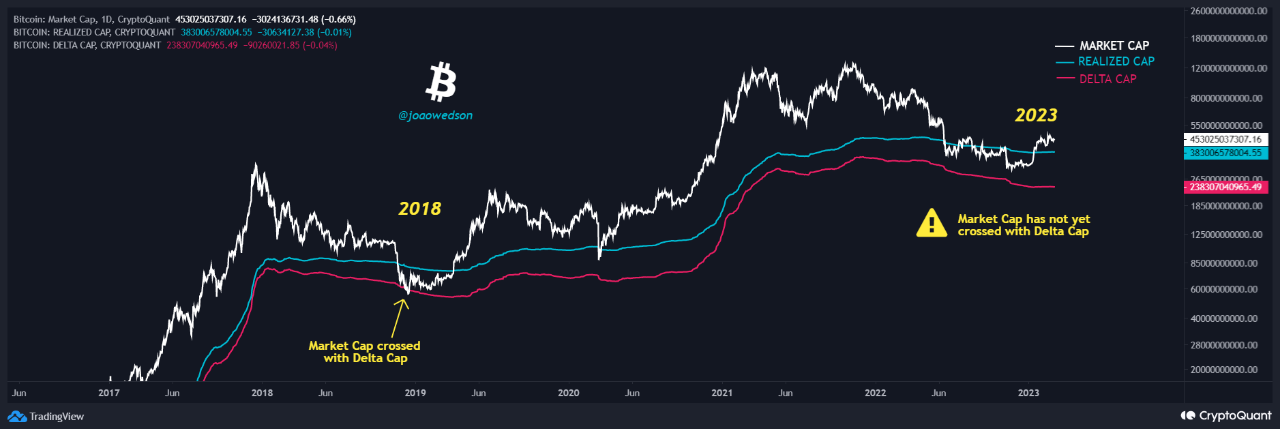

Another analyst Joao Wedson warned investors to gear up for a “possible new scenario of price capitulation.”

Wedson assessed BTC’s Delta Cap metric and found that a price bottom is formed when the coin’s market capitalization crosses with its Delta Cap.

This crossing occurred on three previous occasions: in 2011, 2015, and 2018 and in all three cases, the crossing was followed by a significant drop in BTC’s price.

Read Bitcoin [BTC] Price Prediction 2023-24

While the crossing is yet to occur in the current market cycle, Wedson warned that “we cannot rule out the possibility of new price lows for Bitcoin, as this would be the first time in history that the crossing did not occur.”

Source: CryptoQuant