How To Use Bitcoin ATM

beginner

While many crypto users believe in a cashless and fiatless world, it is yet to come. Most of us still have to perform a lot of transactions using good ol’ cash, including BTC and other crypto purchases.

No matter whether you need a fiver for a cup of coffee or want to top up your Bitcoin wallet without having to go through a centralized bank, crypto ATMs can be of great help to anyone looking to convert their crypto to cash and vice versa. In this article, we will teach you how to use a Bitcoin ATM for the first time.

What Is a Bitcoin ATM?

A Bitcoin ATM does exactly what its name suggests — it is a normal ATM (Automated Teller Machine) that accepts BTC and other crypto coins and tokens instead of fiat currencies and cash. It is also sometimes called a Bitcoin Teller Machine, or BTM. Buying Bitcoin this way is as easy as depositing cash to your bank card using traditional ATMs.

Most Bitcoin ATMs allow users to both buy and sell Bitcoin, but not all of them: don’t forget to check whether the ATM you’re planning to use offers your desired functionality. You can also use crypto ATMs to send BTC to another user’s Bitcoin wallet — just enter their address in the recipient field.

While these ATMs are designed to be secure and keep your funds safe, there are still some risks associated with using them to sell and buy Bitcoin.

- Bitcoin transactions are irreversible due to the nature of blockchain technology, so you need to be extra careful when entering all your personal data, such as your Bitcoin wallet address.

- There are a lot of different Bitcoin ATM operators out there, and some can be less… honorable than others. Do not pay for any extra goods or services offered by the ATM operator, and try to check out the reviews for that particular ATM if it’s run by a company you’ve never heard of before.

- Just like when using fiat ATMs, pay attention to your surroundings: while there won’t be a credit card for anyone to grab out of your hand, thieves can still take your money, steal your personal information, and so on.

How Do Bitcoin ATMs Work?

Bitcoin ATMs don’t look all that different from fiat ones. However, they operate in a completely different way: instead of being connected to a bank, they communicate directly with the Bitcoin blockchain.

In order to buy and sell Bitcoin using a crypto ATM, you will only need two things: a digital wallet and a traditional one. Just insert some bills into the machine and then scan the QR code for your digital wallet or enter its address manually — this is all you need to buy Bitcoin using a Bitcoin ATM.

The cryptocurrency you get from a Bitcoin ATM is sent from the wallet of its operator company.

How to Use a Bitcoin ATM

Although Bitcoin ATMs may seem a bit unusual at first, they are easy to use.

Step 1 – Get a Crypto Wallet

The first step to performing any crypto transaction is getting a wallet that supports the coin or token you want to buy. It can be a paper wallet, a digital wallet, or a hardware one — its type doesn’t matter as long as it can send and receive digital money and is secure.

Step 2 – Prepare Your Bitcoin Wallet

Most Bitcoin ATMs (Bitcoin Teller Machines) allow you to use QR codes to make Bitcoin transactions. Check whether your digital wallet offers that feature — after all, it can reduce one’s stress by eliminating the need to enter a long and non-human-readable wallet address.

Step 3 – Find a Bitcoin ATM Near You

Cryptocurrencies are not widely accepted yet, so the chances of you running into a Bitcoin ATM out in the wild are rather slim, especially if you don’t live in a big city like London or NYC. The easiest way to find Bitcoin ATM locations near you is to use live maps like Coin ATM Radar, Bitcoin ATM Map, and others.

Most of these websites, such as Coin ATM Radar, allow you to look for ATMs by proximity, operator, fee, and other parameters.

Step 4 – Set Up Your Transaction

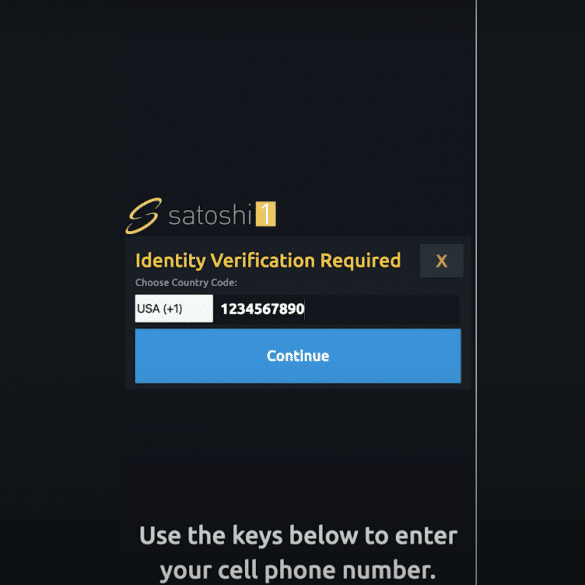

To use a Bitcoin ATM, you will first need to verify your identity.

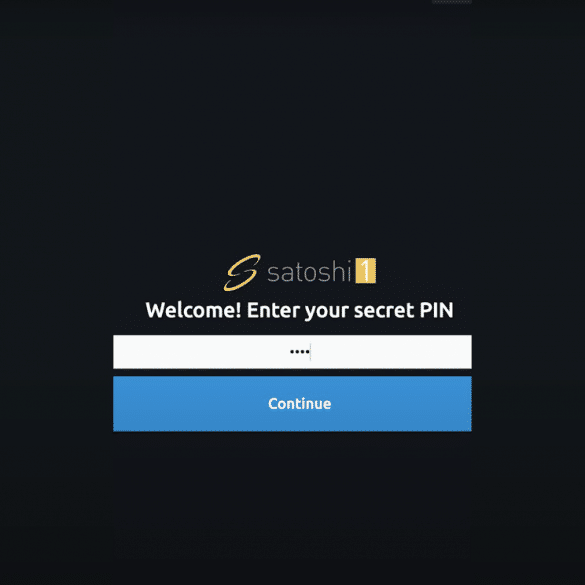

Once that’s done, you’ll need to enter your PIN.

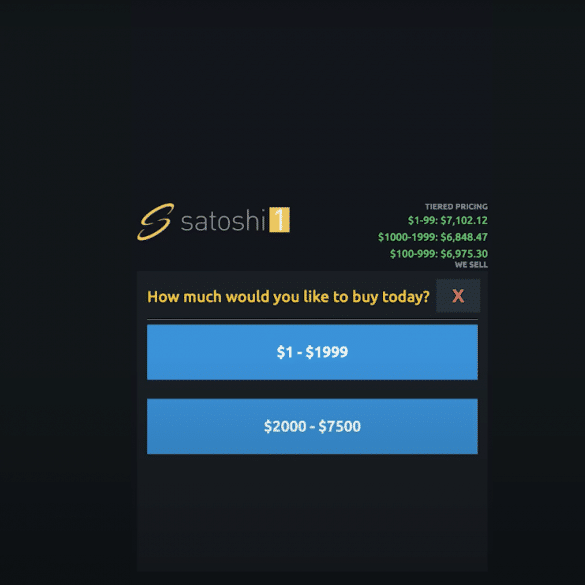

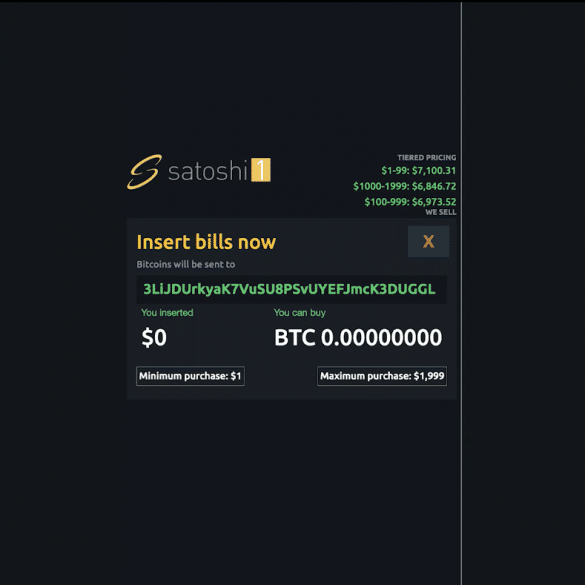

Next, choose the cryptocurrency you would like to get (if the ATM offers more than one) and enter the amount you’d like to purchase.

Step 5 – Enter Your Wallet Information

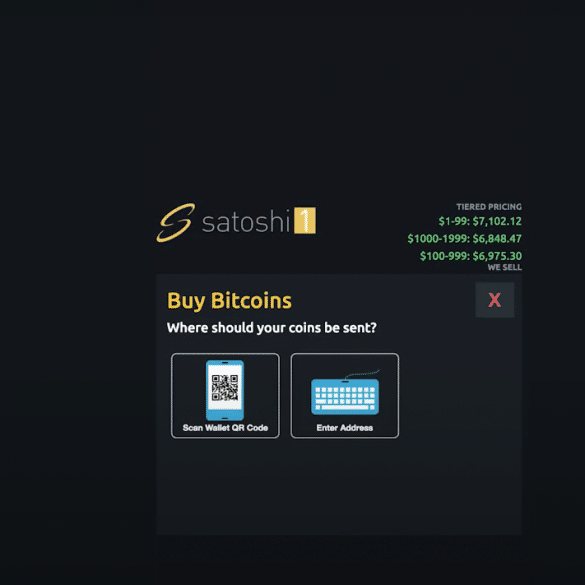

Once you’ve set up your transaction, you will need to enter your Bitcoin wallet address. Most ATMs allow you to use QR codes to minimize the risk of sending your new crypto to the wrong wallet address. If you choose not to go with the QR code option, please remember to double-check the address you entered.

Step 6 – Insert Cash

Double-check all transaction info and insert the required amount of cash into the ATM.

Step 7 – Confirm the Purchase

That’s it! Confirm the purchase and wait for your new cryptocurrency to arrive in your wallet. Delivery times depend on the cryptocurrency you’re purchasing but usually range from 10 to 15 minutes.

Bitcoin ATM Fees

All Bitcoin ATM operators have different policies when it comes to transaction fees. Some of them can be quite high, so sometimes it can be worth it to travel a bit further to take advantage of the lowest fees in the area.

As cryptocurrencies become more widely accepted, the number of active Bitcoin ATMs is likely to increase, and the fees will probably go down. Until then, we recommend using ATM finders that let you sort ATMs by fees.

The Future of Bitcoin ATMs

The future of Bitcoin ATMs largely depends on the further development of the crypto industry. As Bitcoin and other cryptocurrencies become more popular and, even more importantly, more widely accepted as a payment method by various businesses and services, the number of cryptocurrency ATMs you see on the streets will also increase.

There is always a possibility that ATMs, in general, may become obsolete in the future, but we don’t think that’s a likely scenario — at least, not for the next 5 or 10 years.

Having studied the cryptocurrency ATM market, various researchers came to the conclusion that it is going to see significant growth in the next few years. Experts from Allied Market Research, for example, predict that this industry is likely to grow at a CAGR (compound annual growth rate) of 58.5% each year from 2021 to 2030.

And if you can’t bear to wait until Bitcoin ATMs become commonplace and get all the perks that come with widespread popularity, you can always buy, exchange, and sell Bitcoin and other cryptocurrencies on our instant exchange instead.

FAQ

How do I send money to a Bitcoin ATM?

If you are buying BTC, then you can use cash. If you’re selling Bitcoin, you can use your Bitcoin wallet by either manually entering its address or scanning a QR code.

Do I need an account to use a Bitcoin ATM?

While some Bitcoin ATMs may ask you to create an account, not all of them do so. Most ATMs allow you to start buying Bitcoin after simply entering a text verification code.

Can you put cash in a Bitcoin ATM?

Yes, you can use cash to purchase Bitcoins in your nearest Bitcoin ATM.

Are Bitcoin ATMs safe?

Yes, they are as safe as traditional ATMs and any exchange. This is one of the most frequently asked Bitcoin ATM questions since both crypto and traditional banking ATMs can sometimes be seen as less reliable. However, as long as you look out for things like terminals on top of existing ones or cameras, it should generally be fine. Bitcoin ATMs are designed to be secure and protect your funds, but please always remember to be cautious when using them.

How do I use a Bitcoin ATM with a debit card?

In general, the majority of Bitcoin ATM machines accept cash only. If you can’t find one that lets you purchase Bitcoin with your card, you can use a fiat currency ATM to withdraw cash from your bank account first and use it to buy Bitcoins in a BTC ATM.

How much Bitcoin can you send in a single transaction via a crypto ATM?

Each Bitcoin ATM operator (Bitcoin Depot, Coin Cloud, etc.) has their own limits that you can look up on their websites.

They also usually publish instructions on how to send money through their particular Bitcoin ATM machine.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.