Optimism: Will March update give OP its much-awaited bull run?

- Optimism’s development activity surged to its highest level since the start of 2023.

- The daily transaction volume in profit tripled over the past 10 days.

On 28 February, popular layer-2 scaling solution Optimism [OP] shared an update about its upcoming hard fork in March. The tweet was optimistic that there will be no downtime for users. However, network nodes will have to be updated in advance.

Quick heads up to developers: a hardfork of Optimism Goerli is planned for March thanks to efforts by @sherlockdefi Watsons.

No downtime is expected, but those running their own nodes will need to update in advance to continue syncing.

— Optimism (✨🔴_🔴✨) (@optimismFND) February 27, 2023

How much are 1,10,100 OPs worth today?

The protocol added that the Optimism Goerli hard fork was meant to fix inconsistencies in API for receipts in system transactions. The actual dates for all further releases and updates will be shared next week.

Unfortunately, the prospect of a bug fix failed to cheer OP holders. At the time of writing, the native token fell 5.55% in the 24-hour period, per CoinMarketCap.

Sea of changes await the Optimism ecosystem

According to Santiment, Optimism’s development activity surged to its highest level since the start of 2023. This indicated that the network was committed to its milestones and key technical upgrades could be delivered on time.

Source: Santiment

There have been a slew of other upgrades announced by the Optimism ecosystem in recent days. Perhaps the most ambitious among them was the idea of a ‘Superchain’, a cohesive and interoperable system that would unify multiple layer-2 solutions into one.

OP’s bullish idea still has weight

After a sharp move upwards on 10 February, Optimism’s network growth tanked. The refusal of new addresses to engage with OP was a negative signal.

On the other hand, the positive 30-day MVRV Ratio suggested that most holders would book profits if they sell their holdings at the prevailing price. The increasing MVRV Long/Short Difference clarified that it was the long-term bulls who would make greater profits.

The daily transaction volume in profit, which tripled over the past 10 days, lent credence to the above deduction.

Source: Santiment

Realistic or not, here’s OP’s market cap in BTC’s terms

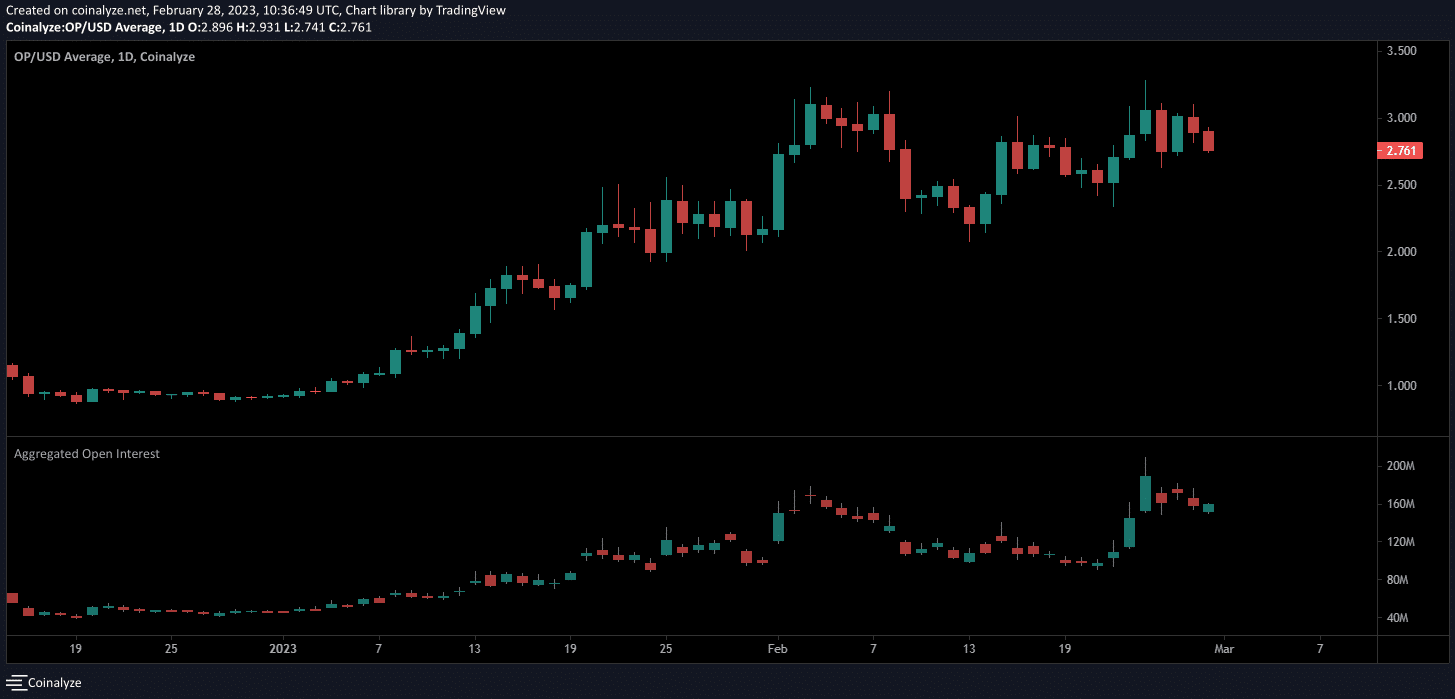

After a prolonged period of decline, Optimism’s open interest (OI) spiked for a brief period last week. However, at the time of writing, it matched the trajectory of price and moved sideways.

The price drop registered at press time could be due to profit-taking by bulls, as established earlier in this article. Hence, there was a possibility of things taking a bullish turn for OP in the days to come.

Source: Coinalyze