Cardano [ADA]: This metric could bring about a change in fortune

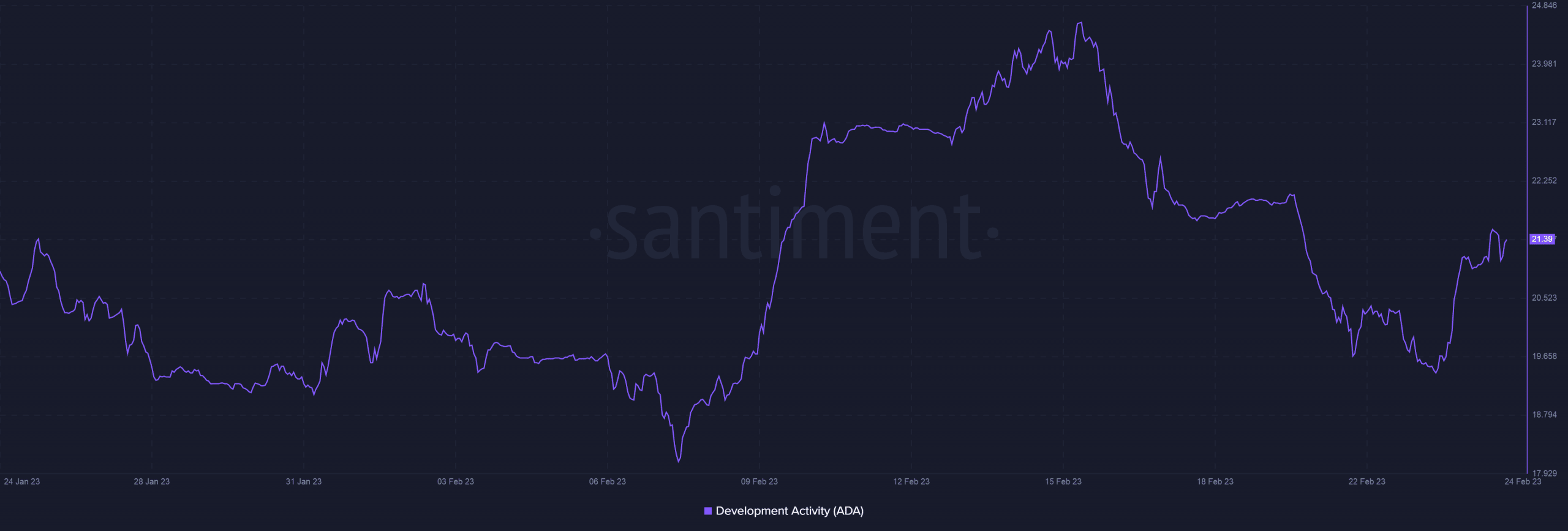

- Cardano’s development activity bounced back impressively over the last few days.

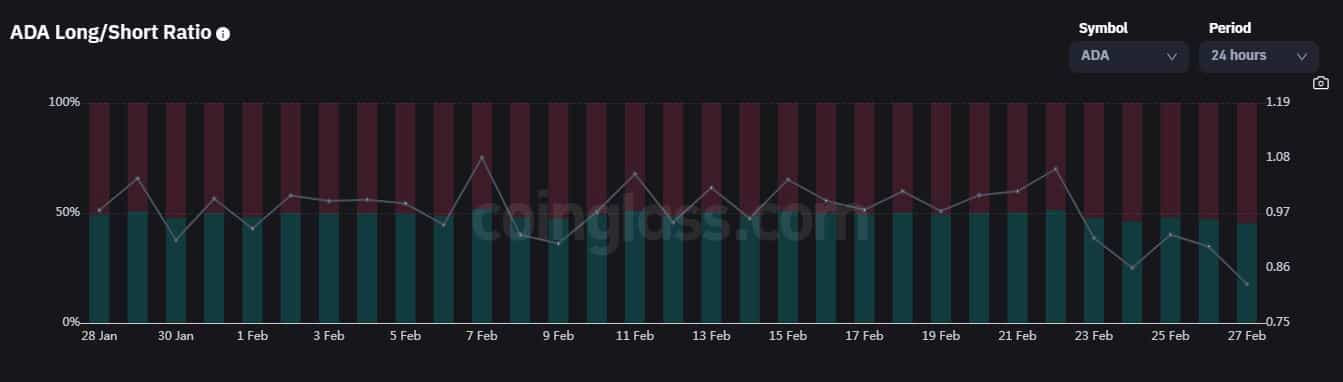

- ADA’s Longs/Shorts ratio dipped steadily over the last few days indicating that investors were not in support of a bullish idea.

Though the Valentine upgrade was rolled out with much optimism, Cardano [ADA] has failed to capitalize on the opportunity. According to CoinMarketCap, ADA dropped significantly over the previous week, plunging 13%, at the time of writing.

Furthermore, nearly $1.46 billion of Cardano’s market cap was wiped out in the same time period.

But things could be taking a positive turn. Cardano’s development activity which was in a downward spiral since 16 February, bounced back impressively over the last few days, data from Santiment revealed.

Source: Santiment

Read Cardano’s [ADA] Price Prediction 2023-24

Cardano’s key development updates

Cardano published the latest edition of its weekly development report. The spike in development activity could be due to the key updates that happened in its ecosystem in the last seven days.

ICYMI: Our weekly #Cardano development update is live on #EssentialCardano!

Check out what our dev team has been up to and get the latest on our development progress.

As always, we welcome your feedback and comments👇 https://t.co/rlJMyLWXYX

— Input Output (@InputOutputHK) February 26, 2023

First and foremost, the networking team provided updates on the fixes in the peer-to-peer (P2P) code. The team also released an updated set of network packages to be integrated with the Cardano-node master branch.

Apart from this, the developers highlighted the progress made on the Lace light wallet platform and said that it will be soon updated on pre-production to test before the mainnet launch.

Furthermore, the Marlowe team informed about the implementation of an initial partial index of Marlowe contracts in Marlowe Explorer.

On the scaling front, the Hydra team completed work on a different way of dealing with contests during the contestation period.

More trouble brewing for ADA?

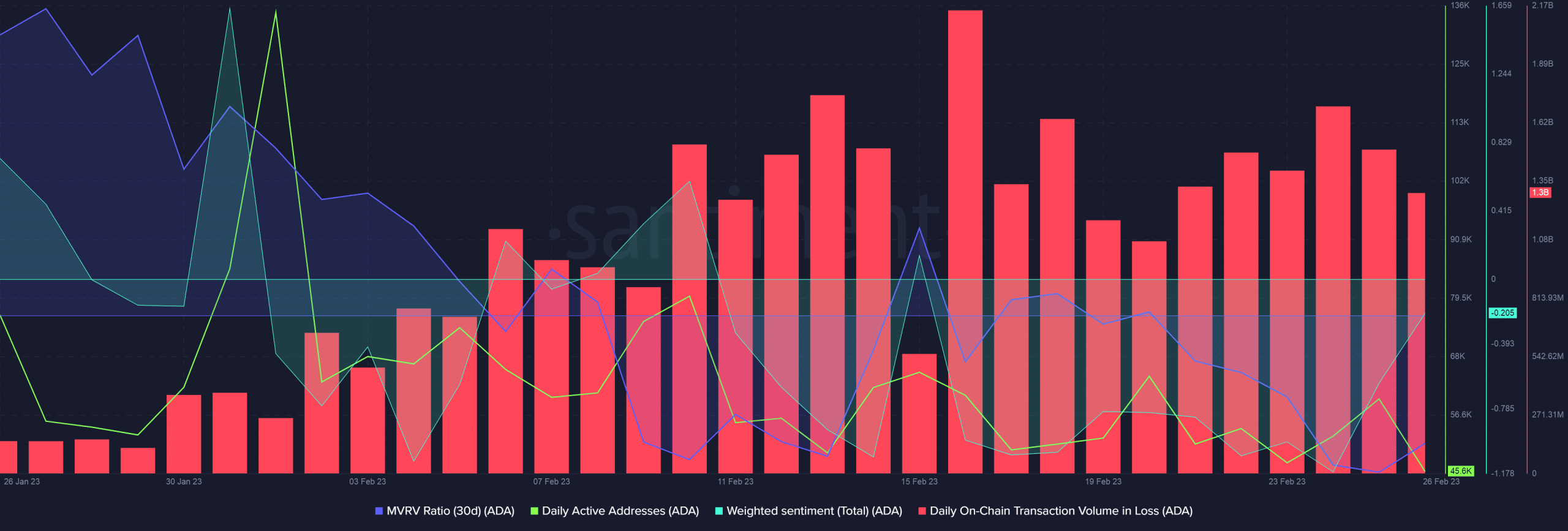

Cardano’s on-chain metrics scripted an uninspiring story. The daily active addresses nosedived since the start of February, per data from Santiment

The negative MVRV Ratio implied that most holders would incur losses if they decide to liquidate their positions. The rising transaction volume in loss added more evidence to this observation.

The lack of profitability in the network dented investors’ confidence in ADA which was negative, at the time of writing.

Source: Santiment

Is your portfolio green? Check the Cardano Profit Calculator

As per Coinglass, Cardano’s [ADA] Longs/Shorts ratio dipped steadily over the last few days indicating that investors were not in support of ADA’s bullish idea.

At the time of writing, the total number of long positions for ADA accounted for about 45% of the total positions opened for the coin.

Source: Coinglass