Bitcoin at $25,000: Market optimism triggers return of ‘buy the dip?’

- BTC’s price briefly touched the $25,000 price mark last week for the first time since June 2022.

- On-chain activity suggested that investors anticipate that prices will rally past that point soon.

Amid tightening regulatory oversight, and negative investors’ sentiment, Bitcoin’s [BTC] price momentarily traded above the $25,000 price mark last week.

While this represented a new price action for the king coin for the first time since mid-June 2022, Glassnode, in a new report, found that BTC’s on-chain investor activity seemed to be on the cusp of a new cycle, indicating a possible turning point.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

A resurgence of the “buy the dip” mentality?

As BTC trades below $25,000, on-chain activity revealed that investors expect the leading coin to reclaim the price position and have begun to “buy the dip” in anticipation of the same.

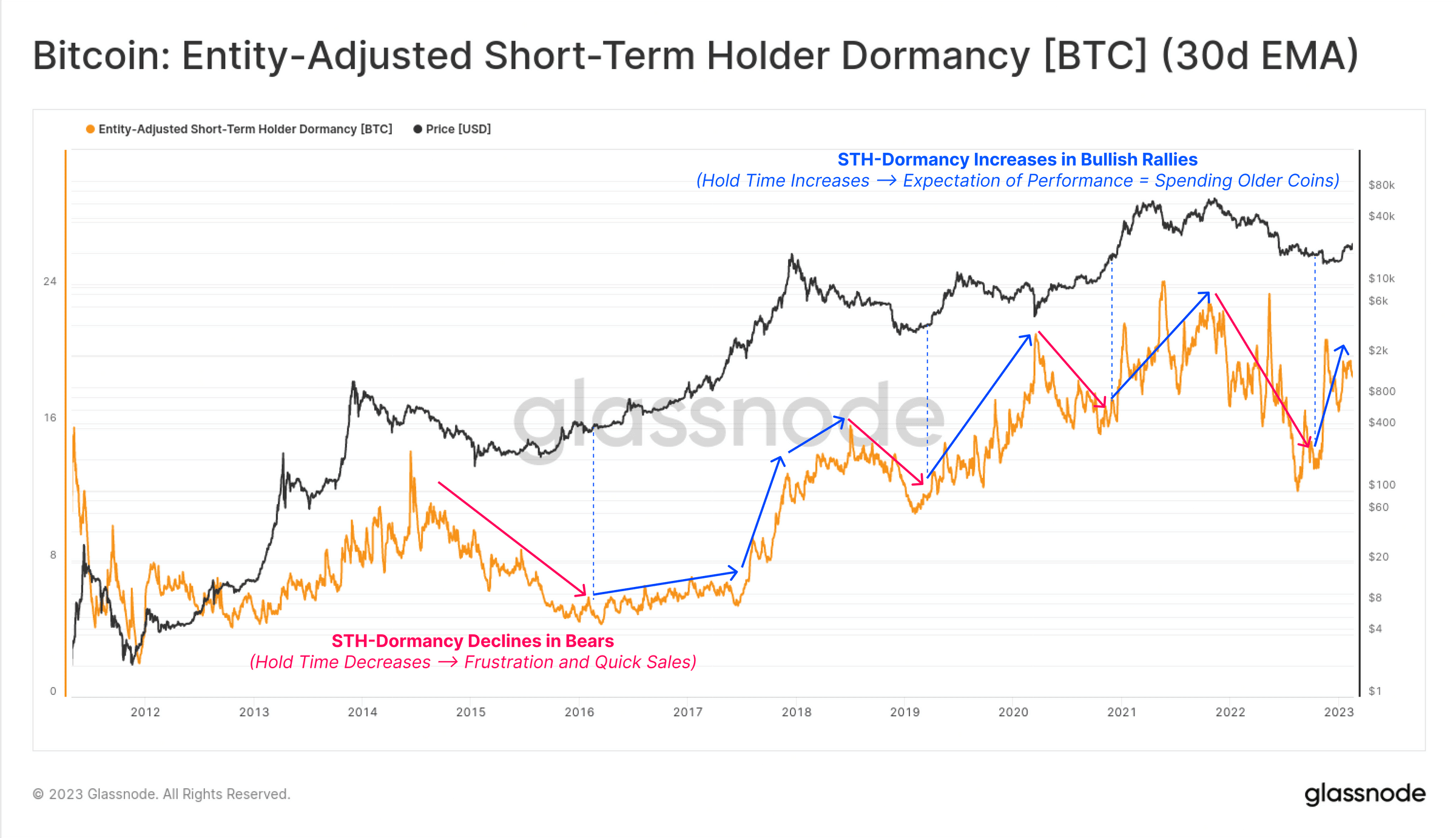

Glassnode assessed BTC’s Short-term Holder Dormancy metric on a 30-day moving average and found that in the current market, short-term holders “are spending coins with a more extended holding period.” According to the report:

“This is typically seen in bullish impulses, as expectations of gains encourage investors to hold on a little longer and ride the market swing.”

Source: Glassnode

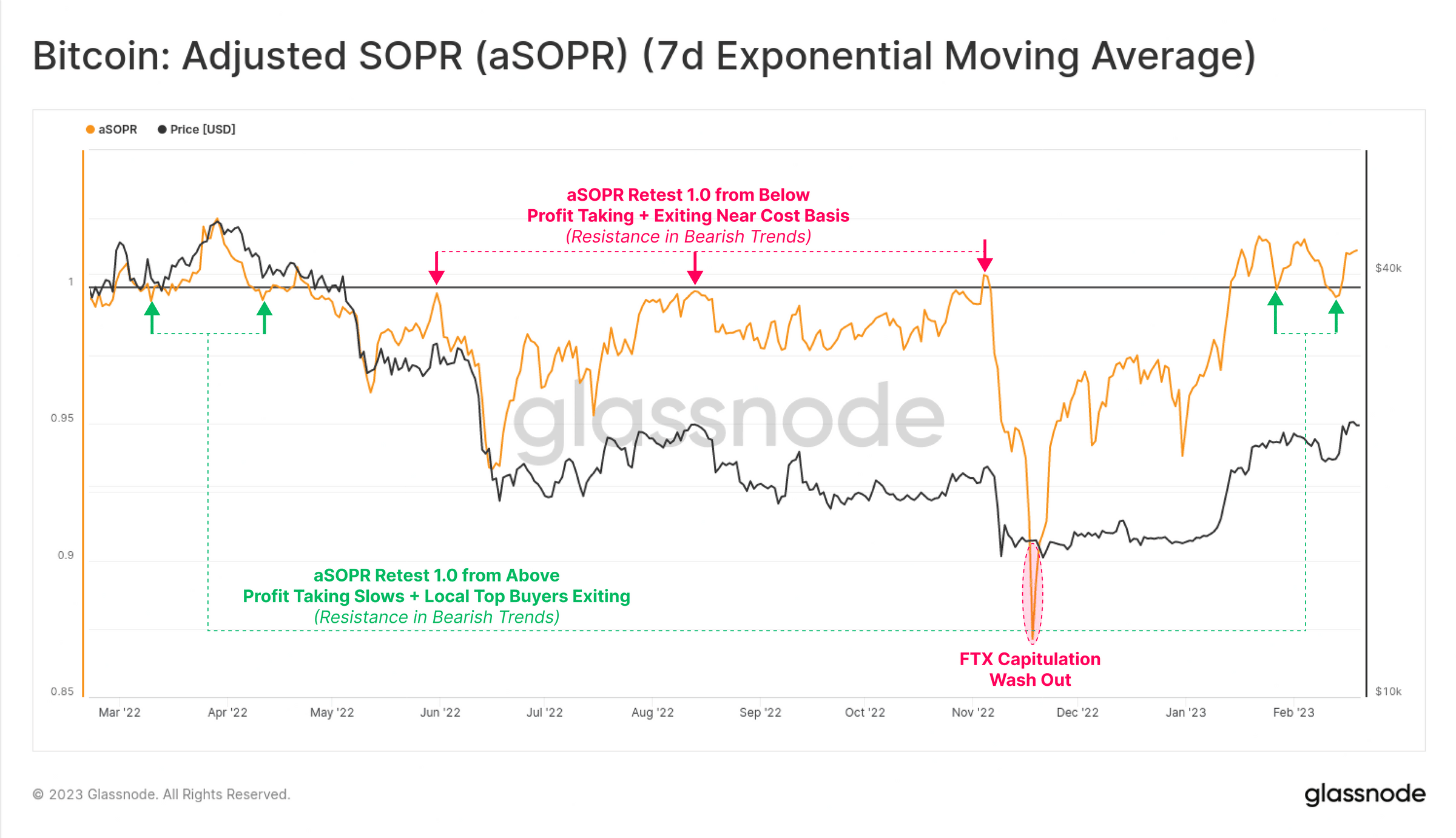

With the year so far marked by a significant jump in BTC’s value, many investors have taken to profit-taking. As most of them anticipate a reclaim of the $25,000 price mark, profit-taking has slowed. Likewise, selling pressure has reduced, Glassnode discovered. This was done by an assessment of BTC’s Adjusted Spent Output Profit Ratio (aSOPR).

According to Glassnode Academy, the SOPR metric provides insight into macro market sentiment, profitability, and losses taken over a particular time frame. The aSOPR excludes all transaction volume for coins with a lifespan younger than 1hr.

According to the report:

“Overall, this signals a reduction in sell-side pressure and a potential return of the ‘buy-the-dip’ mentality. A convincing SOPR retest and bounce from 1.0, especially on longer-term moving averages (14D or 30D, for example), is often a signal of a shifting market regime.”

Source: Glassnode

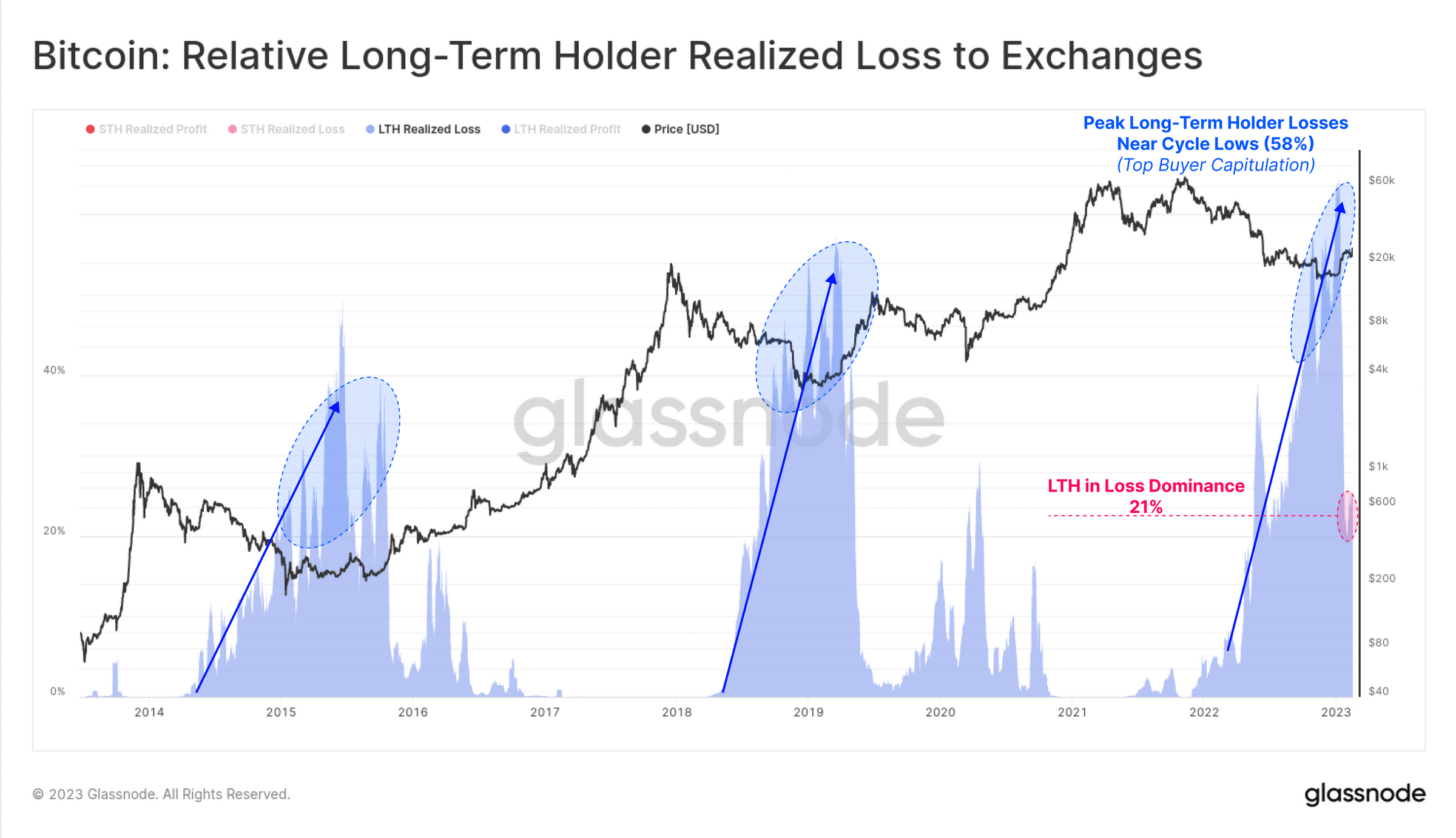

Lastly, regarding BTC long-term holders, Glassnode found that the recent rally in price has led to a reduction in the volume of losses recorded by this investor cohort.

According to the report, long-term holders in loss have seen a dramatic decline from a cycle peak of 58% in mid-January to 21%, in terms of realized value on coins sent to exchanges.

How much are 1,10,100 BTC worth today?

This, according to Glassnode, meant that these investors are regaining confidence in the market and are less likely to sell their coins at a loss. This is typically seen as a positive sign for the market, as it suggests that investors are becoming more optimistic about the future of their investments.

Source: Glassnode