Though GMX shows signs of improvement, this is why HODLers should be cautious

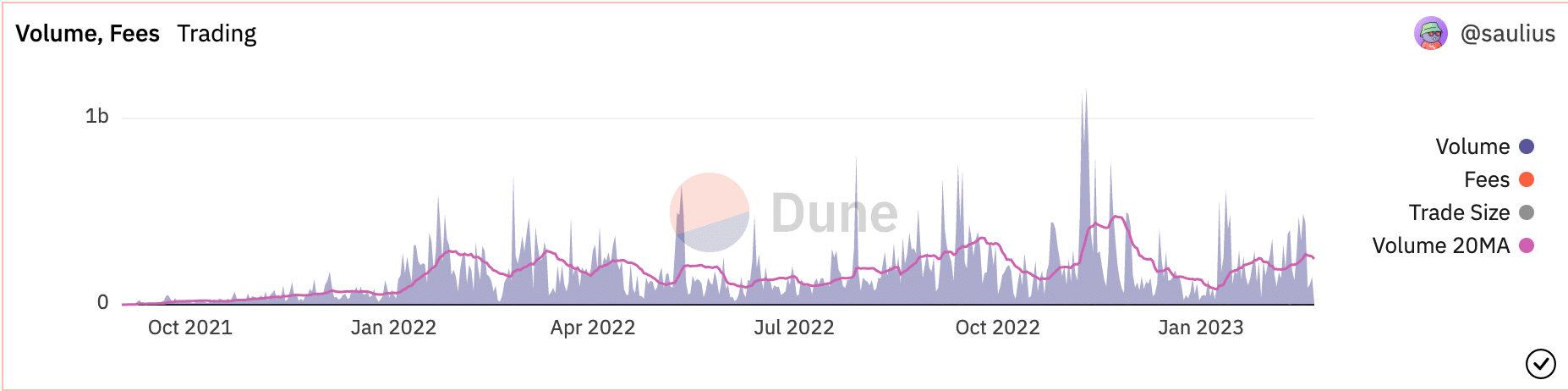

- GMX saw massive growth in terms of volume.

- However, indicators painted a bearish picture for the token.

GMX has been capitalizing on the recent bullish sentiment of the market and has seen quite some growth. One indicator of its progress has been its performance on the Avalanche [AVAX] network. According to a 20 February tweet, it was observed that the number of users using GMX on Avalanche had doubled.

1// @GMX_IO exchange activity and performance on #Avalanche right now is just insane.

What’s the data saying?

Since the start of the year (01/01/2023)

There is now over double the number of users using GMX on #Avalanche pic.twitter.com/JHOJLlr2pW

— Ommiii🔺 (@Ommiii_) February 20, 2023

Read GMX’s Price Prediction 2023-2024

A high number of users indicated that the adoption of GMX had increased materially. The interest around GMX was not only aiding the perpetual contract protocol but also the networks that it was present on.

Along with the number of users, the overall volume on the network had increased as well. According to the aforementioned tweet, GMX’s volume had increased by 250%.

One reason for the growing volume would be the high number of traders on the platform. According to Dune Analytics’ data, the overall number of traders on the protocol had increased immensely over the last few months. A high number of traders on the protocol affected the overall volume and liquidity on the platform.

A majority of these traders held long positions. According to Dune Analytics’ data, the percentage of long positions on the platform was 62.1%. On the other hand, the percentage of short positions on the platform was 37.1%. This showcased the overall optimism of the crypto market and users of the platform.

Source: Dune Analytics

However, while the optimism of the traders continued to rise, the state of the GMX token worsened.

Could the bears make an appearance for GMX?

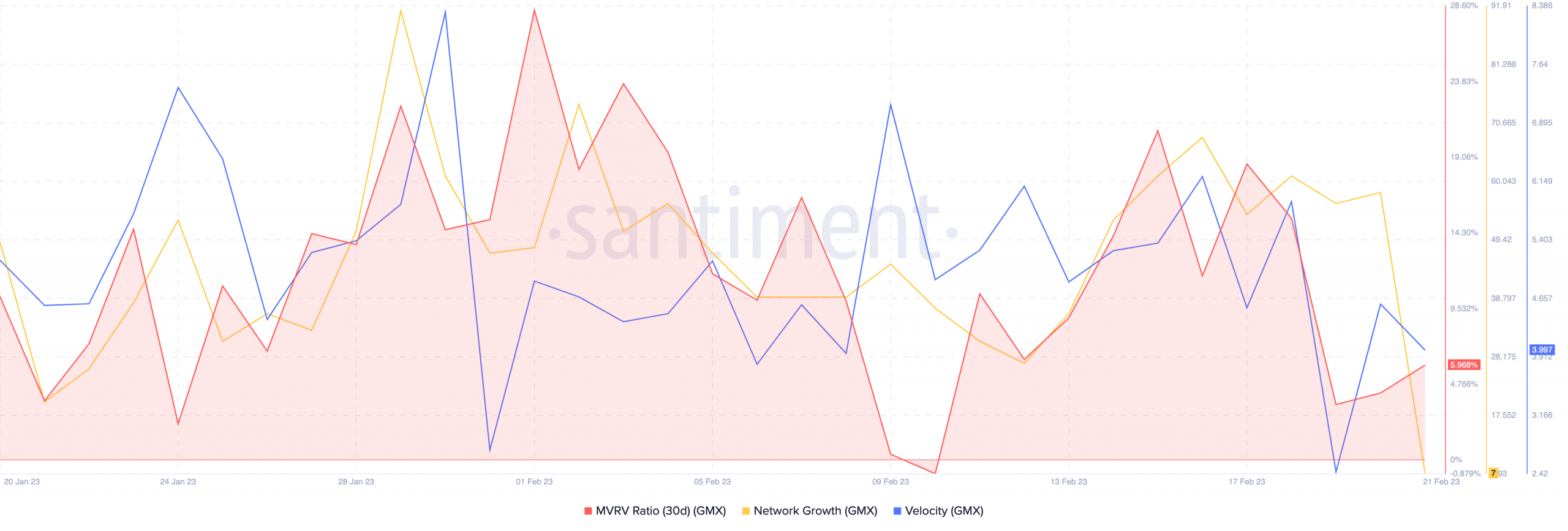

According to Santiment, the tokens MVRV ratio increased over the last few weeks. This implied that if most of the holders were to sell their positions, they would end up profiting. This would add to the selling pressure on holders and could drive the token’s price down in the future.

Along with high selling pressure, there was also a decline in GMX’s network growth, indicating that new addresses had lost interest in the token.

How much are 1,10,100 GMXs worth today?

Coupled with that, there was also a decline in the velocity of the token. This meant that the frequency with which GMX was being traded had reduced.

Source: Santiment

Overall, even though the GMX protocol observed positive developments, the token’s indicators suggested a negative outlook for its future.