Decoding what’s behind Bitcoin’s [BTC] volatility as price touches $25k

- Several funds/institutions poured nearly $1.6 billion into the crypto market since 10 February.

- The bears have taken over the market as BTC’s price plummeted.

Bitcoin [BTC] surprised the entire crypto market by registering gains as its price exceeded $25,000 on 16 February. This was good news, as BTC reached that mark after a long struggle of eight months. Moreover, as per Santiment, one reason behind the pump was that whales had accumulated $2.7 billion Tether [USDT] since December 2022.

🐳🦈 Identifying reasons for #Bitcoin being able to surge above $25k for the first time in 8 months, we can start with key #Tether shark & whale buying power that was increasing since early December. Key stakeholders continue loading up for more buys. https://t.co/zknJcDgf9z pic.twitter.com/o8hbxQyGcv

— Santiment (@santimentfeed) February 16, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-24

Several factors were at play for Bitcoin

Apart from that, Lookonchain also pointed out another factor that could be attributed to BTC’s surge. As per the analysis, multiple funds and institutions have poured nearly $1.6 billion into the crypto market since 10 February 2023, despite the then-bearish market.

For instance, nearly 1.6 billion USDC was withdrawn from Circle during that period. Moreover, another address, “0x308F,” withdrew 155 million USDC from Circle and transferred it to exchanges.

1/ Why did the price of $BTC/$ETH suddenly rise today?

We found that several funds/institutions poured nearly $1.6B into the crypto market since Feb 10!👇 pic.twitter.com/WRaSv4YtgP

— Lookonchain (@lookonchain) February 16, 2023

The aforementioned developments had a positive impact on the market, resulting in a bullish rally. However, the northbound breakout was short-lived, as the market witnessed a trend reversal soon.

According to CoinMarketCap, BTC’s price declined by over 3.8% in the last 24 hours, and at the time of writing, it was trading at $23,713.42 with a market capitalization of over $457.4 billion.

Which metrics are to blame?

A look at BTC’s on-chain metrics revealed quite a few reasons that supported the bears and caused the most recent price decline. For example, as per CryptoQuant, BTC’s exchange reserve was increasing, which indicated higher selling pressure. BTC’s aSORP was red, suggesting that more investors sold their holdings for profit amidst the bull rally.

Another bearish signal was a decline in BTC’s open interest in the last 24 hours as it plummeted by over 9%.

Is your portfolio green? Check the Bitcoin Profit Calculator

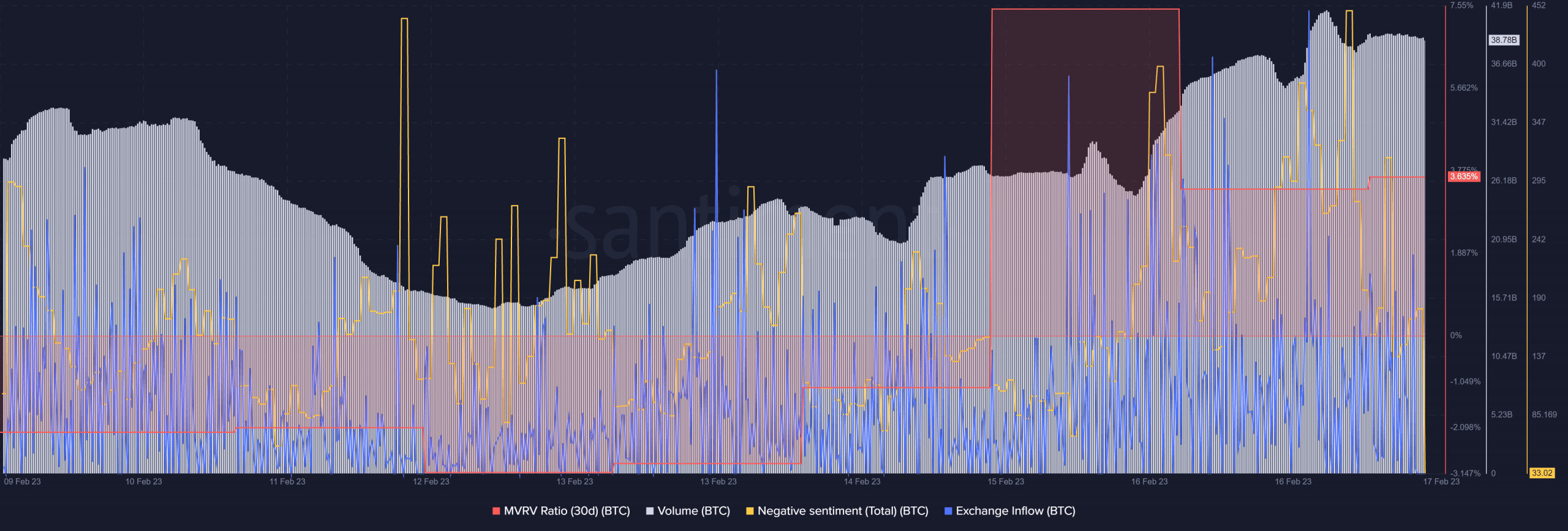

Santiment’s chart also pointed out a few interesting metrics. BTC’s recent price decline was accompanied by high volume, further legitimizing the downtrend. Negative sentiments around BTC spiked in the last few days, indicating less trust among investors in the coin. Moreover, BTC’s exchange inflow increased considerably.

Interestingly, Glassnode’s chart revealed that BTC’s mean transaction volume just reached a one-month high of 1.869 BTC. After registering a considerable spike, BTC’s MVRV Ratio went down, further increasing the chances of a continued downtrend in the coming days.

Source: Santiment