Bitcoin whales, retail investors show contrasting behavior- Here’s why

- The divergence between Bitcoin’s retail and whale behavior grew.

- Activity for the king coin increased, and traders remained positive.

According to new data, the divergence between Bitcoin whales and retail investors has grown exponentially. It’s important to note that the difference in the behavior of these entities could impact vulnerable retail investors in the long run.

How much are 1,10,100 BTC worth today?

Divergence continues to grow between retail and whales at an exponential rate.

Retail now hold just over 3M #Bitcoin while whales have broken below 9M #Bitcoin. pic.twitter.com/WH1e65P1qf

— James V. Straten (@jimmyvs24) February 11, 2023

Based on glassnode’s data, whale addresses were observed to be continually exiting their positions and selling off their BTC.

Conversely, retail investors continued to show interest in the king coin. The number of addresses holding more than 0.1 and 0.01 BTC both reached all-time highs, at the time of writing.

The rise in retail interest could be considered a positive sign for BTC. However, if the decline in whale interest continues, there could be a negative impact on the overall price of the coin. This contrast in behavior could have negative connotations for small investors.

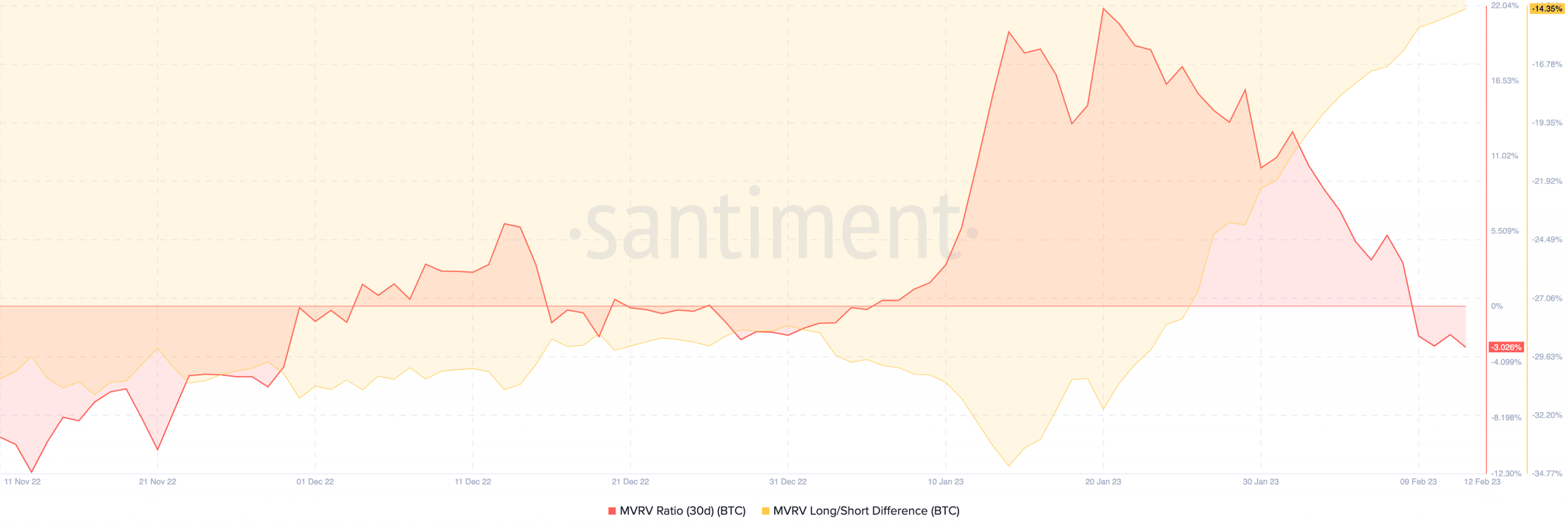

However, at the time of writing, there was not a lot of sell pressure on Bitcoin. This was indicated by the reading of a declining MVRV ratio.

Its negative MVRV ratio suggested that most addresses wouldn’t be able to profit if they decided to sell their holdings at the current price.

Source: Santiment

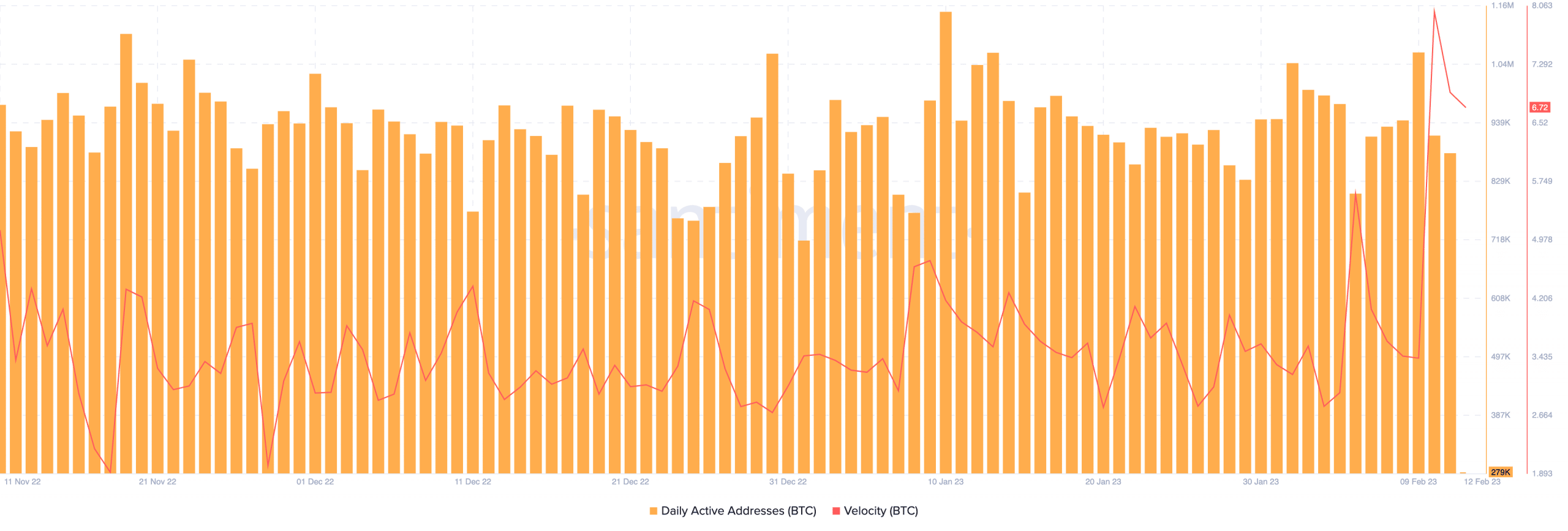

Another positive factor for Bitcoin was its increasing activity. According to Santiment’s data, the velocity of BTC spiked significantly over the last few days.

Coupled with that, the overall daily active addresses also went up. Interestingly, during this period, the mean size of each BTC transaction reached a 5-year high of 1,054.778 BTC.

Read Bitcoin’s Price Prediction 2023-2024

Source: Santiment

Not all good news

There were a lot of positive developments in Bitcoin’s network, but a few areas raised some concerns. One of them was the growth of Bitcoin on exchange reserves.

The growth of exchange reserves indicated that a possible increase in selling pressure can surely be anticipated and the possibility of high volatility too can’t be ruled out.

Source: Crypto Quant

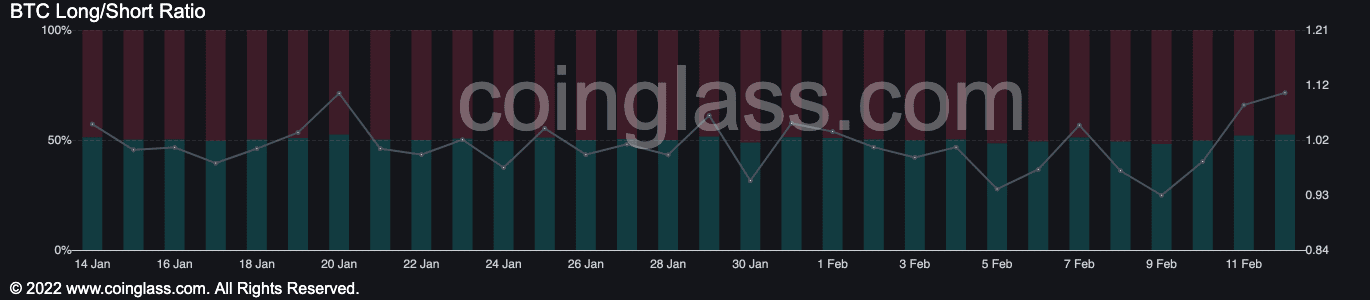

However, despite this, traders remained optimistic about the state of Bitcoin. According to coinglass, the overall number of long positions exceeded the number of short positions on BTC.

At press time, 52.81% of all positions taken against Bitcoin were long.

Read Bitcoin’s Price Prediction 2023-2024

Source: coinglass

That said, however, it remains to be seen whether the traders are right about the future of BTC.