Analyzing Bitcoin miners’ condition in the wake of increased regulatory purview

- Some U.S. states implemented soft laws for crypto mining regulation.

- Miner reserves highlight a lack of incentive for miners to HODL.

Regulators in the U.S. are ramping up their efforts in a bid to streamline the crypto industry. This has been apparent in the last few days with staking being the main target. The crypto mining segment is also receiving its fair share of the regulatory spotlight.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Multiple states in the U.S. including Oklahoma, Montana, Mississippi, and Missouri have reportedly rolled out crypto mining protection laws.

Bitcoin miners will be happy to know that initial reports reveal that regulators are taking a soft or friendly stance. The regulations will allow Bitcoin miners to run small-scale mining operations within private residences.

Bloomberg Tax: US states Missouri, Mississippi, Montana, and Oklahoma have introduced crypto mining protection laws. The bills would permit small-scale Bitcoin mining in private residences and large-scale mining in areas zoned for industrial use. The bills have drawn opposition… https://t.co/0cp8xJjwL3

— Wu Blockchain (@WuBlockchain) February 11, 2023

The same U.S. laws stipulate that large-scale Bitcoin mining operations should be restricted to areas set aside for industrial use.

Well, what does this mean for top Bitcoin mining companies? It has been business as usual for the top mining companies such as Core Scientific, Greenidge generation, and BIT mining among others.

This newly implemented regulation is not expected to bring major changes to their operations unless for those with operations in designated residential areas.

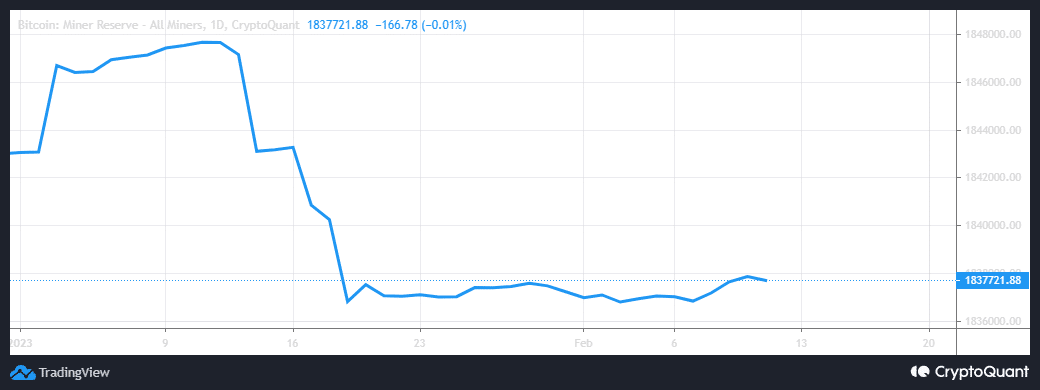

Bitcoin miner reserves remain within the lower range

As far as Bitcoin miner stats are concerned, the current market conditions do not exactly offer much of an incentive for miners to hold on to their coins.

However, the miner reserve indicator registered some growth in the first week of February.

Source: CryptoQuant

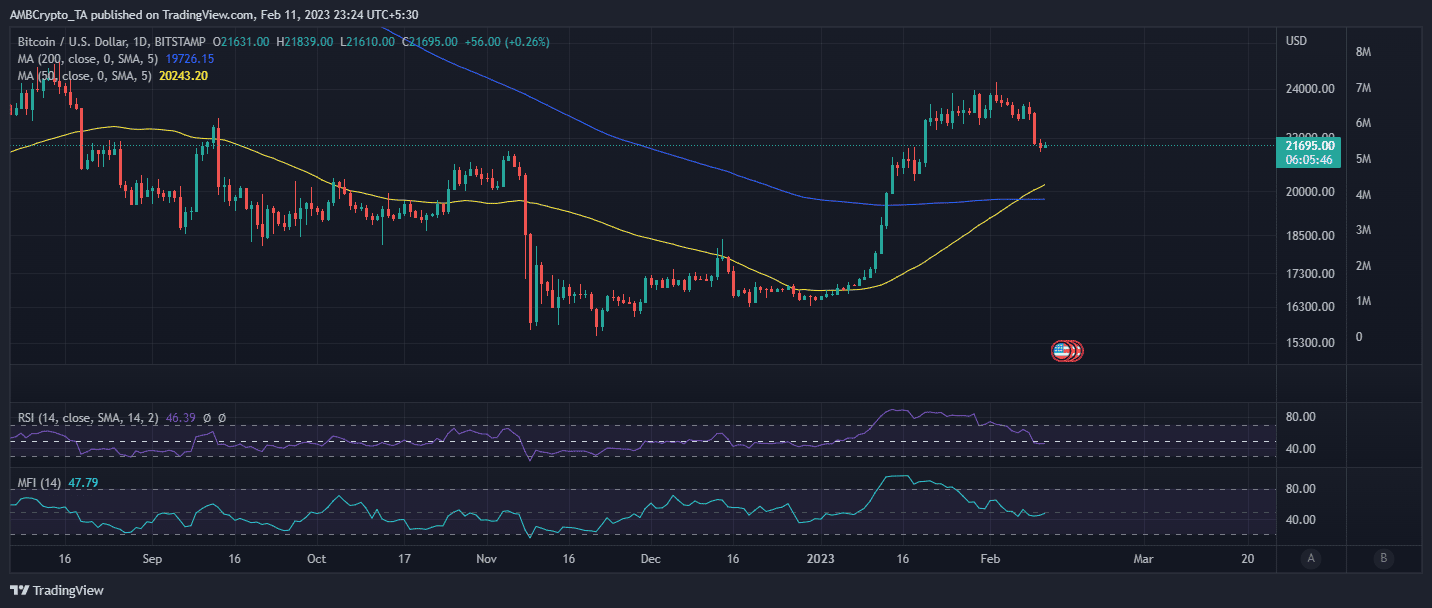

Perhaps a look at Bitcoin miner outflows might provide a clearer view of the state of Bitcoin miners since the start of the year. Miner outflows increased drastically in the first three weeks of January as the price of Bitcoin soared.

This indicates that miners were cashing out their profits. However, miner outflows have dropped since, and are still within a 5-week lower range.

Source: CryptoQuant

These miner stats highlight a strong influence on Bitcoin’s price action. Miners are more likely to hold on to their coins in the hopes of making more gains as the price soars. However, this was not the case in January.

Miner reserve outflows reveal that miners were cashing out perhaps in expectation that the January rally would be short-lived. Bitcoin has already delivered a bearish performance so far this month. It traded at $21,694 after a 10% drop from its YTD high.

Source: TradingView

How much are 1,10,100 BTCs worth today?

In conclusion, the current laws set in place for crypto miners do not carry many risks for the market. They also represent one country, compared to the global scale at which Bitcoin operates.