Ripple: Decoding recent developments around ‘XRP buyback’ theory

- Whale accumulation registered a sharp uptick in January.

- XRP’s weighted sentiment dipped to negative levels.

Pro-Ripple lawyer John E Deaton dissociated himself from the XRP’s buyback proposal and denied accepting any money for his efforts in the two-year-long Ripple vs SEC lawsuit. He stated,

“Unless I file an appearance as a defense counsel representing a Company that is being sued by the SEC, my efforts will continue to be pro bono. I will NOT accept any money from any token holders related to my efforts.”

Deaton’s clarification came in response to the proposed terms of the buyback plan which mentioned making a payment to Deaton Law firm for its contribution to the SEC lawsuit over the status of XRP.

Read Ripple’s [XRP] Price Prediction 2023-24

What is the XRP buyback theory?

The proposal was floated by Jimmy Vallee of Valhill Capital in 2021 who backed XRP to become the reserve currency of the world. Vallee stated that the global financial system would require a scalable digital asset in the future to address the problem of high national debts.

However, he added that for this to happen governments would have to hold a large number of XRPs which have to be purchased from retail holders.

In fact, in one of his latest interviews, Vallee hinted that XRP buyback might be possible if the verdict in the SEC lawsuit comes in Ripple’s favor.

However, not everyone was impressed by the speculative idea. Matt Hamilton, former director of developer relations at Ripple who has been a big critic of the buyback theory, accused Jimmy Vallee of committing bribery.

Whales gallop XRP

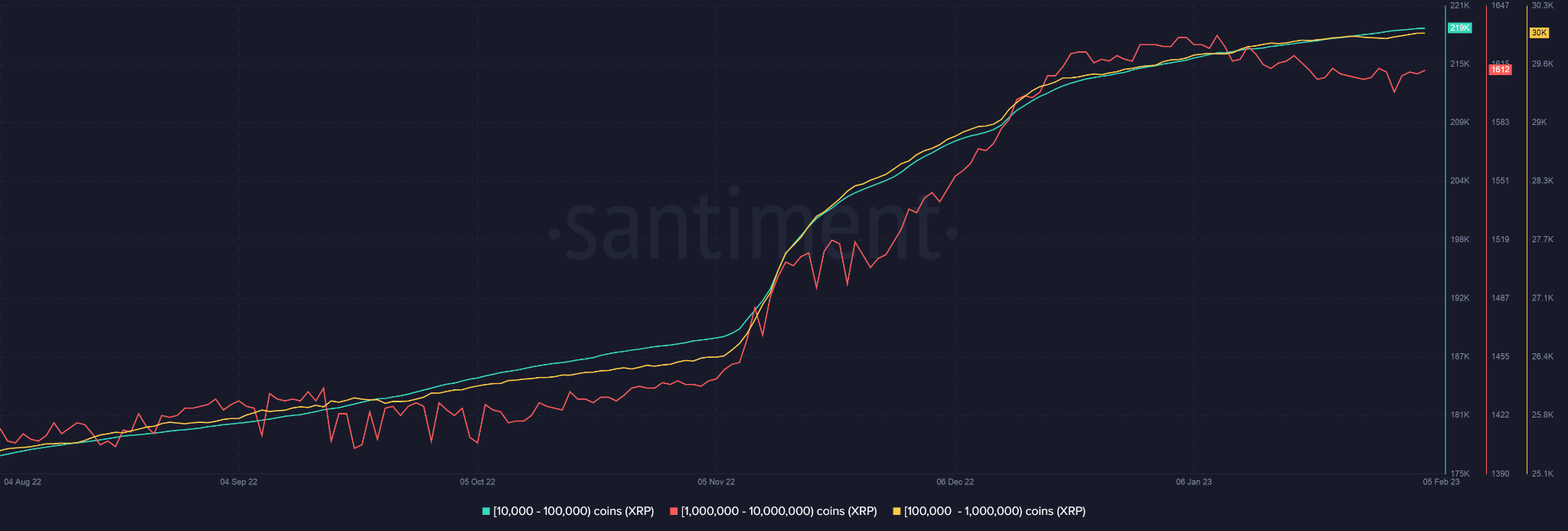

In spite of the controversy around XRP buyback, small and large whales found a liking for XRP. According to data from Santiment, the number of addresses holding between 10,000 to 10 million XRP recorded a sharp uptick since the FTX collapse.

This suggested that they deemed the network to be profitable for some more time.

Source: Santiment

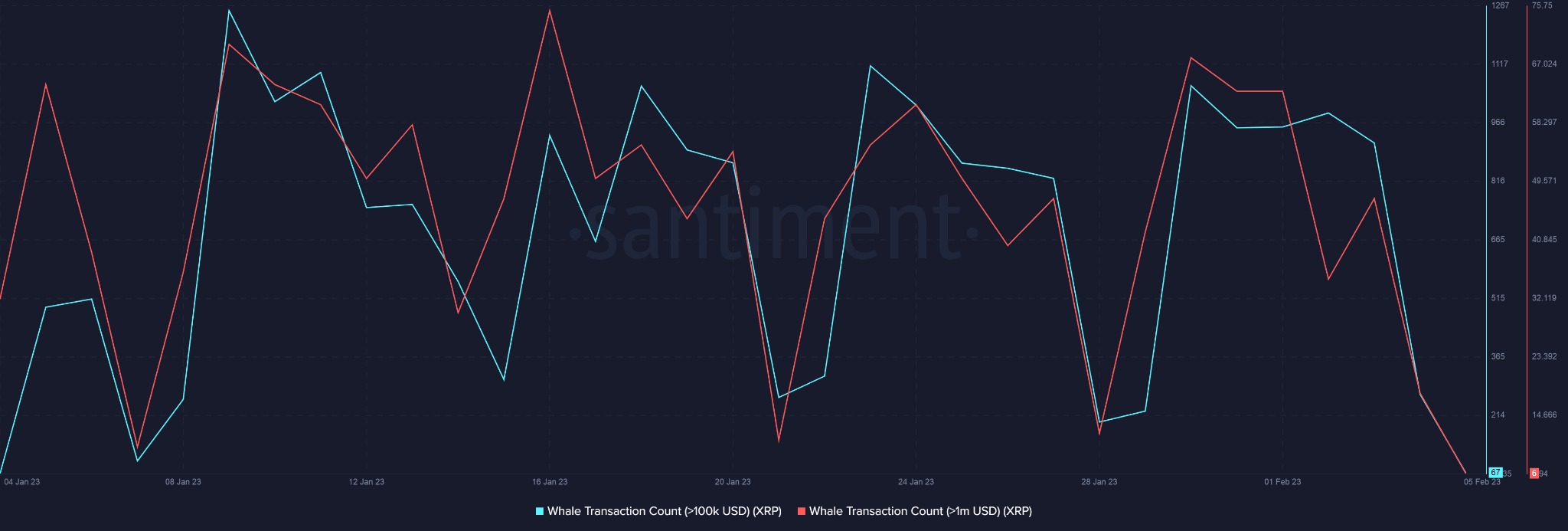

Additionally, the transaction involving large transfers also subsided which meant that this cohort of investors is still not interested in taking up profits. This could aid the northward movement of XRP.

Source: Santiment

Interestingly, Ripple Labs too increased its XRP purchases from the previous quarter, which was outlined in its Q4 earnings report. A wider accumulation trend was observed for XRP.

Is your portfolio green? Check out the XRP Profit Calculator

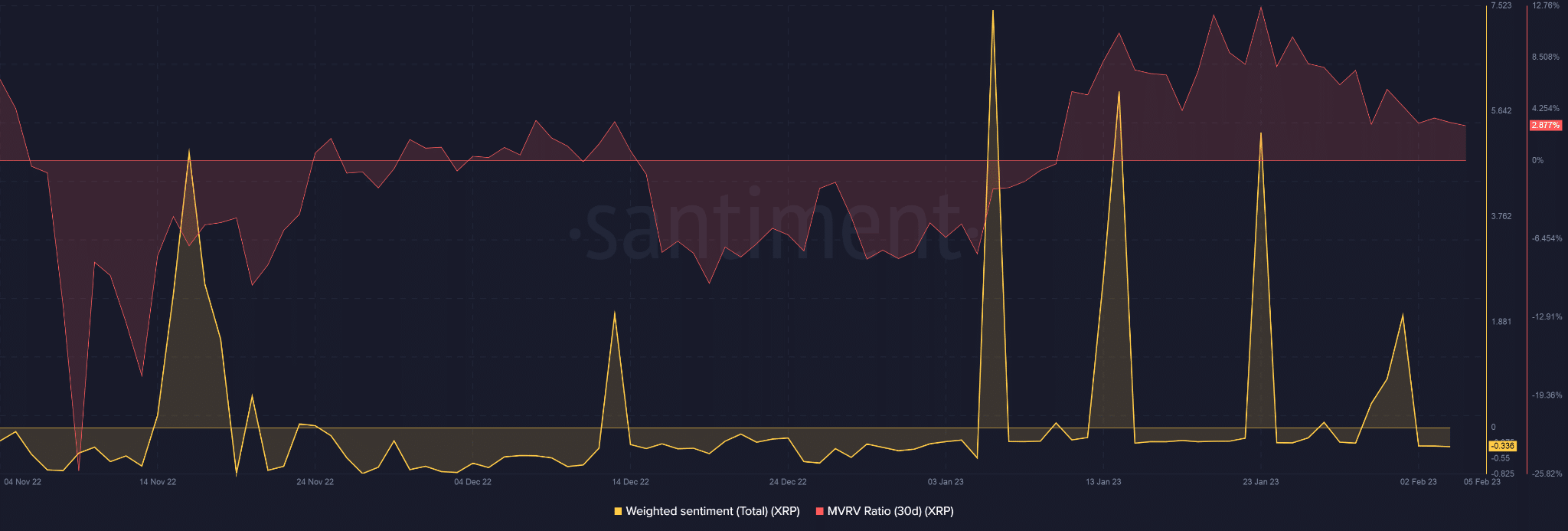

The 30-day MVRV ratio for XRP was still in the positive region highlighting the overall profitability of the network. This was a bullish signal.

Source: Santiment

On the flip side, the weighted sentiment of the coin has been negative of late. The controversy around the XRP buyback could have impacted investors’ confidence.

At the time of writing, XRP exchanged hands at $0.4107, gaining marginally over the previous day, as per CoinMarketCap.