I spoke to ChatGPT about the Ripple-SEC case, and its prediction was surprising

The Ripple vs. SEC dispute has been an emotional roller coaster for those who invested in the case and those following it carefully. Simply put, the SEC has told Ripple that its digital currency, XRP, is a security, and Ripple has responded by saying that it is not.

SEC charges Ripple and two executives with conducting $1.3 billion unregistered securities offering https://t.co/3VP23RpSyV

— U.S. Securities and Exchange Commission (@SECGov) December 22, 2020

Is your portfolio green? Check out the Ripple Profit Calculator

Over this, they’ve been arguing in a U.S. courtroom for what feels like an eternity. As a ruling in the case has yet to be made, I opted to consult with our new A.I. buddy, ChatGPT, to share its view.

A chat with our learned A.I. friend

Q. How does the SEC determine if a token is a security?

The Securities and Exchange Commission (SEC) determines whether a token is a security using the Howey Test, which is a test established by the Supreme Court in 1946. The test determines whether an investment contract constitutes an “investment contract” and, therefore, a security under the Securities Act of 1933.

The Howey Test has four parts:

- It is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

If a token satisfies all four prongs of the Howey Test, it is considered a security by the SEC.

Q. What are the potential strengths of the SEC case against Ripple?

- XRP Sales: The SEC has alleged that Ripple conducted an unregistered securities offering of XRP worth $1.3 billion, which, if proven true, would be a piece of strong evidence that XRP is a security and Ripple conducted an illegal offering of securities.

- Investment Contract: The SEC has argued that XRP is a security based on the Howey Test and that the purchase of XRP constitutes an investment contract. If the court finds that the purchase of XRP meets the four prongs of the Howey Test, it would be a strong argument in favor of XRP being a security.

- Investor Expectation of Profit: The SEC has argued that XRP investors had an expectation of profit from their investments, which could be strong evidence that XRP is a security and that Ripple’s sale of XRP constitutes an illegal offering of securities.

- Control and Influence: The SEC could argue that Ripple exerts a significant amount of control and influence over the XRP Ledger, which would undermine the argument that XRP is decentralized.

- Precedent: The SEC has a strong track record in similar cases, and a ruling against Ripple could set a precedent for other cryptocurrencies and companies in the industry.

Q. The Howey test is the strongest point the SEC is using against Ripple, but how does it come short?

The Howey test is a strong point that the SEC is using in its case against Ripple because it is a well-established test for determining whether an investment contract constitutes a security under the Securities Act of 1933. However, the test has limitations, and there are several ways in which it might come up short in the case against Ripple.

The Howey test is based on a 1946 Supreme Court case and may not fully capture the complexity of modern digital assets like XRP. The test is based on traditional investments, such as land or real estate, and may not apply entirely to a digital asset like XRP.

The test is based on the idea of a common enterprise, which may be difficult to prove in the case of XRP. Ripple argues that XRP is a decentralized digital asset and that its value is independent of the efforts of a third party, making it difficult for the SEC to prove that XRP is a security.

The fourth prong of the Howey test is whether any profit comes from the efforts of a promoter or third party. Ripple argues that profit comes from the appreciation of the token’s value rather than from the efforts of a promoter or third party, making it difficult for the SEC to prove that XRP is a security.

The Howey test is not universally accepted. In other countries, the legal criteria to determine whether a token is a security can be different, which means that even if the SEC wins this case, it might not have any effect on Ripple’s operations outside of the U.S.

Q. How is Ripple not a security?

XRP is not a security because it does not meet the criteria of the Howey test

It is not an investment of money: XRP is a digital asset with its utility and can be used for various purposes, such as facilitating cross-border payments.

XRP is not a common enterprise: It is decentralized, meaning its value is not dependent on the efforts of a central party, such as Ripple, the company.

There is no reasonable expectation of profits: XRP holders do not expect profits to be derived from the efforts of others but instead expect profit from the appreciation of the digital asset value.

XRP holders do not expect a return on investment: It is not an investment in the traditional sense but rather a currency or a commodity, and holders do not expect a return on their investment.

Q. Looking at the actions and motivations of Ripple and SEC in their ongoing lawsuit, what movie characters could they be?

In the ongoing lawsuit between the SEC and Ripple, the SEC could be seen as the “protagonist” or the “hero” of the story, representing the interests of investors and enforcing regulations to protect the public from fraud. In this sense, the SEC could be compared to a character like Captain America, who symbolizes justice and fights to uphold the law.

On the other hand, Ripple could be seen as the “antagonist” or the “villain” of the story, challenging the SEC’s regulations and arguing that XRP is not a security. In this sense, Ripple could be compared to a character like Loki, who is a trickster and often operates outside of the law to achieve his goals.

Author’s note: There was no way I could have warned our guest lawyer that this might not go down well with Ripple enthusiasts.

ChatGPT weighs in on the implications of win or loss for Ripple

Q. What are the possible impacts of a Ripple win or loss?

The outcome of the SEC vs. Ripple case could have significant impacts on the cryptocurrency industry and Ripple as a company.

A win for Ripple could be seen as a victory for the crypto industry as a whole. It could also set a precedent for other cryptocurrencies and companies in the industry, making it more difficult for the SEC to regulate them as securities.

On the other hand, a loss for Ripple could have the opposite effect. It could be seen as a major setback for the crypto industry and could lead to increased regulatory scrutiny and enforcement actions against other cryptocurrencies and companies in the industry.

A Ripple win could also positively impact the value of XRP, as it would mean that XRP is not considered a security, which would reduce regulatory risks for the token and increase its trading volume.

A loss for Ripple could lead to a decrease in the value of XRP as it would mean that XRP is considered a security, increasing regulatory risks for the token and decreasing its trading volume.

If Ripple loses, it could also face significant fines and penalties, as well as a potential order to register XRP as a security and to refund investors. This could also lead to a decrease in trust in the company and negatively impact its future prospects.

A win for Ripple could also result in a boost in trust in the company and a positive impact on its future prospects.

Realistic or not, here’s XRP market cap in BTC’s terms

The state of XRP

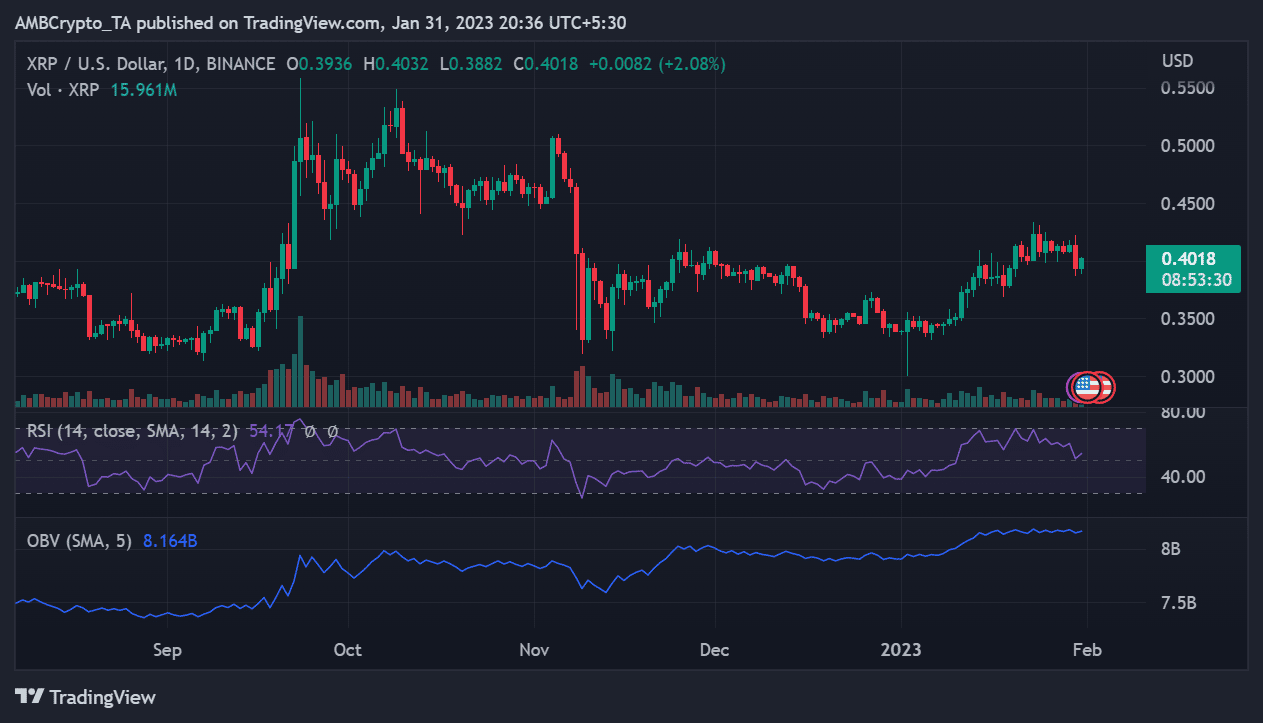

As of this writing, XRP was trading at about $0.4, a significant decrease from the previous high of over $1 it experienced before its slump. Remember that XRP could not be listed for trading on U.S. exchanges when the lawsuit began. The volume that XRP has been experiencing, as a result, came from markets or exchanges outside of the U.S.

On Balance Volume (OBV) analysis on a daily period revealed that the asset had not experienced any major activity. The Relative Strength Index (RSI) line showed that XRP was in a bull trend then. However, the bull trend was not a powerful one, as indicated by the RSI line.

Source: Trading View

Our A.I. buddy obviously has an idea of the Ripple (XRP) case, and the chat is a good deviation from price prediction and analysis. It also always pointed out readily to await the court’s decision, as various factors could affect its outcome.

Regardless of the decision that is made, Ripple and XRP will undoubtedly be affected, and a new course will be set.