Bitcoin: Evaluating if it’s the right time to enter the BTC market

- The count of mini BTC addresses has shot up in the last month.

- Price chart reading showed that buying pressure has weakened over time.

Since Bitcoin’s [BTC] price regained the $20,000 mark, the count of BTC addresses that hold 0.1 BTC increased, data from Santiment revealed.

According to the on-chain data provider, since reclaiming the $20,000 price mark, approximately 620,000 small BTC addresses containing 0.1 BTC or less have re-emerged on the network.

While the market lingered under severe bearish conditions in 2022, these addresses saw slow growth. However, with the unexpected bull run since the year started, trader optimism has returned amongst this cohort of investors, Santiment noted.

🧐 There have been ~620k small #Bitcoin addresses that have popped back up on the network since #FOMO returned on January 13th when price regained $20k. These 0.1 $BTC or less addresses grew slowly in 2022, but 2023 is showing a return of trader optimism. https://t.co/CUAS0nV23x pic.twitter.com/wo8NBDNXs3

— Santiment (@santimentfeed) February 6, 2023

The spike in the count of BTC investors that hold 0.1 BTC or less since the year began can be attributable to the Fear of Missing Out (FOMO). Many of the mini BTC addresses might have returned to the market to take advantage of the recent price rally to log gains.

Will they get desired results?

Read Bitcoin’s [BTC] Price Prediction 2023-24

Will you be rewarded for your FOMO?

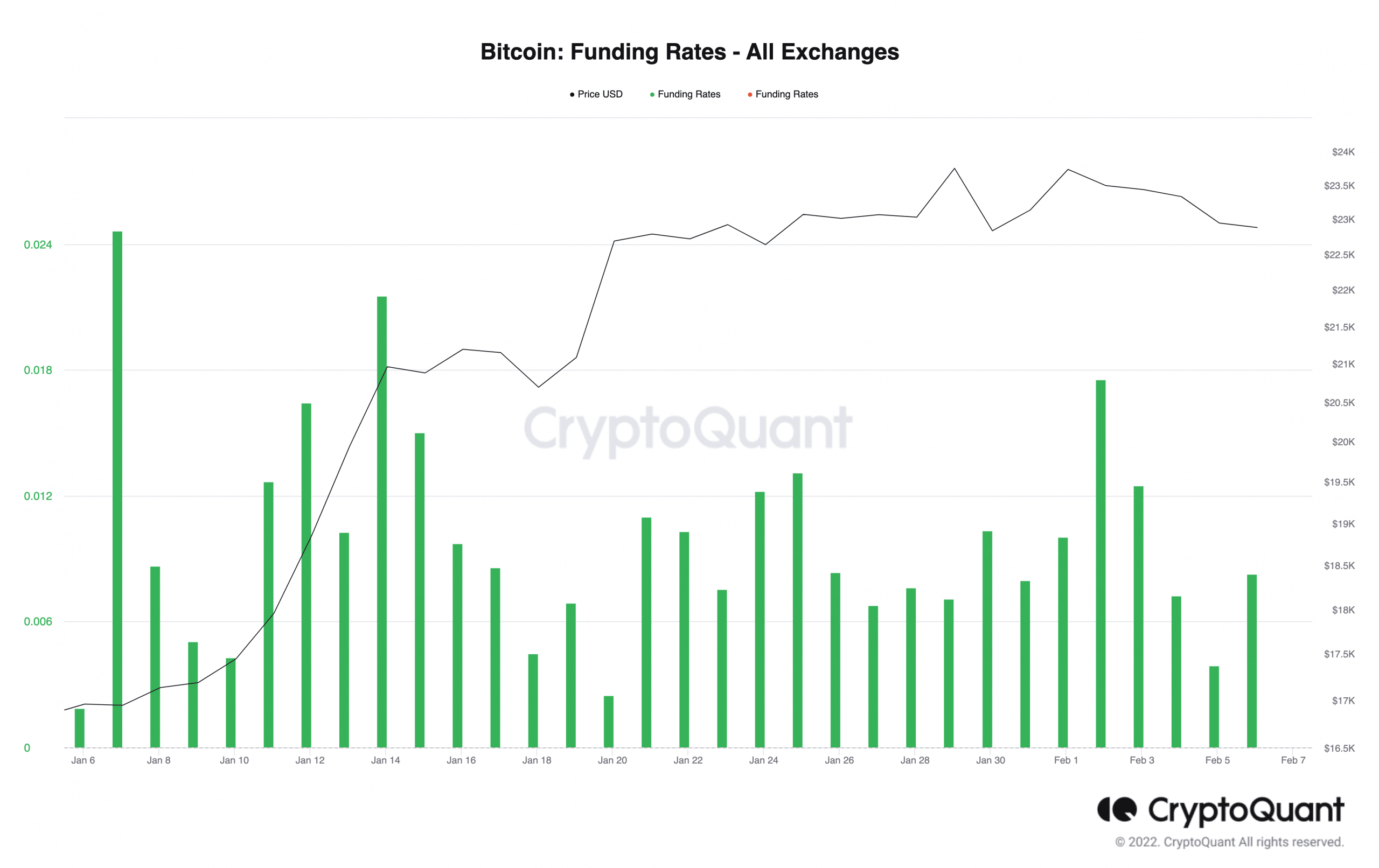

A look at BTC’s funding rates revealed that it has been positive in the last month. Still positive at press time, it was pegged at 0.008.

When an asset’s funding rates are positive, it indicates that there is more demand for long positions than for short positions, and traders who hold short positions are paying a fee to traders who hold long positions.

In addition, when the funding rate is positive, it suggests that market participants expect the asset’s price to increase.

Source: CryptoQuant

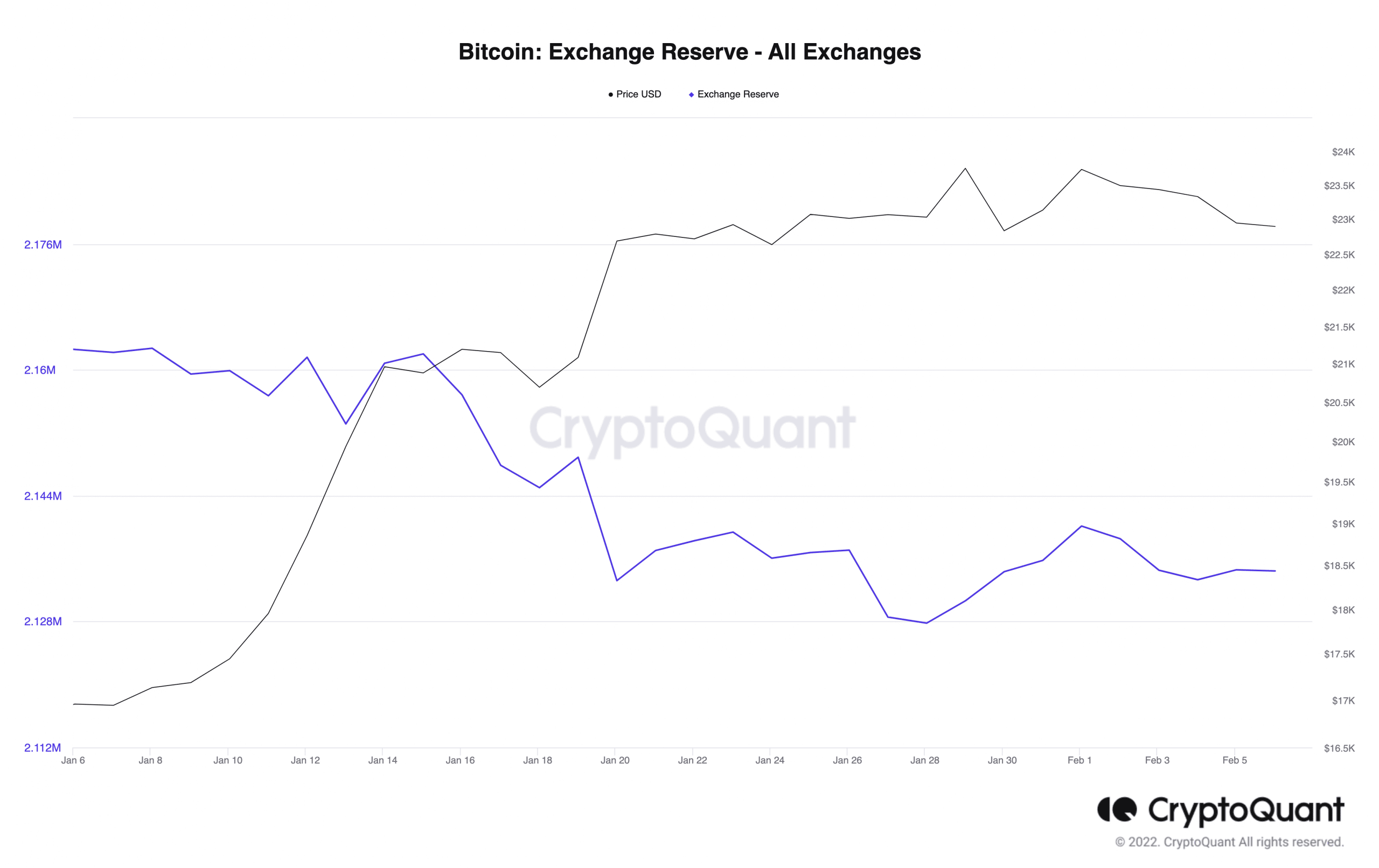

The price of BTC skyrocketed in January, and as the month ended, there was an increase in BTC’s exchange reserve, indicating that many holders transferred their assets to exchanges to cash in their profits.

However, this was only temporary as the exchange reserve of the king coin resumed its downward trend. Per data from CryptoQuant, BTC’s exchange reserve was 2.13 million BTC at press time.

A decline in an asset’s exchange reserve means that fewer coins are in distribution. With a corresponding increase in the coin’s supply outside of exchanges, its price might continue to grow.

Source: CryptoQuant

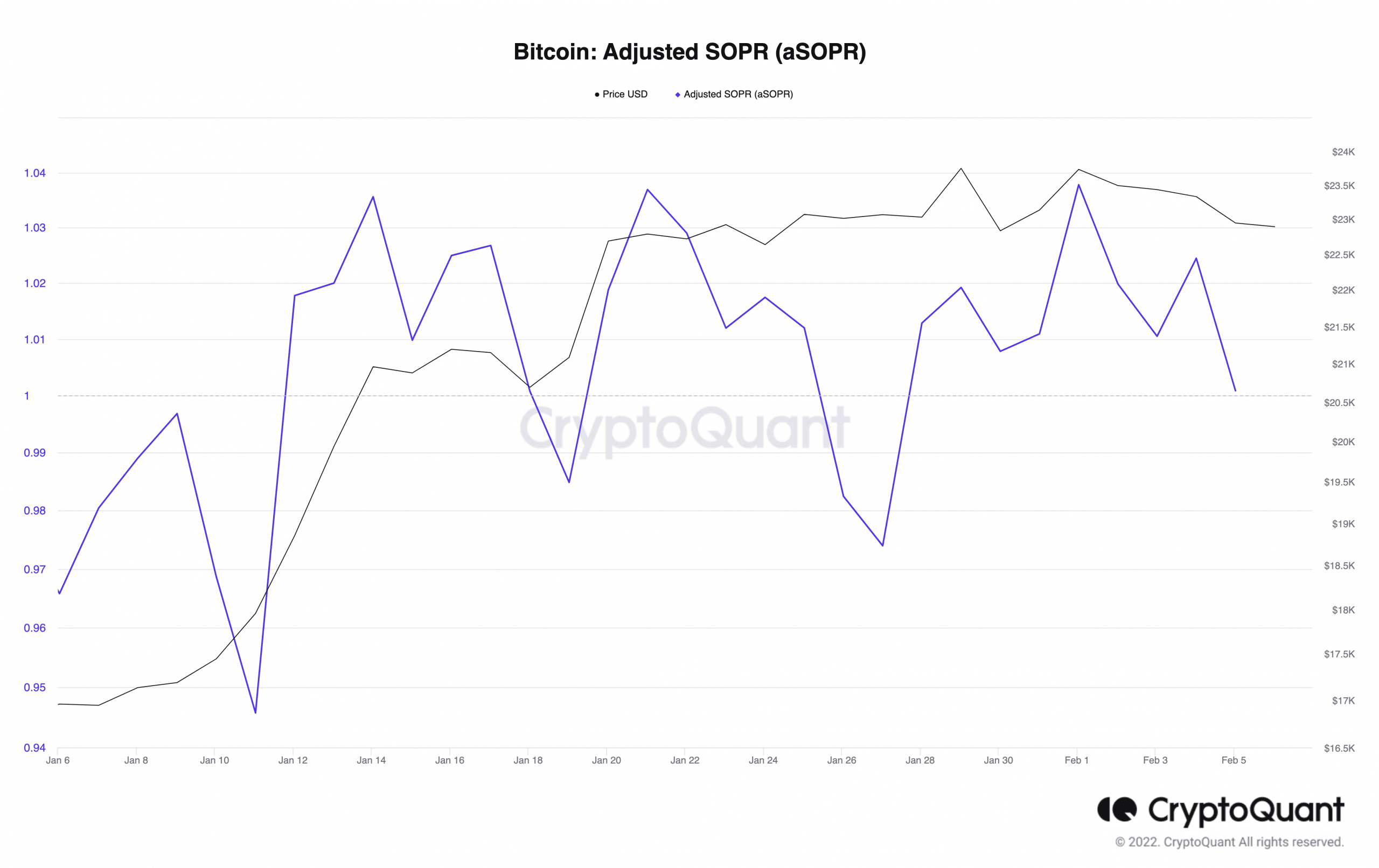

Further, an assessment of BTC’s Adjusted Spent Output Profit Ratio (aSOPR) revealed that at its current price, many investors sold at a profit. At press time, the aSOPR was 1.008. A value above one for a coin’s aSOPR means more investors are selling at a profit.

Source: CryptoQuant

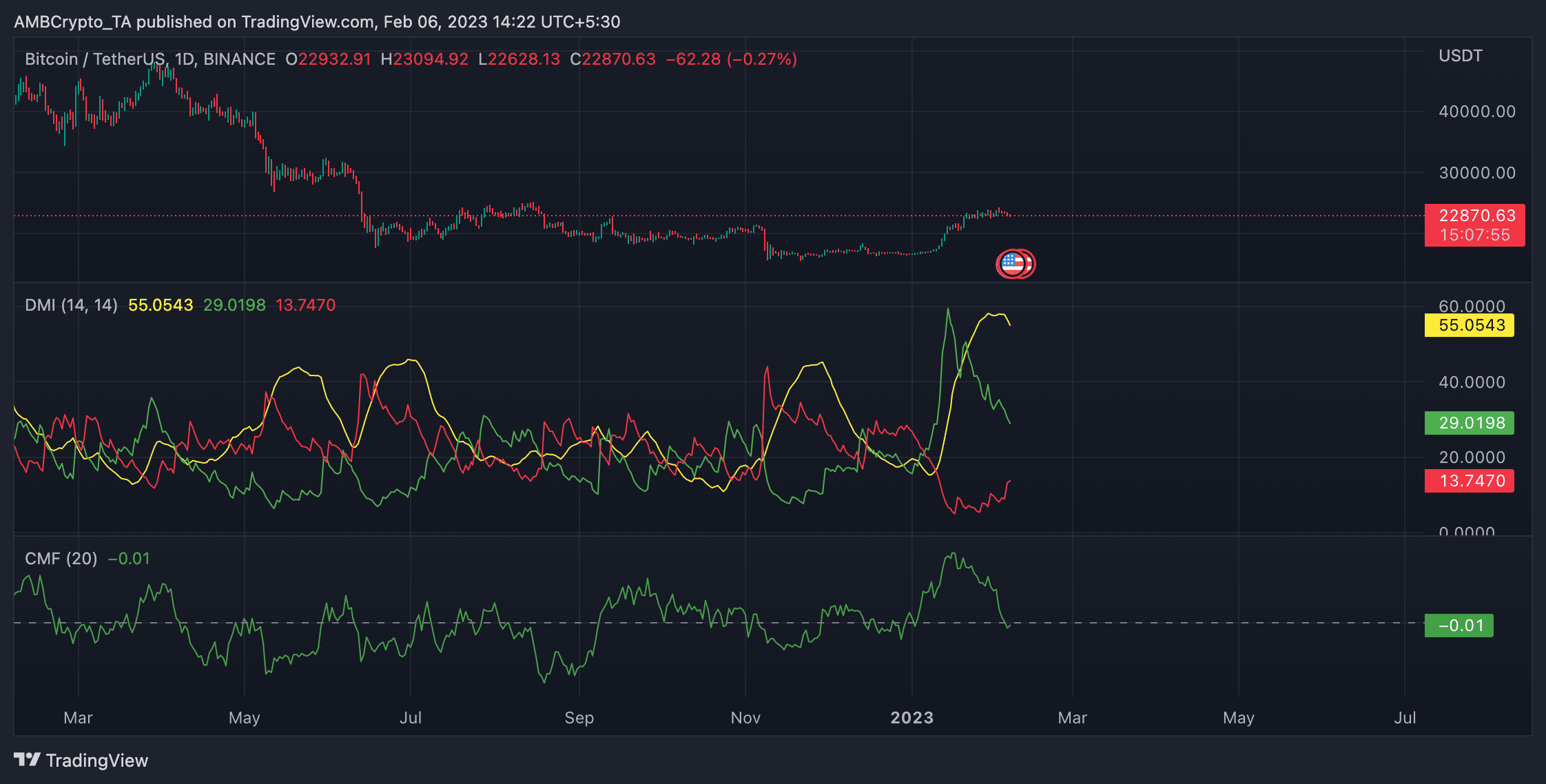

While BTC may be well positioned on the chain, a look at its performance on the daily chart revealed that buying pressure has weakened. At press time, the Chaikin Money Flow (CMF) was negative at -0.01.

Moreso, the positive directional index (yellow) of its Directional Movement Index (DMI) was positioned in a downtrend and inching closer to the negative directional index (red). This showed that buyers were starting to lose control of the market.

Source: BTC/USDT on TradingView