Why ApeCoin [APE] did not respond to BAYC’s achievements?

- ApeCoin’s price decreased by over 5% in the last seven days.

- APE’s Galaxy Score was bullish but market indicators inclined in favor of bears.

Dookey Dash’s success caught many eyeballs, as its popularity was something to be considered. BAYC has announced that they will wind up to the end of the Sewer Pass claim and the Dookey Dash experience on 8 February

As we wind down to the end of Sewer Pass claim and the Dookey Dash experience this Feb 8th we want to dive into some key points everyone should keep in mind regarding scoring and delegation below 🧵

— Bored Ape Yacht Club (@BoredApeYC) February 6, 2023

Sewar Pass NFT collection saw more than $60 million in volume, amounting to $1.5 million in fees on OpenSea, which was a commendable achievement.

Interestingly, X Marketplace revealed that its fees remained at $300,000 for the same volume, out of which, 50% will be burned in ApeCoin [APE].

Huge accomplishment to see $60M+ in volume for @yugalabs Sewer Pass

That amounts to $1.5M in fees on OS

On X it’s only $300K for the same volume and half that would get burned in @apecoin

Which model adds more value to the industry? pic.twitter.com/D4xvnzPsaH

— X Marketplace 🦇🔊 (@Xdotxyz) February 4, 2023

However, Sewer Pass’s success did not have a positive impact on APE, as its price declined by more than 8% in the last seven days. According to CoinMarketCap, APE was down by over 3% in the last 24 hours, and at the time of writing, it was trading at $5.69 with a market capitalization of above $2 billion.

Read ApeCoin’s [APE] Price Prediction 2023-24

Reasons behind the decline

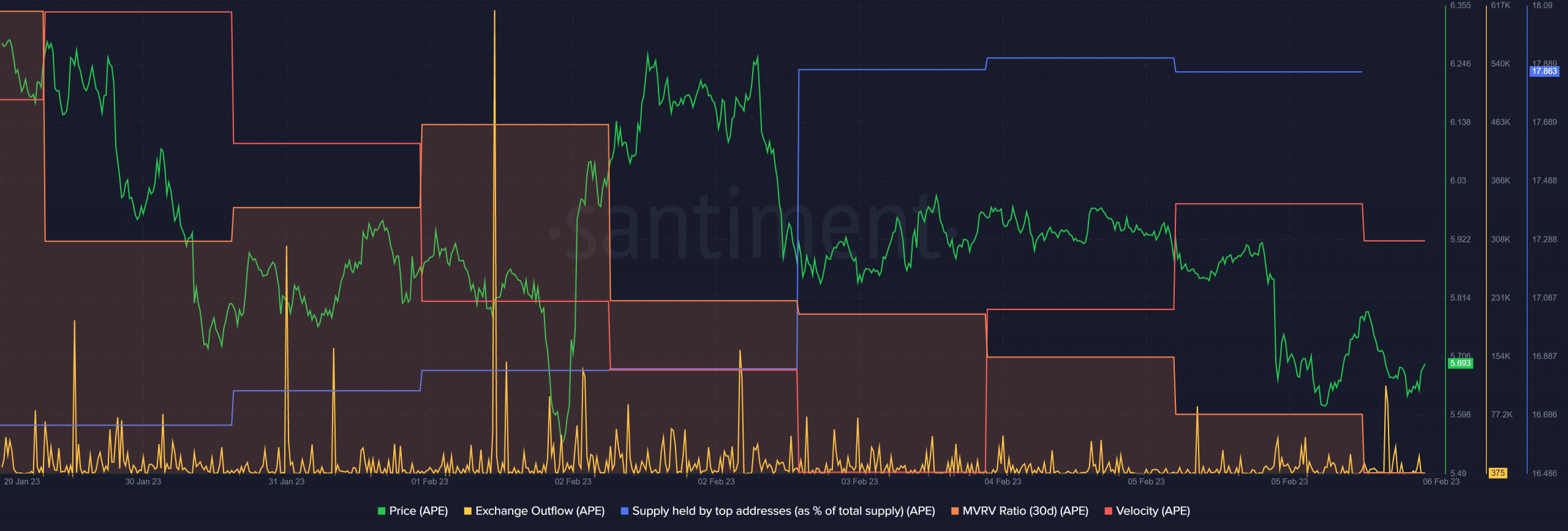

A look at Santiment’s chart revealed quite a few factors that might have played a role in APE’s price plummet. APE’s exchange outflow registered a decline over the last week, which was a development in the bears’ favor.

Moreover, APE’s MVRV Ratio decreased considerably over the last few days, which too was a negative signal. Its velocity also followed the MVRV Ratio and declined last week.

Source: Santiment

Surprisingly, despite the price plummet, APE’s supply held by top addresses spiked, reflecting whales’ confidence in APE. WhaleStats also revealed increased whale activity, as APE was on the list of the most used smart contracts among the top 100 Ethereum whales in the last 24 hours.

Realistic or not, here’s APE’s market cap in BTC’s terms

Investors can expect this

Interestingly, APE was on the list of the top NFT projects in terms of Galaxy Score, which was a bullish signal. Let’s check APE’s daily chart to find out if a price pump is around the corner.

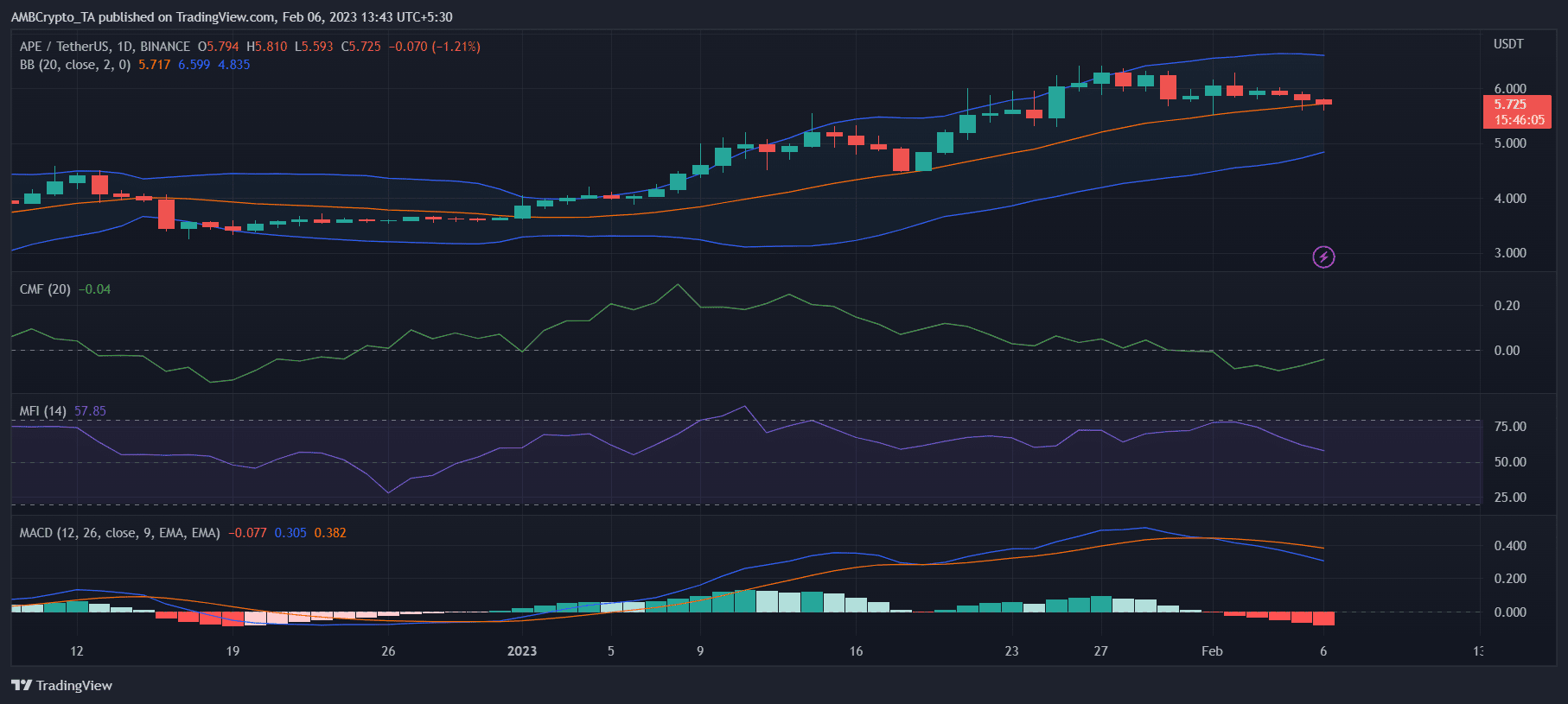

Well, things did not look in favor of the buyers as most of the metrics supported the bears. The MACD displayed a bearish crossover.

APE’s Money Flow Index (MFI) declined and was headed toward the neutral mark.

The Bollinger Bands revealed that APE’s price was not in a very high volatility zone, which decreases the chances of an unprecedented surge in the near term.

Nonetheless, the Chaikin Money Flow was slightly bullish as it went up toward the neutral mark.

Source: TradingView