Evaluating Bitcoin’s price trajectory if regulators dial-up heat on crypto

- Bitcoin may be subjected to regulatory headwinds in the next few weeks.

- Whale and institutional demand for Bitcoin see a slight recovery.

Bitcoin had a strong start this year but that sentiment might soon change. Especially now that fears of a recession are threatening to rip the proverbial bandage off the recovering market. The risk of regulatory-induced FUD might also contribute to a less exciting outcome than anticipated.

Bitcoin did experience a bit of a slowdown in demand in the last few days ahead of the FOMC announcements. However, the same observation remains despite a favorable rate hike. A potential reason for this is that the threat of a regulatory apocalypse is now closer as Congress resumes.

Ron Hammond from the Blockchain Foundation noted in an interview that more stringent regulatory action is to be expected. Regulators are now more alert after the FTX crash. FTX hearings are expected to commence soon and this may encourage Congress to push for a regulatory framework.

Regulators are already cracking the whip on banks

Many mainstream banks adopted a softer stance on cryptocurrencies in the last two years. This includes allowing customers to buy or sell cryptocurrencies directly through their bank accounts. This may no longer be the case now that banks have been advised by regulators to avoid all cryptocurrency dealings.

The FTX debacle has already affected liquidity and shutting off access through the traditional banking system may yield a crypto demand shock. These concerns might be the reason why Bitcoin bulls failed to recover strongly after the FOMC announcement.

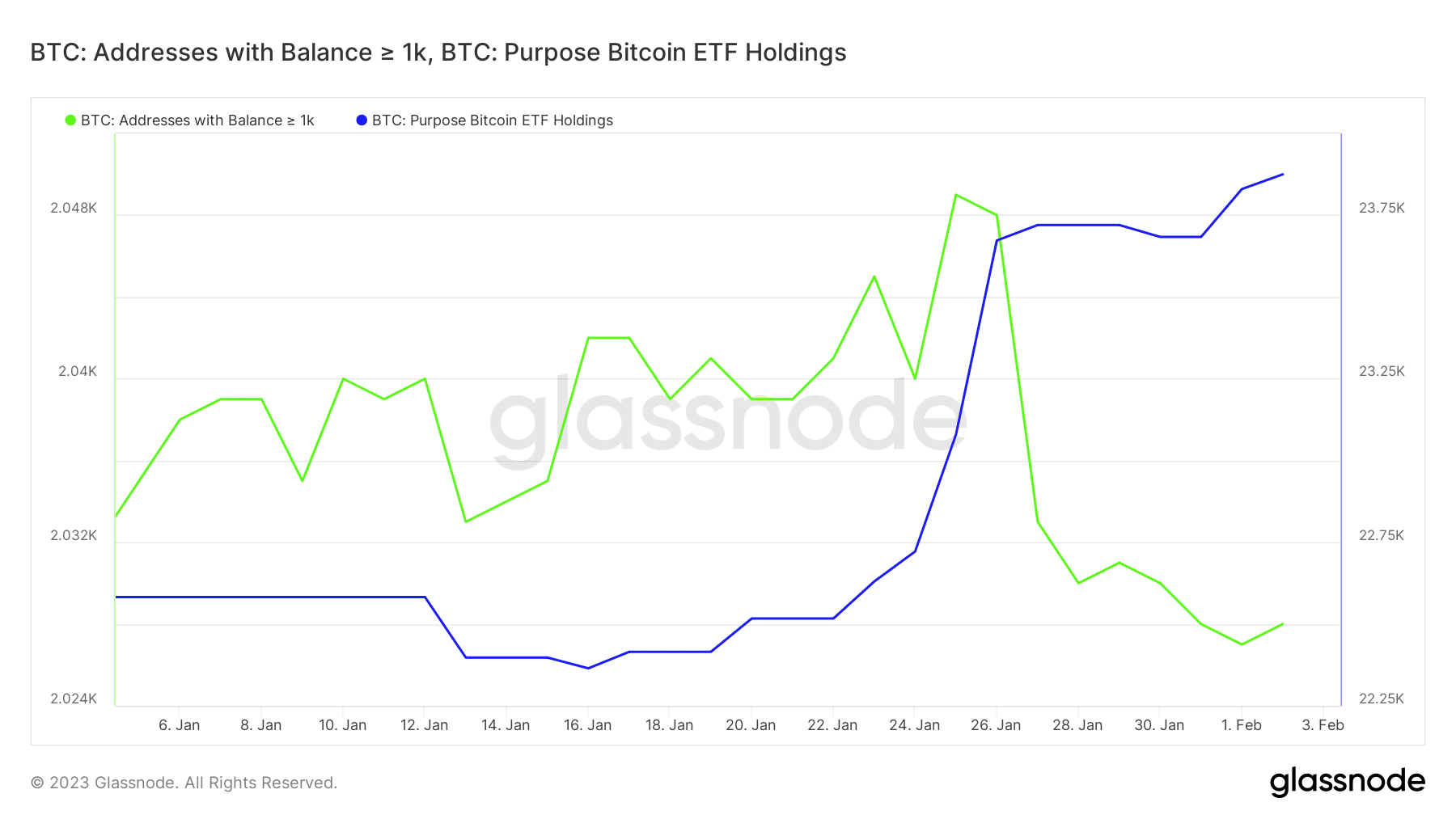

The demand side has certainly demonstrated interesting observations in the last few days. For example, addresses with balances greater than 1,000 BTC dropped by a substantial margin between 25 January and 1 February.

Source: Glassnode

The same metric appeared to be pivoting at press time, and if this continues, then it would symbolize a stronger bullish move. Some whale and institutional demand seem to be on the recovery. For example, the Bitcoin Purpose ETF holdings finally started accumulating in the second half of January.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin’s exchange flows did fluctuate towards the end of January in line with the increased uncertainty. However, the first three days of February brought forth some recovery. Furthermore, exchange outflows outweighed exchange inflows at the time of writing. This confirms that buy pressure is increasing.

Source: Glassnode

The current environment in the market underscores uncertainty and concern about the next move. Some expect BTC to continue rallying while others see the January rally as a false sign that the bull market has commenced.

On the plus side, the current concerns might dissipate if the regulators implement crypto-friendly regulations.