Can Hedera’s [HBAR] strong DeFi presence be the key to its resurgence?

- Hedera’s DeFi sector has registered promising growth, despite the crypto winter.

- Of late, HBAR’s volatility increased by a great margin. Thus, making it a risky investment.

Hedera Hashgraph made significant strides in the DeFi sector, according to a recent report by Messari. Despite the prolonged crypto winter, Hedera’s improvements in DeFi remained unscathed.

Notably, the total value locked (TVL) on the Hedera network has helped the HBAR register growth in its ecosystem.

Read HBAR’s Price Prediction 2023-2024

Source: DefiLama

DEXs take the lead

One of the drivers behind this growth was the increasing interest in SaucerSwap, which launched in Q3 and quickly amassed over $10 million in TVL, improving network services’ performance. In Q4, SaucerSwap reached a new high of $22 million in TVL.

In addition to SaucerSwap, new DEXs HeliSwap and Bubbleswap also contributed to the growth of Hedera. These DEXs launched in Q4 and together accumulated nearly $10 million in TVL.

By the end of Q4, Hedera had a TVL of $23 million. This remarkable growth in the total value locked is very impressive. Especially, given the fact that Hedera’s DeFi ecosystem was only recently established in Q2 2022.

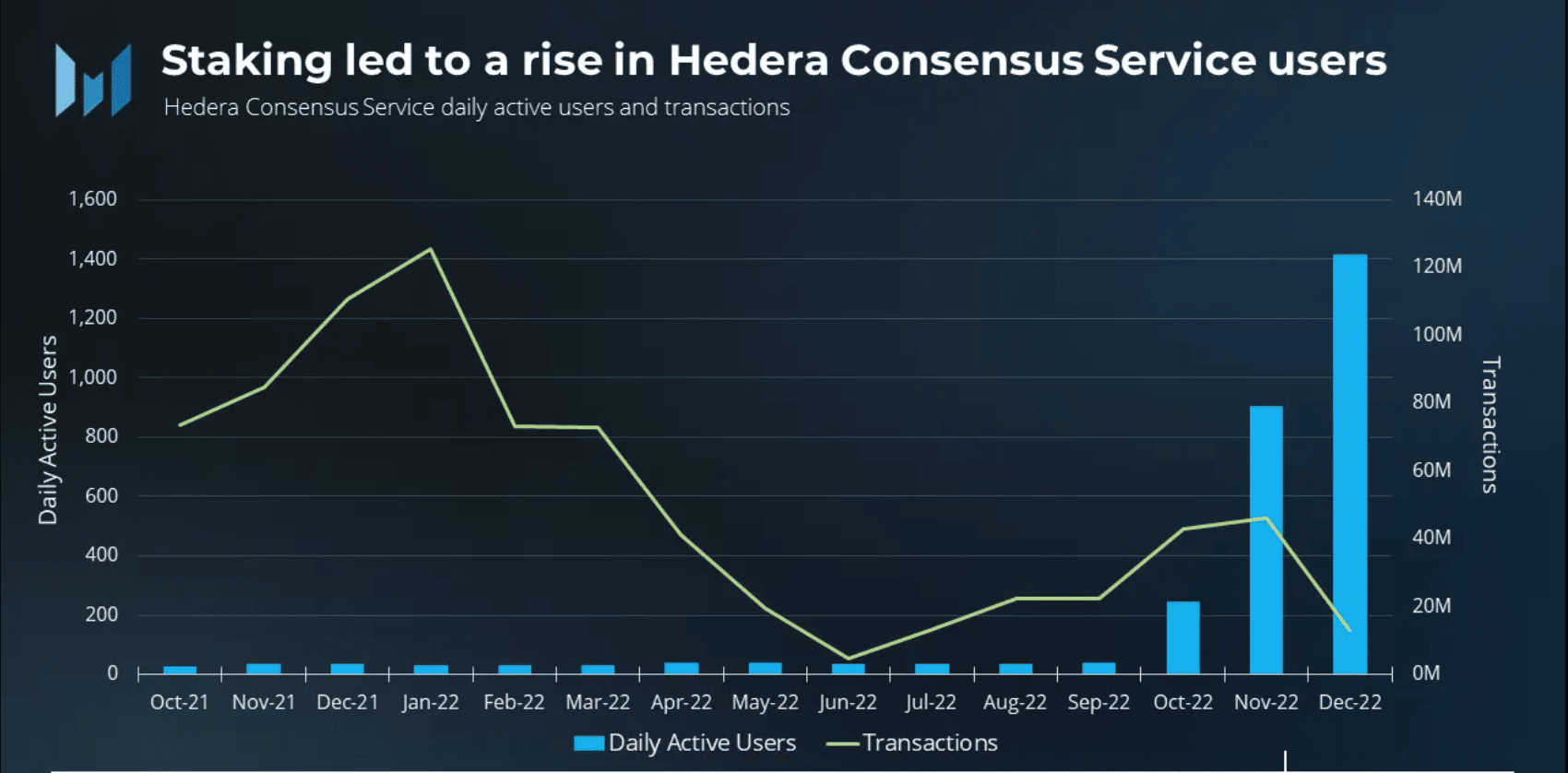

Another factor driving users to HBAR’s ecosystem was the Hedera Consensus Service, which enables the verifiable time-stamping and ordering of events for both Web2 and Web3 applications.

Users submit messages to the Hedera Network, where they are time-stamped and ordered by the Hashgraph algorithm.

In Q4, the Consensus Service saw significant growth with a 23-fold increase in daily active users, from 37 to 855, reaching a new peak and doubling the number of transactions from 50 million to 100 million. This surge in usage was due to the launch of staking.

Source: Messari

State of HBAR

Despite the growth observed in Hedera‘s ecosystem, its tokens volume declined over the past few days, as reported by Santiment.

The volume of HBAR declined from $192 million to $29.27 million over the last few days.

However, a spike in development activity was observed during this period, suggesting that there may be upgrades and updates on the Hedera network in the future, which could regenerate investors’ interest.

Source: Santiment

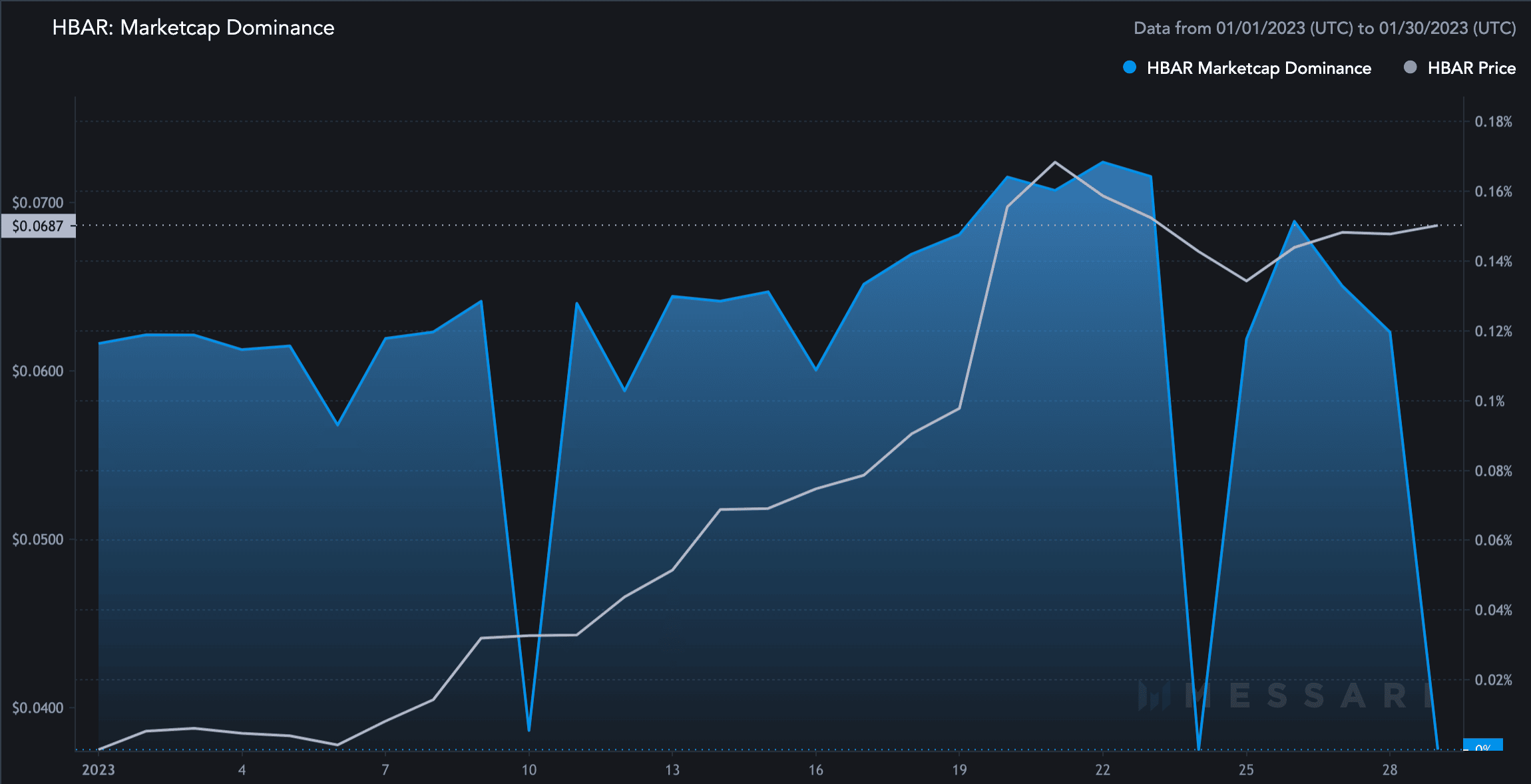

On the contrary, the market cap dominance for Hedera declined, and the volatility for HBAR increased by 0.64%.

This suggested that compared to other, cryptocurrencies, HBAR could not perform well in the market and was a riskier bet for investors at the time of writing.

Realistic or not, here’s HBAR’s market cap in BTC’s terms

Source: Messari

The price of the altcoin looked positive in the lower timeframe. Consider this- at press time, HBAR was trading at $0.0685, with a 1.97% increase in price in the last 24 hours according to CoinMarketCap.